Are you confident you know what your magic number is to live an abundant lifestyle?

So you can do what you want, when you want, with the people you want without fear of running out of money!

Two-thirds of over 50’s worry about how they will fund their retirement. Data cited by Fidelity International recent research, “Building Better Retirement Futures”.

In reality, I suspect this number is higher. Many think they have enough. But it’s not until they retire they realise they can’t do all the things they had planned to do.

Many leave the planning right before they retire. This leaves little room to improve if they’ve miscalculated their numbers.

Serious planning should start 10 years out from your retirement date. This is when the true transition from your working life to your retirement years begins.

As specialists in retirement planning we only know too well the impact of time has on the final outcome.

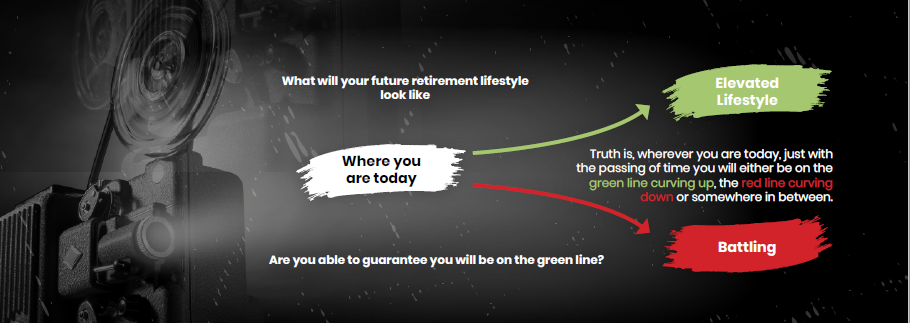

Take the red/green line below. Right now you are as close you will ever be to that green. The natural passing of time proves the longer you leave your planning. The harder, more costlier and more risks you’ll need to take.

Those that end up on the green line, take decisive action which gets them on the green line and keeps them there.

Our sole role is to help people make the jump and get on the green as fast as possible. Staying on the green line requires decisiveness on an ongoing basis. It only takes one poor decision to fall off the green line.

This is where our “Abundant Retirement Lifestyle Model” takes over. To keep people on the green line trending upwards.

A framework we’ve decoded. Not gained just by what we know but by working with lots of people in the transition phase. All the way through retirement. We can equip clients with 9 tools to help them get to a better place.

When does confidence start to increase?

The research showed that for higher superannuation balances. Of those with $750,000-$1 million, 56.3% were still worried about funding their retirement.

It’s only when people have over $1 million in super does their confidence levels start to improve.

And even they still worry about their money…

It’s staggering that after 40 years to plan for this significant event, only 13.6% of the over 50’s are optimistic. Their confident they’ll have the financial resources to do everything they want in retirement.

The rest are settling for the fact they’ll have to compromise on their lifestyle in retirement.

Confidence comes from knowing what to do and what not to do.

Why are people lacking in confidence?

It could be people are still suffering from the Global Financial Crisis hangover. Or recent COVID-19 shocks. Either way people fear a loss twice as much as an equivalent gain.

As you approach your retirement years, there’s a required shift in thinking. A paradigm shift.

While you are working, it’s all about:

-

Accumulating assets

-

Dollar cost averaging (investing on a regular basis)

-

Return on Investment (maximising investment returns)

-

Recovery (you have the time and income to recover from market shocks, you’re not relying on it)

-

Decumulation

-

Return on Income (how you structure your assets to generate an income to fund your lifestyle)

-

Safety margin (enough breathing room to sail through stormy seas in good shape)

-

Exposed (protecting yourself from being exposed, there’s little time to recover)

It’s important to understand this shift in thinking. Changing the direction you need to take as you approach your retirement years.

And yes, you need to know what your MAGIC number is. It’s different for everyone.

So, why do many lack the confidence?

- a clear vision (instead of vague you could see it in high-definition)

- financial visibility (you go from confused to confident about your options)

- predictable path (rather than be in repair mode all the time, you are prepared)

How much more confidence would you have about living an abundant lifestyle? How would that make you feel?

If you’re ready to gain more confidence about the direction you are taking, maybe our Complimentary Retirement Mapping Session is for you. Helping you understand the path you’re currently on. Whether in fact you need to take action to jump lines. What’s required to continue riding the green line curving upwards so you can live an abundant lifestyle.

If you’re ready to explore how you’re tracking and know the opportunities to get you on the green line and stay there. Book a a 15 min call here to find out more.

Glenn Doherty – CFP – Money Mentor | Taking the stress out of planning your self-funded retirement | Founder of Jigsaw Private Wealth