Super Part 4|Investing in Super 101

By now if you have been reading these posts you have been building your knowledge around super, we’ve talked about what is super, tax effective contributions and lump sum contributions.

We’re going to delve deeper into investing inside super. So, let’s get to it…

Let’s start with the basics…

Investments are generally broken down into two areas, conservative and risky investments.

Conservative investments are generally things such as cash, term deposits, corporate and government bonds.

Risky investments are things such as Australian shares, international shares & property.

These are the main investments you can make inside a super fund.

If you own a Self Managed Super Fund you also can invest in direct residential property, commercial property and a number of other direct investments.

The main aim of these investments must be to provide for your retirement.

The two ways you can invest in these types of investments…

Managed Funds – A managed fund is a pool of assets such as Australian shares that are managed by a fund manager. You have no direct control over the investments, you rely on the fund manager to make the right decisions based on the objective of the managed fund.

They can invest solely into one asset class, such as just Australian shares or International shares. Or, they can invest in a range of the above investments. For instance, an Industry fund may invest across a range of conservative and risky assets. They set the ranges, ie 50% in conservative and 50% risky assets and they will hold these levels of investments at all times.

Direct Investments – If you own a Self Managed Super Fund, retail super fund, and some industry funds allow you to invest in direct investments. You can decide what type of investments you own. For instance, you can decide to own Commonwealth Bank directly. This is great for those who want to take control of their own investments or want more control over the type of investments you want to hold. It takes more time and requires more expertise to manage.

Exchange Traded Funds – These have come onto the scene in the last number of years and are becoming more popular due to their low costs. An Exchange Traded Fund is essentially an investment that represents a range of assets. For instance, you can buy an exchange-traded fund that represents the top 200 companies on the Australian Stock Exchange. That way you know you are going to get the return of the top 200 companies, not under, not over, just the return the fund represents.

Many investment managers struggle to beat the market year in year out.

Understanding Diversification…

So, you most probably hear about this all the time but what does this really mean? and it’s not holding a range of Australian shares.

Different investments perform at different points in time. Holding one type of asset like Australian shares in your super would be considered high risk.

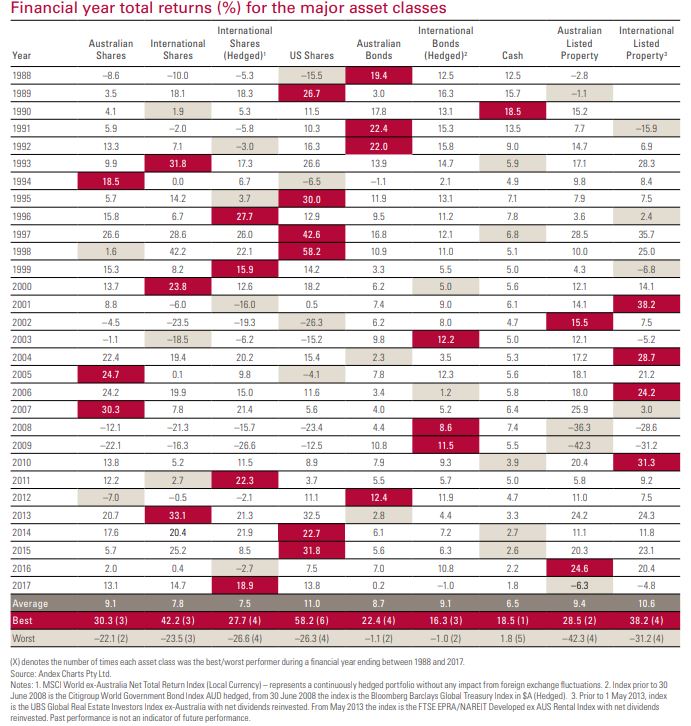

Let’s look at this chart below:-

Not one asset class (Australian shares, International shares, Property etc) performs the best year in year out. The reason for holding a range of investments across Australian, International, Property etc is to allow you to decrease the risk of holding one asset class.

For instance, a lot of Self Managed Super Funds have had significant holdings in Australian shares, but if you look at the chart above Australian shares have only outperformed every other asset in three years out of 19 years. Therefore they would be missing out on the returns generated from overseas shares.

The Australian share market is such a small market compared to the rest of the world, thus diversification will lead to more consistent returns and lower the risk in your super.

What level of risk do I take?

Risk relates to what you are comfortable with losing or the amount of downside you are willing to bear. Obviously the longer the time frame, the more risk that you can take on. You have more time to recover.

So, if you’re in your 40’s, you probably got 20-25yrs before you need to access your money so you’re probably able to take on a reasonable amount of risk, ie hold more risky assets in your portfolio than you would when you are retired. So you could possibly hold somewhere between 70-90% in risky assets (shares and property).

However, the closer you get to retirement, you will look to wind the risky assets back. Don’t forget you’re still going to be invested for another 20 yrs plus but you need to take into account you will be drawing an income.

We, for instance, start accumulating cash so our clients at all times are holding somewhere between 2-5yrs worth of income payments in conservative investments to protect them from any market movements. The last thing you want is you retire and then you need to sell you risky assets perhaps when they are not doing well, you’re starting behind the eight ball. The reason good advice will pay dividends at this point in time.

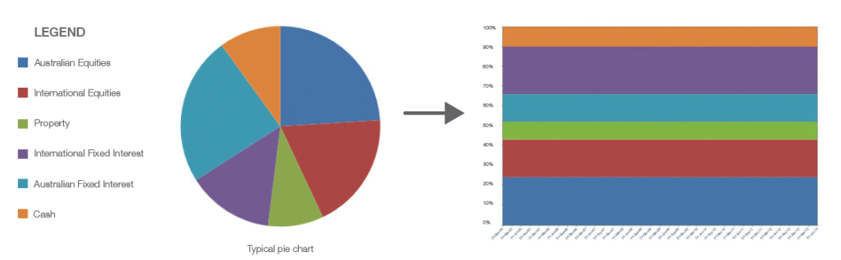

Investment Strategies… What most super fund investment strategies look like.

The majority of super funds are the old buy and hold or what we call Strategic Asset Allocation.

Here’s an example of what that looks like:-

You hold a certain amount of each asset within certain ranges. The good old hold and buy. When you contribute your money will get invested across these ranges depending on the risk level you have chosen.

The assets will be held through good and bad markets. The problem with this approach came to bear in the Global Financial Crisis when super funds got smashed, the funds still held the same level of assets even though they were expensive with the view the markets will recover.

Markets did recover eventually but the ride was not a good one for many. Many people were asking why didn’t they sell down expensive investments? The answer to this is they must retain their allocations to investments.

The downfalls of this approach…

- Generally set and forget.

- You ride through market cycles

- Remolded from time to time

- Your funds are invested immediately

Is there a better way? We have changed the way we invest for clients to address these shortcomings…

While this was all going on I started to question the way we invested for our clients. Surely there was a better way than the old way of holding through market cycles. Why should clients hold expensive assets? There was little control over this and they should have more control over when new money was invested.

So, I have been searching for a better way and we have recently introduced this new approach.

We have recently partnered with Implemented Portfolio’s to provide a much better investment experience to our clients.

This approach helps with capital preservation along with reducing the risk when markets get scary. It provides for a more consistent outcome and our clients know exactly where their money is invested at all times and communicated when changes are being made and why.

The best way to explain the approach is let’s say your driving down the highway just cruising along and up ahead you see a storm approaching. What are you going to do? Of course, you are going to put the brakes on and take a more cautious approach. When the weather looks good again you put the accelerator down and continue ahead.

From an investment perspective when things look scary, you take some risk off the table but if things look really good you able to increase the level of risk you take.

If we cannot get a reasonable return over and above term deposit rates we do not want to take the risk. So investments are only made where a reasonable return is highly likely.

So, we don’t just invest in a certain type of assets just for the sake of it, we look for assets where there is a high certainty of obtaining a reasonable return for the risk taken. A more active approach over the old buy and hold approach.

The outcome, a more consistent return with less risk. The way it should be…

An example of this is below. The process is called Dynamic Asset Allocation.

The benefits of this approach are:-

- We are able to move out of the way of any bubbles

- Large changes are implemented slowly

- New money invested incrementally over time

- Remodelled daily

- Big focus on risk management and asset protection

There are certain things we cannot control, but now we can concentrate on those areas we have control.

If you are managing your own super you may have your own bias. This may lead to underperformance against the market. If this was the case I would suggest you start using index funds.

If the majority of investment managers find it hard to outperform, it’s extremely difficult for an individual to do so. However, there are things you can put back in your control as I have mentioned above.

There are other metrics that are far important to be measuring prior to looking at your investment returns.

They are:-

- What are you looking to achieve? What are your aspirations or ideal lifestyle to are trying to achieve? What are the financial numbers that need to back this up? You can read more HERE>>

- What’s your run rate? What do you need to contribute each year to achieve the above? You can read more about that HERE>>

Hope that helps you gain more focus on what you are looking to achieve in the future.

If you haven’t already downloaded our Start Right Guide to Designed Retirement Lifestyles Guide you can download it by clicking here>>

If you have any questions relating to the above feel free to email me at gdoherty@jigsawprivatewealth.com.au

NEXT STEPS:-

Feel like your confused about how to take control of your money, where to start and how to make it work harder for you? Book a 15 min Fast Track call here>>

We’ll get on the phone for a quick chat and:-

- Have a quick look at the issues you are facing or wanting to address and perhaps a couple you don’t know about.

- Help you diagnose what might be getting in the way.

- Give you clarity about the main actions you should be taking now to get you ahead quicker.

Make it a great Life!

Challenging the Status Quo!

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth

Website: jigsawprivatewealth.com.au

Email: gdoherty@jigsawprivatewealth.com.au

Mob: 0401 253 729