Are you retirement plans feasible or just a pipe dream? What you need to know…

Retirement is an exciting time, full of possibilities and adventures.

- Hooking up the caravan and setting off on the BIG lap

- Realising those travel plans to DREAM destinations

- Pursuing hobbies you’ve never had time for

- More time to focus on your health and fitness

- Spending time with family and friends creating memories…

All before you’re too old to enjoy them…

The reality is with every year that passes, your retirement runway shortens. Leaving less time to enjoy life the way you want.

Have you ever stopped to consider whether your retirement plans are actually feasible?

Over the last week we’ve had a number of conversations around this very question:

- Wanting to exit a stressful working environment. Wanting to retire but not sure they can afford it.

- A couple realising retirement was close. The adviser they were working with hadn’t contacted them for 18 mths. The discussion was never had about how much they needed for retirement. Leaving them in the wilderness about how much they needed. The focus had been on investments and products.

- Recovering from divorce, now wanting a plan to get back on track for a comfortable retirement over the next 10 years.

- A couple wanting to trial to retirement to see if they like it. Wanted to know whether they’d be okay financially.

Just about every conversation we have with aspiring retirees is about whether they are going to have enough money to enjoy the good things in life.

In other words, is our retirement feasible or are we living in a pipe dream…

It’s a crucial question to ask, and here’s why.

If you get this wrong from the start, you don’t need me to tell me how things will end up.

Your runway to retirement shortens every year. Leaving less time to enjoy life the way you want. That’s why it’s important to ensure that your retirement plans are feasible. So you can be confident you can afford the lifestyle you want in retirement.

Before you’re too old to enjoy it…

If not, you have time to make intentional decisions to move you closer to what you want.

What’s a Feasible Retirement Plan?

First off, let’s define what we mean by “feasible retirement plans“.

Simply put, it means having a realistic understanding of your financial situation. Understanding how you are tracking and the lifestyle you can afford in retirement.

This includes factors like your retirement savings, investment returns, inflation, Centrelink pensions if they apply, longevity and projected expenses.

Now, you might be thinking, “But I’ve been saving diligently for years – of course my retirement plans are feasible!” And that may very well be true.

The reality is that many people don’t have a clear understanding of their financial situation in retirement, and this can have serious consequences.

Retirement pitfalls and blind spots:

#1 Retirement Expenses – many don’t fully consider all the expenses they’ll face in retirement. Such as day to day expenses, travel, change of cars, kids weddings, home repairs and other capital expenses. This can lead to a significant shortfall in your retirement income.

Even worse, a simple miscalculation can see you running out of money in retirement.

It’s important to have a framework for understanding the lifestyle you want while capturing your retirement cashflow requirements.

#2 Longevity – many underestimate this on a daily basis. Many think they’ll never live to their 90’s. Unlike previous generations. Unless you have health issues, there’s a good chance one in a couple will make it well into their 90’s.

Failing to plan for a long life expectancy can leave you short in retirement. People are living longer than ever before, which means retirement savings need to last longer. Failing to plan for a long life expectancy can lead to running out of money in later years.

#3 Assumptions – investment returns, inflation and investment risk are a few of the assumptions that if you get them wrong will set you on a path to a nightmare retirement.

Time and time again, people’s confidence levels are creating a false sense of security.

As you approach retirement, if you get any one of these assumptions wrong, you start heading down the path of a retirement nightmare.

Retirement is a time to secure your future income flows so your money lasts. Creating safety nets is critical, so when you hit troubled waters, you’ll still be okay…

Maybe you don’t need to expose yourself to as much risk as you thought.

#4 Retirement Standards – if you’ve been googling, you’ve probably come across the ASFA Retirement Standard. Stating a couple requires $645,000 for a comfortable retirement.

I can’t say any of my clients fit those descriptions.

- For instance, a client we are working with right now. They want to give up work and spend the next 10 years travelling through Asia.

- Or another client, who wanted to sell up the family home, hook up the caravan and indefinitely travel around Australia. Until they had had enough. For them, we showed them the feasibility of their plan. So much so that they brought their plans forward by 2 years.

