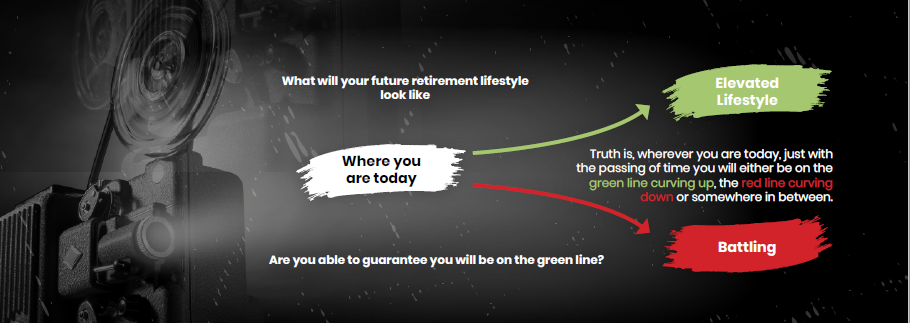

Which investment strategy will deliver a safe and reliable income for you in retirement?

A critical cog in your retirement plan is getting your investment strategy right.

After you’ve determined what you want to achieve in retirement.

Know how you are going to fill your 168 hours in a week, so you don’t get bored.

Worked out how much your retirement is going to cost.

Understand how you are tracking towards your retirement.

It’s now time to fine tune your financial engine. Determine the best fit investment strategy to deliver your retirement income. Consistently and safely!

ALSO READ: Your Retirement Pit Strategy! What To Do 5 yrs Prior To Retirement?

While there are many investment strategies you could use. We’ll discuss three main investment strategies. And the impact they could have on deliverin your retirement income.

There are many ways to invest your money. But, there is no one single investment strategy which will suit everyone.

It’s a matter of understanding what options are available. And selecting one which suits your personal situation.

Retirement risks you need to account for!

One of the most ignored risks is longevity risk. Compared to previous generations we are living longer. Which means your money needs to last much longer.

Below are three risks you need to account for when determining the type of portfolio which will suit you.

Market risk:

Everyone faces this risk. It’s simply the risk of losing money when the market falls.

As you edge closer to retirement, your capacity to withstand market falls diminishes. No longer will you have your employment income to rely on.

Imagine for a moment, you’ve just retired, investment markets have fallen significantly.

The decisions you make at this moment of panic will seal your fate well into your retirement.

Sequence of return risk:

The order in which you generate your investment returns.

Likewise, the risk of selling investments to fund your income when investment markets are down and/or falling.

It’s a risk which can be managed.

Inflation risk:

The increase of goods and services over time. The Reserve Bank of Australia aims to keep inflation between 2-3%.

Given one of your continuing expenses will be healthcare. It can be higher than what you would experience in your working years.

You want to continue to live a comfortable life in retirement.

There’s a level of risk you need to take with your investments. So you can keep up your purchasing power in retirement.

You’ll need to take measured risk, but how much?

Unless you have a bucket load of money. Enough to generate enough income to fund your lifestyle for the rest of your life.

You’re going to have to accept some level of risk to allow your money to last the distance.

As an individual, you’re going to have accept a level of risk you’re comfortable with. Enough to get the job done!

In terms of the risk you are able to accept, risk can be broken down into three areas:

Risk Tolerance:

Your views on the level of risk you are willing to accept. It will depend on your past experience and your ability to accept falls in your portfolio.

Risk Capacity:

While you might be able or feel like you can accept risk. Your personal circumstances will dictate you can accept very little risk.

In other words, the level of risk you can accept is dependent on the money you have saved.

Risk Requirement

The amount of risk you need to bear to make your retirement plan work. It’s based on the lifestyle you’re wanting to live.

A concept we use with every client, working out the return required to get the job done.

If you’re on track to be a self-funded retiree you may not need to take on excessive risk.

As you can see, it’s not just a matter of accepting the investor strategy your super fund gives you. There’s much more to the equation.

What’s the best investment strategy to safely deliver your retirement income?

You may be thinking that your super fund, “the tool”, contains the fairy dust to achieve your financial goals.

It’s like drugs supplied by a pharmacist, tools to help you achieve a health outcome.

They are an important cog in your financial plan.

But, more importantly, your goals are what drive the tools you use to get the job done.

Your financial life is not straight forward. There are many factors you need to take into account when assessing the right investment for you.

As we assess each of the below three investment strategies. We’ll assess them based on three key risks.

Market risk, sequencing risk and inflation risk.

#1 Continue the accumulation strategy you used through your working years

Your working years are all about accumulation. Maximising your total return based on the amount of risk you were happy to accept.

While this strategy serves you well in your working years. It works against you in your retirement years.

By deploying a similar strategy in your retirement years. It assumes you need to accumulate money and maximise your investment return.

Whilst this may be best suited to wealthy retirees, with a significant wealth base.

It has little flexibility to adapt to a decumulation strategy in your retirement.

When over time, your portfolio will fall in value. And that’s okay!

Continuing with the same strategy in retirement has some risks.

You’ll have to adjust your spending based on the ups and downs of your investment balance.

Without a thought out plan the chances of you outliving your money is high.

#2 Simple Bucketing

Rather than looking at your investment as a whole. You break it into separate and distinct buckets of money.

We’ve talked about this in previous blogs, “The 30 second retirement income plan”.

ALSO READ: Investing: What You Need To Do To Safely Achieve Your Retirement Lifestyle?

You hold adequate cash reserves for emergencies.

Enough cash or conservative assets to fund 3-5 years worth of income requirements.

The remainder to be held in growth investments.

This simple strategy provides you with a safety buffer. A little more metal between you and the outside world.

A strategy where you are not forced to sell assets when the market falls to fund your lifestyle.

While a little more complicated than the do nothing approach.

This strategy requires discipline to rebalance your investment allocations. At least yearly.

Where most fall down with strategy is trying to time the rebalance.

You need to remain disciplined and rebalance in a timely manner.

Forget about timing markets here, you won’t be able too!

#3 Simple Bucketing with Dynamic Asset Allocation

Same bucketing as above, but with dynamic asset allocation.

This strategy is not bound by fixed allocations to specific markets.

The objective of this strategy is to balance risk with return.

Reducing the need to remain in asset classes. Because your investment strategy tells you, you have too.

Reducing the need to remain invested in assets which show a low return for the risk you are taking.

In other words. The search is for asset classes which will perform well for the risk you are taking, measured risk.

It’s pro-active investment management strategy. Allowing your portfolio to actively move out of the way of market bubbles.

Increasing risky assets when future expected returns look attractive. While reducing risky assets when assets look expensive.

Using evidence based concepts and discipline to drive investment decisions. Not hope and pray strategies.

It takes away the human errors of rebalancing or failing to rebalance.

This investment strategy is more complex than most. However, the upside is a much smoother ride through your retirement.

After all, retirement is all about enjoying your life. Not for worrying about your money.

As you approach retirement. Your investment strategy is not something that should be set and forget.

A decision based on which one will protect and deliver your lifestyle needs in retirement.

If you’re ready and want to find out how your retirement plan could pan out. Along with knowing what your risks and opportunities are as you approach your retirement.

Here’s your opportunity to book your complimentary Retirement Breakthrough Session here.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals