Retirement Planning: It’s all about CONTEXT!

What’s the advice to soccer stars who earns millions in a week?

European soccer stars earning thousands a day stick to cash…

Recently I ventured out for a casual dinner with a couple of industry colleagues.

In the middle of my meal. The conversation turned to misguided conversations financial advisers are having with their clients.

Around how they invest money for clients.

While important, far too much time gets wasted on this discussion. Rather than how you can use your money to live your best life!

This brought up a very interesting discussion about an adviser my colleague knew in the UK.

He specialised in advising well paid European soccer players. The ones that earn millions of dollars a week.

They love spending their money on luxury homes, exclusive resorts, private airplanes, exotic sports cars and anything else their heart desires.

The kind of lifestyle of the rich and famous we’d all love to enjoy!

We got talking about how this adviser managed the money of these rich and famous soccer stars.

It was not what I was expecting.

He saw his role as preventing these soccer players from making dumb decisions. Wasting their millions.

Request for a lamborghini. Sure, you can have one but not two…

The daily challenge was taming their managers. Talking the players out of spending money on things they didn’t need.

How did this adviser to stars invest their money?

Well, this blew my mind a little but made a lot of sense.

I was thinking exotic investments, private companies and any other investment promoted to the rich and famous.

No, no, no…

It was straight cash and term deposits.

As my colleague when on to explain.

They earnt so much money, they didn’t need to take any risk with their investments.

They’d have enough money to live off the interest for the rest of their life. That’s how much money they were able to save and put away for when they were no longer able to play soccer again.

They didn’t need to strive for growth. Nor be geared to the hilt or succumb to the dodgy investments promoted to the wealthy all in the name of saving tax.

Context is everything when planning your retirement

Sadly, the majority of financial planners provide product and investment advice.

Letting their clients down and not focusing on how their clients can live their best life with the money they have.

And this is where context is so, so important when planning for your retirement.

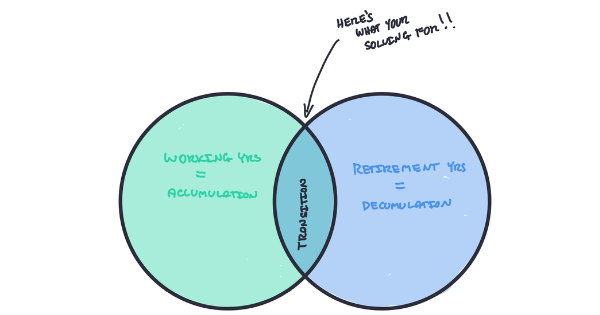

Through your working years it’s all about the goal of accumulating assets. So yes this part of your life is all about maximising your assets, maximising your return.

You let regular investing (prudent investing) do it’s thing. Compounding is your friend while panic selling is your enemy.

ALSO READ: Evidence Based Investing

As you approach retirement, a shift in thinking is required about how you manage your money.

It’s all about context, it’s about risk management…

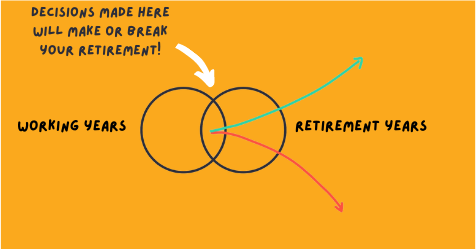

If retirement is not far down the road for you.

At some stage your income from employment will cease.

Your focus turns to living off your investments/assets. You’ve accumulated over your working life.

There’s nothing to fall back on if you get it wrong.

Before you even think about your investments or for that matter the products you use (all tools in the tool bag by the way). You need to know what you’re solving for.

Are you on track?

Very few people have clarity about whether they are on track to live their dream retirement lifestyle.

Feeling like there doesn’t seem to be a way of knowing whether you’ll be ok.

If this is something you’d like to know, schedule a Retirement Breakthrough call here.

The very first task we undertake for a prospective client is to intimately understand how their current path could pan out. Before discussing any investment or product for that manner.

Ultimately understanding what’s going to happen to their bucket (aka retirement assets).

