Dangers of Drifting vs Benefit of Decisions Towards Retirement

Hands down, the most asked questions are “how much money do I need for retirement?” and “will I be ok?”, normally code for will I run out of money in retirement.

The simple answer, it depends…

It depends on the retirement you have in mind. But, here’s the thing, many leave the planning till it’s too late to make a significant difference. In other words, people drift, and then they drift so far the jump from poor or crisis to okay or ideal is fraught with risk and danger.

What most don’t realise is small, meaningful changes compound over time.

We get it, retirement planning is complex and confusing at best. And, yes, we know there are many challenges right now. It’s also not a time to be caught like a deer in headlights.

We will get past this. The best thing you can do is be prepared. Prepared with a plan that will take you on the path to your ideal retirement. Where you will enjoy time freedom. When you choose to do what you want when you want. Perhaps a plan to take advantage of the current opportunities that have the ability to springboard your progress when everything gets back to normal.

Retirement Plan Progress…

Are you drifting further away from your ideal retirement or are you making decisions to ride the curve? Maybe you are keen to accelerate your progress.

Let me explain.

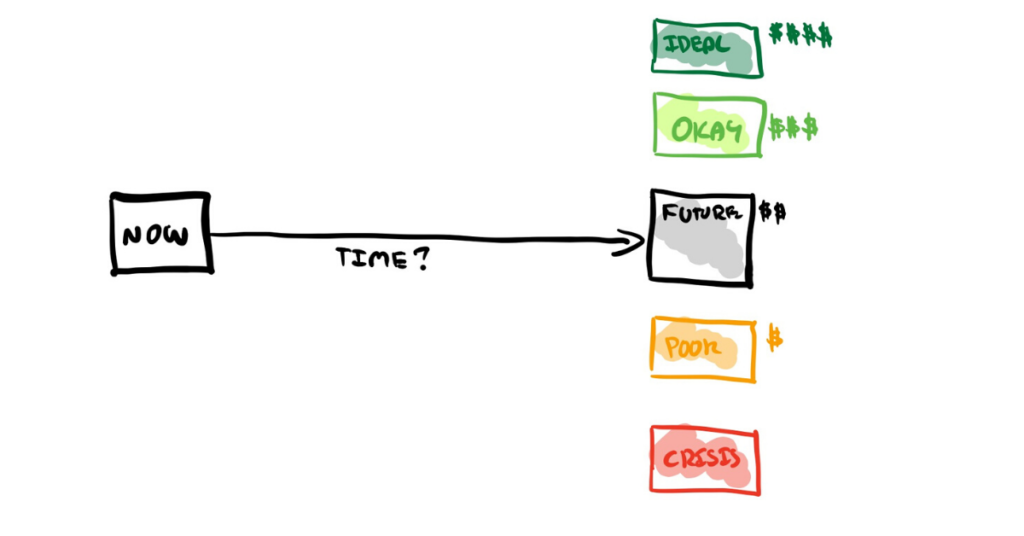

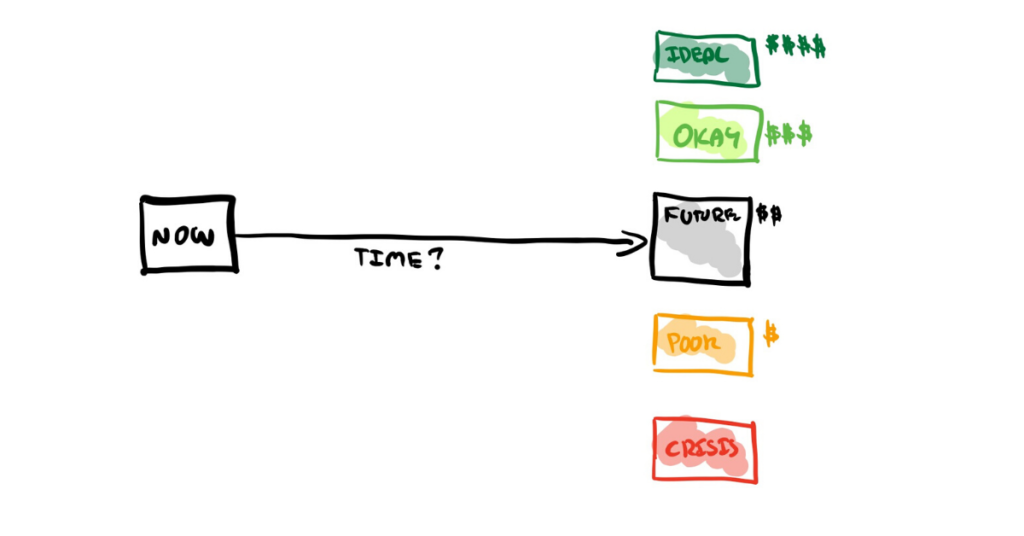

In this very minute, this is your financial reality. But, at some time in the future, you want to be in a position to retire to your version of an ideal retirement. Which is going to require an amount of money, often referred to as your retirement savings.

