Lessons from the FIRE movement that will SAVE your Retirement…

Lessons from the FIRE movement that will save your Retirement…

The FIRE movement hey, what are you talking about this time, Glenn?

You may or may not have heard of the FIRE movement or Financially Independent Retire Early.

They want to do things differently, impatient, wanting to not wait until their 60’s to enjoy the freedoms most work their whole lives to achieve.

They are people aged in their 30’s and 40’s living frugally, saving anywhere between 50%-70% of their salary to speed up their retirement date.

For some this works, for me not so much.

I’m happy to work, I love what I do. As long as I can do what I want I will continue doing what I am doing.

I’m also not sure I know too many who would subject themselves to this extreme way of living just to retire in their 40’s. Essentially life as you know it disappears.

While many may just ignore this group, there is a critical lesson to be learned that could save your Retirement…

Here’s the thing, the major premise this movement is built on, drawing 4% of their balance per year may be floored.

They have invested and saved in an era where returns have been good and in most cases above average.

They are assuming those returns will continue.

I’m telling you now, ignore at your own peril.

Whether you are limping to the line with just enough for retirement, know you will have enough or know you are going to leave a nice little legacy for your kids, it’s going to impact your investments in some way, manner or form.

Want to know you’ll be ok in retirement? Click here to book a call and we’ll help you work that out.

Here’s the thing, the last 10 years have generated really good returns. It’s lowered many into a false sense of overconfidence.

Maybe you’ve been doing things yourself.

You might be patting yourself on the back for the great work you have done.

Or you might have been spooked by the naysayers and retreated to cash.

Either way, we know it’s going to be different in years to come…what if we enter a low return world?

How is that going to impact your retirement plans?

If you base your retirement plan on incorrect assumptions you will have just blown up your retirement plan.

It only ends one way…in tears and compromising on your best life…

Want to know the simple yet effective steps on how to set yourself up for retirement? One with less stress and anxiety about your money and more security and confidence that you’ll be ok? Click here to book a Confident Retirement Call now and we’ll help you work it out.

Let’s say for a moment you are sitting down to dinner, ready to eat your favourite meals.

But all of a sudden someone comes along and takes away a portion of your meal (your meal is reduced by 25%).

You were so looking forward to devouring the whole plate…

You now have two-thirds of your meal remaining…

It’s now going to be that way for years to come.

Apart from the fact that some will look towards the positive side of losing weight…I can’t say I would be happy only eating 75% of the meal for the rest of my life…how would that make you feel?

Ripped off…angry with the world…disappointed you miscalculated…blame someone else…be miserable or feel like you’re missing out.

What about you?

Now let’s say that you have been planning your retirement for years. You’ve worked dam hard to get there.

You’ve looked at your numbers, thinking returns will be similar in years ahead.

Yep, I’m going to be fine you say.

But, what if all of a sudden those returns don’t eventuate, just like the meal example above, your returns are cut by a third for the foreseeable future.

Think for a minute how that would impact your best life in retirement?

How would that make you feel?

Are you willing to accept less in retirement knowing how hard you worked to get there?

I don’t know about you, but I’d want to make sure I have all my bases covered.

I’d want to know how I would be looking if markets suffered a period of sustained lower returns.

It’s something we do for our clients every year, we explore every avenue, everything that could derail a retirement so they have more confidence in living their best life.

So, what does that look like Glenn?

I’m glad you asked.

For illustration purposes, I’m going to use a couple who has saved $1,500,000 and require $60,000 per year indexed. In this example, we are not going to take anything else into account to keep it simple but for most, there would be some travel and other capital expenses along the way.

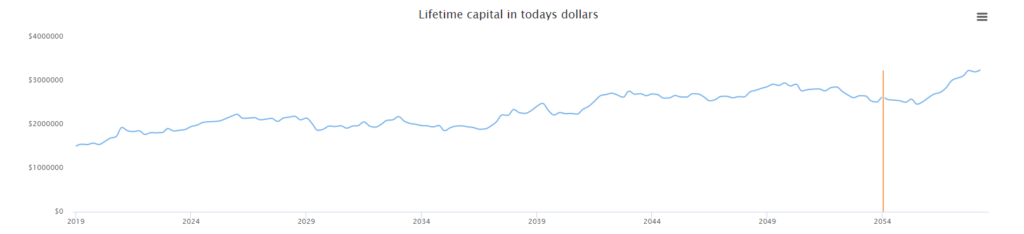

The most important aspect is testing against various market conditions to ensure you live the best life in retirement…

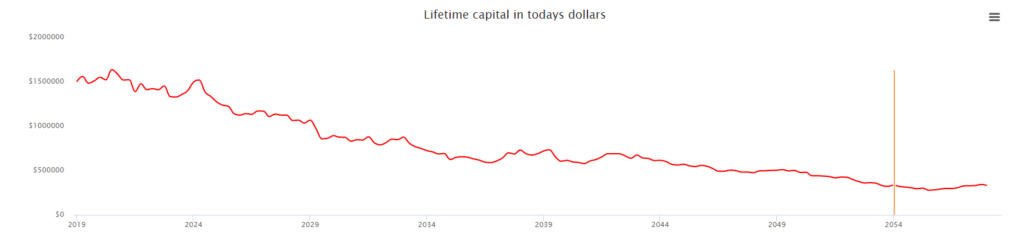

Pessimistic case…

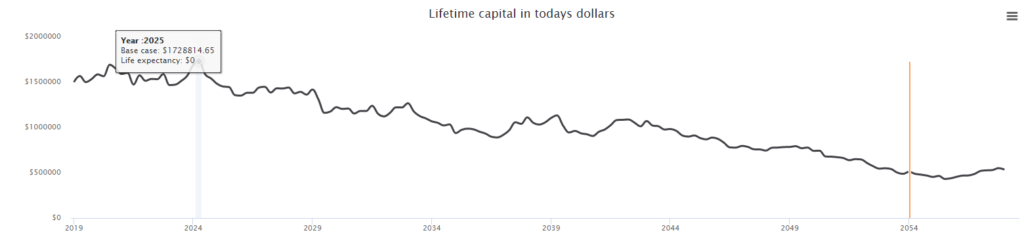

Base case…

Pessimistic case…

While this is essential, there are a couple of other factors you can use in combination to ensure you have done everything you can to set yourself up to live the best life in retirement:

#1 Know how much you will require to fund your best life in retirement.

#2 Test against different market conditions.

#3 Life expectancy. While we’re given our end date it’s prudent to be conservative. After all, we are starting to live longer…

#4 Don’t take on any more risk than you need to get the job done.

How would you feel to know exactly what was possible?

Glenn

Make it a Great Retirement!

We help busy professionals, business owners, and pre-retirees thrive and survive, leading into, transitioning into and living in retirement because living their best life is what matters most. After all, that’s what really matters.

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth