BLOG

By now if you have been reading these posts you have been building your knowledge around super, we’ve talked about what is super, tax effective contributions and lump sum contributions. We’re going to delve deeper into investing inside super. So, let’s get to it… Let’s start with the basics… Investments are generally broken down into…

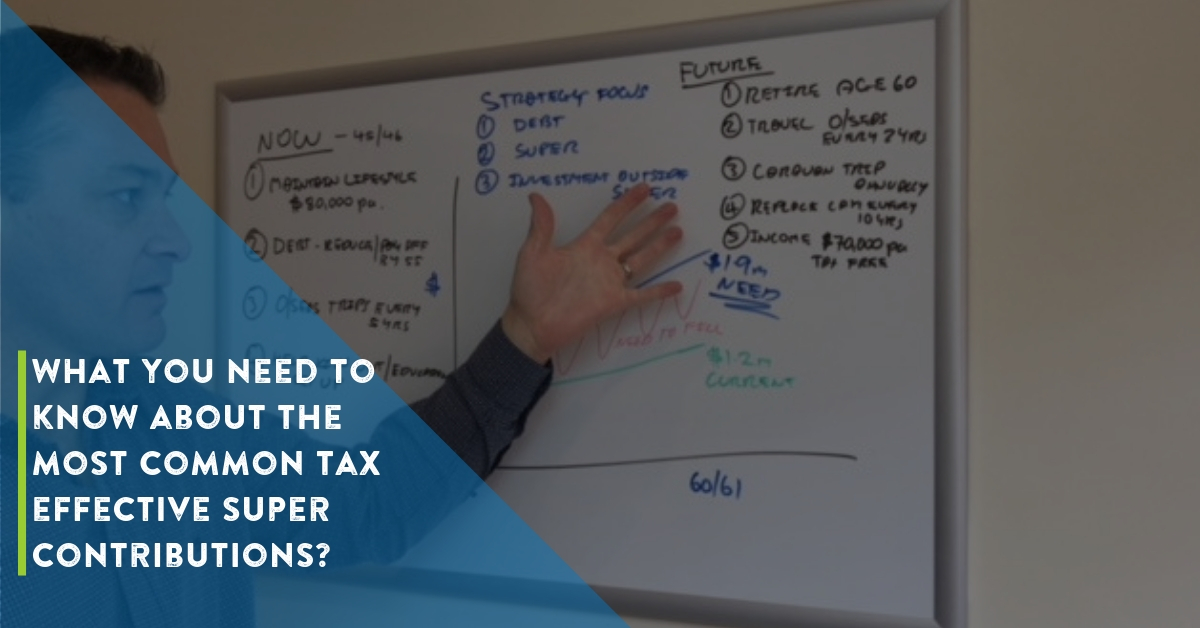

Read MoreSo, here we are. We’ve gone through the most common tax effective strategies in our previous post. If you did not read it, you can read it here>> Next, we are going to take you through the new rules relating to lump sum contributions and what you can and can’t do. Why would you even…

Read MoreIs your super what you think it is? I’ve been having many conversations recently around different types of super funds, retail, industry, and Self Managed Super Funds. Industry funds are promoting compare the pair, I’m sure you have heard of them or seen them. Then more recently we’ve had the big banks caught with their hand…

Read MoreOkay. so last week we got a handle on what superannuation is. It’s a tax structure first and foremost and a place to invest second. If you missed last weeks post you can access it by clicking here>> So, this week are going to get into the nitty-gritty of the most common tax effective contributions. …

Read MoreSuperannuation is something of a bit of a mystery for most. We as Australians have a love/hate relationship with superannuation. In some cases it’s complete financial apathy; we tend to just ignore it. It’s something that is there, but we know we’re not going to get access to it for a long time,…

Read MoreIf your looking to Retire in style there is only one metric you really need to know to achieve it in the time frame you want. It all has to do with T20 cricket. We use this metric with all our clients to keep them on track for whatever they want to achieve and it…

Read MoreThat’s right folks, forget returns. Forget SMSF’s. Forget which fund to invest in or which property to invest in. Forget focusing on the wrong things. It doesn’t start with investments. It doesn’t start with tax. It doesn’t start with superannuation. There are more important questions you need to answer before you consider any of the…

Read MoreLike any household, it’s constantly organised chaos. In ours, we have two young boys, one aged 4 and the other 7, yes they are the ones in the image. If you asked them they would consider themselves the owner of everything from the house, to the cars and to everything else we own. The way they…

Read MoreFirstly I want to discuss some real client cases where they have got it wrong, not followed the rules and it ended up costing them big time, and not only money. But if you get this right the rewards are massive. We’ll discuss the Secret Sauce, the rules you should be following to keep you…

Read MoreIt’s no different from choosing a pet. Do I get a dog, cat or bunny. They all have their pros and cons, but what is the right one for you will be different to the next person based on their specific needs and wants. They are different in many ways, they are not the same…

Read More