Start your financial engine! What to do 5 years prior to retirement?

You’re at the prime of your earning potential. Your personal and professional networks are thriving. Financial obligations are nearing an end or ceased(supporting kids, paying off mortgages etc). You’ve got more free time. Your attention naturally turns to reflecting on the life you’ve lived and the life you want to live in the years still ahead. To make the most of the time you have left on this great planet of ours.

While you’ve done some things, done some stuff, you’re retirement planning is now front and centre.

Sitting there wondering whether you’ll be okay.

Now is the time to fire up your financial engine so it’s in peak operating condition to carry you through your retirement years, safely. The next phase of your life. A life well lived, not a life fully worked.

Preparing for retirement is like preparing for an adventure

It’s fascinating that people spend more time planning a holiday than they do on their retirement, which sometimes can be a 30 year plus holiday. You only get one go at it, so you may as well do it right.

Think of climbing Mount Everest. One of the most challenging climbs in the world. While this may not be your cup of tea. It’s the meticulous preparation that goes into such a climb which makes it a successful and fulfilling experience.

Firstly, you’ve got to pick the time you want to go, when it’s safe to climb. The logistics as in flights, accommodation and necessary paperwork. Assessing the right equipment you’ll need on this challenging adventure. You have to assess your fitness and mental capacity and what’s required to get you in the condition to manage the climb safely.

Dwight D. Eisenhower said “In preparing for battle I have always found that plans are useless, but planning is indispensable.”

Having walked this journey many times over, we can tell you there will be many more challenges along the journey. But if you are equipped with the right tools you’ll be okay.

How prepared are you?

Click here to complete the Retirement Diagnostic Quiz and find out your retirement readiness score.

Now is a great time to evaluate life and what’s left to achieve.

As you approach retirement, there are many barriers to overcome.

Barriers to planning one of your biggest life transitions

You’re just so busy. With the busyness of work, travel, family commitments and perhaps caring for older parents. Means planning for your retirement is put to one side. You keep kicking the can down the road.

In your fifties, as financial commitments decrease, surplus income allows for more luxuries. The 50’s creep. It’s easy to flitter money away on things that don’t matter. It’s okay to have a little more fun but not at the expense of things you really want. More time freedom to have more go-go in the early years of your retirement. It’s about achieving the right balance.

But beware of creating a financial cage. It’s easy to let things slide. Be careful of taking on loans for investment properties, caravans, boats or subsidising adult children. Further obligations and bad investment decisions can force you to work longer than you had wanted too.

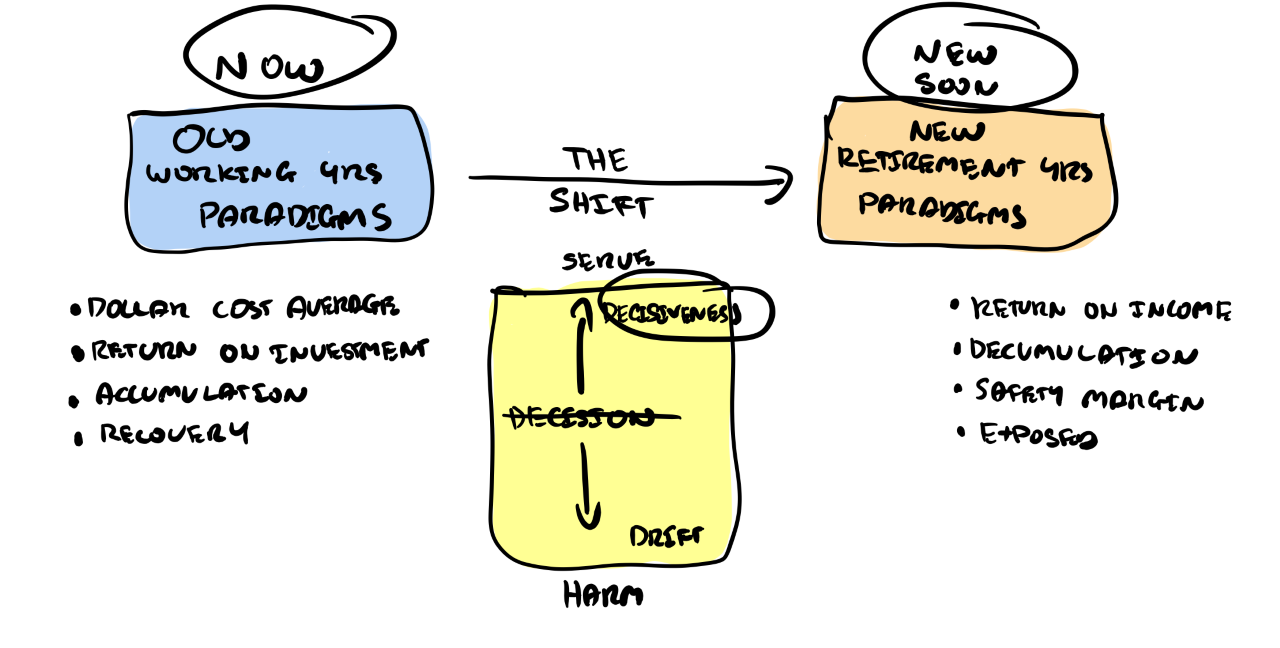

Thinking you need to manage your money and investments as you have for the last 30 years or so. A change in thinking is required as you enter this transition period. What got you here, won’t get you through retirement.

What you can do now to set yourself up for retirement?

#1 How are you positioned for the life you want to live in retirement? Dialing in your numbers is critically important if you want to enjoy the good life retirement brings.

#2 Assess the opportunities you have to narrow the gap between where you are right now compared to the life you want in retirement financially. Be prudent with your assumptions, now is not a time let your overconfidence take control and leave your ego at the door.

#3 If you stopped work today, how would you fill your days? There’s only so much golf one can play before the novelty wears off. Here’s a worksheet to help plan for that.

#4 How’s your social life? Who would you call to have a coffee tomorrow? Is there a need to explore ways to broaden your social networks?

What’s most important to you?

To get the most out of your retirement years, George Kinder posed three important questions:

#1 Imagine you are financially secure, that you have enough money to take care of your needs, now and in the future. How would you live your life? Would you change anything? Let yourself go. Don’t hold back on your dreams. Describe a life that is complete and richly yours.

#2 Now imagine that you visit your doctor, who tells you that you only have 5-10 years to live. You won’t ever feel sick, but you will have no notice of the moment of your death. What will you do in the time you have remaining? Will you change your life and how will you do it? (Note this question does not assume unlimited funds.)

#3 Finally, imagine that your doctor shocks you with the news that you only have 24hrs to live. Notice what feelings arise as you confront your very real mortality. Ask yourself: What did you miss? Who did you get to be? What did you not do?

These questions are designed to help you get to the bottom of what you really want, so you can focus on designing the life you want.

Imagine for a moment you’ve lived your life, you’re in your box reflecting on the life you’ve lived. Will you be lying there thinking you could have done more. Or lying there with a big fat smirk on your face, saying to yourself, wow that was one hell of a ride.

Once you understand what you really want, your financial decisions become clearer and will reflect the life you truly desire.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for over 50’s couples and individuals | Founder of Jigsaw Private Wealth