Do you need to flip your investment script to secure your retirement lifestyle?

Investing for retirement is the most talked about topic with financial planners. Outside how much money do you need for retirement.

Sure, the way you invest is important. After all, the way you invest will determine your investment return and how well you do.

It’s the sexy part of retirement planning. The one thing you can sit around a BBQ on the weekend with a beer or wine in hand and discuss who’s better at it among friends.

The financial services industry and the financial pornography networks thrive on it. They play on our human emotion of not wanting to miss out. That need to beat the market. They prey on our greed.

If we take the ego out of the equation for moment.

It’s not where the focus should be.

In our 9 step framework we use for clients, investing is down at number 5.

Sure, while in your working years, for a large part it’s about maximising the returns you achieve.

But when you start to approach the home stretch, a change in focus is required.

If you are anywhere up to 10 years from retirement, you’re already in what we call transition phase.

If you’re in this transition phase. There’s a paradigm shift in the way you approach your investing.

After all, you’re ability to recover from losses diminishes.

That’s not to say you need to cash in all your chips.

Unless you have buckets loads of cash.

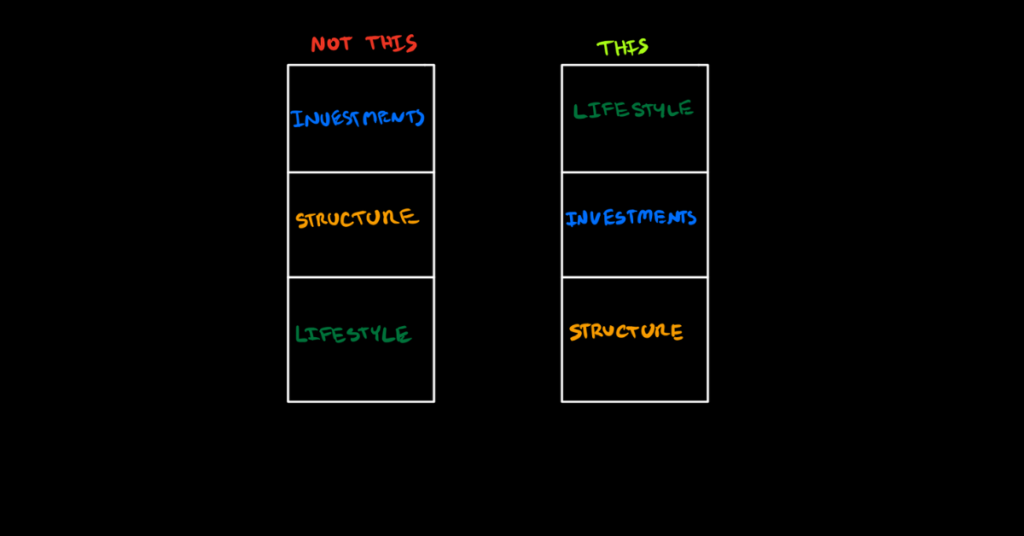

Here’s what most do:

#1 They focus on their investments

While some have the knowledge. Many are amateur’s at best. Picking a few stocks here and there. Looking for a big whale in a large sea of shares.

While investment markets are doing well, the law of averages is on your side. Anyone with a pulse can make money.

The challenge comes when that trend comes to an abrupt end.

And that’s when retirement dreams are crushed.

#2 The Structure

For many, they seek the comfort of managing their own investment. Some through Self Managed Super Funds. The allure of being in total control is too great.

For others, let down by past experiences, seek out the best performing fund. Without understanding what they are getting into. In most cases they end up taking on more risk than they are comfortable with.

#3 Lifestyle

What can we fund from the assets we have? Tends to be some of the last thoughts, yet is the one thing most of us look forward too. More time freedom. To do the things you want, with the people you want, when you want.

What we find in this approach, is while some succeed. Many will have to sacrifice in retirement. All because their planning is back to front or they have left it all too late.

It’s time to flip the script…

Here’s the approach we finds works best to achieve an abundant lifestyle:

#1 Lifestyle first

What is the lifestyle you want to live? What do you want to achieve or do before you end up in a box?

At this stage, you want to forget about what you think you can achieve. Start to dream BIG. You can adjust later. You want to know what is possible first.

No point holding back only to die with too much…

The next important question to answer, is, what is your lifestyle going to cost.

Now you have the foundations to start planning your retirement. With purpose and intention.

# 2 Investment strategy which matches your lifestyle

This is different to picking a bunch of investments. Or picking the best performing super fund.

Remember what I said in #1? Match your investments to the lifestyle you want to achieve.

One important component is first understanding the path you are on. What’s required from an investment perspective to get the job done.

Sure, you might end up taking on more risk, but knowing the minimum to get the job done increases your confidence.

Step 4 in our framework becomes critical. Understanding the possible scenarios based on certain assumptions. Using prudent assumptions is best.

This step drives the type of investment strategy clients adopt. It’s driven by the return you need to generate to make the plan work. With a margin of safety built in.

Allowing for an investment portfolio to be built on purpose. Not mashing together a bunch of investments for the sake of it.

# 3 Appropriate structure

Finding the appropriate investment vehicle for the strategy you have adopted above.

Taking into account tax, cashflow and investment suitability.

Agile enough to ride the waves safely and with confidence. So you don’t get wiped out.

This is step 6 in our nine step framework to help clients live an abundant lifestyle.

Follow this simple approach and you’ll have a retirement strategy built for purpose. Built to withstand the challenges you’ll face leading into retirement and through retirement.

Sure you want to have the finish line in sight. But that traps you. Instead focus on the process. The things you can control. The small steps you take that will lead to you reaching the finish line in great shape.

Using a proven process amongst the noise and uncertainty provides confidence. And I’ve seen how following this type of framework can lead to meaningful decisions. Which keep people on the right track to meet their long-term lifestyle goals.

Now’s a great time to check in and see if your plan still works of it’s time to shift gears.

Schedule a call here to find out what you need to do to stay on track and life an abundant lifestyle with confidence. I’d be delighted to have a chat.

Glenn Doherty – CFP – Money Mentor | Taking the stress out of planning your self-funded retirement | Founder of Jigsaw Private Wealth