ALSO READ: Are you confident you know your MAGIC number to live an abundant lifestyle in retirement

Three categories you could potentially fit into:

#1 Not Enough

At this point you don’t have enough in your bucket to fund the lifestyle you desire in retirement.

#2 Just Enough

You’ve got enough to fund your retirement, but maybe no one’s told you.

#3 Too much

You’ve got or will have more than enough money. The problem is you may go to your grave with too much money. Thinking you could have done so much more had someone told you.

Retirement planning is all about knowing what’s going to happen to your bucket (retirement assets).

Once you understand what’s going to happen to your bucket (aka retirement assets), you’re in a position to be decisive.

You’re in a position to make life changing decisions, decisions which have an impact on the way you live your life.

The no.1 concern pre-retirees have is the fear of running out of money in retirement.

What would it be worth to you to know what’s going to happen to your bucket?

Don’t wait a second longer.

You don’t want to wait until you’re on the verge of retirement? To find what’s going to happen to your bucket? Only to find out could have done more if you planned earlier.

Schedule your Retirement Breakthrough Session here.

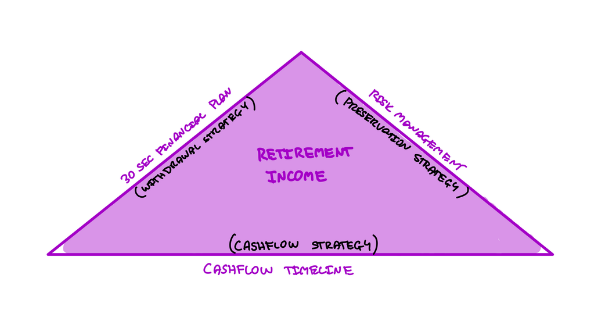

Three critical components to solve your retirement income equation

Yes, three critical components required to solve your income equation.

You’ve got to know the income you need to fund your lifestyle in retirement.

Your planning for this should start as early as possible prior to your retirement date.

Two reasons why planning your retirement income early is important:

#1 The share market will fluctuate. Surely you don’t want to be in a position where you have to sell investments when the market falls.

You want to make sure money is available to pay your retirement income no matter what happens. Without having to sell growth investments when the market is down.

#2 When you move from a regular paycheck from working and start taking it from your investments. You’re gonna freak out.

For your whole working life you’ve been putting money into super or other investments. Your investments have largely gone up, up and up.

Sure investment markets have fluctuated. But if you’ve stayed the course your investments have gone up.

When you retire, you’re going to start taking money from your investments and they are going to drop.

But that’s okay provided you’ve done long term cashflow planning.

ALSO READ: Your Retirement Pit Strategy

How do you make your retirement bucket go further?

It’s all a matter of following a simple framework.

One that allows you to participate in market returns.

Unless you have a bucket load of money like the European soccer stars I spoke of earlier. You’re gonna need to take on some risk. And that’s okay…

Your retirement could span some 20-30 years or more!

30 second retirement income plan!

#1 Emergency bucket – it’s your get out of jail free card. If an emergency pops up unexpectedly, you have the funds to access immediately.

#2 Income bucket – hold enough money in conservative investments (ones which don’t move around a lot). To cover your income requirements when investment markets fall.

#3 Growth bucket – the remainder can be held in growth investments.

There you have it, our 30 second retirement income plan.

Mr & Mrs Smith – Are we on track to retire in 6 years time?

When Mr & Mrs Smith came to us, they, like a lot of people we talk too, had been to an advisor previously. This adviser said there was nothing they could really do for them.

It was clear they did not specialise in retirement planning.

By implementing the “Abundant Lifestyle Framework”, we looked at how their current path was going to pan out.

