Avoid crashing your financial sportscar and live a fulfilled life in retirement!

When you combine a serious sport with entertainment and it becomes one of the most watched shows on TV, is there a problem?

As you line up to try and putt a golf ball through a hole in a wall while being set on fire.

Or run across a narrow ledge past a line of fluro dunnies. With water on one side. Knowing that any second the doors are going to be thrashed open and it’s a matter of when you’ll be flung into the water below.

It’s Holy Moley and my kids love it…

You’ve got a jacked up version of golf. Is this what we’re attracted to in our investment strategies?

Maybe. A group of rebels in a social media forum called Reddit form an alliance to stick it to the boys on Wall Street.

A real life modern day Robinhood…

These modern day robinhoods managed to drive up the price of a company called GameStop to hyper inflated levels. Forcing the rich boys on Wall Street to close out their position. To the tune of billions of dollars down the proverbial toilet…

Yeah, they really stuck it to them!

On a serious note we have a very successful investment manger from the US, title an article “Waiting for the last dance”.

Hmm…is there something here we all need to be taking note off?

Now I’m not trying to shock you. Nor am I telling you to cash in your portfolio and run for the hills.

We’re not into speculation nor predicting what investment markets will do.

We’ll leave that up to the crystal ball experts.

At certain points in investment market cycles, signs start to appear that we need to take notice off.

Questions to ask right now?

#1 If you have a typical diversified portfolio, how much of that is in shares and how much is in conservative assets like cash, term deposits and bonds?

#2 How would your portfolio perform if we had another 2008 market crash?

#3 Do you have a risk management strategy in place to manage your retirement money? One which would minimise your investment losses should another share market crash occur?

These may be hard questions to answer. In fact you’ve most probably never answered them before.

But, they are vital questions to be asking right now.

Why are these questions important?

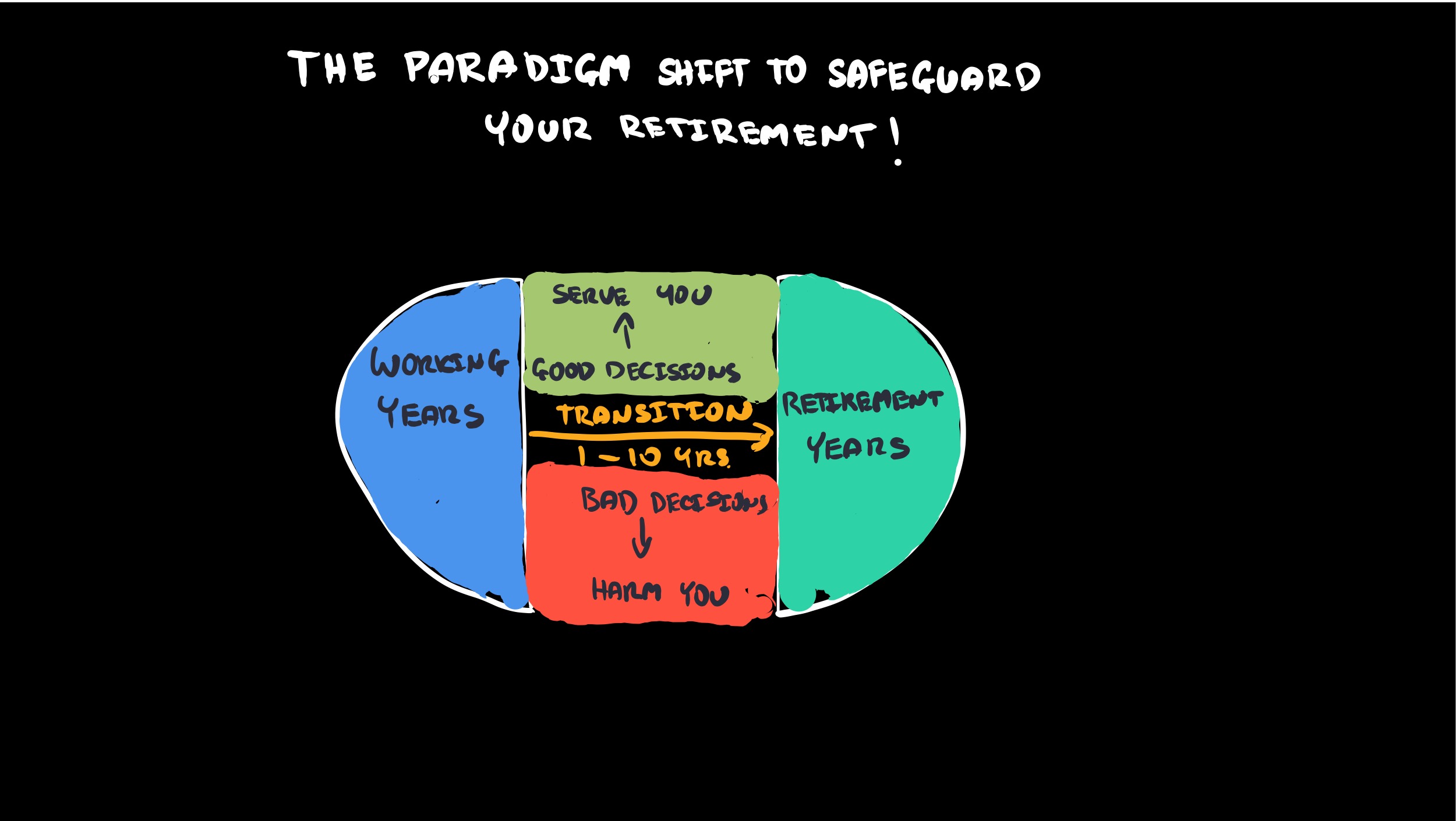

If you are 1, 5 or even 10 years from retirement, you’re already in transition phase. The decisions you make over this period have a significant impact on your retirement. Good decisions will serve you. While bad decisions will harm you.

The financial services industry has been very good at marketing and training you in this accumulation phase of your working life.

After all, it’s how they profit from you. The more you accumulate the more they make. It’s not in their best interests to tell you to take your money out.

But what they do poorly, is help and educate you on the decumulation phase.

You see, it’s not about dollar cost averaging. It’s about the balance between income and growth while implementing a risk management strategy. Never will you be more exposed to risks than in your retirement years.

A fast sports car or a an SUV

Historically, we know investments suffer a major decline every 5-7 years. Doesn’t it then make sense you need to have a plan for when this happens?

Let me ask you a question:

If I told you that every 5 years or so you were going to be involved in a car crash. Do you think this would impact the way you would drive? Would you be more cautious?

Do you think this would influence the type of car you buy and drive? Would you take more notice of the safety features in the car?

Maybe even review the crash test results with more interest.

Do you think knowing this you would buy a car which was bigger, heavier and would handle a crash better?

Knowing all this information. Would you be inclined to buy a sports car that can go really fast? Or would you buy an SUV, something a little bigger which will get you from A to B fast enough, but with a little more metal between you and the outside world?

Most people are driving around in a fast sports car unaware or unprepared for when the next crash comes.

I’m not telling you this to send fear down your spine. But to help you realise what you don’t know. To help you not end up in a wreck while still in your financial sports car.

The number one concern of pre-retirees

The number one concern of pre-retirees is whether they’ll have enough money no matter the level of wealth they have. The second, running out of money in retirement. This leads to compromise and many are facing the harsh reality they’ll have to give up on some of their dreams in retirement.

And if this is on your mind, doesn’t this make sense that the first thing you should do is make sure you eliminate any holes in your bucket?

Yes, we’re challenging you to understand what’s possible, to know what blindspots could impact your dreams. Too many meander into retirement thinking what got them there will get them through retirement. Most of what you understand from your working life is focused on accumulating money. Dollar cost averaging.

Maintaining this mindset in retirement will work against you as you enter the decumulation stage.

Stop settling for the half truths the financial services industry spins you and seek out the truth, so that you can enter retirement fully prepared, fully educated on the path you are about to undertake.

It’s important to be educated. Know your options and the impact these could potentially have in your retirement years. It’s called financial visibility and forms one component of “The Abundant Retirement Lifestyle Framework” we implement for all pre-retirees and retiree clients.

If you would like to gain the financial visibility to be confident your retirement plan will deliver what you want. Understand all the options and the impact so you are prepared. Rather than repairing your retirement plan from poor decisions. When it’s too late. Book a no-obligation call here and we’ll have a discussion about exactly how you can do that.

So you can enter retirement prepared, confident and knowing you’ll be able to live the life you want, free from worrying about running out of money.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning for over 50’s couples and individuals | Founder of Jigsaw Private Wealth