Retirement Planning

Confusing Luck With Skill Maybe Detrimental To Your Retirement Years

Confusing luck with skill can leave you high and dry in retirement. Let me explain how luck, not skill played a part in your’s truly still being in one piece today. Risk, Luck, Skill or Plain Stupidity Back when I attended University in Ballarat, you could say I did some dumb things… In my late…

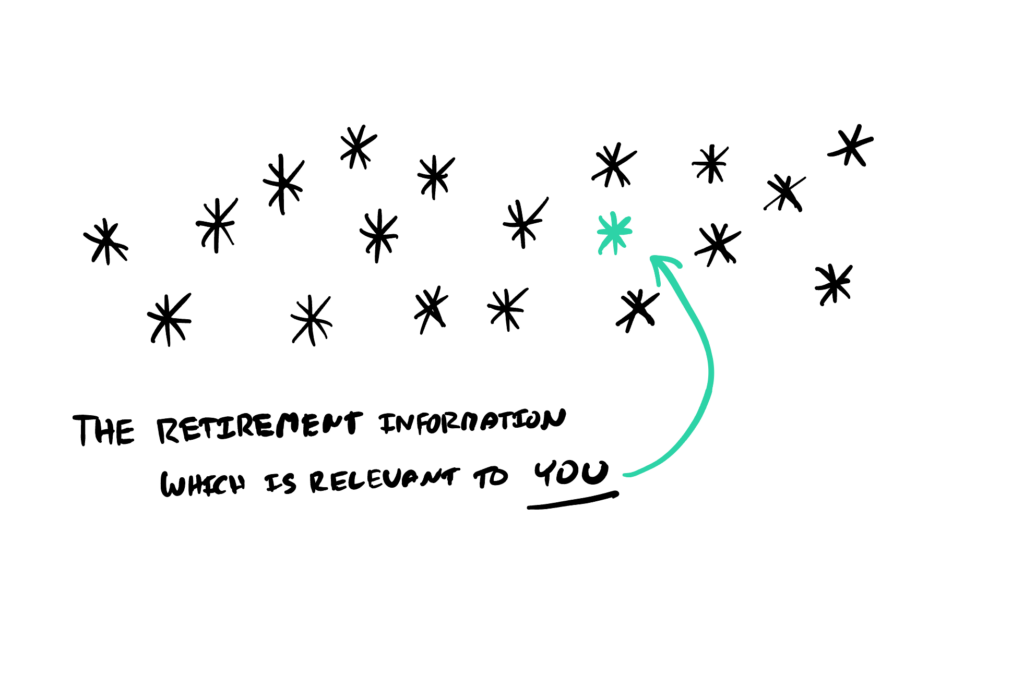

Read MoreBreak Free from Analysis by Paralysis and Step Towards the Retirement of Your Dreams

The Paralysis of Analysis Are you constantly scouring the pages of google conducting your own research? Trying to source relevant information and on the hunt for anything that will assist with planning your retirement? If you are, I’d like to congratulate you for taking an active interest in retirement planning. It’s important to educate yourself…

Read MoreHow To Rip Off The Retirement Blindfold and Master Your Retirement Roadmap?

Are you one of the many struggling to plan for your retirement? Do you know if you are going to be okay financially in retirement? Over 5,000 people have downloaded our free book download, “Enough” over the last few years. Combine that with hundreds of Retirement Clarity calls is proof enough many are struggling to…

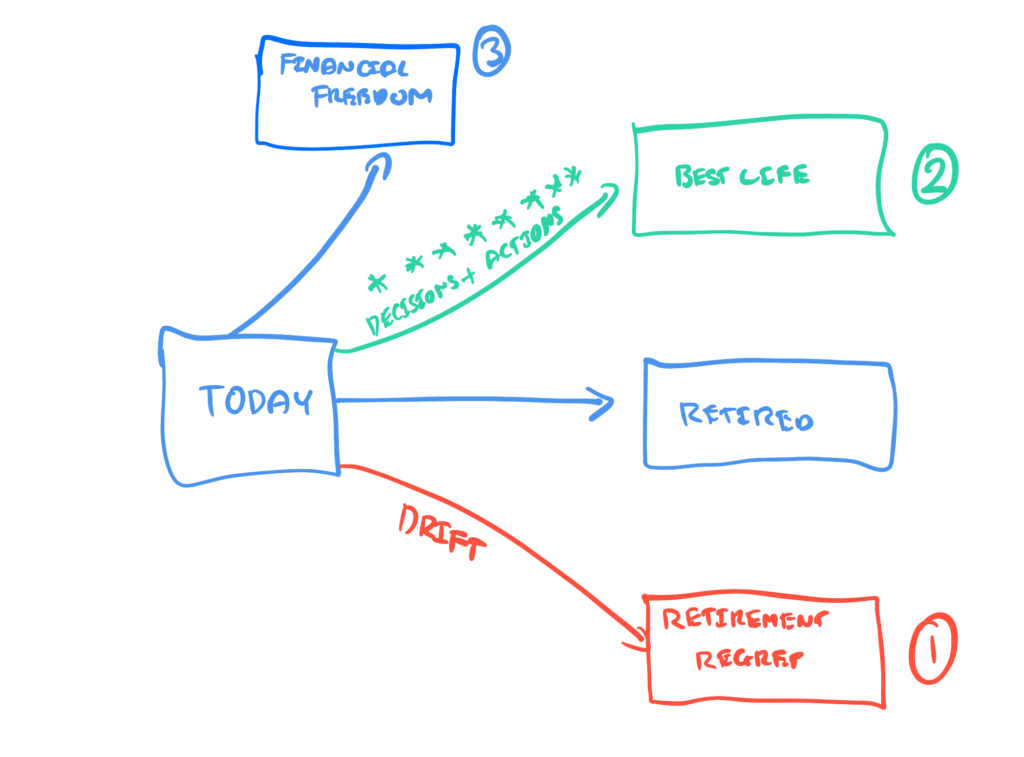

Read MoreWhich retirement path are you on, retirement regret or living your best life in retirement?

As you reflect on 2023 and enter 2024, have you considered whether you are on track for a comfortable retirement? If you are within 7 years of retirement, you need to know… One thing we know for sure is time passes, it’s unstoppable, it’s undeniable. At some future point you will end up retired, whether…

Read MoreMistakes Over 55’s Are Making In 2023 That May Cost Them A Comfortable Retirement

After over 200 conversations with over 55’s in 2023 I’ve collated the biggest retirement mistakes we see people making as they approach one of the most exciting periods in their life. In this post, we highlight the top 7 mistakes we’ve seen from 200 conversations in 2023. Retirement is a major transition, a major life…

Read MoreIs Professional Retirement Advice Worth The Cost Or A Waste Of Money?

As retirement draws near, you might find yourself reflecting on your readiness. Have your plans kept pace with life’s changes, or are there uncertainties about retiring on your terms? More importantly knowing whether you’ll have enough to sustain a comfortable retirement lifestyle? It’s common to have thoughts of “I should have started earlier”…the good news,…

Read MoreFour Financial Pillars for a Retirement Rebel Retirement Plan

Are you asking: How Much Is Enough For A Comfortable Retirement? When Can I Retire? How Long Will My Money Last? What Am I Missing? How Long Do I Need To Work For? How Do I Set It All Up? Then you are not alone and you are in the right place… If you’re struggling…

Read MoreUnlocking a Comfortable Retirement: The Three C’s Revealed

As retirement nears, many face a mix of anxiety and uncertainty about this new chapter. What does life after work hold for me? How will it reshape your daily experience? Fearful about their financial security. The constant worry about whether you’ll be okay and concerns about whether you will run out of money in retirement.…

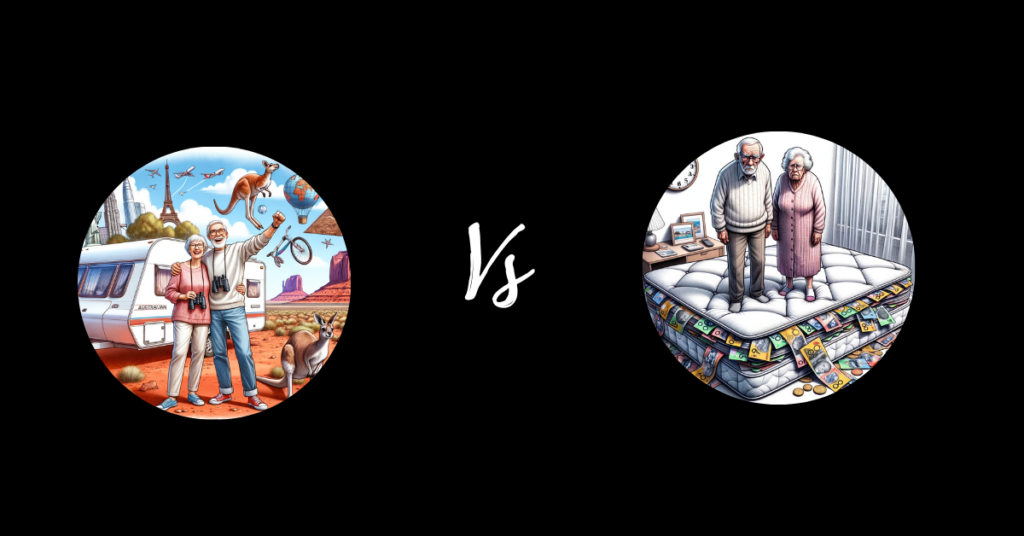

Read MoreLiving Rich or Dying Rich: Your One Shot at a Remarkable Retirement

Imagine this: You work hard all your life, saving and investing for the period in your life where you can start enjoying the fruits of your hard work. Free time to travel more, take on hobbies and interests you’ve never had time for, spend time with loved ones and live life at a more relaxed…

Read MoreHow Much Money Do We Need In Super for a Good Retirement for 2 People?

Retirement is a time most of us eagerly anticipate. It’s a period of life where you can put your feet up, relax, and enjoy the fruits of your labour. However, the road to a successful retirement can be riddled with uncertainty, especially when it comes to one fundamental question: How much money do we need…

Read More