How Much Is Enough For Your Retirement? Two Heavyweights Battle It Out…

Retirement brings with it many emotions.

Fear about whether you’ll have enough for a comfortable lifestyle in retirement…

Anxiety about making the transition from your working life to a retired lifestyle…

What about the unknowns you need to prepare for?

Excitement for what lies ahead and many more…

But there’s one question that baffles most when it comes to making sure they are in a financial position to retire.

Where work becomes optional…

How much money do I need to fund a comfortable retirement?

For some time there’s been one authority for defining how much you need. The Association of Superannuation Funds of Australia (ASFA). Also known as the Retirement Standard…

Updated quarterly, they are often quoted in the financial press and have been a go to for many soon to be retirees.

The debate has heated up in recent times with a new kid on the block, Super Consumers Australia (SCA) in partnership with Choice adding to the debate.

SCA’s view is that the ASFA numbers are way too high.

So who is right and which one should you rely on…

The undisputed heavyweight, in the red corner we have ASFA…

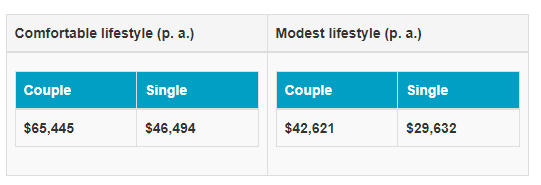

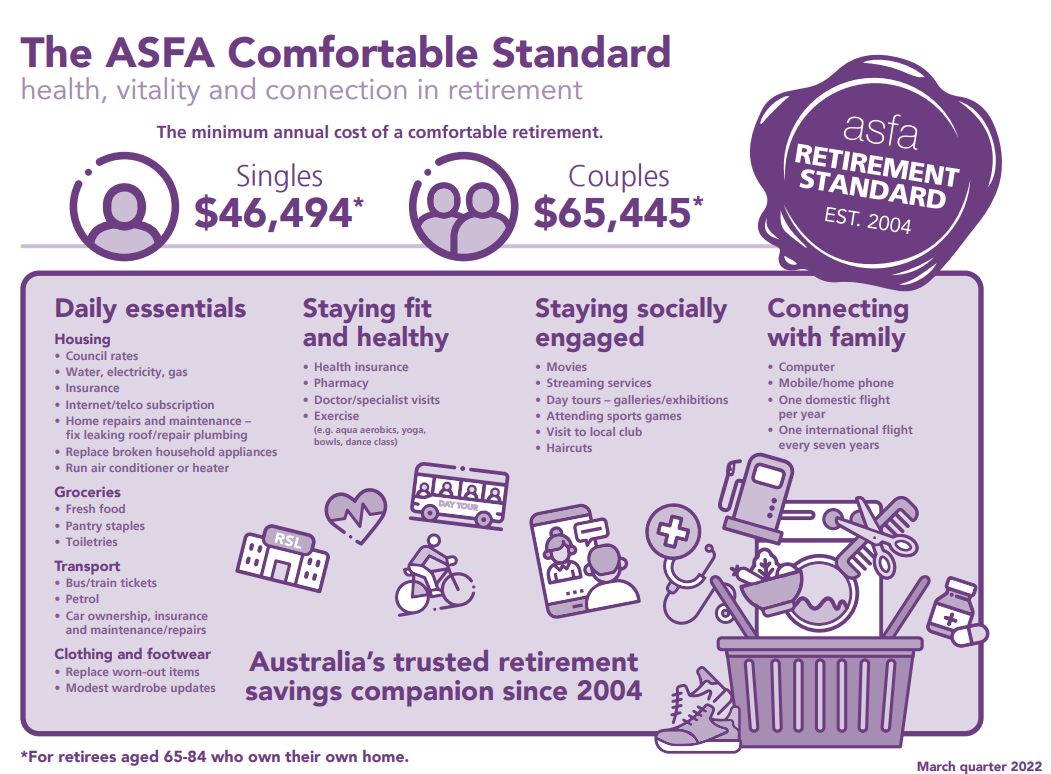

ASFA tracks a range of expected expenses for retirees between the ages of 65-84.

ASFA refers to this as a “comfortable retirement lifestyle”. Enough to maintain a good standard of living.

