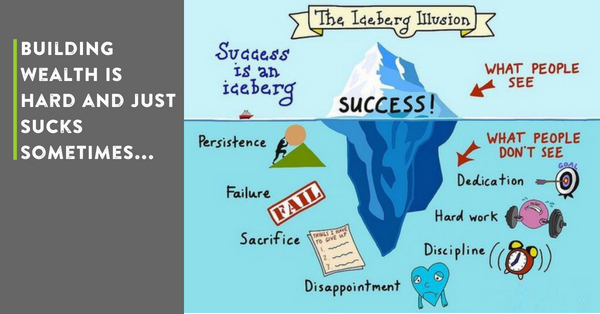

Building Wealth is Hard and just sucks sometimes…

Building wealth is hard and just sucks sometimes, but you most probably already knew that, didn’t you?

Recently I went on a Body Transformation Challenge, the one where they promise to transform your body from what it is today to that nicely chiseled body you see on the cover of magazines. I learned a lot of things over the last 2-4mths and some important lessons that can help guide your wealth building journey in a good way.

So why did I do this? Well, I’m still not a 100% sure, the main reason was that I wanted to look a little better and fit into clothes better. I didn’t go into it with any real goals, just thought I would give it a go and see what happens, and it was hard tough work.

Over 8 weeks I lost 16kgs, added 3.5kg lean muscle, dropped 14cms around my waist, dropped 8cms around my chest and 9cms around my thighs. Those that know me know that I’ve always been a solid guy. Still not chiseled but much fitter and healthier for the experience.

Here are the lessons I learned along the way that you can implement when building your wealth for your future…

You don’t have to have exact goals.

I went into this challenge with the view I would give it a go and see what happens, they had had great results and it helped that I knew of these people so I knew they had the goods. I didn’t go in it to lose x number of kgs nor for the competition component (best transformation over the 8 weeks). I did surprise myself by coming, joint runner-up. I have to admit I was a little embarrassed as the other runner-up had the chiseled body. The winner was a 55yo lady.

You know what, for 20 plus years I have been advising clients and rarely have they given much thought about what it is they want to achieve financially. They might have an idea or a rough guide but rarely do they come in and say this is what I want in terms of wealth, income, assets, lifestyle.

The financial planning industry is obsessed with goals and we shouldn’t be. We are there to help our clients paint a picture of the life they want for themselves and provide the advice and guidance required for them to achieve whatever is important to them. It’s just that many people have not taken the time to sit down a work that one out.

So, it’s ok not to have exact goals. One of the things I promote with clients is let’s just get a general idea of what you’re looking for and we will refine in the years ahead. Sometimes that is better than being exact, it takes the pressure off somewhat.

Seek out a great adviser.

I think this is a key point for most but rarely do people take the action to seek advice. Even the local Warren Buffett requires good advisers from time to time.

This is what I did with the guys who I completed the transformation program through. It helped that I had a little background on them, but what I found is their program suited me and they had the right experience that made sense to me.

I could have gone off and done it all myself, and I have done that, but you will get better results by using someone who has all the experience and will make it happen at a faster pace.

You can check out my post on how to choose a financial adviser that will work in your best interest by CLICKING HERE>>

Accept it’s not going to be an easy ride but you will adapt.

I found the first couple of weeks to be the toughest of all. I had to cut out everything from sugar, carbs, and alcohol. In the first couple of weeks, I was eating mainly salad and protein which was extremely tough. However, what I found is my body started to adapt. I found that at lunch I was leaving half my lunch and eating the other half as a snack later in the day. It started to get easier as you got used to it.

This is the same when it comes to building wealth. Sometimes at the beginning, it’s a bit of shock if you need to make changes, but you learn to adapt and move on. They say that a new habit takes approx 90 days to become normal.

Use the right benchmarks.

One of the first things our trainers said was don’t weigh yourself all the time (ie throw the scales in the bin) and don’t use your weight to gauge your results. Why you might ask, well as they told us you need to be using the right benchmarks, what really matters is your body measurements. Basically, ditch the scales and get out the measuring tape, and they were right. You could have sent yourself crazy, while weight may not have been dropping the other measurements were.

