Is this the missing piece in your retirement puzzle?

You’ve reached middle life or a little further on than that.

You’ve done some things, done some stuff and now retirement is on the horizon.

You’re “Next Chapter” is not far away.

But there’s an elephant in the room…

How do you know you’re going to be okay financially in retirement?

How do you set your finances up for retirement?

Most don’t know what you don’t know…right?

Maybe you’ve googled a few topics trying to find some answers.

It’s a little like being lost in the woods, never finding you’re way out. Let alone taking any action.

Maybe you’ve reached out to a financial professional. Only to be disappointed because they were only trying to sell you a product and didn’t focus on you.

There’s no real way of knowing whether you’re going to be okay.

Here’s a video discussing “The Quest for the New Retirementality!”

Here’s the problem

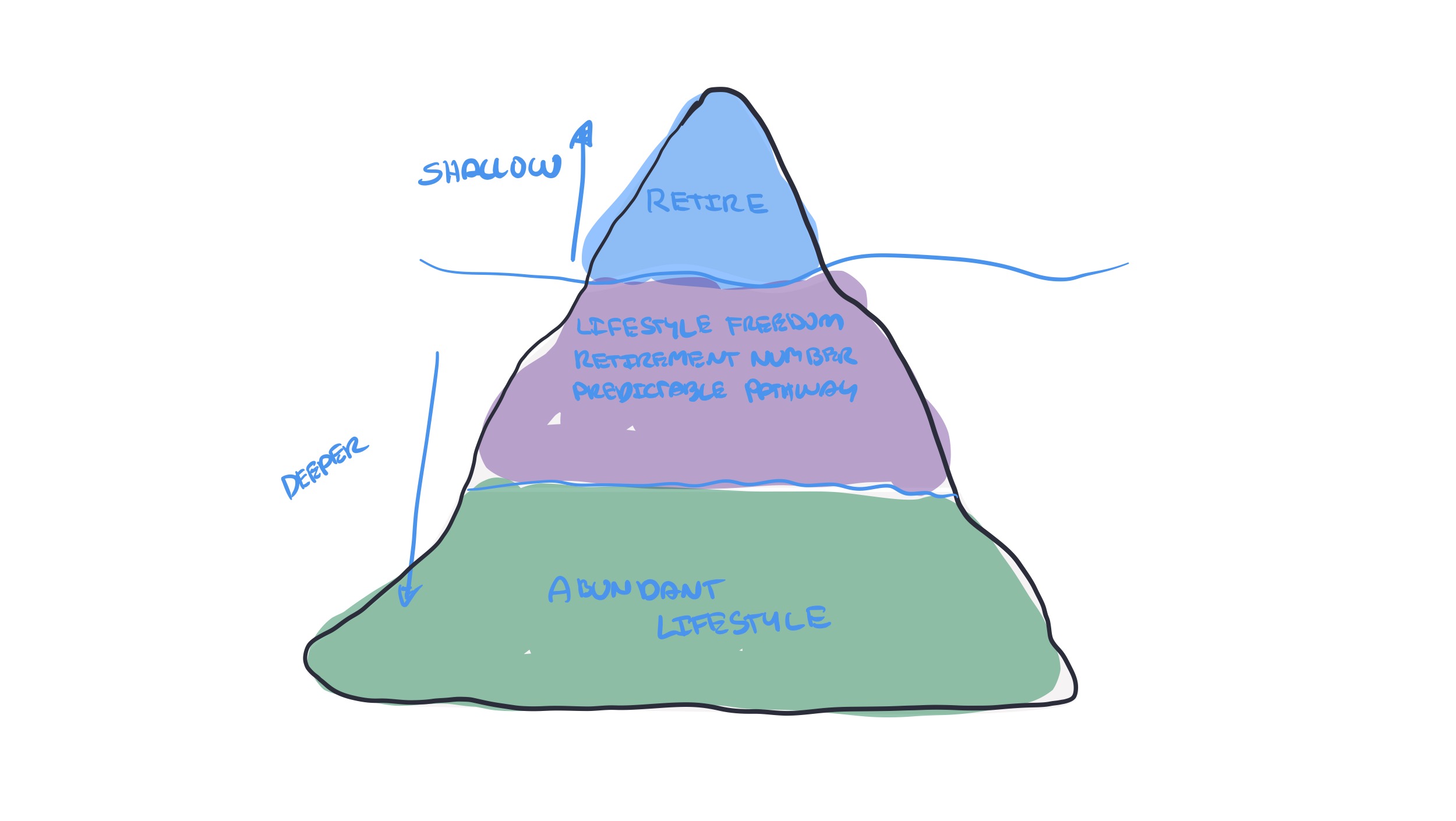

Most are thinking about retirement. While this is what most are wanting to do, retire. It’s a shallow conversation.

It’s like the tip of the iceberg…

We know the majesty of the iceberg is below the water line.

If it’s not about retirement, what’s it about?

