The Ins and Outs of Super: What is it? How does it work?

Everybody wants to retire comfortably, but few people know how to get there. One of the most important assets you can accumulate for your retirement is superannuation.

But what are the ins and outs? What does it do? How does it work? In this blog post we’ll answer these questions and more!

What is superannuation?

Many people are confused about what super is, or what it does.

Superannuation was legislated and started back in 1992.

Superannuation is a pool of money you accumulate over your working life. The aim, to build up enough money to provide you an income in retirement.

Your employer will contribute into your super as part of your employment package. Currently your employer will contribute 9.5% of your salary into your chosen super fund.

You are able to contribute extra amounts into super up to certain limits.

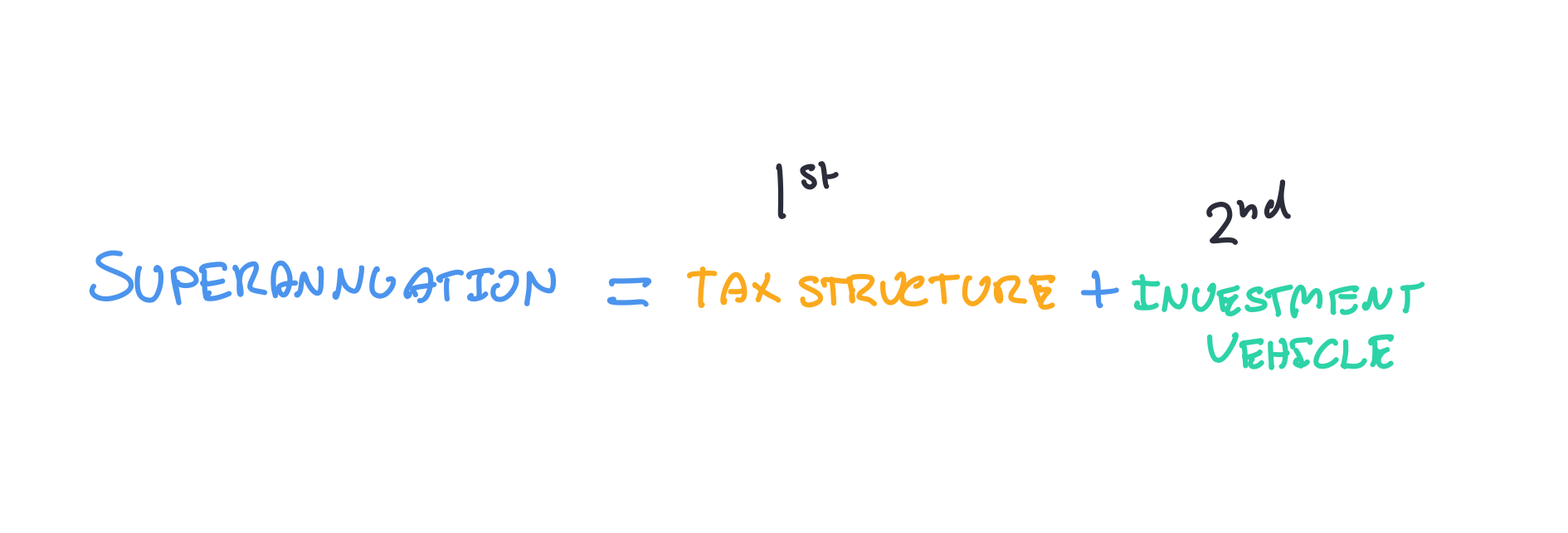

Superannuation is primarily a tax structure that helps you save for your retirement.

You pay less tax on your salary today. But when it comes time to retire and withdraw from your super fund. You may get a larger chunk of money back because of reduced taxes.

How does super work?

Super is geared towards providing an income to support your lifestyle in retirement. It’s a savings account with special tax treatment.

You have the flexibility to invest your money and choose how you want it to be invested.

You are able to contribute into super over and above your employer contributions. But you must stay below the government limits.

To encourage you to contribute more to your super fund. The government has legislated attractive tax rates.

The idea is that when you retire, your income will come from superannuation payments. Rather than relying on other sources of income.

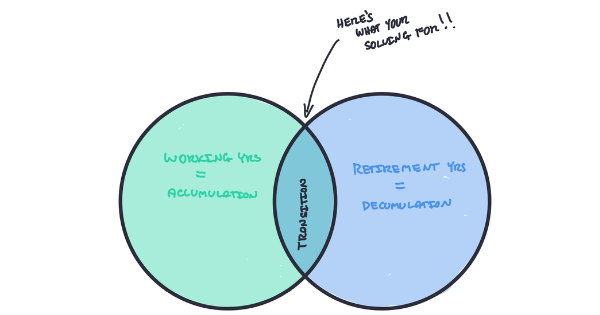

Three distinct phases to super

Accumulation

As the name suggests, while you are working you are in accumulation phases.

