Retirement Playbook: 50 Things Every 50 or 60 Something Should Know About Retirement

#1 Know how much is enough money to live the rest of your life

The biggest question on the minds of people in their 50’s is will they be okay in retirement. In other words “How Much is ENOUGH?”.

It’s critical to know your number, so you can achieve and keep the lifestyle you have.

Knowing your number will create ultimate freedom for you.

#2 Your working years are about accumulation. Retirement is all about risk management.

Your whole working life is all about building your nest egg. For most, super is the second biggest asset you’ll accumulate.

You see your balance go up over your working life.

As you approach retirement, your approach needs to change. It’s all about risk management. Your fund will go down over time as you start taking an income from your assets.

ALSO WATCH: Paradigm Shift To Safeguard Your Retirement

#3 How much income will you need to fund your retirement lifestyle?

Use this time prior to retirement to work out how much your lifestyle will cost in retirement.

It’s likely in your early years of retirement. With more time on your hands. You’ll spend more money as you will be doing more things.

#4 Start building your bucket list

By now, I’m sure you’ve ticked some things off your bucket list. So you get the most out of retirement and don’t miss any experiences. Start building that bucket list now.

Sure, it may change over time, but the better you can articulate what you want out of life. The better your planning becomes.

#5 Get ready for a long retirement

While many think they will not live a long life. The reality is far different. With live expectancies increasing, you’d better plan on a 30 year retirement.

It’s highly likely one in a couple will live well into their 90’s.

ALSO READ: How To Plan Financially For A 100 Year Life With More Freedom?

#6 Plan to pay off your mortgage

The last thing you want to do is entering retirement with a mortgage. Aim to pay it off prior to retirement so it doesn’t become a drag on your cash flow.

#7 What’s your retirement income GAP

Retirement planning is about cash flow. Determine if you have an income GAP now, before it’s too late.

Estimate how much income you’ll require in retirement and how long it will last. If you have an income GAP, look at ways you can close that GAP now.

A financial planner can help with the assistance of sophisticated cash flow modelling software.

#8 Learn from others

Retirement can be a long hard road to navigate. Look around you. What have you observed that’s worked for those who have retired around you?

Likewise, what have you observed from those who didn’t retire well?

Learning from what’s worked and not worked can help you retire successfully.

#9 Social networks

Work plays a significant role in our social networks. Think about how you are going to maintain your social networks post work.

Do you have to look at other avenues to expand your social networks?

#10 Consult a real lifestyle financial planner

Retirement planning is complex. It’s one part science and one part art. It’s different for everyone.

A real lifestyle financial planner (like yours truly) will help you identify the life you want. Help you achieve it and most importantly protect it no matter what happens. Your lifestyle is the centre of all conversions.

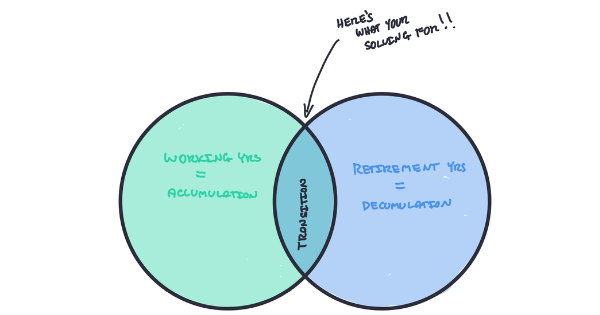

#11 CONTEXT is everything

What are you solving for? Many think as they approach retirement it’s all about maximising your investment return.

What you’re really solving for is how to generate a consistent income to fund your lifestyle for the rest of your life. Once you know that using prudent assumptions and every decision after that becomes easier.

ALSO READ: Retirement Planning: It’s all about CONTEXT!