It’s going to be X number of years from now which is your time between now and your future.

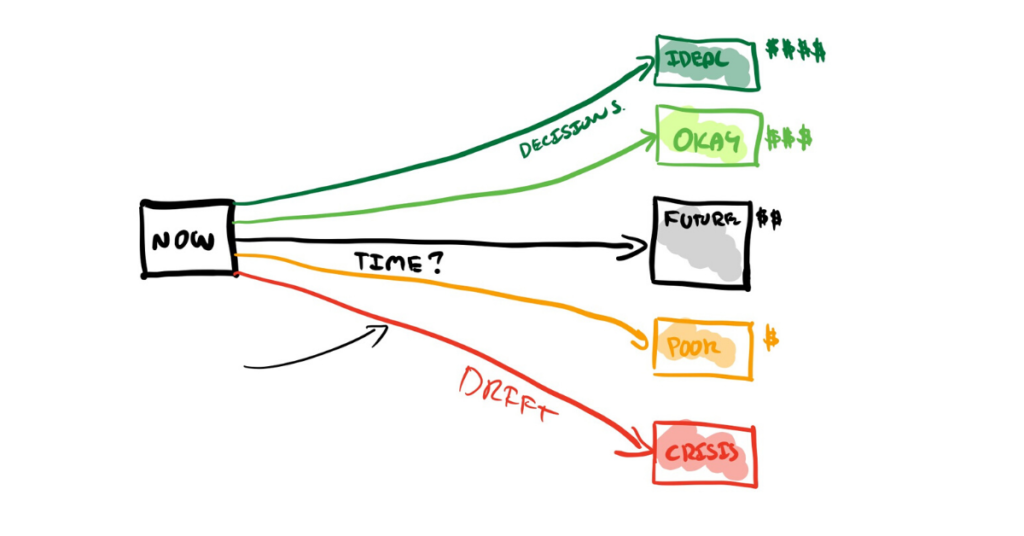

4 Retirement Outcomes

When you reach retirement, you are going to be in one of four scenarios:

???? Ideal position. The position you’d prefer to be in to reap the rewards of all those years of hard work. Enough to fund your active lifestyle and new adventures knowing you won’t run our of money.

???? Okay position. It’s going to be okay. You’re not going to miss out on much. It’s okay but not ideal.

???? Poor position. Sadly, there’s going to be a position below the black line that will represent a poor financial position at retirement.

???? Crisis position. Truth is, some, unfortunately, rightly or wrongly are going to get to a point where they are going to be in a crisis position.

It’s a common perception the path between where you are now and the future is a straight line. It’s not…

