How average returns may not be telling you the whole story?

Time and time again we hear comments like:

My fund averaged XYZ this year.

My fund is the best returning fund.

This fund generated XYZ over the last 3 years, why didn’t mine do that well?

But is this an accurate assessment?

Is it a true reflection of the return/real $$$ you’ve received?

Can you believe the return stated on your super statement?

It only matters what you keep…not what the average was!

Misunderstanding what average returns represent, can lead you down the garden path.

Is financial marketing blindsiding you into making misinformed financial decisions?

Think about all the adverts you see on TV.

They all promote their own great funds, leading with investment returns. Their sole selling point.

Interestingly the financial services industry is worth approximately $1.3 trillion dollars.

Safe to say, it’s in their best interest to get their hands on your hard earned cash.

They’ll do what they can to convince you to invest with them or to use their fund.

Both industry and retail versions alike.

Does the average return metric matter…

Let’s examine a brief example:

Would you be happy with a 20% pa return on your investment?

Of course you would! Right?

Let’s consider the below example to see if you’d feel the same way…

$200,000 starting balance

Year 1: Loss of 50%

Year 2: Gain of 100%

Let’s look at the average return over those two years.

-50%+100% = 50%/2 = 25% average annual return

Sounds pretty good right?

But what’s happened to the value of the account?

Year 1: Minus 50%: $200,000 – 50% = Loss of $100,000

Year 2: Plus 100%: $100,000 + 100% = Gain of $100,000

So, if you started with $200,000, lost $100,000 in the first year and gained $100,000 in the second year.

How much have you made? $0

You might be sitting there asking, how can you make 25% pa and not increase the balance of your investment?

It boils down to how you calculate statistical averages in years where losses occur.

And if the time frame in question is shorter, averages can be misleading.

Likewise, if you’re looking at longer term averages.

If you look at longer periods of time. Say 3, 5 or 10 years returns.

On the surface you might say that’s great, I’ve done well.

But were you invested for the exact same period the returns represent?

You may want to go back through your super or investment statements and look at the hard numbers.

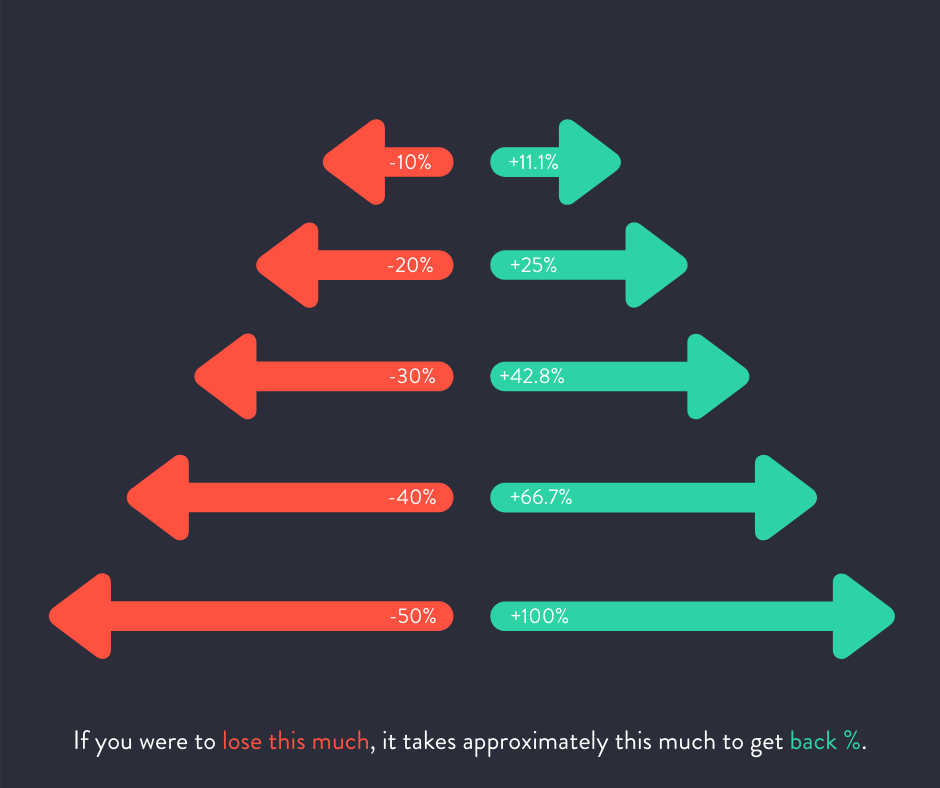

What return does it take to recoup a loss?

The below chart illustrates the return you need to recoup losses.

Us it to help you construct a portfolio for retirement which meets you specific retirement needs.

Don’t accept higher risk for the sake of it.

How to make smart investment decisions instead?

#1 How are investment returns achieved?

While there are some outlier investment managers who outperform investment markets.

The majority rarely outperform over the long term.

In other works, most investment managers struggle to beat the market.

The driver of investment returns is asset allocation. The way you divide your money between cash, conservative and growth investments.

Here is a great resource “What is Evidence Based Investing?”

#2 Align your investment portfolio with the lifestyle you want to live!

Many put the cart before the horse. Put investing at the forefront of their plan.

While important, it’s also important for you to understand how to protect your lifestyle.

Focus on how your investment portfolio will fund your retirement lifestyle.

How do you need to structure your super/investments to replace you income in retirement?

Often the three bucket strategy works well for most.

Have enough money is cash and conservative assets to cover 3-5 years of income.

This will prevent you from having to sell down investments when markets fall.

But don’t leave it until you retire.

You should start to plan how you are going to fund your income in retirement at least 5 years prior.

#3 Regular rebalancing

Your retirement plan should never be set and forget.

Life changes, investment markets and the world changes.

Meaning at times you will need to revisit your investment/super portfolio.

Managing your risk levels up to and through retirement is a critical part of your plan.

So that you don’t take on more risk that you need too.

While making sure you have just the right amount of risk to get the job done.

On a yearly basis you’ll need to dial up or dial down your conservative and growth to meet your ongoing needs.

Change in thinking required as you approach retirement!

All your working life it’s been about accumulating assets, taking on risk.

As you approach retirement, it’s all about risk management.

You need to start looking deeper than the surface level average return if you want to worry less in retirement.

Many are sitting on a time bomb not knowing or understanding the impact of how they are invested.

This is a friendly reminder as you approach retirement. You need to look further than average returns for guidance.

A good retirement plan takes into account how you are going to replace your paycheck every month.

Puts enough metal between you and the world, so when things hit the fan, you’ll sail through just fine.

Provides you with peace of mind.

You’ve covered all your bases and you have the confidence to live a fulfilled lifestyle in retirement.

Would you like a review of your current retirement? Have it put to the test to see whether it’ll see you comfortably through your retirement?

Schedule a complimentary Retirement Breakthrough call by clicking the booking button below.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for over 50’s couples and individuals | Founder of Jigsaw Private Wealth