The same comes to money and creating wealth, most are using the wrong benchmarks. Most will compare themselves to what the market is doing and returns others are making. Here’s the thing, it’s the wrong benchmark. You need to be measuring your progress towards your own financial goals and it’s not related to what the market is doing. It comes down to how you are progressing toward your financial goals.

We also provided progress reports every four weeks to show how far we’d come. This provides a context in progress you are making. Something we always do with our clients. At regular progress meetings held throughout the year, we track the progress made between the various progress meetings and when they started with us. It tracks the in and outs along with the impact the markets have had. We then compare their progress with their end financial goals. It provides a very powerful tool to keep clients focused on the right behaviors to bridge the gap, the ones that the client can control.

Let me ask you this one question if you were able to achieve all your financial goals in life and never ever beat the market, would you be ok with that? See what I mean, it’s not the return that becomes important, it’s the outcomes that are going to make a difference.

Don’t get me wrong, you still want to be getting a reasonable return but sometimes I find people focusing on the wrong benchmark rather than the benchmark that is going to give them the experiences and enjoyment in life. Ultimately that’s what we value, experiences right?

It’s going to suck sometimes.

I remember dreading some of the workouts that I was to complete, I knew the pain I would be going through, how hard they would be. It would have been easy to go off and do something else more enjoyable. Sometimes I would be asking myself what am I doing, but I made the effort to just get them done, I made it a priority and just did the work no matter how tough it got, thinking of the bigger picture.

Sometimes things don’t go according to plan, I remember towards the of the 8 weeks I had soreness in my foot, some exercises were painful. I could have thrown in the towel and gave up but I didn’t, I kept going and did what I could.

It’s the same when it comes to creating wealth, sometimes it’s just going to plain suck. Things aren’t going to always go according to plan.

We always tell our clients at any recommendation meetings that the minute they walk out our door those recommendations are redundant. You should see the look on their faces when I tell them that. You’ve just done all this work and now you are telling me they are redundant?

Here’s the thing, life happens, you might have an emergency that requires you to draw on some of your assets, your kids might need some financial assistance that you didn’t count on, you lost your job, the markets crashed, I think you get the picture.

As much as we would like everything to go in a straight line, it just doesn’t happen that way, our role is more important to the client when they are going through these up and downs, keeping them on the right path, recalibrating based on their unique circumstances.

Understand that sometimes it will be tough and just know when it gets tough, you have to bunker down and just get through it, don’t just take the easy route and throw in the towel.

Understand at times it’s going to seem like you are going nowhere.

This was a major thing in this 8-week transformation program. I got to a stage where things had plateaued and I was thinking, is this really worth it, do I continue on? Then our coaches with their wealth of experience came out and explained this is going to happen and you will get through and move forward. Without this reassurance, I’m not sure I would have continued.

The same goes for creating and building wealth, sometimes all the work is going to seem useless, you need to have someone by your side helping you through this so that you can continue to move forward and make the right decisions.

Did you know that it takes roughly 75% achievement of a goal before things start to really take off? You need to work on getting to the 75% and things will compound significantly from there.

The same happened with the transformation program, we started to see rapid results at about the 6 weeks mark.

The right groundwork needs to be done first and sometimes it’s going to suck, but that perseverance will pay off.

Reward yourself along the way.

Yes, that’s right, reward yourself. What’s the point of doing all the hard work and not celebrating it? It doesn’t need to be anything expensive. Just something to reward the effort that you have put in. It could be anything from a nice bottle of wine or a night out with your partner. Something that will allow you to celebrate your achievement along the way that will make it all worthwhile.

It’s important to reward achievement. We are more likely to continue to put in the effort.

Creating wealth leads to options, options on how to live your life however it provides many challenges, it not easy and sometimes life just gets in the way. Set the right path, persevere and you will be rewarded.

If you feel someone would benefit from this information, feel free to send it on.

Make it a great life!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Mob: 0401 253 729