While their “modest lifestyle” refers to living just above the age pension. Nothing elaborate, just covering the basics in life.

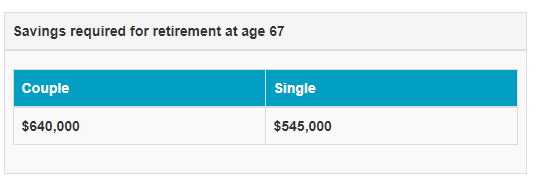

Based on the income required to fund a comfortable retirement lifestyle. ASFA have determined a capital amount people will need to fund this income. This takes into account access to the age pension through retirement.

The new up and comer in the blue corner, the SCA…

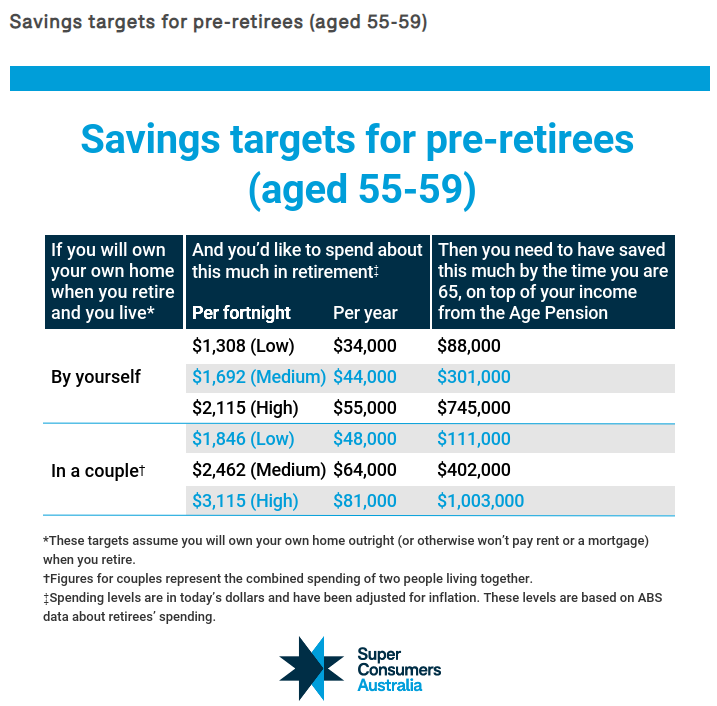

Super Consumers Australia (SCA) works on saving targets as a starting point. Assume you own your own home and that most people will access the age pension.

SCA argues that the ASFA numbers are unrealistic and unachievable for most retirees…

SCA takes a dig at ASFA for “representing the superannuation industry”. Looking more closely at actual spending and not taking into account aspirational goals.

SCA argues ASFA represents the top 20% of retirees. Which creates unrealistic expectations for most retirees.

SCA says that a couple would need to have $402,000 in retirement savings to draw a medium income of $64,000 pa. Taking into account income from super and the age pension.

Whereas ASFA put that number at $640,000.

A media storm erupts…

This new research by SCA was supported by well known financial commentator, Scott Pape. More commonly known as the “Barefoot Investor”.

Scott is well known for his support of the Aussie battler…

Now in support of SCA figures making it more attainable.

He’s often said that you only need a modest amount of money in super, the age pension and work one to two days per week in retirement and you’ll be fine.

But to be honest, it depends on who you talk too…

After including this information in his recent newsletter, Scott Pape received a barrage of messages…

“That’s WAY TOO LOW!”

“Are they eating baked beans in retirement?”

“You need AT LEAST $1 million to do anything half decent in retirement!”

“My view? The million dollar number is a myth…As long as you own your own home, you can live a meaningful, purposeful, retirement with much less money. After all, we have the amazingly good fortune to be living in the greatest country on earth, with a strong social safety net based on the aged pension plus subsidised medical and aged care.”

Writer for The Sydney Morning Herald, Jessica Irvine made some sense writing:

“If I were to cut out overseas holidays, eating out, gym fees and stop driving to work, I’m fairly confident I could get myself somewhere closer to the industry’s ‘modest’ standard. And that’s comforting, indeed. Learning how to live on less is definitely the most empowering thing you can do when it comes to setting yourself up for retirement. Don’t forget that once you’re retired, you’ll have more time to cook meals at home and less need to spend money to offset the stresses of work.“

How much do you really need and who’s right?

…it depends on whether you just want to get by on the basics or you are someone who wants more in retirement.

While both ASFA and SCA make a great argument, it comes down to you, the individual and what you want out of retirement.

Do you want to survive on the basics?

Or…

Are you someone who likes to travel, eat out with friends, enjoy nice wine and have BIG plans for your retirement years?

For some, they are happy with the basics while others want to live a good life in retirement.

As someone who has worked with pre-retirees and retirees helping to craft their retirement roadmaps for two decades. We have clients who live on $40,000 a year right up to those who need $150,000 a year.

It boils down to what you want in retirement.

For some, around one million will see them through retirement.

For others living an active retirement, they will require more.

The type of client we work with are generally going to be self-funded. If they structure their finances in the right manner. Somewhere between one to two million will see them through retirement quite comfortably.

Are you someone who is aspirational and wants the good things in life?

To travel regularly…enjoy a good bottle of red wine…go to nice restaurants…keep fit…enjoy your hobbies and more.

Or are you someone who is happy with a more frugal lifestyle?

The bottom line…it’s an individual thing…no one’s going to live the same retirement lifestyle as you.

While you can use these numbers from ASFA and SCA, the only number that is going to be right. Is the number that makes your retirement dreams a reality…

What do you need to consider when calculating how much you really need?

Monthly income – how much do you need to live a comfortable lifestyle. Pay the day to day bills, going to nice restaurants, enjoying a nice bottle of red, funding hobbies and more.

Capital expenses – what are the once offs that you need to consider. Overseas holidays. Are you flying first class or economy? Five star hotels or three star hotels? How often do you replace your car and how much is the changeover?

Do you want to help your children or grandchildren out financially?

Do you plan on buying a caravan at retirement?

Longevity – the big unknown. How long are you going to live? This will have a big impact on how much you’ll need. The longer you live the more you’ll need. Underestimate this and you risk running out of money.

A great tool to help you get a feel for how long you need to plan for is the Lifespan Calculator. While I wouldn’t fully rely on it, it can be a useful tool for helping you work out how long you might need to plan for in retirement.

Risk Level – How much risk are you willing to accept in retirement? The more risk you are happy to take the less you need. But you risk blowing up your retirement.

The lower the risk, the more money you’re going to need…

Investment returns – investment returns are unpredictable. Overestimate and you run the risk of blowing your dough too quickly. Our preferred option is working out the return you need to make the plan work and then work back on the level of risk you need to take.

Paid work – Are you going to take on paid work in retirement? We have a lot of people who are going to retire. But will pick up work on their grey nomad journey around the country.

Alternatively, some will take on a role part time because they have a lot more to give.

Centrelink – Will you access age pension during retirement? Or if there is an age difference is their a period of time you can access the age pension.

Downsizing – Are you planning on realising a capital from the sale of your residential home?

While this is not an exhaustive list, they are some of the key components that you need to take into account when working out how much you need.

You can see, it’s not as easy as what most people think…

Who’s right…ASFA or SCA?

Neither…the only right answer is what income you need to live a comfortable retirement and do all the things you planned for.

Sure, they are a great starting point, but if you’re aspirational in your retirement dreams, you’re going to need more than what ASFA and the SCA suggest.

Get your numbers wrong on this and it does not end well…

The longer you delay having a plan for retirement the less money you’ll have in retirement…

Aussies are not known for their planning…

We all have dreams of reaching retirement and the things they’ll do. But most have no clue how they are going to achieve it.

Too many people are walking blindly into retirement…

It’s hard and it’s complex to work it all out…

I don’t blame them, it can be extremely overwhelming…

A number of clients we’ve been working with recently all had dreams of working for a certain period of time prior to retirement.

After crafting their customised retirement roadmap, they were in a position to retire a number years earlier than they had expected.

Without a plan, they would have continued on their merry way, unknowingly working longer than they needed too.

Maybe you’re in that position now, but don’t know it. Or maybe you won’t have enough but don’t know it…

Either way, every day you don’t have a plan is less money you’ll have to enjoy in retirement.

If this is you, book your Retirement Clarity call below and we’ll help you figure where you retirement plan needs fine tuning.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement