BLOG

Would you like a short-cut? To reduce the number of errors your mind has control over. The biggest risk to your retirement is not market movements nor inflation. We explored cognitive biases which affect your financial decisions in our previous post. You can read the post by clicking here>> Repurposing emotion for more favourable outcomes!…

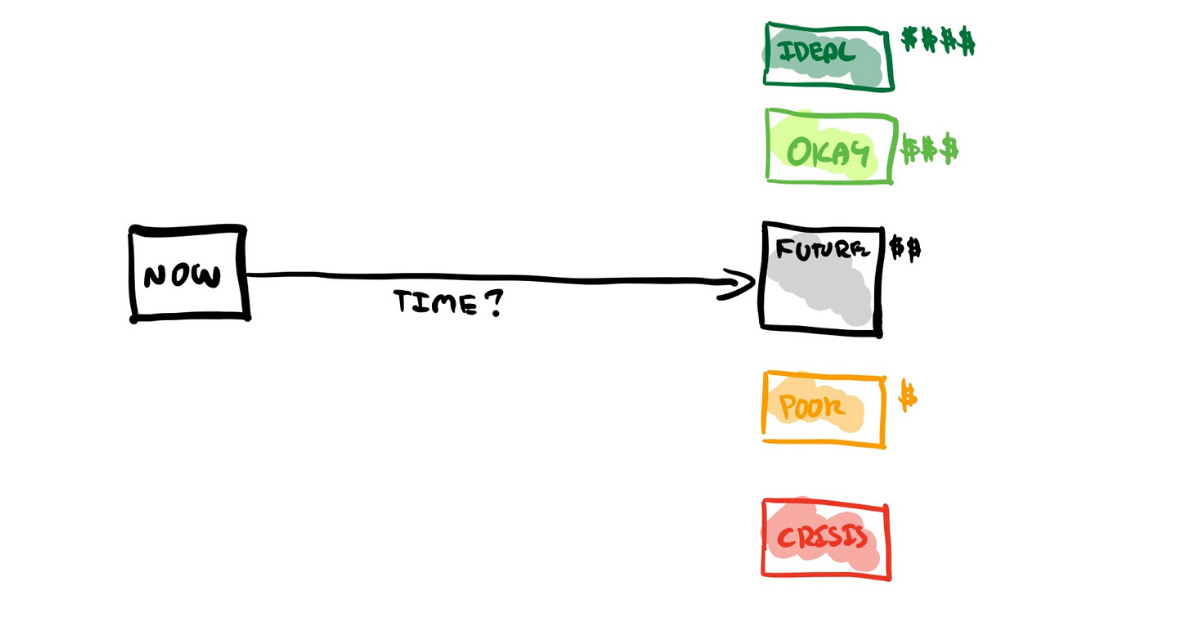

Read MoreAre you uncertain about your retirement plans? Like most, COVID-19 has infected many retirement plans. No matter the amount of money you have, it’s affected, everyone. Whether it be the way you invest. The timing of your retirement. Or a complete rethink about the retirement you had planned. Even the assumptions you based your plan…

Read MoreHands down, the most asked questions are “how much money do I need for retirement?” and “will I be ok?”, normally code for will I run out of money in retirement. The simple answer, it depends… It depends on the retirement you have in mind. But, here’s the thing, many leave the planning till…

Read More5 Secrets to Investing for Retirement like a Pro! Video 1 – 5 Secrets to Investing for Retirement Like a Pro! Secret 1 of 5 Video 2 – Investing for Retirement Like a Pro! Secret #2 of 5 Video 3 – Investing for Retirement Like a Pro! Secret #3 of 5 Video 4 – Investing…

Read MoreHere’s your guide “5 Secrets to Investing for Retirement like a Pro!” Click here or the image below to download your guide>> Here’s to living your best life! Glenn Doherty – CFP – Money Mentor | Retirement Specialist for High-Networth Couples and Individuals($500k-$5m) | Founder of Jigsaw Private Wealth We conduct zoom…

Read MoreInvesting | How To Manage In A Crisis? Click here to download your guide>> Here’s to living your best life! Glenn Doherty – CFP – Money Mentor | Retirement Specialist for High-Networth Couples and Individuals($500-$5m) | Founder of Jigsaw Private Wealth We conduct virtual client meetings! Advice Disclaimer: Any reference in this…

Read MoreCOVID-19 disruption…a disruption that will change the way we live forever. It’s affected everything we do. From how we work, educate our kids and retirement planning to name a few. We were seeing these trends pick up pace before COVID-19 changed life the way we knew it. Forcing us into isolation. Forcing us to change…

Read MoreAn important part of managing your wealth is keeping your money safe. Your portfolio is designed to preserve your wealth over time. To pay income when you need to it. Avoid selling growth assets in down markets. Here are a number of videos to educate you on how those investment decisions are made. How…

Read MoreThe world is crazy right now! If retirement is on the horizon it can feel a little like landing a fighter jet on an aircraft carrier in the middle of a storm. One minute your thinking ahead, planning out your retirement. The next minute it all changes as you watch it turned on its head.…

Read MoreInvesting can be a fearful thing to do. After all, the last thing you want is losing the money you’ve worked so hard for. Now more than ever is no time to be fearful. As Warren Buffet quotes in times like these: “be fearful when people are greedy and greedy when people are fearful” The…

Read More