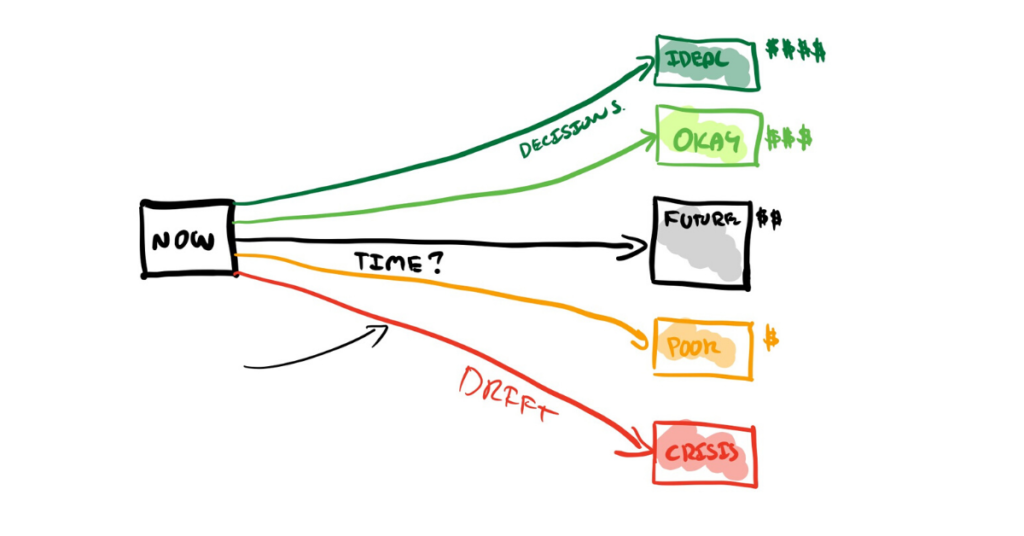

Dangers of Drifting

The red line heading down towards a crisis accelerates as time goes on. This happens because people drift. Drifting almost always means heading downwards.

The orange line heading towards poor, is also a form of drifting, however not as steep.

The benefit of Decision Makers

As represented below or above, those who end up in an okay or even better position, ideal, are decisions makers. Decision making is the difference between arriving in an ideal position compared to a crisis position.

If you want, you could replicate this yourself. Add the dollar amounts next to the boxes which would represent your ideal, okay, poor and crisis financial position at retirement. Try and pinpoint which line you are on.

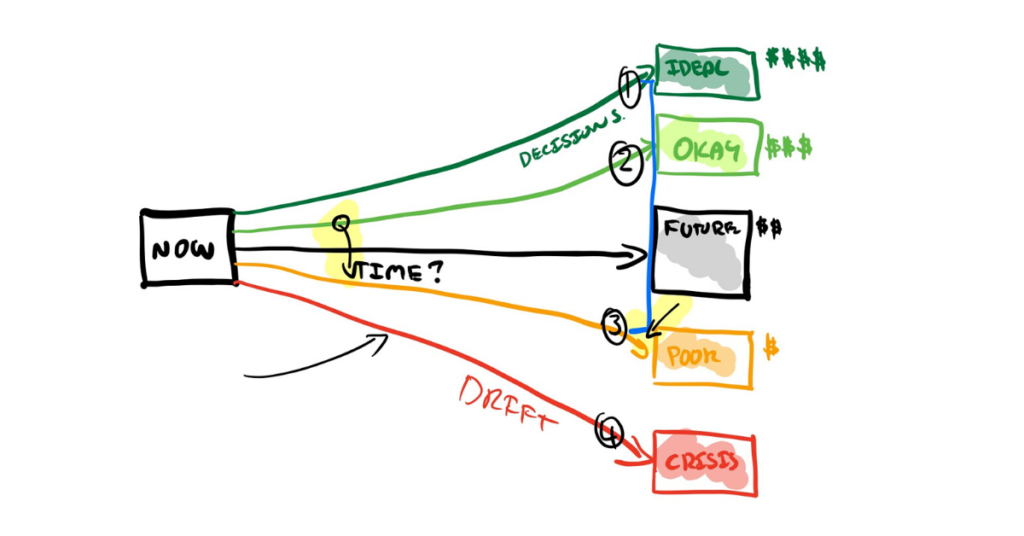

Problematic Scenarios

Now, let’s say you’re on line 2 (below illustration) closer to your future retirement date and you drop, let’s say to 3. That’s going to be problematic.

But, if you are on two and the lines are close (as shown by the highlighted arrow near to the now box) and then you start to drift and don’t notice it. That’s possibly a problem if not picked up early enough. If you don’t know it’s easy to drift. As you can see the line accelerate downwards. There’s a big difference between 2 and 3 at a future date.

Either way, it’s problematic if not picked up earlier enough. At the same time, it becomes an issue if you move between lines closer or at retirement. Let’s say a drop from 1 to 3.

Trying to make that jump back is going to be impossible, risky expensive and hard.

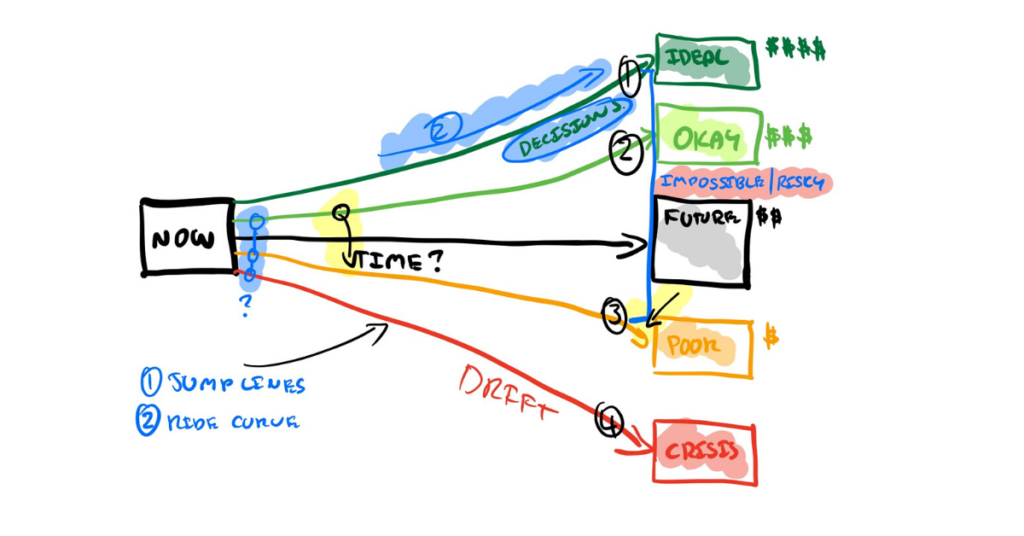

Decision making early as possible

So, if you are on line 4, 3 or even 2, line 1(blue circles closer to the now box) may not feel that far away from you right now. But right now, for many line 1 is going to be as close as it’s ever going to get for many.

Jump lines and ride the curve

So, the first BIG decision is to jump lines. The second BIG decision is to ride the curve. Make a decision to do something that’ll help you ride the curve in the right direction

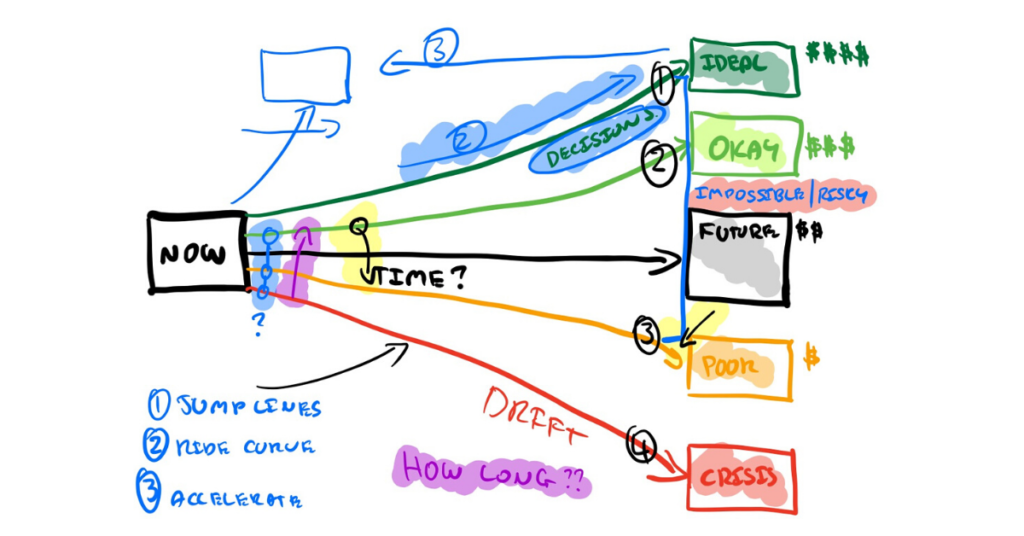

There is a third opportunity that is available.

Accelerate the results

For people who really want to make it happen, the third option is to accelerate the result and make it happen much sooner. This is for people that are really serious about this.

The BIG question for you. No matter what line you are on, how long do you want to wait before you jump lines and ride the right curve?

The same goes for when you in retirement, people drift, but those who make decisions, even if only micro when things are going well and when they are going bad end up with the spoils. Those who drift and don’t make decisions at critical points suffer the most.

Feeling like you need to put a spotlight on your retirement plan so you can be certain you are on the right track? Then it’s time we had a chat and see what you need to be doing right now to minimise any gap so you don’t have to face making risky, impossible and expensive decisions in years to come. Book your “Safeguard Your Retirement” strategy call below and discover how to be riding the right curve for your retirement.

Click here to book your complimentary “Safeguard Your Retirement Strategy Call” now.

Here’s to living your best life!

Glenn Doherty – CFP – Money Mentor | Retirement Specialist for High-Networth Couples and Individuals($500-$5m) | Founder of Jigsaw Private Wealth