EPIC Retirement Framework: How To Confidently Maintain Your Lifestyle In Retirement?

Imagine for a moment you hoped on an airplane (when you can obviously). You saw the pilot hop straight into the cockpit. Door closes and you’re pushed back from the draw bridge.

Minutes later the plane was on it’s way…

On reflection you think, hang on minute…you didn’t see the pilot complete a peripheral check of the plane…you didn’t see the pilot with a checklist…you didn’t see any movement of the flaps which they check prior to flying.

How would you feel?

Would you feel safe?

And what if you found out their navigation system wasn’t working…

How would you feel now?

Secretly having a heart attack!

Lucky for you a pilot never takes flight until all checks are complete. Checklist complete, weather checks and navigation system working perfectly.

Sadly this is what many retirement plans look like. With many winging it. It’s a disaster waiting to happen.

Why would you put your retirement lifestyle at risk?

Planning your retirement safely is no different than a pilot preparing for flight. There are processes, frameworks and checks which need to be made to ensure you stay on track.

And when you go off track you have the rules and framework to get you back on track.

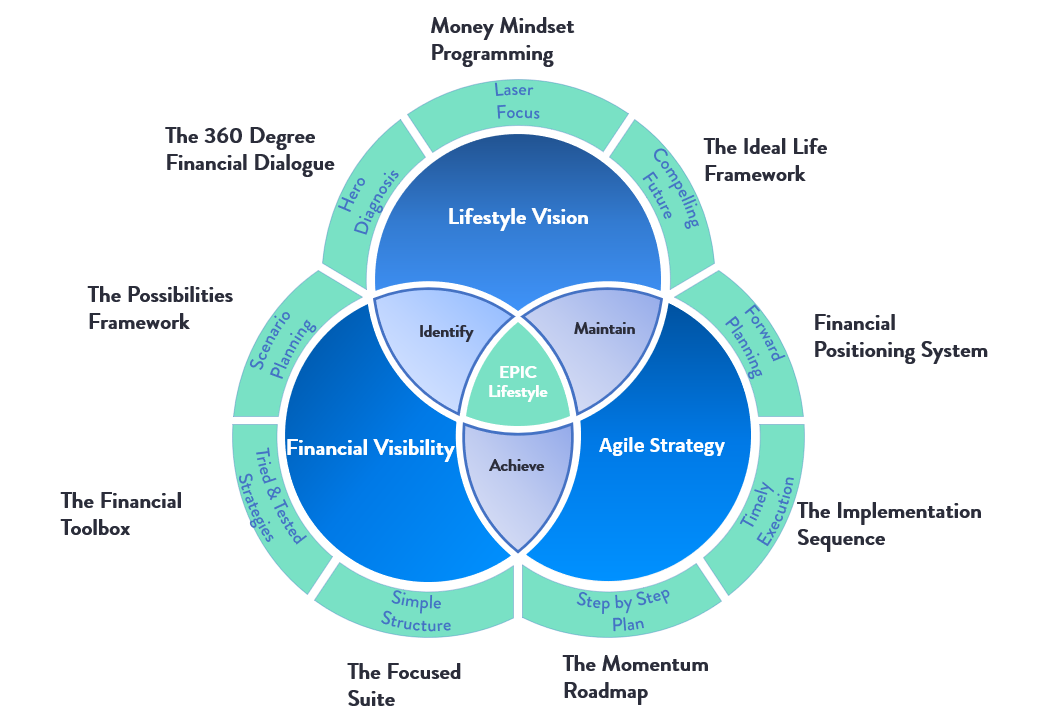

I’d like to introduce you to the EPIC Retirement Lifestyle Framework.

A framework to help you identify, achieve and maintain your lifestyle in retirement, no matter what happens.

Identify the lifestyle you want live

Diagnosis

It all starts with understanding your current reality. What is the lifestyle you have now? What are the things you want to more of? What are the things you want to less of?

Understanding the lifestyle you want to live is critical in your planning. It’s also critical to understand what’s getting in the way. At times this may not be so obvious.

This is where an external party, such as a professional financial planner can assist.