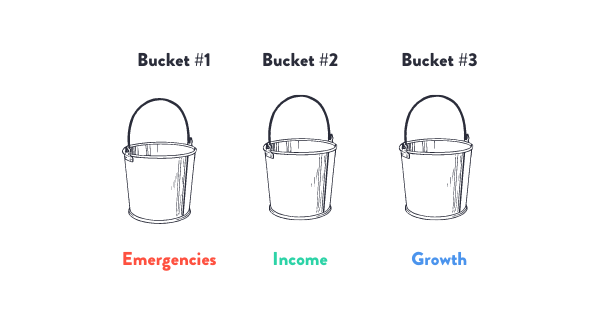

#12 Start building your income bucket

Many people heading closer to retirement still maintain an accumulation mindset. That means they retain their single diversified investment inside their super fund.

This will work against you leading into and through retirement.

Your income bucket is your protection when investment markets go down. Aim to hold enough to keep you afloat and fund your retirement income while investment markets recover.

ALSO WATCH: 30 Second Retirement Income Strategy

#13 Dial in your risk

While you may choose to accept higher risk, it’s critical to know the level of risk you need to take to get the job done.

With the right information, perhaps you don’t need to take as much risk as you think.

Do you know the impact your current investment risk could have on your retirement lifestyle?

ALSO WATCH: Investing For Retirement 101

#14 Right fit your investment strategy

Is the investment strategy you are currently using tailored to the lifestyle you desire in retirement.

Are you making investment decisions based on the research? I.e. investing based on how investment returns are generated.

#15 Maximise your super contributions

Don’t let consistent changes to the super system put you off contributing to super. At this point in time, making contributions to your super fund will be the most tax effective strategy you action.

But keep an eye on the limits. You don’t want to exceed them.

ALSO READ: Retirement Honey Pot: 6 Super Strategies To Build Your Nest Egg For Over 55’s

#15 Make a plan for your super contributions

With contribution limits for all types of contributions. It’s important to plan out your contributions leading into retirement.

This way you can maximise the benefits of the superannuation system.

#16 Build an emergency fund

You want to make sure you’ve got enough cash available for emergencies or if you need to get your hands on some cash fast.

Everyone’s situation is different. 6-12 mths of income held in cash is a good guide.

#17 Don’t go to conservative

Many get freaked out close to retirement. Some will cash out if they experience a market fall.

Remember, retirement can last 30 years or so. So you’ll still need to hold growth investments inside your investment portfolio.

#18 You can’t time investment markets

No-one can time investment markets. There are many factors that go into how prices move up and down each day. Some sentiment, others data driven.

Adopt #12, hold firm and stick to your strategy.

#19 You still need growth investments in retirement

Your retirement is going to last a long time. You still need to hold growth investments. The right level will depend on how much risk you need to take. Or how much risk you accept.

ALSO READ: Which Investment Strategy Will Deliver A Safe And Reliable Income For Your In Retirement

#20 Don’t overestimate your future returns

Many fall for overconfidence bias. This is when you assume better returns than would be prudent to accept.

It’s best to err on the side of caution and use more conservative assumptions when it comes to expected returns.

#21 Know the transitions you’ll face leading up to and through retirement

Key in your retirement is understanding the transitions you will face. This will include your own retirement, caring for parents, helping grandchildren, personal sickness and many more.

Speak to a lifestyle financial planner to help walk you through the potential transitions you’ll need to plan for.

#22 Don’t hold off doing your will. Get it sorted now!

Many don’t have a current or up to date will. As much as we don’t like to face our own mortality.

You also don’t want to leave your family with a financial mess to navigate if something happens to you.

#23 Use tax incentives to optimise your savings and investment returns

You want to make sure your investments are in the most tax effective vehicle. Super tops the list due to its low tax rates. If your income tax rate is above 30%, you may also want to consider tax bonds (max tax rate of 30%).

#24 If you have a retirement GAP. Get your insurance sorted.

If there’s a GAP between what you need to fund your retirement and what you currently have. You may want to consider appropriate levels of insurance to cover you if you were to be permanently injured or unable to work due to sickness.

After all, don’t you don’t want to downsize your retirement because you refused to cover yourself financially.

