Retirement Honey Pot: 6 Super Strategies to Boost Your Retirement Nest Egg For Over 55’s

Many struggle with what super strategies they should be using. Let alone knowing what’s available to build their nest egg.

Others worry about the performance of their super fund. Let me be clear!

Don’t confuse investing with your super tax structure. They should be treated separately on their own merits.

If you’re anywhere up to 7 years from retirement these super strategies are the main ones to consider.

Sound retirement planning is all about working out what is going to happen to your financial bucket. As you transition from your working life to retirement.

If you don’t know what’s going to happen to your retirement bucket. How can you make any sound financial decisions?

Schedule your “Retirement Breakthrough” call here and we can help you with that.

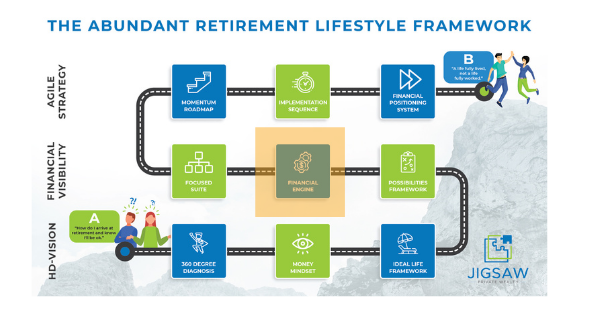

Super strategies is just one component of what we call your “Financial Engine”, accelerator 5 of 9 of our “Abundant Retirement Lifestyle Framework”.

A framework for getting the life you want with the money you have.

#1 Super Splitting

While some couples don’t like the idea of splitting their super. It’s a great way of optimising your superannuation contribution caps. This strategy can be used to inject more into your super honey pot and guess what? You pay less tax on your earnings now and in retirement.

CLICK here to view the video>>

#2 Catch up Super Provisions

If you’re super balance was less than $500,000 on the 30th June in the previous financial year and haven’t used all your concessional cap, you’re able to make catch up contributions.

This is a great strategy for topping up your super account tax effectively. Especially if you or your partners super fund balance was less than $500,000 on the 30th June in the previous financial year. And you haven’t used your concessional cap of $25,000 in previous financial years.

Click here to view the video>>

#3 Using super to pay debt tax effectively

If you are over age 60, here is a strategy to tax effectively pay down your debt.

Many don’t know about this strategy and is one we use on a regular basis with new clients.

#4 Access a Centrelink pension if their is an age GAP!

If there happens to be age gap between you and your partner. Your may be able to take advantage of your age gap and access some age pension entitlements.

#5 Lump sum contributions

If you happen to have excess cashflow and maximised your tax deductible contributions. Here’s a strategy to build your retirement nest egg.

ALSO READ: The over 55’s guide to super contributions for building your retirement nest egg

#6 30 second Retirement Income Plan

We reveal our super simple retirement income plan. One that will save you from heartache and despair in retirement.

ALSO READ: The Ins and Outs of Super: What is it and How does it work?

????Is it time your present had a chat with your future?????

If you’re a professional over age 55 working hard to fund your retirement, struggling to work out if your plan is viable and whether or not you’re taking all the right steps. But don’t know whether you’ll have “ENOUGH” for that perfect lifestyle in retirement.

You want to feel secure about your retirement plan, know that it’s viable and you are taking all the right steps. Ultimately you want to know that you’ll be okay financially in retirement.

It’s time to book your Retirement Breakthrough Session below.

Feel free to reach out and☎️ book your complimentary Retirement Breakthrough Session.

You’ll know whether you are track or not. Along with identifying risks and opportunities.

Live your best life in retirement!

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals