Why Retirement Awareness Is Critical To Experiencing a Happy and Comfortable Retirement?

The game plan started to unravel just after the midpoint of our batting innings…

It was the last cricket game for the season for my son’s Under 12’s team. We’d only beaten this team two weeks prior in a tough contest.

As their coach, I set the game plan…

On our home deck, knowing 100 runs would be tough to chase down as we were sent in to bat first.

At Under 12 level, it’s about managing your best and not so good players. You have a certain number of balls to face and then retire.

8 wickets and 28 overs to play with.

I sent in a strong opening pair who got us off to a good start. With solid players following and some of best batters further down the batting order.

All was looking good, until one of our best players got run out without facing his quota. A risky run given we had plenty of time.

Then my own son went for a big shot. It was looking like a four until the opposition player put one hand in the air and the ball stock. Most players would have failed to catch this one.

Following were a succession of wickets…wicket after wicket…falling too quickly for my liking.

With overs in hand, the plan had be changed. Pivoting on the run…

Now I had to manage players who didn’t score many runs and got out easily.

One of those players had done well, not many runs but was looking like he would get through his allocation without losing his wicket.

Knowing our retired players could return, all I needed him to do was block the ball on his last ball…we couldn’t afford to lose more wickets at this stage.

I walked over from square leg where I was umpiring and had a quiet word to him…block this ball. Don’t take any risks with it.

The opposition bowled the ball outside off stump and he couldn’t resist and swung the bat…caught behind.

My heart dropped as I hung my head before gathering my thoughts and consoled him as he walked off.

In walked one of our more accomplished batters…the problem was he was batting with one of our lower order batters…who held up the strike.

Normally that wouldn’t be a problem. But in Under 12 cricket, when you return, you only have a maximum of three overs. Whether you’re facing or not.

It’s not a time for a low scorer to hold up the strike.

The more accomplished batter was on strike towards the end of one over. Knowing he had one over to come… we didn’t want the lower order batter holding up the strike.

The accomplished batter was match aware. On the last ball of the over he knew he had to get to the other end…so he could face the next over.

I walked over to the lower order batter at the non-striker’s end and said you need to run, so be ready.

The ball was bowled…the run was there…he was too slow off the mark and ended up getting run out.

Another wicket we did not need…

Not long after we were bowled out for 68 with 5 overs to spare…

Not the outcome we were expecting.

There were two instances where match awareness would have led to a better outcome. A chance to bat the whole innings out.

The match ended in a nail biter. We fought back hard with the ball.

At the 16 over we had them at 6/41. By the 25th over they were 7/67 with one wicket in hand and struggling to score runs.

We had the chance to take the game . But with dropped catches but they got over the line by 1 wicket.

Being match aware would have seen a different result.

Retirement is no different…

Get your PDF copy of ENOUGH? here…

Why Retirement Awareness Is Critical To Experiencing a Happy and Comfortable Retirement…

As you set out on your path to a comfortable retirement, you’re gonna come across challenges…things you didn’t expect.

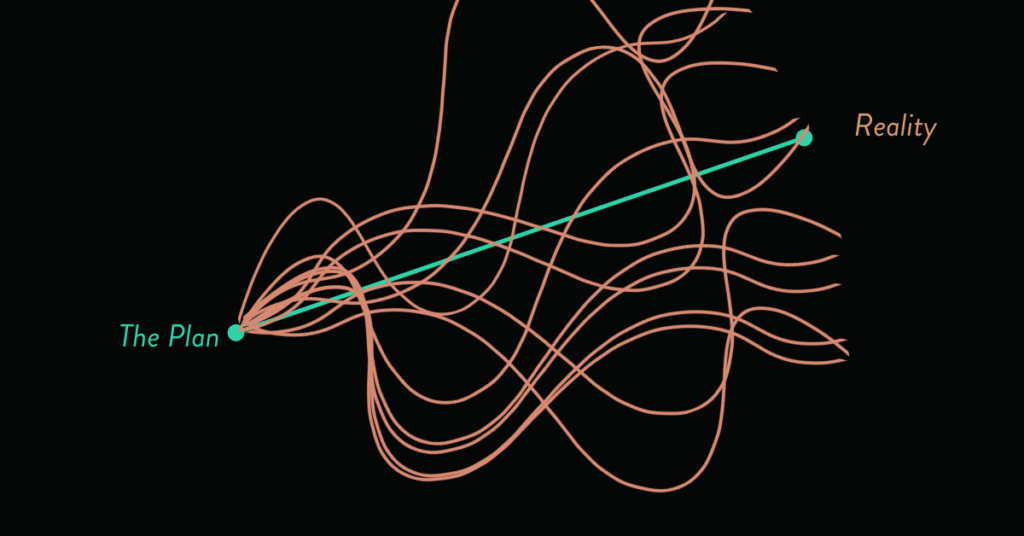

Many think once they have a plan, that’s it…they’re set…

The problem is that the plan is based on the landscape at that specific time.

Working in this space for over two decades we know that you need to revisit your plan regularly.

It’s uncharted territory…a place you’ve never been before.

It’s a little like a pilot flying a plane…they have a detailed flight path.

You only have to ask any pilot and they will tell you it’s rare any flight goes according to plan.

Sure they have a departure point and an arrival point. But between the two, there are constant course corrections that need to be made to keep the flight on track.

Your retirement journey is no different.

Your retirement plan reflects your current reality…based on a set of assumptions at that point in time.

As you take those steps towards and into retirement, you’re going to learn more information about your assumptions…

Life does not unfold in one straight line…

Investment markets are unpredictable…

Inflation changes…

Cashflow requirements change…

Suffer a health scare…

Legislation changes…

Investment markets will do something different than you thought…

Attitude towards risk changes…

Something about your goals change…

You’re going to die earlier or later than you thought…

As you take those steps forward, you’re going to learn more information and incorporate it into your retirement plan.

This is the very reason, being retirement aware is critical to living a successful retirement without fear of running out of money.

You have a choice, you can take the flight plan and fly the plane alone or take the flight plan and have the pilot navigate your journey with you…

45 days to Retirement Clarity…

Imagine for a moment you made one decision today that could result in you having all the answers to your retirement questions in 45 days.

You’d know how much money you needed for the rest of your life…the strategies and tactics to safeguard it and when it’s feasible to transition to retirement with confidence.

A complete retirement roadmap to guide you on your retirement journey…

Would that be valuable for you?

If you’re open to it, schedule a call with Glenn to discuss how you could have a completely personalised retirement roadmap in 45 days or less.

Request a call by email Glenn at gdoherty@jigsawprivatewealth.com.au or click here to schedule a call.

Glenn Doherty – CFP – Financial Planner | Helping people within 10 years of retirement achieve a successful retirement