With over 22 years of working in this profession helping hundreds of people plan and achieve their ideal lifestyle. Everyone’s idea of a good lifestyle is different…

It’s one reason why we take a deliberate approach to uncover what the money’s for prior to discussing the money side of the equation.

The bottom line is that understanding the feasibility of your retirement plans is crucial to your financial security in retirement.

Not doing so can lead to serious consequences like running out of money. Struggling to make ends meet, or even having to go back to work when you thought you were done.

It’s important to address these potential pitfalls before it’s too late. The closer you get to retirement age, the harder it can be to make up for any shortfall in retirement savings or unexpected expenses.

If you don’t address these issues, it means you’re going to have to compromise on your retirement lifestyle.

By addressing these common pitfalls and taking a proactive approach to retirement planning, you can set yourself up for a comfortable and secure retirement.

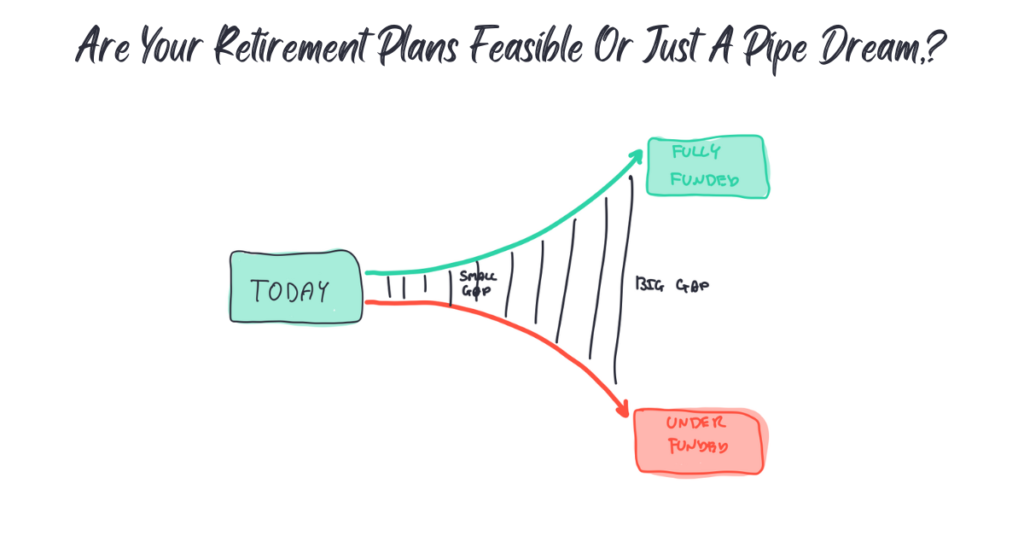

If you’re slightly off, you’ll miss the mark…

The majority of people have no idea whether they are on track or not for a comfortable retirement. Being slightly off, even by the smallest of margins can have a huge ripple effect on your retirement experience.

Imagine for a moment you’re on a plane leaving Los Angeles flying to Rome. This flight takes approx 12 hrs on a direct flight.

But, what if the plane’s nose is pointed 1 degree off course to the south. After 12 hours you’ll land somewhere in Tunisia, Africa. One degree to the north and you might land in Solvenia or Austria.

The same goes for retirement planning. If you’re not on track from the beginning, you’re at risk of missing your retirement goals by a wide margin.

This is especially dangerous if you’re leaving retirement planning close to retirement.

The longer you leave it, the less time you have to make up for any shortfalls.

So, if you’re within 7 years of retirement, it’s essential to start thinking about your retirement plans now. Don’t wait until it’s too late to make any meaningful changes.

Remember, retirement is about enjoying the activities you’re always dreamed of – hooking up the caravan for the BIG lap, adventures overseas, pursuing hobbies, more time to look after your health and fitness and spending valuable time with friends and family.

All before you’re too old to enjoy them.

If you’re thinking:

- Are we on track for a comfortable retirement?

- How much super do we need to have?

- Can we retire now?

- Will we run out of money?

- Wondering whether your assumptions are right.

- How do we set it all up?

Then it’s time to book your complimentary Retirement Clarity Call by clicking here.

We’ll have a chat about your plans and provide some clarity and a framework to get clear on your retirement options.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement