Piloting your retirement plan: when “going-around”isn’t an option!

Since I was a little kid, I’ve been fascinated by planes. There’s something mesmerising about how they land. How they majestically take-off into the skies and disappear through the clouds. At all speeds and altitudes to take us to the far reaches of this great planet of ours.

But like most things, what goes up must come down, right? The plane must eventually land. There is a secret to the perfect landing, ask any good pilot.

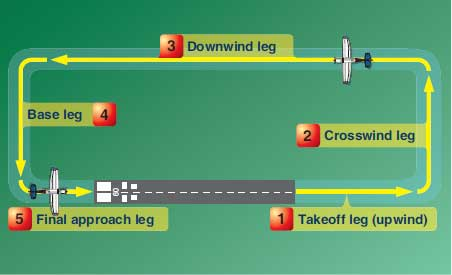

It all starts with flying a perfect pattern.

When a plane comes into land, there are three patterns they fly. Or three legs to the landing routine or landing pattern. It’s made up of the downwind leg, base leg and the final approach. Prior to entering the pattern. As is with preparing for takeoff. There are a number of checklists the pilot must go through to ensure nothing is missed prior to landing. To ensure a consistent and safe landing.

But notice the last words of the last sentence: consistent and safe!. Sure, it’s possible to land a plane without going through the proper checklists. But is it one I’d like to a passenger on? Hell no!

You’re most probably wondering what this has to do with planning your self-funded retirement? It’s a great metaphor to use to show how small and sometimes insignificant actions. Done correctly can compound over time to produce a successful result. But missing those all important actions. Can lead to unanticipated results at best or accidents and disasters at worst (i.e. a retirement crisis).

Let me explain further how it’s so important in planning your self funded retirement!

The downward leg

As with any pilot, communication is critical along with their systems in front of them. But if you are flying into a non-control towered airport, it’s even more important. To know who’s around you in the air and what they are doing. Likewise, you’re using your radio to let them know what you are doing. Being fully aware of what’s going on in the airspace around you.

Prior to entering the pattern. As the pilot is constantly doing through their flight. The pilot is taking note of not only other airplanes in the area (things which are out of their control). But also what is going on in their own cockpit. Such as fuel levels, engine performance, airspeed and altitude. All the things which are in their control.

While communication is critical for a pilot. It’s also critical when you are planning your self-funded retirement. Communicating to your partner about what you want out of retirement. What you will be doing with your time. Both together and alone. Making sure you are on the same page. After all you don’t want to kill each other, right? You will want to communicate this to you family and professional advisers.

Accurately informing them of your current position. Where you want to go (the life you want in retirement) and what you want to do with your time.

Here’s the thing, you can’t just think it or wish your way to a self-funded retirement.

You see,“Life is not a rehearsal and precious time is slipping away”. You know that, don’t you?

Turning base and final approach

When the pilot enters the turning base pattern, there making sure they are hitting two critical items. The right airspeed and altitude. But what’s interesting about this part of the pattern. If you are not hitting the right numbers (airspeed and altitude). The consequences of NOT hitting them are not felt at this point in time.

The old saying, “you don’t know what you don’t know” applies at this stage. You’d think everything was going along just as planned.

This is where the compounding effect of not hitting those two critical items. Cause problems as you turn to your final approach. Too fast and too high, and your correcting altitude and power to stabilise your approach. Too low and too slow and the opposite is true. There’s plenty already to think about prior to landing. Let alone adding further workload to the landing.

This is where the margin of error becomes very real and any errors become massive problems. As the runway becomes a bigger picture and your ability to correct reduces by the second.

Going around

But a pilot has one last move up their sleave, “the go-around”. If they don’t like the way the approach is going. They can just “power up, pitch up and clean up” the airplane and go give it a another shot.

But that’s not the case when you are planning your self-funded retirement.

“Life is not a rehearsal and precious time is slipping away”

You don’t have a second chance. You don’t have the option to “go around” again. You only get one go at it. Your runway to a self-funded retirement (or whatever you want to name it). Is getting closer by the minute, day, month and year.

There are a number of critical numbers you must hit. If you are going to retire successfully and live your best life. To ensure you have a smooth and uneventful landing in retirement.

✔️ Your number! (How much is enough? Enough to live your best life WITHOUT

fear of running out of money.)

✔️ The path you are on! (Not enough, just enough or got too much)

✔️ Savings (How much do you need to save to hit your number?)

✔️ Return (What return do you need to generate to live your best life?)

Make sure you understand these critical numbers in your retirement plan. Because going around is not an option for you. There is no second chance!

Do you want to know what your NUMBER is? So you can live your best life possible without fear of running out of money. So you’re not sitting there regretting what could have been when you’re in your box! Most don’t know the answer to these questions and it’s impacting their life in a BIG way.

You deserve answers to these BIG questions, you need answers to these questions and more. Book your call (which is at our expense) on the link below. We’ll guide you through questions that will help get you the answers you’re looking for. ????????

https://go.oncehub.com/RetireReadycall

Here’s to living your best life!

Glenn Doherty – CFP – Money Mentor | Taking the stress out of planning your self-funded retirement | Founder of Jigsaw Private Wealth