Investment Portfolio Safety Drill – Rebalancing

Investment Portfolio Safety Drill – Rebalancing

Do you remember the good old see-saw?

You don’t hear of them much anymore, in fact, I don’t know the last time I saw one in a playground!

I used to love them as a kid, up and down, up and down. I was the type of kid, yes the naughty one, who at the bottom would jump off only to watch the kid on the other end tumble back to the ground with a great big thud as the balance of the see-saw changed.

Sure, I had my fair share of falling back to the ground as people jumped off the other side. It was never a great feeling.

The premise was to keep the balance on both sides of the seesaw so you could enjoy the even up down.

But Glenn, what does this have to with investment portfolio’s you might say?

It’s about finding the right investment balance on a regular basis so you don’t come back crashing to earth. So you don’t experience the pain of uneven risks in your investment portfolio, particularly in retirement.

Just like the person jumping off the seesaw at the bottom. There is uneven weight distribution, and usually, there is some pain or discomfort involved.

In our last post, we discussed the importance of balancing out the risk you take in comparison to the life you want to live. Call it the minimum amount of dosage of risk to get the job done, not the maximum amount of risk. If you missed it you can catch up by clicking here>>

What is rebalancing?

In our previous post, “Investment Portfolio Safety Drill – Part 1”, we discussed how to assess the amount of risk you need to take and what different types of risk levels looked like.

On often overlooked part of retirement planning is rebalancing your investment portfolio. It’s safe to say that it could make or break your retirement if you do not manage it on a regular basis.

Here’s a great chart from Vanguard Investments showing the impact of rebalancing and not rebalancing:

Let’s look at an example. Let’s say in 2016 you set your portfolio up with an allocation of 60% shares and property (growth investments) & 40% cash and bonds (conservative investments).

The investment markets have been pretty good since 2016, right?

It’s likely the growth part of your portfolio has done well while you’re more conservative side has been ho-hum.

If you did nothing, your portfolio allocation might look something like this:-

80% growth/20% conservative

Your risk level has completely changed. See our previous post and review the chart to see the increase in risk here>>

Rebalancing would mean selling some of your growth investments and buying more of your conservative investments.

Confirmation Bias!

But, hey Glenn why would I want to sell investments that have been doing really well for me and buy the investments that have performed poorly you might ask?

Shouldn’t I just be buying more of the ones that have been doing well?

It seems against everything we believe in, right?

So, it’s normal to just let things go when they are doing well.

We’re only human after all.

We’ll look for every reason, every bit of information that supports our thinking. You are going to seek out all the information that supports you’re thinking about retaining those investments rather than rebalance and do the complete opposite of what you should do.

It’s called confirmation bias and we all do it, me included.

Let’s look at the depths of the Global Financial Crisis for example. At the bottom, undertaking a rebalancing exercise in your investment portfolio was a scary experience.

Let’s think about it for a minute.

You’re being asked to sell your most conservative investments only to buy growth investments that have suffered a 50% drop.

How scary is that? Why wouldn’t I just buy more of my conservative investments?

If we take the emotion out of our decision-making process which is extremely difficult, and just follow a well thought out process everything will work out.

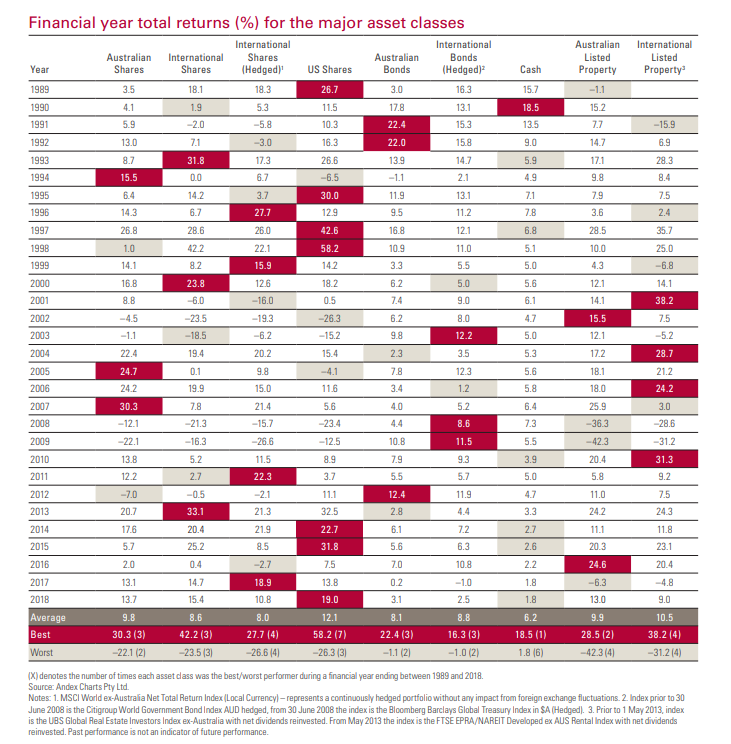

You see, all investments have their time in the sun, one year it will be Australian shares that perform the best, the next International and then Property. They all move in cycles.

Just take a look at this chart from Vanguard Investments:

If it’s against everything we believe in, why should I rebalance?

As we do for all our clients, we assess the level of risk they need to take to get the job done, so they can ROCK RETIREMENT!

We implement a disciplined investment strategy that takes out all the emotional decision making that gets in the way of success.

You have your comfort level set, the amount of downside you are willing to take.

As we presented in the example above, the amount of risk in the investment portfolio has increased significantly.

As always, no one knows what investment markets are going to do, not even the experts!

Rebalancing is a critical step in safeguarding your investments pre-retirement and in retirement.

So, when should I rebalance?

There is no hard and fast rule with how often you should rebalance.

However, if you are working with a good adviser, they will assist you in making the right decision based on your unique circumstances.

Ideally, undertaking this exercise once a year would be sufficient. There is no real evidence to suggest that doing it any more regularly adds any more value.

In some instances, it’s ok to let investment portfolio allocations run a little. That is you allow a range that you are comfortable with prior to rebalancing. You might allow, say 5-10% over the level of risk you are comfortable with prior to rebalancing.

There are also other issues to take into account, such as timing for capital gains which may impact your decision to rebalance. However, tax should not be the driving factor in holding off a rebalance.

With our clients, we generally allow a range somewhere between 5-10% prior to rebalancing. Given we know our clients very well, we know the ones that are happy with a little more risk and the ones who could not cope with increased risk levels.

It’s important to know what you are comfortable with tied to the life you are trying to live and follow a well thought out process.

Problems start arising when you deviate from the process or plan.

The key to any successful retirement is to have a well thought out plan, both leading up to retirement and while living your life in retirement.

Practical Planning:-

- Locate a copy of your investment portfolio with the different investment allocations on them.

- Compare it to the comfort level you have.

- Make the necessary changes to bring your asset allocation back into line.

NEXT WEEK, we’ll be discussing how to set up enough cash reserves in the last installment of our Investment Portfolio Safety Drill series.

Hope that’s been useful:-

Now, go ROCK RETIREMENT…

NEED SOME HELP?

If you’re someone who is up to 15 years away from retirement. You plan on being self-funded. You have accumulated some assets and want some help to hone your retirement plans. Feel free to book in a 15 min Rock Retirement call here>>> . In this call, we’ll help you work out what that first step is for you, what you need to focus on to fast track your progress.

I’ll be honest here, we won’t do your pushups for you. But if you are motivated for the right reasons we can save you a lot of time and heartache. We can save you from the mistakes most people make to fast track your way to a ROCKING RETIREMENT.

Ps. We don’t sell you anything on this call. We will help you determine what the next step is for you. However, if you are someone who is looking for a get rich scheme, silver bullet or believe you know everything we are not for you. If you are someone who really wants to achieve financial freedom, committed and wants to work collaboratively then we can help.

Know someone that would gain benefit from the information, feel free to forward on.

Glenn

Make it a great Life!

Challenging the Status Quo!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Email: gdoherty@jigsawprivatewealth.com.au

Mob: 0401 253 729