Are you doing it all wrong? Retirement Planning is not Financial Planning…

Or perhaps you need a plan to make work optional…

You might be sitting there going, but aren’t you a financial planner…

I am a financial planner but one who specialises in retirement planning…there’s a BIG difference.

For most of your working life, financial planning is what you need. Accumulating and squireling your hard earned cash away until the day you retire.

That’s fine while you are working.

But when you approach retirement the game changes…

What most people do…

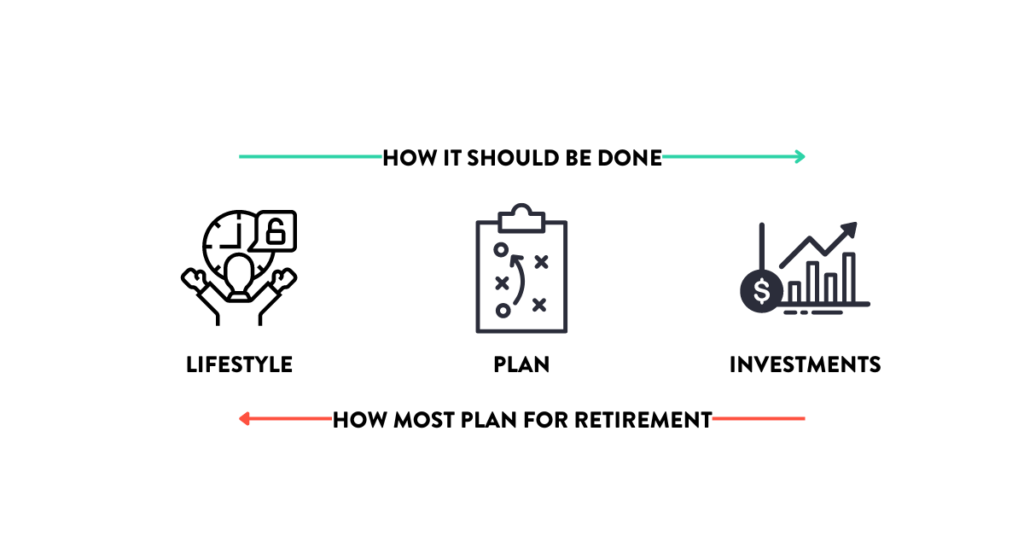

Start with the financial bling…the exciting stuff that gets the blood pumping.

They focus on their investment portfolio or shares they need to purchase.

Which then leads to strategies to build up money in their nest eggs. The financial planning side of things.

This is what most people do. Where the focus is. But is it the wrong approach if you want to live a great life in retirement?

Retirement Crisis…

There are two BIG retirement crises that rarely get talked about…

On the one hand there are people for whatever reason are behind the eight ball.

Perhaps they started late…divorce…suffered a financial setback…health…redundancy or ignored planning.

That’s real and the crisis we know about.

The other crisis believe it or not, are those that have done everything right. Or the fortune to have things go their way.

They’re in a position where choices are plentiful. While on the surface their crisis doesn’t sound bad. Compared to those that are behind the eight ball.

After all they have the money…are in position to live the life they want…they know it internally.

But for some reason can’t do it…

Like everyone else they are worried about interest rates, recessions, investment returns and an uncertain future.

They have a crisis of confidence to create a great life for themselves and have an impact on the world.

YOU MAY WANT TO READ “Asking $30k Questions Will Allow You To Live A Rich Lifestyle In Retirement”

Paralysed by choice and uncertainty…

One of my roles as an adviser is to help these people see through this uncertainty and choices to create a great life before they are too old to enjoy it.

One of our long term clients faced this exact issue recently. Sadly her husband passed away 20 years ago.

She has more than enough money yet felt guilty every time she spent money on things to make her life more comfortable.

Given the level of wealth she had, we discussed giving some of her money to her nieces and nephews. All with mortgages and struggles post COVID (my client had no children).

We showed she could comfortably give this money away without any impact on the lifestyle she was living.

Not only that, my client had suffered some health issues of late and wanted to make one last trip to the UK. Struggling with the fact it’s a long trip and not sure how she’d cope.

We suggested she spend the money on business class flights to make the trip more manageable.

I was shocked when she thanked me after the meeting for giving herself permission to use this money on what she thought was an extravagant expense.

YOU MAY WANT TO WATCH “How To Stay Confident In Your Retirement Plan When The Future Is Uncertain?

Financial Planning is not Retirement Planning…

Financial is critical to retirement planning…

You spend most of your life doing financial planning.

But when you hit retirement, you are in the reaping phase of life…

Using the financial resources you’ve spent your whole life accumulating for something more important than money.

Living a great life…

One of the biggest problems I see with people planning their retirement is the financial side of things is at the hub.

Sure it’s critical to get the financial aspects right, but it’s a means to an end.

Don’t make creating a great life an afterthought…

Making decisions…

Get your PDF copy of ENOUGH? here…

In times of chaos, when everything seems to be going against you in the world. When the future is full of uncertainty. It can be tough to make decisions. Especially the right ones.

The best way we’ve found over many years of helping people plan for a great life in retirement, is to follow an organised process.

A way you can methodically think through an issue and arrive with a course of action. Without all the noise in our heads getting in the way.

#1 What is your dream retirement lifestyle?

Rather than start with the financial aspects of retirement planning. Start with your vision of what a great life looks like for you.

What are you doing and how are you spending you time?

Is it buying a caravan and completing a BIG lap of Australia?

Maybe it’s spending time on your interests and hobbies…

Working through your bucket list…

Memorable overseas adventures…

Spending time with family and friends…

It’s different for everyone…what do you want to be doing when you have more time and freedom?

What’s getting in the way of making this a reality before you’re too old to enjoy yourself?

#2 What is a feasible roadmap to fund your great life?

Having a vision is great. But how feasible is your roadmap? One that allows you a safe passage, avoiding a retirement blow up…

Will the financial resources you’ve accumulated over many years be able to fund your vision?

How much investment risk do you need to accept to avoid a financial disaster?

What changes do you need to make to make your plan feasible?

Will your plan be able to withstand shocks so you don’t get KO’d part way through retirement?

Many people don’t know how feasible their current plan is. Let alone the hidden risks and blind spots lurking under the surface. Ones that could rear their ugly head at any time without notice…

Most people I speak to have no idea how much money they will need to fund a good lifestyle in retirement.

Nor do they know if their current plan, if they have one, is feasible…

If you want to continue to live a great life in retirement, you need to know if your money will last.

The scary part of not having a plan to guide you. Less money to enjoy in retirement…

#3 How resilient is this feasible plan you’ve created?

Now that you’ve got your feasible plan, how resilient is this plan you’ve identified?

It’s feasible you can on this journey, but how resilient is this going to be so you don’t get KO’d mid journey?

What things can KO you mid journey?

Taking on more investment risk than you need to…

Not having enough safety margin…

Overconfidence in your assumptions….

Blind spots and risks you couldn’t see coming…

You need to walk through the decisions you need to make so your plan resilient.

#4 Take action…

While you can get side tracked with the financial bling. You want to make the main thing the main thing…

The main thing is the life you want to live and how do you make this possible?

If you use an approach that helps you think through your vision for what a great life looks like. Create a feasible plan, think through how to make it resilient and optimise it.

A lot of your decisions are pre-decided on purpose. You’ve been proactive…

You don’t need to worry about inflation, markets going down or the financial bling on the financial pornography channels.

A process for thinking through your decisions is key to living the life you want. Free from worrying about running out of money.

Is it time you made the main thing the main thing?

Schedule your Retirement Clarity call here today with Glenn on the calendar below. The call is designed to help you gain clarity on how you can achieve your comfortable retirement lifestyle.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement