How do you measure up?

Retirement Planning is a little like covering up through winter.

It’s not until we hit summer and the layers come off that we realise we are we are underprepared and then we start with the latest trend to lose weight quick only to realise we should have started earlier.

Planning for your lifestyle in retirement is no different. Ove 50% of Australians are underprepared, effectively covering up. Eventually, you will have to uncover. What are you going to find?

The earlier you start the more successful you will be and hey you get to enjoy your hard work and live the lifestyle you always wanted when you finished work.

So now we’re into spring. Got through the winter where we all cover up with oversized clothes and indulge with good old comfort food.

But now the weather is warming up and now you’re thinking about looking great in that swimsuit for summer.

So, it’s harder to hide those winter layers.

Now we start comparing ourselves to everyone else.

However when it comes to wealth…. you can hide a lot driving in the latest car and living in the flash house.

So, what if you flashed your financials to the world? What would it look like?

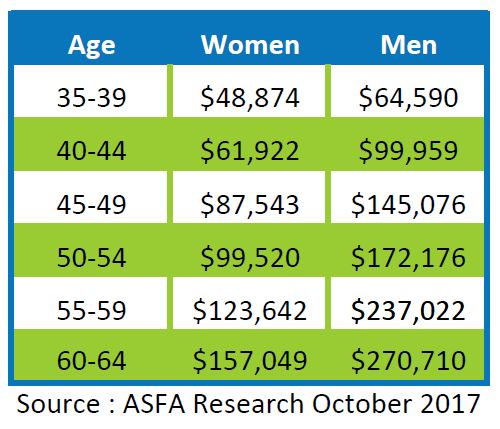

In the last few weeks, we have been talking all things super so let’s have a look at the average super balances and see how you measure up.

Here’s the thing, it’s the same as asking does my bum look big in these pants.

My fitness trainers have always said to me not to compare yourself to everyone else. Your body type is unique and any results will not be the same as someone else.

Therefore it is imperative you stop comparing yourself to everyone else.

The most important thing is to focus on is what you are looking to achieve, what is going to make you happy (your ideal lifestyle) and make appropriate plans around that rather than waste many hours worrying about what everyone else’s financial circumstances are like.

Here’s the thing, they don’t give a dam…

So, if you were to look under the bonnet of those that have the fancy car and the fancy house, it’s likely to be an absolute mess with a tonne of debt holding up the lifestyle. Believe me, I have seen this time and time again.

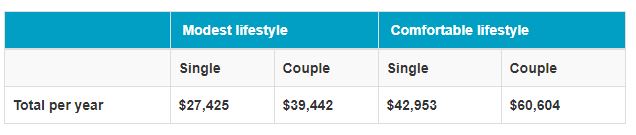

So, what does the average Retiree yearly spending look like?

Source: ASFA Retirement Standard (June quarter 2018)

This may well be great and you may be looking at this and thinking, yeah that’s about all I need and some will be going I need more than that.

The reality is everyone has different ideas on what they want their retirement to look like. I have clients that live on $40,000 a year, most sit between $50,000-$80,000 a year and then there are others that require $120,000-$150,000 per year or more.

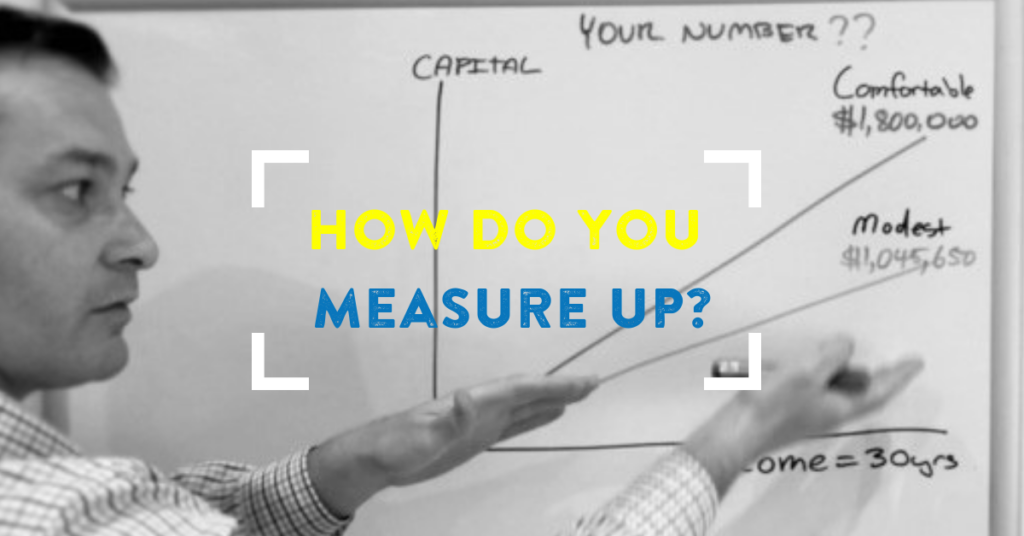

Based on the above chart here is the amount you would need to save to fund that income for up to 30 years:-

Source: Bluenotes 17th July 2017

Given that most of us are going to be retired for a long time, for some up to a third or more of our life, don’t you want to make sure you’re well prepared to live a comfortable life in retirement?

The numbers above are only averages, but if you want to find out your exact number, download our guide below and calculate your number.

To find out what you need to be aiming for you can calculate what you need to fund your future lifestyle by downloading our Start Right Guide to Designed Retirement Lifestyles by clicking here>>>

The other most important factor is measuring yourself against the right metrics.

Once again my trainer said to throw away the scales and get a tape measure. When training to look better you are going to lose fat and gain muscle, so your weight loss is only part of the equation. The most important metric is your measurements, so only use the tape measure to measure your success when losing fat, they were right.

Here’s the thing, this is very relevant when measuring your progress against your retirement lifestyle. Most don’t know how to measure their progress and most focus on the wrong metrics.

So, here’s one metric that is going help you fast-track your progress. Click here to view the article>>>

The key takeaways are:-

- Don’t compare yourself to everyone else.

- Know your numbers.

- Use the right metrics to compare your progress against.

So, now you have two options:-

- You can decide to take this information and give into apathy and do nothing while living with the fact you may not have the retirement you first thought you were going to have. You’ll be the one sitting there feeling sorry for yourself that you can’t afford to do what your friends are doing.

- Alternatively, you can be pro-active, take stock, work through your number, work out your gap and look for solutions to fill the gap so when you arrive, you arrive in style ready to rock your lifestyle when you give up full-time work.

Hope that helps.

PS. Building a retirement nest egg does not mean you have to give up your current lifestyle. You can have your cake and eat it too. You just need the right approach that gives you a balanced approach. Want to fast track it all? Just book a quick call below and we’ll have a quick chat to work out where you focus needs to be. Nothing to sell, just a quick conversation to point you in the right direction.

NEXT STEPS:-

Feel like you are confused about how to take control of your money, where to start and how to make it work harder for you? Book a 15 min Fast Track call here>>

We’ll get on the phone for a quick chat and:-

- Have a quick look at the issues you are facing or wanting to address and perhaps a couple you don’t know about.

- Help you diagnose what might be getting in the way.

- Give you clarity about the main actions you should be taking now to get you ahead quicker.

Make it a great Life!

Challenging the Status Quo!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Email: gdoherty@jigsawprivatewealth.com.au

Mob: 0401 253 729