Do you know what your investment return for super was in 2020 and should you care?

Do you know what return you achieved inside your super fund for calendar year 2020?

Based on Chant West’s research. The average industry Balanced Fund (holding growth investments of 41-60%) generated a return of 3%.

While you wouldn’t call this shooting the lights out. It’s a great result considering the worlds economies were on life support from March 2020.

And here lies the challenge in making sense of these numbers. It’s difficult to differentiate between the differing asset allocations. None less make sense of all the information.

The labels of super funds, for instance Balanced or Growth are hotly debated topics.

Chant West has done a great job in helping separate into 5 key categories:

- All growth (96%-100% growth assets)

- High Growth (81%-95% growth assets)

- Growth (61%-80% growth assets)

- Balanced (41%-60% growth assets)

- Conservative (21%-40% growth assets)

*Growth assets will include Australian shares, international shares property, infrastructure and private equity to name a few.

Drill down into many super fund asset allocations and you’ll find some surprises. Many classed as Balanced should in fact be growth or even high growth.

Check yours. You may be taking on more risk than you thought.

What were the average returns for calendar year 2020?

- All growth – 4.1%

- High Growth – 3.7%

- Growth – 3.7%

- Balanced – 3%

- Conservative – 2.4%

If we look at Future Fund performance for one minute. They generated 1.7% with cash holdings of 20%.

Look more widely and one of the world’s most successful investors, Warren Buffet, generated 2.5%.

These numbers do not take into account those who jumped off the roller coaster mid ride and retreated to cash. Wealth destroying crystalising to cash.

Other factors contributing to performance:

Given the events of 2020, the performance of these funds would have been impacted by investors selling to cash. Portfolios required to sell down to fund lump sum withdrawals from super.

These events would have forced many super funds to sell assets. To ensure they had sufficient cash on hand to pay withdrawals.

There are many decisions made inside these types of super fund which you have not control over or say in. Having a significant impact on your balance.

Customised investment portfolios inside super alleviate these types of issues. Instead of leaving your super to a structure with little control. Utilise portfolios and investment strategies designed based on your unique circumstances. Where you have full control with the right guidance to tailor your portfolio.

Should you care?

Sure, you want to know if you are in the ballpark based on the level of risk you are taking.

But’s there’s no need to wrap your head around every conceivable option.

Rather than sweat every year on these returns, do this instead…

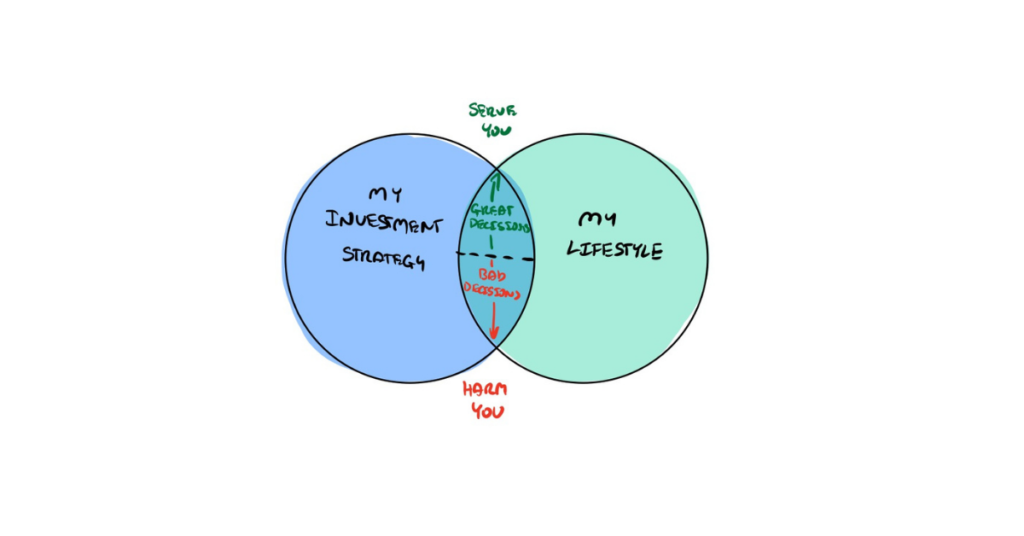

Assess your returns based on the lifestyle you want to achieve now and in retirement.

Here’s some guidelines on how to do exactly that.

Think about the lifestyle you want. What’s that going to cost. What’s the minimum dose of investment risk you need to live the lifestyle you want? And consciously dial it up, if you want too.

Segment your investment portfolio to provide flexibility when the markets catches a cold. So you can continue living your best life and not freak out. Without damaging your future lifestyle.

Test for probable outcomes and outlier events.

Focus on assessing your progress against your own personal benchmark and forget about the rest.

You’ll be far better off…

Sure, you want to make sure you don’t underperform. Trying to outperform investment markets is fraught with danger. Professional investment managers struggle to outperform investments markets over the long term.

Follow proven, research driven investment guidelines. For instance in this report “Evidence Based Investing” talks about the power of asset allocation driving investment returns. Not stock picking.

When you’re ready to uncover the perfect strategy for you. One based on a proven framework. One based on funding the lifestyle you want rather than throwing darts at a dart board with a blind fold on.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for over 50’s couples and individuals | Founder of Jigsaw Private Wealth