ALSO READ: The Couples Retirement Conundrum: More than a Number

Laser Focus

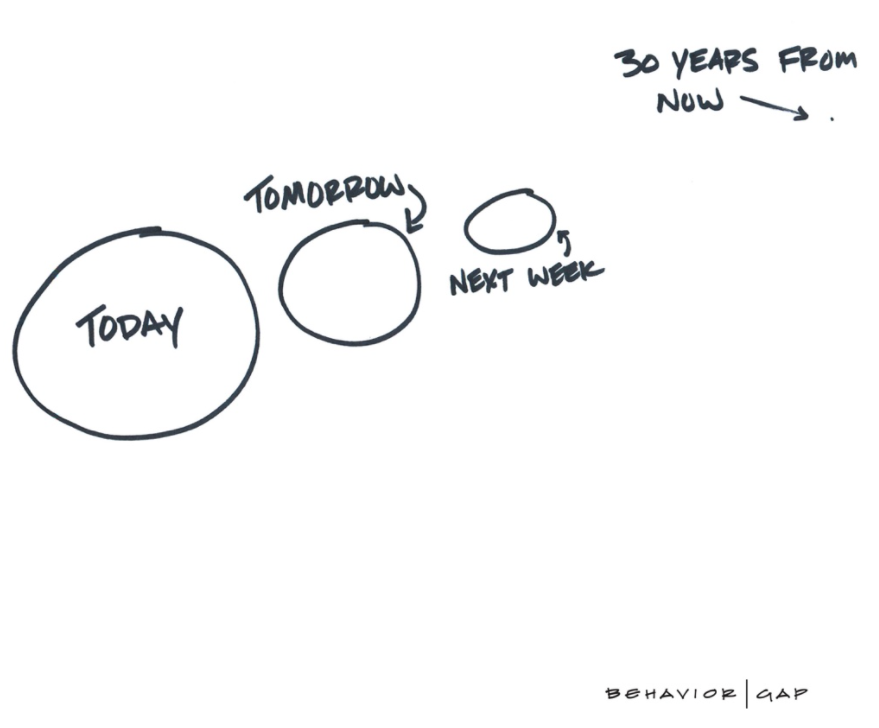

Many get caught up with what everyone else is doing or working towards old paradigms sending them down the wrong path.

Your retirement will not be like everyone else’s. Yours will be unique to you. Therefore whatever plan you are working towards it needs to be individualised to your very specific requirements.

Likewise what got you here today, won’t get you through retirement. Transitioning into retirement requires a different way of thinking.

Understanding your plans will ebb and flow. You require flexibility built into your retirement plan.

Knowing the life transitions you need to plan for will be critical in your planning. When we refer to transitions that would include:

- Empty nest

- Special family event (i.e. children’s wedding)

- Financial assistance to a family member

- Education costs of grandchildren

- Ageing parents

- Health of a spouse

- Career change

- Job re-structuring

- Job training/education

- Selling a business

- Gradual transitioning into retirement

- Changing residential home

- Retirement income planning

- Investing for retirement

- Debt repayment

- Reconsidering investment risk levels

- Significant investment gains/losses

- Considering investment opportunity

- Receiving inheritance

- Estate planning

- Charities

- Gifts to children/grandchildren

- Aged care

Compelling future

Setting a solid foundation for the lifestyle you want is critical in any successful retirement plan.

It’s about combining the science and the art of retirement plan.

Once you have identified the lifestyle you want to live it time to cost your retirement out. Otherwise you are flying blind and will continue to freak out whether you have enough money for the rest of your life.

Achieve the lifestyle you want

Scenario planning

Now that you’ve worked out the lifestyle you want to maintain. Now it’s time to work through the possibilities. The financial side of the equation.

What is it going to take to achieve your lifestyle?

This stage involves long term cash floor modelling to uncover any kinks in your plan, risks and opportunities. Using prudent assumptions of course.

You’ll be in one of three categories:

- Not enough

- Enough, but don’t know it

- Too much

Why is this so important?

Time is slipping away. Life is not a rehearsal!

It’s about understanding what will happen to your financial bucket.

ALSO READ: Live Life With No Regrets! How To Plan Financially For A 100 Yr Life With More Freedom

Most people don’t know how their financial future will pan out. If you’ve worked with an adviser in years gone maybe the focus has been on the investment piece.

But what if you were able to see for the first time how your financial future could pan out. How would this change the way you live your life?

Opportunities and risks which this step uncovers:

- Worrying about whether you’ll be okay, when you don’t need too

- Consider retiring earlier than you were expecting

- Spend more now on experiences while you’re fit and able to

- Perhaps you can reduce working and enjoy life more

- Take less risk with your investments so you experience smaller falls

- Maybe you need to save more for the lifestyle you want

- Perhaps you need to work longer or at reduced hours to achieve your lifestyle

- Maybe giving up work is not for you, but you can undertake work which is rewarding

- Help your kids out more than you thought

The list is endless.

The purpose of such a step is to better plan as you transition from working less and more time for the things you enjoy.

More importantly, it allows you to stress test your plan on a regular basis while achieving more confidence. To consider opportunities you had never thought of.

Tried and Tested Strategies

Ever feel like if you see a financial professional they are going to try and sell you a product or investment?

It’s not what you want, right?

You’ll notice we have got through 5 steps and still we have not talked about any products or investments.

There’s a reason for that. They are the tools in the toolbox.

Until you understand what you are planning for, how do you know what tools (products and investments) you need?

You can break this into two categories, tax and investments.

Once you understand the lifestyle you want to achieve and maintain, you can start to explore opportunities to fast track your results.

For the large part this will involve strategies to maximise your super contributions.

ALSO READ: Retirement Honey Pot: 6 Super Strategies to Boost Your Retirement Nest Egg For Over 55’s

If you are in a position where you have maximised these, you may want to look at other tax structures.

Many spend a significant amount of time on the investment piece.

Here’s the rub…you can’t outperform investment markets and the research backs this up. So why waste so much time trying?

It’s time to stop listening to investment managers and super funds pumping their own chest shouting from the rooftops how good they are.

The only return which matters is the one which helps you achieve and maintain your lifestyle. In other words, the return on your lifestyle.

One question for you, “if you never ever beat the market return but you were able to achieve everything you wanted to in life, would you be happy with that?”.

I’m going to take a punt here and assume you answered yes. Which means achieving and maintaining your lifestyle for the rest of your life is the most important thing.

Use that to drive all your financial decisions.

Simple Structure

It’s step 9, now it’s time to look at what financial tools, if any, you require to get the job done.

Firstly, you’ll need to decide on the type of investment strategy you’ll employ to deliver your retirement income safely and consistently.

ALSO WATCH: 30 Second Retirement Income Plan

Once you are clear on the tactics and strategies you need to take action on. The least important part of your plan is if you require financial products. To find ones which will allow you to implement your tactics and strategies easily and safely.

Maintaining your lifestyle

Step by Step Plan

What does your plan look like? Do you even have a plan?

Or are you winging it with no real direction?

It’s important you have a framework and a game plan to work with. Without one, you’re just lost in the woods with no map on how to get out.

It can be as simple as a one page stating what you are trying to achieve and the actions you need to take.

We call ours “The One Page Plan”.

Timely Execution

It’s ok having the best laid plans, however if you fail to execute they are worthless.

Ever bought a book, but never read it…ever signed up to a course only to never implement the learnings?

Or said you’ll do something only to find months or even years down the track, it’s still not done.

I think we’ve all done this at some point in time.

Your retirement plan is one area you can’t fail in when it comes to execution.

Why do sportspeople have coaches? To help them implement the plan.

This is one area we see many people heading into retirement fail in. Rather than executing on their plan, they procrastinate and miss opportunities.

Forward Planning

Once you have a plan in place, there’s no room for complacency. Your life will ebb and flow and so will your financial plan.

To ensure your plan will still deliver the lifestyle you’ve worked hard for, you’re going to need to continually retest your assumptions. Based on your lifestyle changes and changes in the outside world.

Your future is unpredictable. Preparing is better than repairing.

At times you will go off course and will need to pivot.

We call it the “financial positioning system”.

It’s a way of keeping your finances in check no matter what’s going on around you.

How much money is enough for the rest of your life?

If you’re like most, you’re trying to work out if you’re on track and wondering whether you will be okay in retirement.

This is exactly what our complimentary “Retirement Breakthrough Sessions” are designed for.

To help you identify the lifestyle you want, how to achieve it and most importantly how do you maintain it for the rest of your life.

Retirement planning involves many moving parts. We make it simple for you.

Schedule your complimentary “Retirement Breakthrough Session” here.

Live your best life in retirement!

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals