6 things people assume they need a retirement planner for (which they don’t)

One of the most challenging things in working in the financial services industry is managing the perceptions of what people think they are paying for ongoing advice and where the real value lies.

You could say this is largely driven by what I call the “financial pornograhy” channels. Sprouting anything from the rooftops just to get your attention.

Just take any correspondence from a financial services company. It’s likely it’s discussed a product or the returns they have achieved.

At this point you should be nodding…

Therein lies the GAP.

While financial advice in many cases can be quantifiable, often it’s not. The real value from a real life centred financial planner is highly qualitative.

We sought to address this GAP through our unwavering approach to Return on Life!

After all, what’s the one thing you want?

Hint: this is an easy question…

You want a lifestyle…

And there’s one thing you don’t want…

Anything less than you have today.

Our most important role for our clients is to make sense of the money they have to live the life they want. Without fear of running out of money or dying with too much!

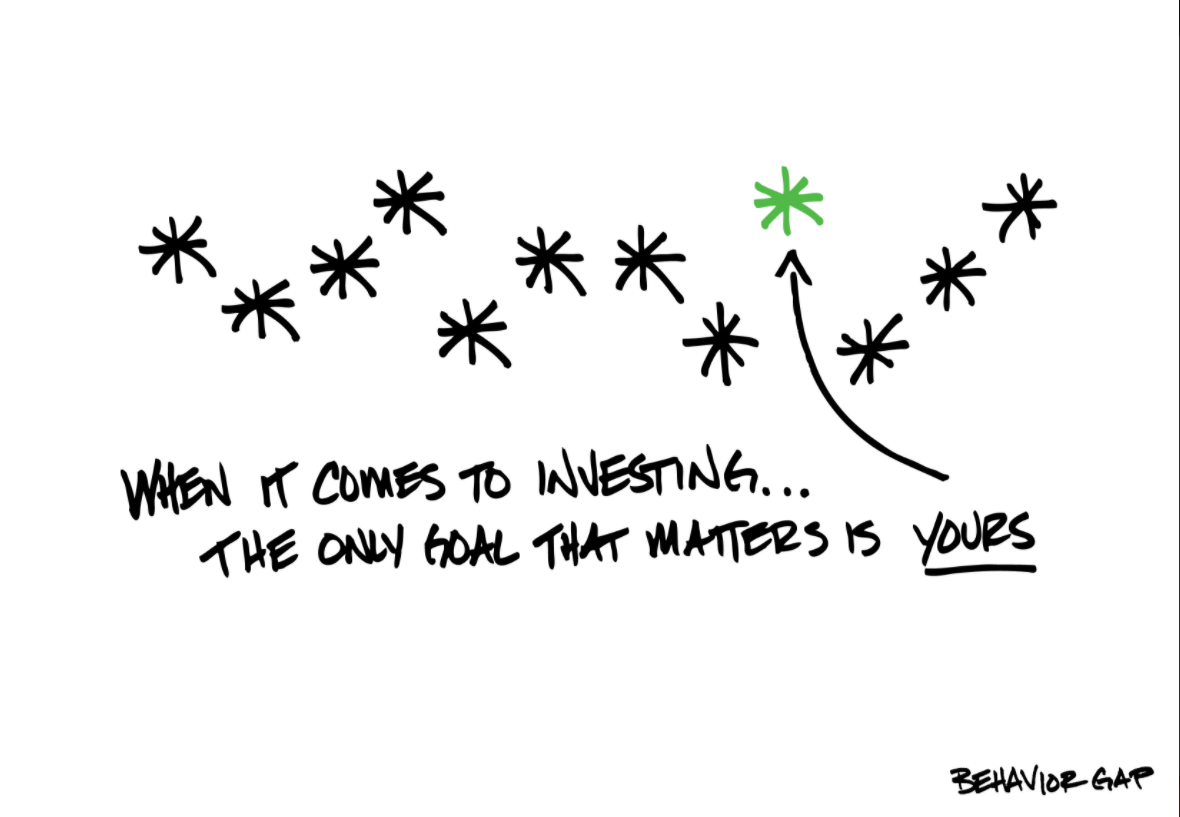

Picking the best investments

The holy grail! Outperformance, stellar returns are two expectations that are nigh on impossible to deliver.

Sure, it’s an easy sell to promote the idea of unique insights and complex investments gives you access to the smartest people to deliver eye popping returns.

However, the reality is if “consistently outperforming investment markets” was a walk in the park, everyone would be doing it!

Value of a Life-Centred approach!

It’s important to keep it simple. You don’t need to be smart, tricky or try to outsmart investment markets. It’s much simpler than that. Long term, the market is on your side.

The value of a life-centered financial planner is to help you find the balance. What’s going to help you get and keep the lifestyle you desire. You want to avoid trickery and potions while finding a solution which will see you through safely.

Accessing Unique Products

Once using unique products or investments, which usually come with high fees, may sound good in theory but rarely deliver value for money.

Nor do they generally justify the risk.

Value of a Life-Centred approach!

There are always going to be trade offs. Risk comes with the ticket to the game if you want a good return. You can’t get away with one without the other.

The value a life-centred financial planner brings to the table is to identify the opportunities and risks worth taking or for that matter not taking.

Tapping into knowledge you don’t have

For advisers it’s easy to sell the idea of paying high fees for knowledge you don’t have.

With Mr Google at your finger tips, everything an adviser knows can be googled if you look hard enough.

Many of our clients have a good level of knowledge and have a reasonable handle on their finances.

Value of a Life-Centred approach!

You may be certain and confident you are on the right path to deliver your retirement lifestyle. That’s one thing, but it’s another thing to be sure.

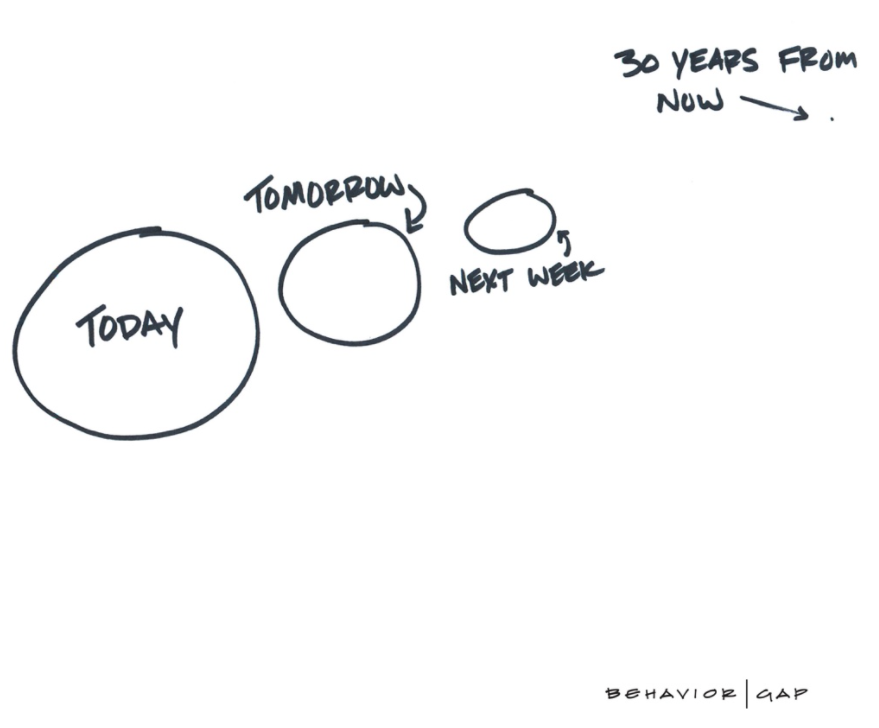

Our experience tells us, the path between where you are today to where you want to go is not a straight line. It curves and it bends. There are many variations of the path you are on and how you might get to your end destination.

This is a key area a life-centred financial planner can help you with. With your lifestyle at the centre of the equation. With our experience and wisdom travelling this journey many times over we are able to help you craft a roadmap to get you from where you are today to where you want to go.

More importantly, to help you work out whether you’ll die with too much or not enough. Maybe you can experience more, perhaps take less risk or retire earlier than you thought.

Feedback from our clients is this visibility is priceless!

Tell you what to do

It frustrates me when I come across people who are told to do certain things without understanding why they are doing them.

On the other hand, it’s even worse when someone is given great advice, however, fails to implement.

Here’s the thing, time is slipping away and life is not a rehearsal!

Value of a Life-Centred approach!

While you can get all the information you want from Mr Google, there’s one thing Mr Google can’t do for you. Tell you the information which is right for your specific circumstances and explain why it’s relevant to you.

A life-centred financial planner will tell you why it’s important to you and what impact it will have on your unique circumstances.

We work with our clients collaboratively. Providing them with a framework to make confident decisions to deliver the lifestyle they desire for the rest of their life. Without fear of running out of money. It provides a level of accountability to ensure advice is implemented.

Focus on the Optimal Outcome

Sure you can turn your financial plan into a simple math puzzle. Meaning one single solution. But there’s a BIG problem with narrowing in on one single solution. It doesn’t account for when your plan meets the real world and the psychology of the individuals involved.

For example, we were working with some clients who based on simplifying their financial plan into a simple maths puzzle. Just retired and their investments were significantly invested in shares and property. Plug these numbers into some software and things look hunky dory.

But that software didn’t take into account what could happen in the real world or the fact these clients would freak out when their investments could potentially drop by $700k. A big blindside…

Value of a Life-Centred approach!

We worked with these clients to devise a plan with which they could maintain their current lifestyle. However, drastically reducing the level of risk they were accepting in their plans. In other words, helping them avoid a BIG blindside.

Not only would this avoid a BIG disaster. Potentially a $700k disaster. But they would be able to sleep better at night knowing they’ll be okay.

Creating performance reports

Once upon a time preparing for client meetings required preparing and printing lots of performance reports. Focusing on what happened in the previous 12 months. And sure it’s important to know what happened in the past, know how your positioned right now: what you have, how your investments performed and what you added and took. But…

Value of a Life-Centred approach!

If you keep looking in the rear view mirror, at some point you’re going to get wacked by what you don’t see in front of you. In other words you’re going to miss out on doing things and experiencing more in life. Where are you going? What type of lifestyle do you want to live in 5, 10, 20 years time?

This is where a life-centred financial planner comes into their own. They’ll help you look and see what is possible with the money you have. They’ll not only help you get the life you want but more important help to maintain it. Help you understand what you need to plan for and avoid your plans from blowing up.

The true value of a Life Centred Financial Planner

You can’t boil your financial plan down to just maximising your numbers; treating life like one BIG maths equation with one single solution.

A sound financial plan will one which helps you identify, achieve and maintain your desired lifestyle. Without fear of running out of money or dying with too much. No matter what happens.

Providing you with a framework for making financial decisions with your lifestyle at the centre of the equation.

4 layers of a Life-Centred Financial Planner

- Financial Strategist

Looking at your situation, your life and helping you to create a playbook for you to get you where you want to go as soon as possible. - Financial Coach

Coaching you through financial decisions that could help you or hinder you. We bring wisdom, advice and input to make sure you don’t sabotage your journey midstream. - Retirement Roadmap

Help you to construct your personal retirement roadmap based on the above. Your strategy in life and the decisions you need to make. We’ll help you build a plan around that. - Financial Management

We’ll help you manage your money in a way that helps you get and keep the lifestyle you want. With the money you have.

Not only is it a maths puzzle, but more importantly it’s a life puzzle.

But here’s the thing, time is slipping away and life is not a rehearsal.

The longer you leave it, the harder, costlier and riskier it is to achieve your desired retirement lifestyle.

When you’re ready, schedule your complimentary Retirement Breakthrough Session here.

We’ll start helping you to build your personalised playbook for not only achieving your desired retirement lifestyle. But how to maintain it without fear of running out money.

Live your best life in retirement!

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for Over 55’s powered by Life-Centred Financial Planning