Your focus is on building and accumulating as much as you can in your super fund. Adding amounts on regular basis over a long period of time. Taking advantage of compounding.

While you are in accumulation phase any contribution your employer makes is taxed at 15%. Any contribution you make and claim a tax deduction for up to government limits are taxed at 15%.

You can also contribute further amounts to your super fund. Called non-concessional contributions. There are certain limits you must remain within.

Transition into retirement

As the name suggests, this is when you convert your super fund to income phase after age 60.

Primarily used to support your lifestyle as you reduce your workings hours and progressively transition into full retirement.

However, you do not receive the full tax benefits as you would when you are fully retired.

Instead, the income you receive will be tax-free and not included in your tax return. All income and capital gains you generate within your super fund will be taxed at accumulation tax rates.

Retirement

This is the transfer of your accumulation account into retirement phase. When you are fully retired from the workforce. Where you will now start to receive an income from your super fund.

Currently the maximum amount you can transfer into retirement phase is $1.6m. However, the government will increase these limits from time to time.

While in retirement phase you super will pay you a regular amount each month which you nominate.

Once you are fully retired from the workforce after age 60. You will not pay any tax on earnings, capital gains or income paid to you.

One reason why many people try to sock as much money into super as they can.

When you hit retirement, it’s all about risk management. Making your money last the distance through prudent management.

We also call this phase, decumulation. When you’ll notice your super fund reducing over time as your receive your income to fund your retirement lifestyle.

What are the different types of super funds?

There are many types of super funds:

Industry funds – generally set up in conjunction with employers and unions. Known also as not for profit super funds.

Self managed superannuation funds (SMSF). If you want to manage your own money you’ll set up a SMSF. You are appointed the trustee and responsible for your super fund meeting all the legal obligations and reporting requirements.

Retail super funds – commonly know as for profit super funds. Run by banks or private companies. Retail super funds will generally allow more investment options.

Government legislated super funds – commonly know as public sector funds. These are superannuation funds established by federal, state and territory governments for their employees.

What are the different type of investment options?

Your investment options will be dependent on the super fund you are in.

Retail super fund – this generally means that you will have more investment options.

You’ll have access to direct shares, exchange traded funds and professional investment managers.

Providing a large range of options to tailor your super to your individual needs.

Government legislated funds – these are public sector funds and there is a limited range of investments.

They’ll offer you a small investment list. Generally a conservative, balanced, growth or high growth option to invest into. You’ll have little control over how your money is invested.

Self managed superannuation (SMSF) – offers the greatest flexibility when it comes to what you invest in. However, any investment made must meet the rules of the fund.

Industry super fund – these funds allow a handful of options and you will generally be invested alongside many other investors.

Most offer a restricted investment list. Most will offer access to a conservative, balanced, growth or high growth options.

Some industry super funds are opening up their investment options to include a limited amount of direct shares and exchange traded funds.

ALSO READ: How do you choose which investments to use?

How much tax is paid?

Superannuation, primarily a tax structure offers the most attractive tax incentives all tax structures.

That’s why it’s become the number one saving vehicle for retirement in Australia.

Contributions your employer makes as part of their superannuation guarantee and any personal super contributions you claim a tax deduction for are taxed at 15%.

Within your super fund you will generate income and capital gains. The income your super fund generates is taxed at 15%. While your capital gains are taxed at a maximum rate of 10%.

Once you are retired and convert your super fund to a pension. The income you receive will be tax free. While all income and capital gains you realise inside your super fund will be tax free.

When can I withdraw my superannuation?

You cannot withdraw your super until you meet a condition of release, which is related to your age (58 years or older), the condition of involuntary unemployment, retirement from work after reaching preservation age and other specific circumstances.

If you are working and aged 60 you can convert your super fund to an income phase. Commonly known as transition to retirement.

You are restricted on the amount of income you withdraw from your super fund. You can take a minimum of 4% of your balance and a maximum of 10%.

Once you are aged 60 and over and fully retired from the workforce, you’ll have full access to your super fund. You can either withdraw the total amount or transfer it an account based pension and elect to receive a regular income.

What is the difference between superannuation and retirement?

Superannuation relates to the whole super system.

During your working years you are in accumulation mode. Building your super as much as you can through contributions and returns.

Once you hit retirement, you’ll enter decumulation. Your likely to convert your super fund to an account based pension. You’ll start withdrawing a regular retirement income to fund your retirement lifestyle.

ALSO WATCH: Paradigm Shift To Safeguard Your Retirement

How much super do I need for retirement?

It’s not a one size fits all. You’ll need to assess your personal needs and desires for retirement.

A rule of thumb for calculating how much super you’ll need to last your retirement years is to multiply your expected annual living expenses by 25. That will give you a ballpark estimate of what you’ll need for retirement in terms of super contributions.

For example, if you needed $65,000 pa to fund your lifestyle in retirement. Multiply $65,000 by 25. Which will give you $1,625,000.

This is assuming you’ll be withdrawing approximately 4% pa.

Want to add a little more buffer, increase the amount you multiply your annual living expenses by.

While this is a quick back of the envelope calculation. To be sure your money will last the distance and provide you with a comfortable retirement lifestyle. Cashflow modelling is critically important.

Understanding how your retirement future could pan so you can make sound financial decisions based on your personal circumstances.

What happens when I turn 60?

While you cannot access your super contributions before you turn 60 unless you meet a condition of release. Once you reach that milestone. You can access it or transfer some of those funds to an income stream for a set period of time.

How do I choose the best super fund for me?

With the vast array of super options available. It’s not a straight forward question to answer.

It’s a little like putting the cart before the horse.

The best super fund for you is going to be dependent on your current situation and your future lifestyle needs.

Remember, a super fund is tool in the toolbox and you need to choose the right tool for the job.

Here’s a framework we use to help clients decide the best super fund for them.

- You want to understand your future income needs. Here a comprehensive cashflow is critical to assist with what you will require from a super fund.

- How far you are from retirement? This will determine the risk strategy you’ll need to implement to ensure no matter what’s happening in investment markets or the world, you’ll still be able to retire when you want.

- The 30 second retirement plan. This is where you’ll determine how much you’ll require for emergencies. How much do you need to allocate to conservative assets to fund 2-5 years of income. The remainder can be invested in growth investments.

- After completing a comprehensive cashflow projection. You’ll be able to determine the return you will require to get the job done. Maybe you don’t need to take as much risk as you thought.

- What type of investment strategy do you require to safely manage inflation, sequencing and market risk.

After working through what you need to achieve for your individual needs. It’ll become clearer what you need your super fund to deliver and the best fit for you.

The super system has been built for accumulation. It’s a danger to think you can continue with the same strategy as you enter retirement.

Don’t get sucked into choosing your super fund based on returns. You’ll end up in a investment you likely not be able to tolerate in retirement.

Remember it does not matter what super fund you have. Your super fund is simply a tax structure. Your investment return is driven by the way you allocate your money across different asset classes.

ALSO READ: How To Structure Your Finances And Safely Generate A Regular Income In Retirement?

Can we have faith in the government moving the goal posts?

Yes, the government is constantly tinkering and changing the goal posts when it comes to superannuation. It can be hard to have faith that the government will provide a solid future for our super.

We’re tasked with making an educated guess as to how much money we need on hand. When and where it needs to come from – not knowing what might change down the track.

This uncertainty makes it difficult to make sound financial decisions. Given you have no idea what the government is going to change next.

What if the government makes further changes to the superannuation system? And you’re not happy with those changes.

This can be a real concern for many Australians.

What if they decide to increase the compulsory withdrawal age of superannuation. Rr even tinker with how much money is offered in your retirement phase?

We could just see our retirement savings going from bad to worse.

It’s likely there will be more changes to come. So not only do you have to keep on top of these announcements and their potential implications.

We need to also make sure we’re taking full advantage of the superannuation system. To ensure that your retirement savings are still being looked after.

The government has already made changes, and they will likely continue to do so in future as well.

What about investing outside super?

While superannuation will be your number one vehicle for your retirement savings. It’s not the only place you can invest your hard earned dollars.

You have a number of options for investing your money outside the system.

It’s all going to be driven by:

Whether you need to have access to your money prior to retirement.

How much risk you want to take with your investments?

Your preference for what type of investment classes you want to invest.

The tax rate you are on.

Your options will include:

Your personal name – in other words you’ll invest in your own name, either your own name or in joint names. Any income will be added to your own tax at the end of the financial year. Provided you hold your investments for longer than 12 months, you pay tax on 50% of any capital gains realised.

Family Trust– a family trust will give you the flexibility to choose who to distribute the income within your family unit. If you spouse or your family members are in lower tax brackets. You can allocate income to them and pay tax at a lower rate than what may have been payable.

Tax Bond – a largely unloved tax structure which is coming back into popularity. Used by those on higher tax brackets who either can’t get any more into their super or want access to the money. A tax bond is taxed at a maximum tax rate of 30% (in most cases much lower). If you hold the tax bond for 10 years or more there are no taxes payable on withdrawal. If you withdraw between year prior to year 8. You will be taxed on any capital gain and receive a tax offset for the tax paid in the bond.

Super is a great way to save for your future.

Don’t let the myths that surround it deter you from making important decisions. Use the information in this blog post as an opportunity to see why super can be so beneficial!

Super is only one piece of the puzzle when planning your retirement. It’s complex and confusing.

It’s best to work alongside a adviser who can assist you make the best decisions to benefit you’re unique circumstances.

Feel free to reach out and book your complimentary Retirement Breakthrough Session. We’ll help you work out how future could pan out. Along with identifying risks and opportunities.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals