BLOG

After releasing the Retirement Lifestyle Worksheet I have had many questions about How much is Enough?. So I thought I would try and answer that question here. If you have not done so already you can download out Retirement Lifestyle Worksheet by clicking here>> It’s a worksheet you can use to design your own Next…

Read MoreI have come across a lot of discussions recently around whether to charge board to your kids once they are earning an income, some have said yes to cover costs, some no, some yes but we will bank it for you, so the question is what do you do? You child has gained their first…

Read MoreI was having a discussion with a client of ours recently who was looking to retire in the next couple of years. He was having difficulty in working out what he would do with his time when he retired. He didn’t want to be sitting around not knowing how he was going to fill his…

Read MoreThe Big Super Secret Alright, here’s the big secret. Ta dah! The superannuation system is very, very specifically designed. It’s actually one of the most complicated systems in the world, and I want you to think about it as a giant reward system. It’s like Qantas frequent flyer on steroids. It’s designed to reward one…

Read MoreYes, you heard me right, salary sacrificing into your super fund can be sexy, unless you believe you have no future… Salary sacrificing is the main contribution strategy we use with clients to help them with their retirement planning so they can ensure they can live the lifestyle they want when they give up the rat…

Read MoreCase Study | Retirement Planning | Joe & Kerry Background: Joe & Kerry both worked hard in their careers while bringing up three children. Like most, they live a busy lifestyle. Although they love what they do they realise that the day they finish work and retire is coming at a faster pace than what…

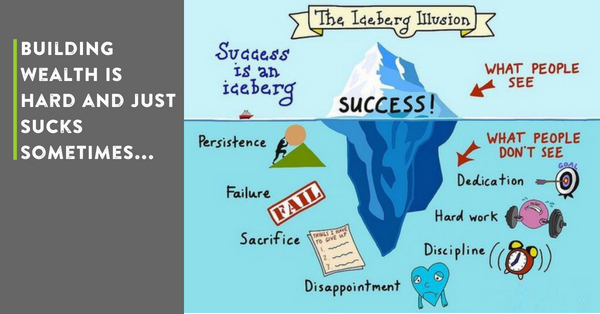

Read MoreBuilding wealth is hard and just sucks sometimes, but you most probably already knew that, didn’t you? Recently I went on a Body Transformation Challenge, the one where they promise to transform your body from what it is today to that nicely chiseled body you see on the cover of magazines. I learned a lot of…

Read MoreIf you haven’t been living under a rock lately, you would have heard of a major event going on in Australia, called the Royal Commission. It’s an investigation into the way the banks and the financial planning industry have been behaving and it’s hasn’t been good reading. It reminds me of my wife’s favorite show…

Read MoreTo self-manage or not to, that is the question most ask themselves. It generally starts with a discussion at a BBQ after you have settled in, discussed the recent news and caught up with the latest gossip with your friends. Now, we as Australians are not that forthcoming when it comes to talking about money. …

Read MoreWe all want our kids and grandkids to be financially savvy, right? But when we talk to them about saving and investing it’s like, why would I want to do that when I can just go out and enjoy it all now, they just want the instant gratification. Below we are going to give you…

Read More