How knowing what you don’t know can set you up for retirement success?

Money, dreams, aspirations and your NEXT chapter are at stake.

It’s a BIG burden to bear…

And when it comes to your money and funding your retirement, it’s a highly emotional topic.

After all, you’ve worked for 30 plus years building your next egg.

Your emotions are heightened as you approach your next major life transition.

Your fight or flight radar is in overdrive!

Just one bad decision can leave you living with regret for the rest of your life.

But there’s one glaring area that comes up in the majority of prospective clients we meet.

You know the saying “you don’t know what you don’t know”?

Yep, it comes up in just about every Retirement Breakthrough Session.

It’s the things you don’t know that could be costing you money now and in the future.

Common areas people trip up

The way you structure your finances leading up to your retirement.

The way you utilise or don’t utilise your super contributions to improve your position at and through retirement.

It’s the way you think about investing and the strategy you use.

A process for making financial decisions. One not driven by emotions.

Sure, you can go to the google labyrinth and never be seen again. Let alone finding an answer specific to your personal situation.

For most, it leads to frustration, spinning your wheels and inaction as analysis by paralysis kicks in.

Our brains have not had an upgrade

The trouble is opportunity. If you’re excited, it means trouble…

As Dr Daniel Crosby, author of “The Laws Of Wealth”, says, we couldn’t be wired any worse for financial decision making. Particularly when it comes to investing.

As humans, we’re created for action, emotion and created to act on our own individual impulses.

While this has served the human race for hundreds of years.

We have profoundly bad wiring when it comes to making important financial and investment decisions.

Yours truly has been at the receiving end of bad wiring once or twice over the years.

Unlike your mobile phone which receives regular updates/upgrades.

Our brains have not had one for thousands of years.

How a framework can transform your retirement journey

Or a set of rules.

This is where automation and discipline shine everyday of the week. Removing emotion from important financial decisions.

When you make a discretionary decision it violates the rules or framework you should be following.

These mistakes ultimately cost thousands, if not hundreds of thousands to your retirement nest egg.

Leading to a compromised retirement lifestyle. Working longer than you had planned or a reduced legacy.

Dr West Gray of Alpha Architect conducted research about how often discretion beats rules based decision making.

He found 94% of the time following simple rules beat even PHD level human discretion.

For most people especially heading into and through retirement. It’s hard to stay the course, because we are highly emotional human beings.

After all your money, dreams and aspirations are at stake.

What’s what you don’t know costing you?

Sitting in the front row allows us the ability to see what people are doing. What they don’t is costing them.

Recent examples:

- Prioritising paying debt over contributing to super. By reversing this thinking. Medium term benefits provided a positive of over $100,000 the their nest egg at retirement.

- Thinking the current plan is best. Rethinking their strategy by utilising super rules to reduce hidden death taxes by $150,000.

- Thinking a DIY approach to investing was best. After analysing the current investment strategy. We identified this client did not need to expose their retirement to such risk. Reducing their investment risk according to the income they needed to last through retirement. Led to more confidence and less worry in retirement.

- Thinking their current retirement path was ok a couple reached out to see how they were tracking. After a thorough analysis. We identified some changes which enable them to increase their retirement benefit by nearly $200,000 over 10 years. Giving them the choice to retire a couple of years earlier if they so desired.

In all cases these changes to their current arrangements meant they’ll arrive at retirement in better financial shape. Aware they will not run out of money while not having to worry about how investment markets are behaving.

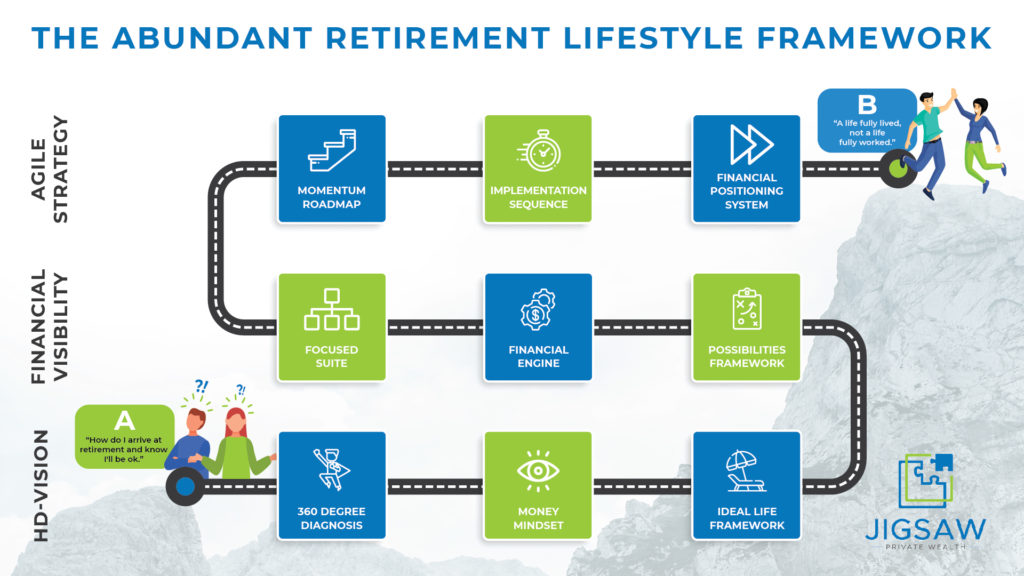

All using “The Abundant Retirement Lifestyle” framework to guide their decisions. A set of tools to make financial decisions based on a proven framework.

The 3 E Framework

Dr Daniel Crosby, suggests a simple framework to make better financial decisions. Move the dial decisions.

EDUCATION: Learn to understand how investment markets really work. Not just how shares work, but ultimately what the driver of investment returns are. Learn how emotional it is and the impact it can have on the quality of your financial decision making.

Sure you can try to figure it out on your own. Or you can short cut your learning experience by working with a retirement specialist.

ENVIRONMENT: How you set your finances up. For our clients we set up a margin of safety in every single retirement plan. One which provides a feeling of safety.

For instance we use a bucketing approach for every client. Providing comfort and confidence.

The right strategy, right portfolio and the right mix of investments. So they can safely navigate their retirement journey.

ENCOURAGEMENT: There’s going to be times when your emotion will start to seep through. Your nerves are going to be tested, particularly around or through retirement. At times you’re going to freak out.

Your impulses are going to be heightened at a time of great emotion. Critical at this point is having just in time feedback.

We have decoded a tool for helping keep people focused on the journey. It’s called the “Abundant Retirement Lifestyle Framework”. 9 tools or rules to keep clients focused on the journey and avoid costly mistakes.

What’s the true role of an adviser?

In the past, financial advisers were essentially sellers of financial products for big financial institutions. This has largely changed over the years.

While you may have personal opinions on this, either from good or bad experiences.

This is the main role of an adviser, to help you navigate the journey you’re on. The investment piece is important and one of the components of your financial engine, it’s a small part.

For most people especially those close either close to retirement or in retirement. It’s hard to stay the course because we are emotional human beings.

Remembering your money, dreams, aspirations and legacy are at stake.

The real benefit of good financial advisers is to keep you out of 3 or 4 fundamentally bad decisions over an investment or retirement timeframe. While guiding your investment behaviour.

You only need to look at the market events in the last 20 years. The tech bubble in early 2000’s, financial crisis and Covid-19. All providing opportunities to get wrong, BIG time…

Some of the BIG mistakes we’ve seen

- Holding overly aggressive investment portfolios – losing hundreds of thousands of dollars

- Selling out in a down market, wiping hundreds of thousands of dollars from a portfolio

- Holding one asset class and watching their assets tumble by 50%

- Not investing for fear of losing their money

- Holding too much cash – yes you can hold too much cash and this can cost you hundreds of thousands of dollars

- Chasing the next shiny investment only to watch it crash and burn

The role of a good adviser is to keep you cool, calm and make rules based decisions (not based on emotion) in extraordinary times.

Keeping you from falling victim to emotionally driven decisions. Not only saving your retirement lifestyle. But can generate a multiple of return on the financial investment in a good financial planner.

Would you like to know how you can transform your current retirement plan?

One which cuts through the confusion, saves you time and delivers a clear path to follow.

Here’s your personal invitation to book a “Retirement Breakthrough Session”.

We’ll help you start to build your personal blueprint. One which will deliver your comfortable retirement lifestyle. With less worry…

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for over 50’s couples and individuals | Founder of Jigsaw Private Wealth