It’s about the outcomes you’re looking to achieve…

Being clear about the lifestyle you want, a clear vision. Achieving lifestyle freedom.

Having financial visibility. Knowing where you stand and the viable options available to you.

Finally, having a proven pathway to follow.

It’s not really about that either, is it?

We believe everyone deserves to live an abundant lifestyle.

Isn’t that what you really want?

A life well lived, not a life fully worked…

The hole in your retirement plan!

There is one glaring hole in everyone’s retirement plan, more so for those going down the DIY route.

It’s not having a clear framework for making sound financial decisions.

Sure, you might have an idea of what your retirement lifestyle might look like.

But once you’ve completed all the fun stuff, then what?

How are you going to feel fulfilled in your retirement years?

Complete our Return Of Life Quiz to find out the areas in your life you may want to focus on.

Once you’re crystal clear on the vision for your retirement, what’s next?

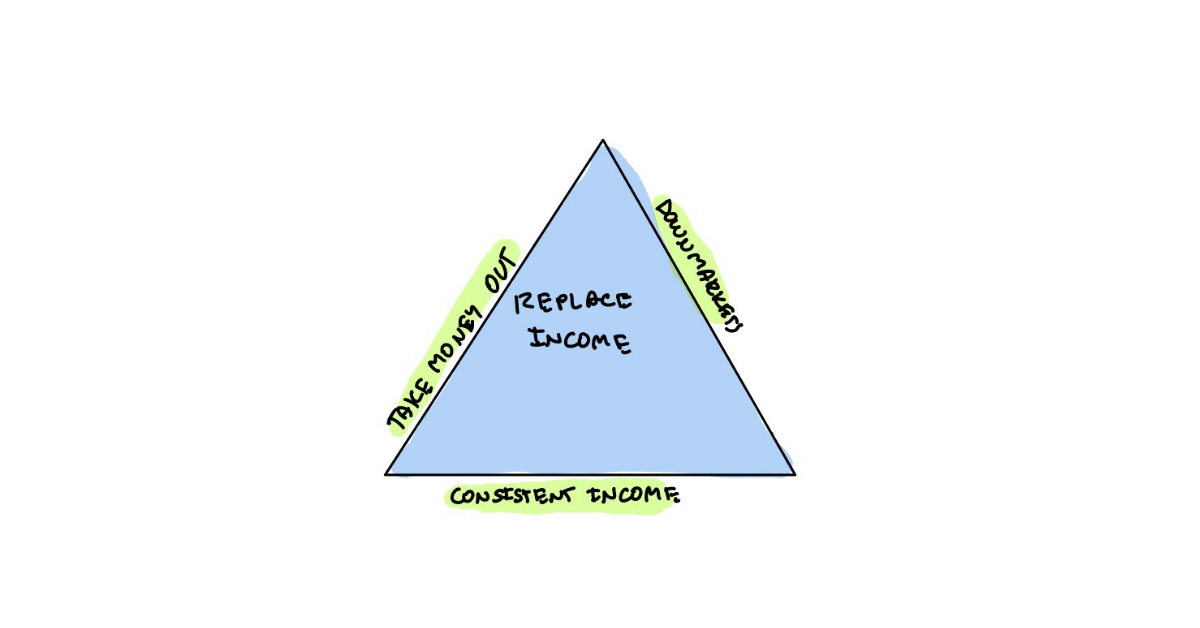

What problem are you solving for?

You’re probably thinking, have I got enough money for retirement?

While on the surface, this may look like the problem you’re solving for. There’s an even more important problem you’re trying to solve.

How do you replace your income once your regular monthly income stops?

And when we think of solving this problem, there are three critical questions which must be answered.

#1 How are you going to withdraw your money? So you receive your monthly income.

#2 How are you going to plan for a down market?

#3 How are you going to keep your cashflow consistent?

Understanding your retirement cashflow timeline is critical to helping solve this equation.

Why is a retirement cashflow timeline critical?

Understanding how your regular income will flow into your bank bank is critical.

Preparing in advance allows you arrive at your retirement date in great shape.

This aspect is something many ignore.

You want to make sure you have enough money set aside prior to retirement to fund your first few years of income.

You don’t want to hit your retirement date. Watch the sharemarket suffer losses and have to sell your investments in a down market.

Do you?

Those who are unprepared end up working longer than they had expected. Some are forced into downsizing their retirement lifestyle.

Prepared rather than repair

Your planning needs to happen way before your retirement date.

The sharemarket, as everyone knows, fluctuates. You don’t want to ever be in position where you are forced to sell investments in a down market.

You want to make sure there is sufficient cash to fund your income in down markets.

We don’t want to put our clients in that position. Be appropriately prepared.

As you start drawing income from your investments in retirement, you will start to freak out…

All your life you’ve seen your investments go up in value. Sure, share markets have fluctuated but for the most part your investments have gone up.

When you’re in retirement, you start taking money out to fund your income and you’ll see your balances go down. And that’s okay.

Provided you’ve done the planning up front.

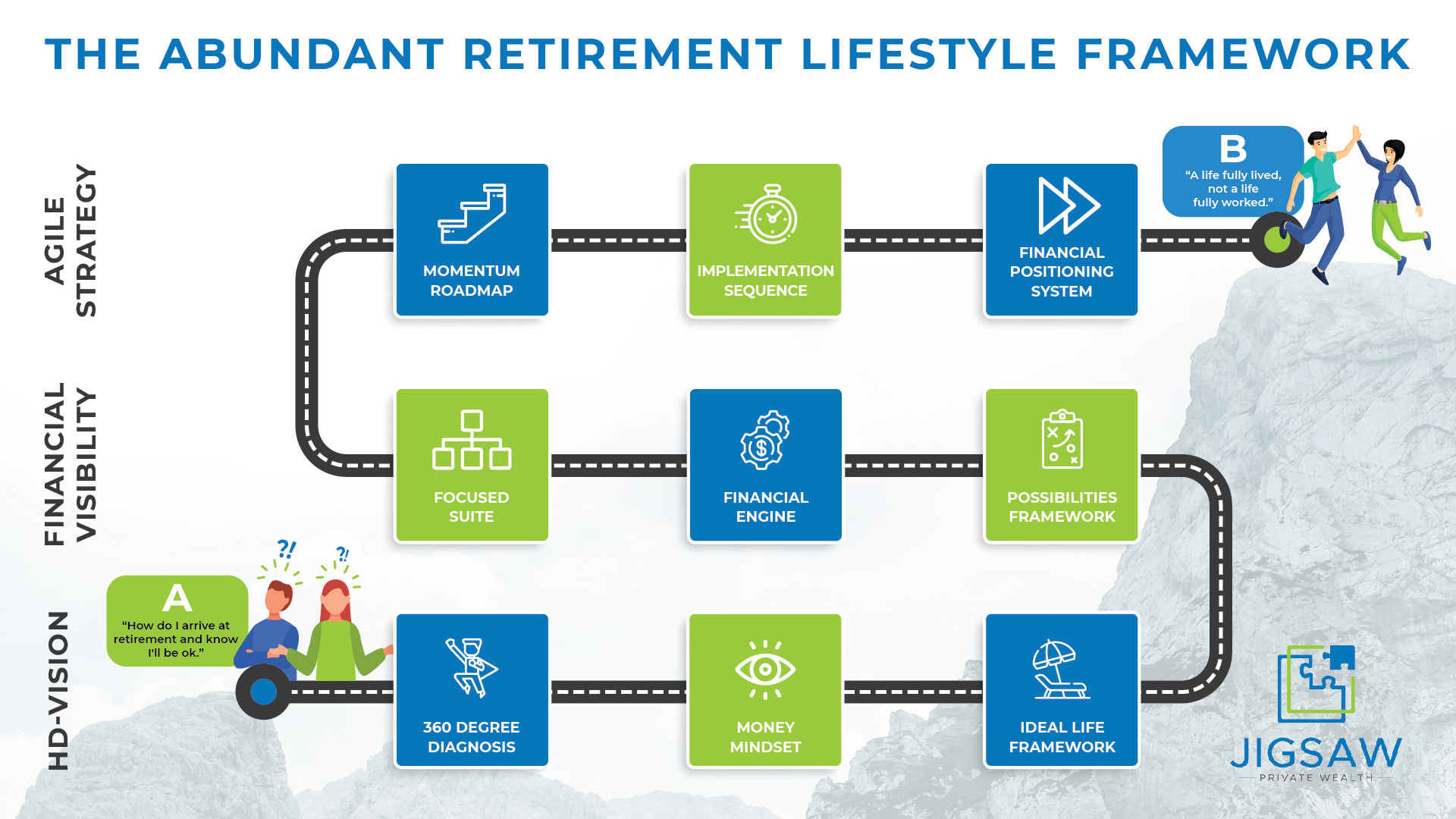

A framework to confidently plan your retirement

You’ll notice there has been no discussion on the type of super fund you use or the type of investments you use.

This is deliberate. Too many people jump straight to the tools without setting the scene first.

Once you understand what you’re planning for. Your better prepared to determine to tools you will need to get the job done.

This framework is not only responsible for adding hundreds of thousands of dollars to client’s retirement nest eggs.

But, more important, giving clients the confidence to retire on their terms. Knowing they’ll be able to sleep well at night and not have to worry about running out of money in retirement.

It’s the blueprint for planning and living and abundant lifestyle in retirement.

A live well lived, not a life fully worked.

Would you like your own personal framework for achieving your retirement lifestyle?

One which cuts through the confusion, saves you time and delivers a clear path to follow.

Here’s your personal invitation to book a “Retirement Breakthrough Session”.

We’ll help you start to build personal blueprint. One which will deliver your comfortable retirement lifestyle. With less worry…

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for over 50’s couples and individuals | Founder of Jigsaw Private Wealth