ALSO WATCH: Your next mountain and the quest for the new retirementality

Here’s the results:

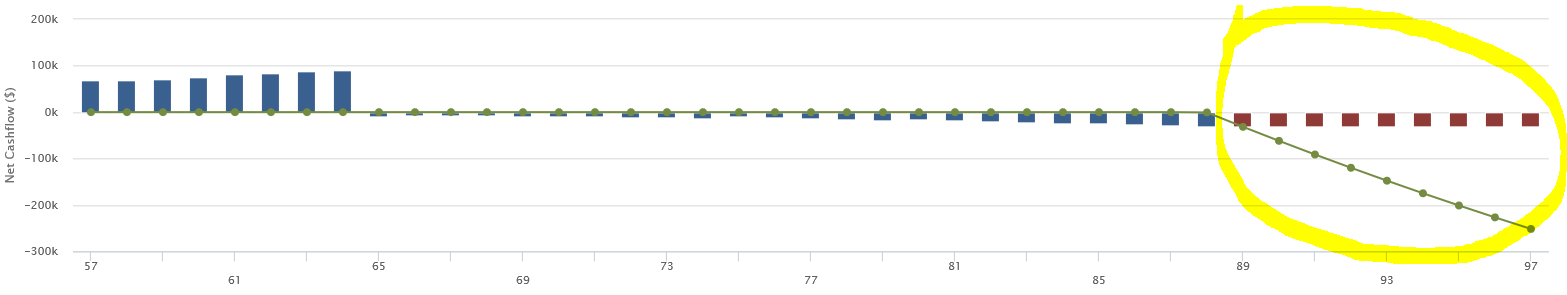

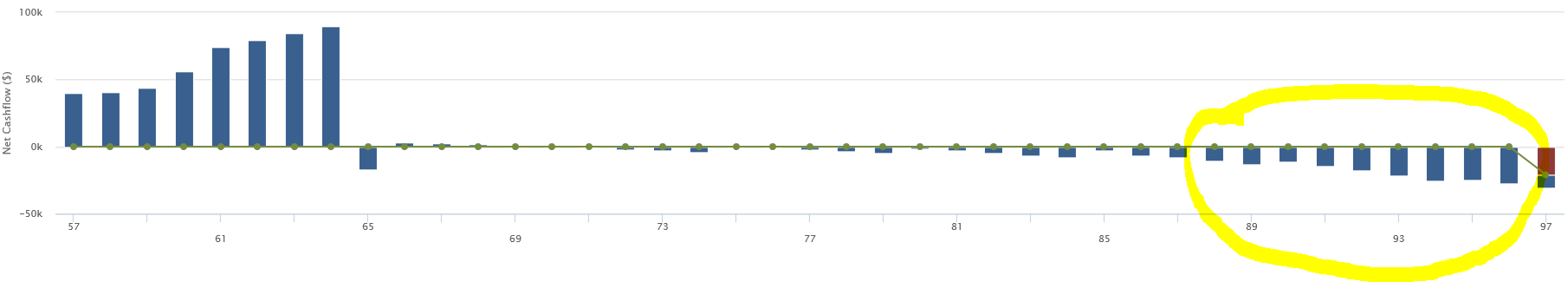

When looking at this chart, blue is good, red is bad.

As you can see their income is not going to last the distance. In fact it’s going to run out at age 88.

So, we went to work on some strategies they could implement to see what outcomes they could achieve.

Here’s the results:

We tested a number of targeted strategies. How they could optimise their current financial arrangements.

You can see by the results above, these strategies would allow their money to last longer. With no changes to their lifestyle their income would now last 10 years.

While Mr & Mrs Smith’s income will last longer with some sound advice. There are a number of other benefits we identified.

#1 They could in fact consider retiring earlier. If they reconsidered how they used their assets.

#2 We identified a number of estate planning strategies. These would save their estate 000’s should they pass away prior to exhausting their super.

It’s important to to not focus on the above numbers but rather understand the importance of cashflow modelling.

Barney and Betty Rubble – Portfolio at risk of turning to rubble

Another couple who came to us, on the verge of retirement. Had received some advice and wanted a second opinion.

Barny and Betty were in a comfortable position. They had sufficient assets to fund their retirement income (approx $1.5m)

But as we ran our eyes over their super investments, there was an alarm bell ringing.

They were invested roughly 90% in growth investments. Their retirement plan was on very shaky ground.

While calculating their retirement income plan. Our software showed that they would be ok. But it did not take into account the impact of a market fall.

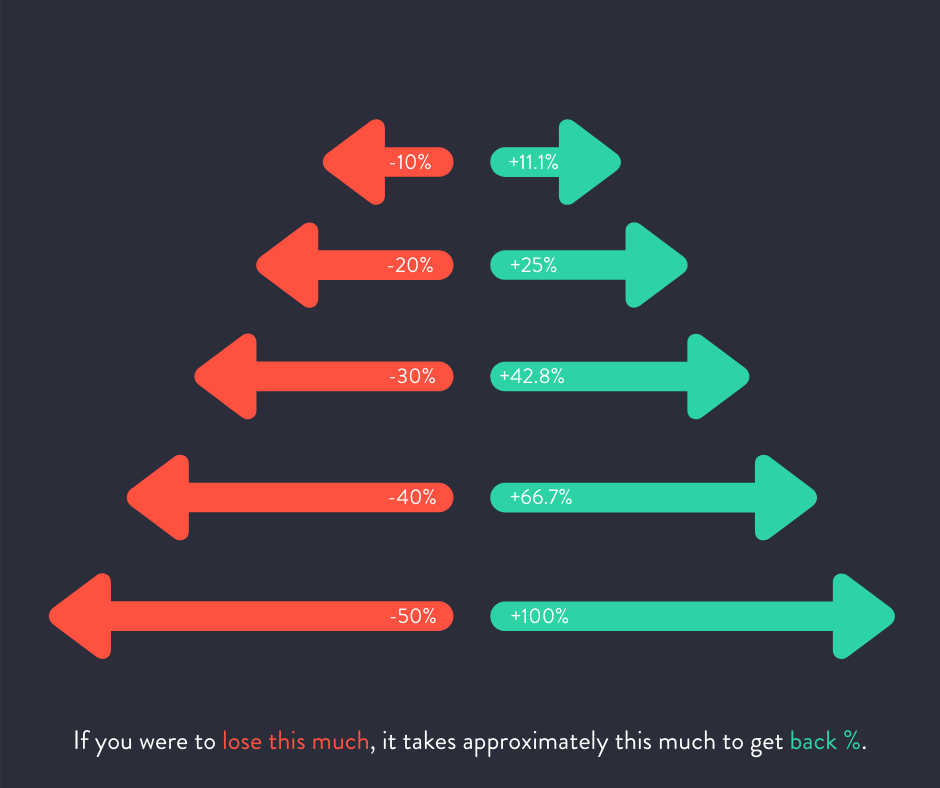

Let’s take a look at this below chart:

While in your working years it’s a little easier to sustain losses, you know you have the time to make them up. You have the security of your income to cover your living expenses.

However, the investment strategy which works for you in your working years can work against you in retirement.

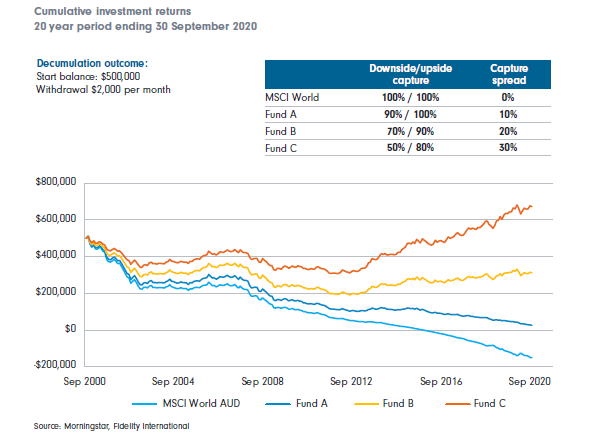

Let’s look at the below chart from Fidelity:

You’ll see that an aggressive investment strategy works against you in retirement. As you start to take an income from your investments.

As you approach retirement, capital preservation needs to be front of mind. Any market fall will derail your plans.

How you manage this can have a significant impact on your retirement.

We were able to show Barney and Betty if they de-risked their portfolio. Not only would they minimise any significant fall in value during retirement. They would still get the job done.

This would save them from experiencing hundreds of thousands in losses when markets fell. But they could rest easy knowing no matter what happened with investment markets. They would be okay.

That is real financial planning…helping you get the life you want with the money have.

If this is something that resonates with you. Here’s your opportunity to book your complimentary Retirement Breakthrough Session here.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals