When Should You Start Planning For Your Dream Retirement?

In your 20’s it’s all about fun…get educated…land your first job and live a carefree lifestyle.

Then you hit your 30’s. Time to take life a little more seriously. You get married if you haven’t prior to age 30. Perhaps kids are in the picture or not that far away.

Life is hectic…your career is taking off…the focus becomes securing a home and setting yourself up for the rest of your life.

In your 40’s, life is a little chaotic. Raising responsible kids (you hope), getting them through school, paying the bills. There’s little thought about retirement at this stage of life.

Before you know it you hit your 50’s…thinking how did life pass by so quickly.

Now you’re really looking down the barrel. Retirement starts to come in the picture.

As you hit your late 50’s, the seriousness of how you are positioned starts to kick in.

You start to worry about retirement more than you ever have.

Will you be able to retire when you want to?

Will I have enough money to last me through my golden years?

It’s important to understand your numbers at this point. Any costly mistake has the potential to derail and maybe ruin your retirement dreams.

But when do you start planning for your dream retirement?

We’ll get to the answer shortly. But first, let’s look at what’s holding people back from planning their dream retirement…

Haven’t downloaded a copy of our book, Enough? Click here to download…

Owning up to your current reality…

I believe we all know how important it is to have enough money for retirement.

However, for many, facing how they are currently positioned can be daunting at best.

It’s scary to know you’re on the cusp of retirement and perhaps you’re not in a better position than you should be. To know you may not be able to live the lifestyle you had hoped for in retirement.

But here’s the thing, the sooner you face your current reality. The easier it is to resolve your current retirement GAP.

You’ll be in one of three situations, not enough, just enough or more than enough.

The sooner you understand how you are positioned right now. The sooner you’ll know the hidden gaps you’re unaware of and how you can address them.

How are you feeling about your current reality?

Do you HONESTLY know how you are positioned for retirement? I don’t mean a hunch either.

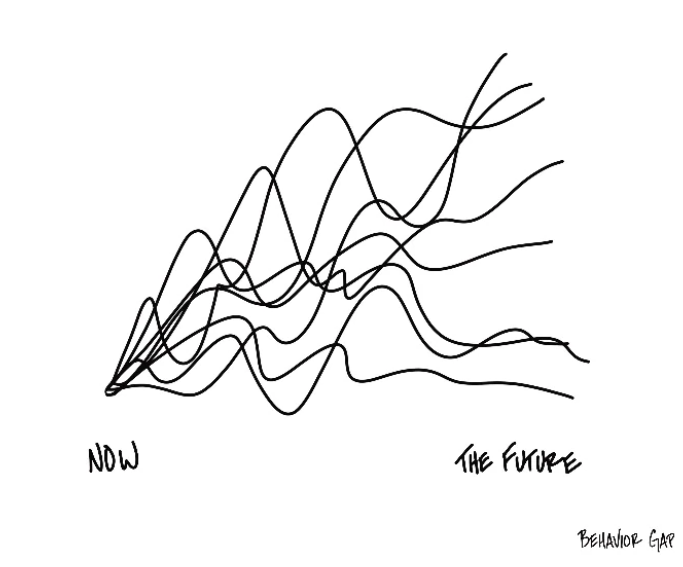

Do you know if your numbers work on different assumptions?

It’s a serious issue. Many don’t take it seriously enough and wonder in retirement why they can’t do the things they had planned for.

Complexity makes it hard to work anything out…

With substantial changes to the super system, contributions, taxation, estate planning and investing over the years.

It’s hard to keep up with the changes at the best of times…let alone someone who doesn’t work in this space everyday.

Sure, you can go to google, but this leaves many more confused than ever.

Trying to figure it out on your own is harder than ever.

We’ve seen many try to go it alone…try their best.

But if you don’t understand how all the rules work, the finer details. You risk stuffing it all up or even worse losing money.

Recently we were working with a couple. They had tried to work it out themselves. The wife had stopped working for a period of time. Meaning she met a condition of release and was able to convert her super to tax-free pension.

When we met them, the wife had found some further work, meaning they had missed the boat on converting their super to a tax free pension. Now they’d have to wait until she finished work again.

For every year she now works, they are losing money by paying more tax than they needed too.

Not only that, they added some excess cash they had sitting around to their super.

However, this meant they added it to a big taxable component in their super. Money that is still there when you pass away, is a nice tip to the tax office and less to your loved ones.

Given their super balances, it made it harder down the track to convert to non-taxable components. Potentially less money to be left to their estate. And we’re talking hundreds of thousands of dollars.

These are just some of the rookie mistakes we see on a daily basis…

What if you make a mistake?

What rookie mistakes are you making now that’s costing you money?

As you approach retirement, there is little room for error. You can’t afford to make any big mistakes at this stage in life…

Procrastination may be killing your retirement dreams…

If you’ve put your retirement in the too hard basket, you’re not alone.

Are you like the Ostrich…putting it’s head in the sand?

Not wanting to accept the answers to the questions you are trying to answer.

While procrastination may feel good now. It’s not going to feel that great when you learn what you’ve missed out on along the journey.

The sooner you face the inevitable, the sooner you can achieve your dream retirement.

Do you know how much money you are currently losing by putting your planning off?

Bad experiences…

In the last few years we’ve spoken to a lot of people who have had a bad experience with an adviser.

Almost all of them, were years ago, in a different era in financial advice.

We can narrow these bad experiences down to a number of issues…

The adviser was predominantly an investment adviser, thinking they had the secret sauce for beating investment markets on a consistent basis. Beware of any adviser that is promoting a secret solution to beating investment markets.

It just isn’t so…

Conflict of interest was a BIG one. Where the adviser put their interests before their clients. In other words the solutions put in front of clients was to profit the adviser in a number of ways.

Jack of all trades, master of none. In other words they were a generalist and not a specialist in the area of retirement planning.

It’s no wonder, most are more comfortable visiting their dentist than a financial planner.

The good news…the financial planning professional has changed significantly over the last couple of years.

There is much more regulation in place. So much so, that nearly half the advisers have left the profession over the last 5 years.

Financial planners are required by law to put their clients interests before their own…

Don’t let one BAD experience hold you back from achieving your dream retirement.

There are many financial planners that will transform your life and more importantly help you navigate you towards and through a comfortable retirement.

For instance, we’re travelled the retired journey with hundreds of couples over two decades. We’ve seen what works and what doesn’t and precisely what and how you need to plan.

Just like a guide, we know what to look out for and when you come across a challenge we know how to solve it.

When should you start planning your dream retirement?

The day before yesterday…

Next best day…the day before that…

Next best day after that…the day before that.

I think you get the picture.

Here’s the thing, the longer you leave it, you risk having less money than you should have had at retirement.

This means less options available for you.

Let’s not forget working longer than you need to. Nobody wants that.

As a good colleague of mine, Paul Armson says in his book, ENOUGH.

“Life’s not a rehearsal”

We have no idea how long we have left. It could be a long time or a short time.

Either way, we know you’re going to have a lot more fun in your 60’s than in your 80’s.

What’s holding you back?

How long are you willing to wait?

Don’t risk your retirement by leaving it for another day…

Let’s have a chat about your retirement. Let’s help you work out how you’re positioned. What gaps you need to be aware of. Maybe even help you put together a roadmap to navigate your retirement journey with more confidence.

Make the next smart step and contact us for your complimentary Retirement Clarity Call below to start managing your retirement plan the right way, today.

Glenn Doherty – CFP – Financial Planner | Helping people within 10 years of retirement achieve a successful retirement