Superannuation

ASPIRATIONS + SAVINGS + TACTICS + METRICS = FINANCIAL FREEDOM

Now more than ever there’s so much noise around. Stock markets are up one day, down the next, the media puts it right in your face ( I call it financial pornography), but at the end of the day no one knows what’s going to happen. 50% are going to be right, 50% are going…

Read MoreMy $52,381 mistake that can save you thousands!!!

Many of us think we can beat investment markets or pick the latest stock that is going to make us rich. Even take a hot tip from the bloke at the local pub. We’ve all been there with the hope it will make us rich or at least make us feel better. This happens more…

Read MoreSmashing Financial Goals Never Happens Easily!!!

As a kid, I loved lego while also giving things a go. Nothing seemed to get in the way, nothing seemed to scare me. However, as we get older fear sets in, fear of failing, fear of what people other people will think, fearful of the unknown. I see these traits in people all the…

Read MoreWhen Markets Fall!!!

Whether you have a lot of experience with investing or very little, you’ll experience periods of frustration and concern with your investments when markets go down whether you are a long way from retirement, close to retirement or already retired. From time to time investment markets get a little scary. For some, this brings up anxiety,…

Read MoreFather of one struggling on $300k a year!!!

Getting on top of your finances is something many are aiming for. However, you would think that earning $300,000 a year would lead to quite a comfortable lifestyle. Nice house, nice car, regular holidays, kids in nice schools however it is quite common for people on this level of income to feel like they are…

Read MoreSmashing the Myths you have about Financial Advice…

For most seeking financial advice, it’s like going to the dentist. You know you have to do it but it’s something we all put off and one of those things we don’t like to do. Especially now given the current the Royal Commission uncovering some very inappropriate practices to the point where they could be…

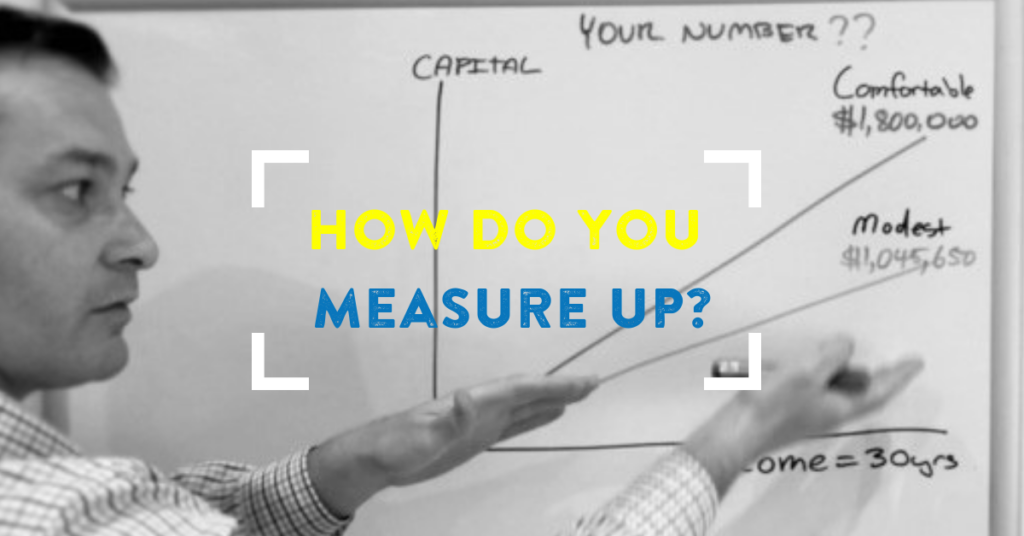

Read MoreHow do you measure up?

Retirement Planning is a little like covering up through winter. It’s not until we hit summer and the layers come off that we realise we are we are underprepared and then we start with the latest trend to lose weight quick only to realise we should have started earlier. Planning for your lifestyle in retirement…

Read MoreSuper|Estate Planning|Hidden Super Death Tax

Ok, so if you have been following the series on getting to know your super better you will now have a better idea about your super. It’s going to be one of your biggest assets, so it’s important you start taking an interest in it, particularly after the revelations coming out from the Royal Commission…

Read MoreSuper Part 4|Investing in Super 101

By now if you have been reading these posts you have been building your knowledge around super, we’ve talked about what is super, tax effective contributions and lump sum contributions. We’re going to delve deeper into investing inside super. So, let’s get to it… Let’s start with the basics… Investments are generally broken down into…

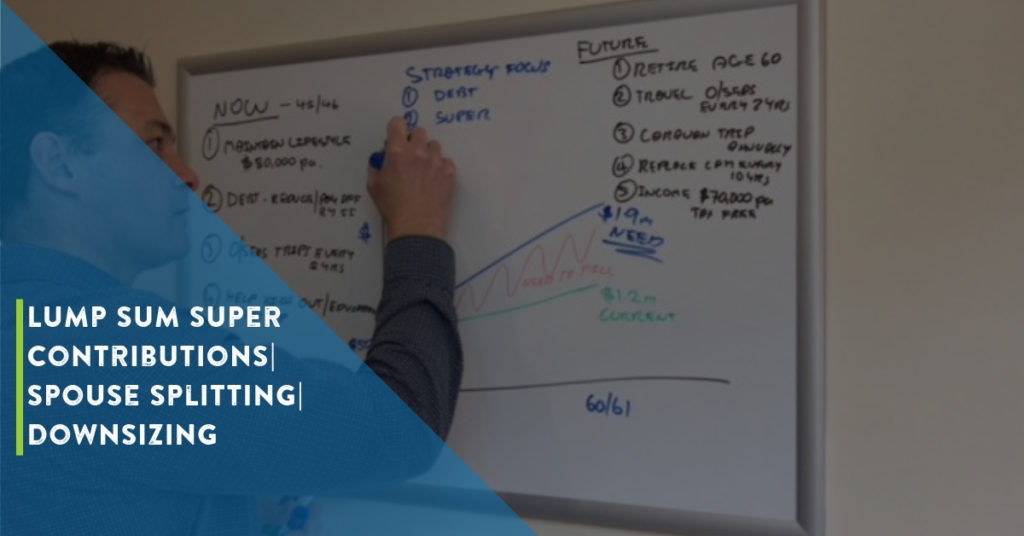

Read MoreSuperannuation Part 3|Lump Sum Contributions|Spouse Splitting|Downsizing provisions

So, here we are. We’ve gone through the most common tax effective strategies in our previous post. If you did not read it, you can read it here>> Next, we are going to take you through the new rules relating to lump sum contributions and what you can and can’t do. Why would you even…

Read More