#25 Be prepared to retire when you least expect too

While you may have a retirement date in mind. Research shows us that most people don’t retire when they had expected too.

This makes it critical to get your finances sorted, so there’s nothing that will get in the way of you retiring when you want (i.e. market falls).

#26 Build media resilience

As I call the media, the financial pornography channels. Realise the majority of what they put out into the world is fear and greed.

Build yourself a safe plan, build a moat, remain committed to your plan and most of all be agile.

Things will change and you will need the right information to make sound financial decisions.

#27 Don’t check your portfolio everyday

Checking your investments everyday is going to drive you nuts!

Sure it’s okay to look at them every now and again, but if you look at them every day you’ll fall into thinking short term.

If you build enough metal between you and the outside world, you’re live will be all the better for it.

#28 Don’t compare your retirement to everyone else’s. Yours is unique

Oh, this is the BIG one. Standing around the bbq with a glass of wine in hand, the discussion always comes out about how you are invested or how well someone is doing.

Don’t let what other people are doing impact your retirement. Yours is unique to you, therefore your plan needs to reflect your personal retirement story, not someone else’s.

#29 Plan for inflation

Inflation is the big killer of your purchasing power over time. Retirees in particular due to where they spend their money. Inflation will generally be higher than those who are still working.

Plan for it. Make sure you hold enough growth investments to earn a decent return and help you keep pace with inflation.

#30 Plan on lower investment returns

This is going to be the biggest shock for those retiring over the next few years. Coming off the back of big returns, expect lower returns.

This is where knowing your numbers based on prudent assumptions will help guide your financial decisions and how you invest to fund your desired lifestyle.

#31 Get on the same page as your significant other

While working, most couples will spend time apart. What do they say, “time away makes the heart grow fonder”.

Have the discussion around what each other wants out of retirement. While you’ll have slightly different interests, you want to make sure you’re on the same page when it comes to what you want out of retirement. It’s a different dynamic when you’re around each other 24/7.

#32 Add up the costs of travel

No doubt you have travel plans. Whether that’s a life dream of touring Europe or Alaska or packing up in a caravan and driving around Australia for a couple months of the year.

It all has a cost associated with it. Know the amounts you need to build into your cash flow to fund these adventures.

#33 Add up other expected BIG lump sum costs

There may be other BIG costs you may have planned through retirement. Maybe it’s helping the kids out. Change of cars. Funding weddings. Family holidays.

Whatever it is, have a think about what these are going to cost and start building them into your cash flow projections now so you are prepared.

#34 Have a hobby

There’s only so many days you can spend on the golf course before you start getting bored.

If you don’t have a hobby, think of things that interest you and will keep you busy in retirement.

We had a client who made rocking horses for all his grandchildren. Another who was into making quilts and travelled to quilt shows around the country and overseas.

#35 Make fitness a priority

Retirement is a marathon, not a sprint. You’re going to have more time on your hands so build fitness into your schedule.

Maybe that’s going to the gym. Maybe walks with your partner or friends. Making bike riding or hiking.

Whatever it is, build it into your schedule so you can do all things you had planned too while you are still fit and able.

#36 Check your binding nominations on all your super accounts

Make sure you have nomination on all your super fund accounts. This will save your loved ones a lot of hassle and there will be a lot less paperwork.

#37 Retirement Mindset

Mentally prepare…yes that’s right. There are a lot of unknowns when it comes to retirement.

We see plans change all the time.

Realise it’s probably going to take a few go to get it right.

#38 Focus on what’s important

I can’t stress this one enough. Find the things that you love to do. That you get great fulfillment from and do more of them.

Perhaps you need to find a passion in your retirement years.

#39 Are you going to downsize at retirement

Are you going to be an empty nester with too much space in your home. Maybe downsizing is on the cards for you. Maybe you’ll realise some equity in your home to add to your retirement bucket.

#40 Ask these important questions before retirement

#1 How are you going to spend your time?

#2 What kind of life do you want in retirement?

#3 How important is it to have family near you?

3 critical questions to help you get the most out of your retirement years.

#41 Delay retirement

Maybe you’re not ready for retirement. There’s no harm in delaying it. Maybe you need to accumulate a little more to worry less in retirement.

The earlier you know how you’re tracking the better financial decisions you’ll make.

#42 Transition into retirement

Perhaps you love your job but are looking for a little more freedom to spend time on other things. Maybe reducing your hours will give you the best of both worlds.

One bonus is your money will go that little bit further.

#43 Don’t let your children ruin your retirement

Yes, this is a BIG one. Your children are adults. They need to take responsibility for there our future.

Be mindful of the risks of using your home as security for theirs.

Sure, help them out if you can, but let them ruin your retirement.

#44 What blind spots do you have

One of the biggest areas pre-retirees and retirees trip up financially are their own blind spots.

At times it’s their behaviour. They freak out when investment markets fall without thinking about the long term impacts of their decisions.

Having not walked the retirement journey before, you are unaware of the potential course corrections you will have to make along the journey.

Understanding what the potential blind spots may exist will better prepare you for the decisions you’ll face.

#45 Are you going to volunteer?

For some, volunteering allows you to still contribute to society. A sense of community and connection with other volunteers can be a rewarding experience.

If you are thinking of volunteering, think about the organisations you may wish to volunteer with.

#46 What about a part-time job?

You may not want to continue in the job you currently have. However, you may feel you have more to contribute. Perhaps not in a full time role.

If part-time work is on the cards, think about the type of roles you may consider. This will help provide a plan for when you enter retirement.

We have many people who say they want part-time work at Bunnings.

#47 What is it you want to achieve between now and the day you end up in a box?

This is a BIG one. While you may have dreams. It’s time to dream BIG. Figure out what it is you want to achieve with the remainder of the time you have on this planet of ours.

The more you understand what it is you want to achieve the more you’ll be focused on a fulfilling retirement journey.

ALSO READ: How To Live An EPIC Retirement With These Simple Steps

#48 How are you going to react when your investments go down?

As you enter retirement the security of your regular income stops. You’re at the mercy of investment markets.

There will be times where you’ll freak out and your nerves will be tested. Now is the time to understand what could happen and prepare in advance.

Have measures in place to fund your income without the need to sell your growth investments in down markets.

#49 Don’t let 65 or 67 be the determination of your retirement

Many times over I hear people say that they plan to retire at age 65 or 67. When I ask why. They often say, it’s the retirement age.

Your retirement age should be based on when you are ready and are financially able to do it.

If you have enough and you’re ready age should not be the determining factor.

#50 Life is not a rehearsal!

I can’t stress this one enough and it’s why I’ve left it to last. You don’t know how much time you have. Planning in advance will allow you to live your best life. To do all the things you want while you’re fit and healthy.

Maybe you have more than enough to enjoy life a little more, but haven’t been told.

Perhaps you have little more work to do to be in a position to do all the things you wanted to do.

It’s now your duty to to understand how you are positioned. The sooner you know this, the better financial decisions you will be able to make.

How much money is enough for the rest of your life?

60 minutes to plan your next 30 years!

If you’ve finished reading this post, your trying to find the answer to “Will I have ENOUGH?” or “Am I on TRACK?”.

It’s hard to work out if you’ll have enough money for retirement!

You may have super, investments and/or a good income, but most people have no idea what it all means or what sort of financial future awaits them.

If you don’t get this right you don’t get to experience your best life in retirement.

At Jigsaw, we feel your frustrations and know you’re striving to live your best life. And we know you don’t want to worry about whether you’ll be okay in retirement. Because of this we’ve developed a framework for you to use so you too can experience your best life.

Knowing how much money you need to give you the freedom to live your life, minus the complexity, confusion and misinformation.

That’s exactly what our “Retirement Breakthrough Sessions” are designed to do. Help you work out your “ENOUGH” number and the exact steps you should be taking with your money so you can live the best life possible.

Schedule your complimentary “Retirement Breakthrough Session” here.

Live your best life in retirement!

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals