Investments

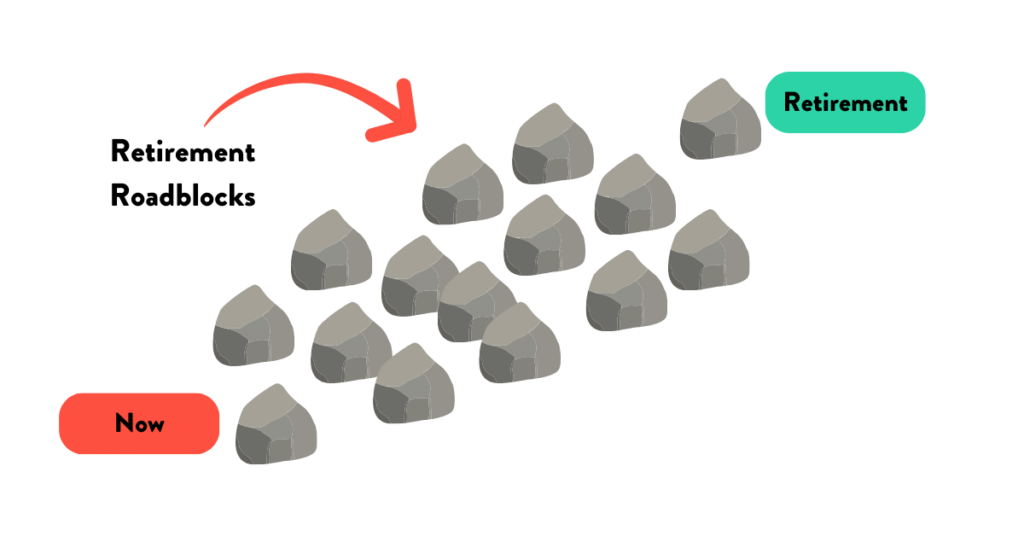

Blast Through Retirement Roadblocks So You Can Navigate Retirement With Ease

Are you ready to take the reins of your retirement, or are you simply drifting into the unknown? You have plans to retire at a certain point in time. You dream of the freedom, experiences and memories you want to create. But you don’t have a clear path to make it happen. It’s like navigating…

Read MoreHow do you choose which investments to use? Investment options explained!

With a buffet of investments available, how do you choose which ones to invest in? Do you go for the healthy low risk options? Or take a risk and go for the sugary options. The ones which will give you a high and come crashing down as the high wears off. When thinking about the…

Read MoreInvesting: What you need to know to safely achieve your retirement lifestyle?

You spend your whole working life accumulating assets with the ultimate goal of reaching the summit (retirement and living a fulfilling life). Focused on achieving the best return you can along the way. After all, you can take on a reasonable amount of risk knowing you have your employment income to fall back on. Besides,…

Read MoreHow average returns may not be telling you the whole story?

Time and time again we hear comments like: My fund averaged XYZ this year. My fund is the best returning fund. This fund generated XYZ over the last 3 years, why didn’t mine do that well? But is this an accurate assessment? Is it a true reflection of the return/real $$$ you’ve received? Can you…

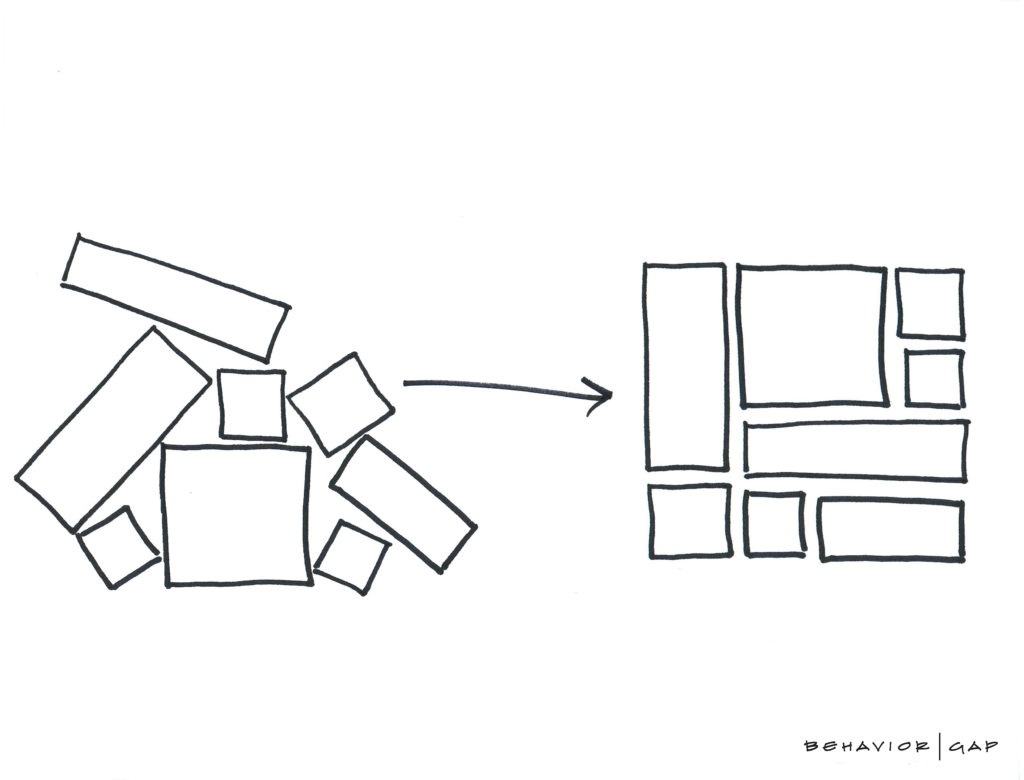

Read MoreHow to structure your finances and safely generate a regular income in retirement?

Transitioning from your working life to your retirement lifestyle is a major life transition. Moving from a structured Mon-Fri 9-5 routine to little to no structure. For some this can be an extremely daunting and stressful time. The reality is your routine will change. Your financial arrangements will change and you’ll probably freak out a…

Read MoreDo you know what your investment return for super was in 2020 and should you care?

Do you know what return you achieved inside your super fund for calendar year 2020? Based on Chant West’s research. The average industry Balanced Fund (holding growth investments of 41-60%) generated a return of 3%. While you wouldn’t call this shooting the lights out. It’s a great result considering the worlds economies were on life…

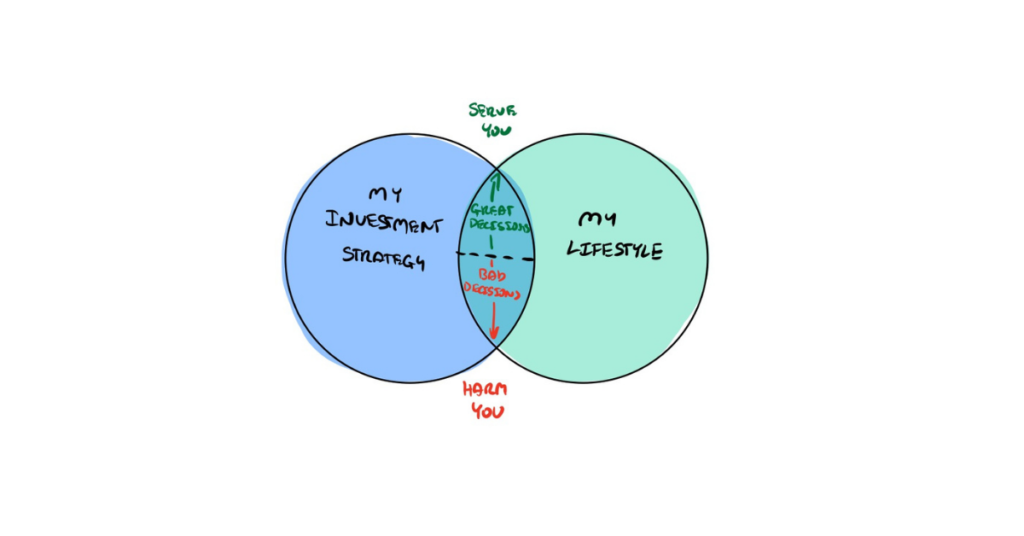

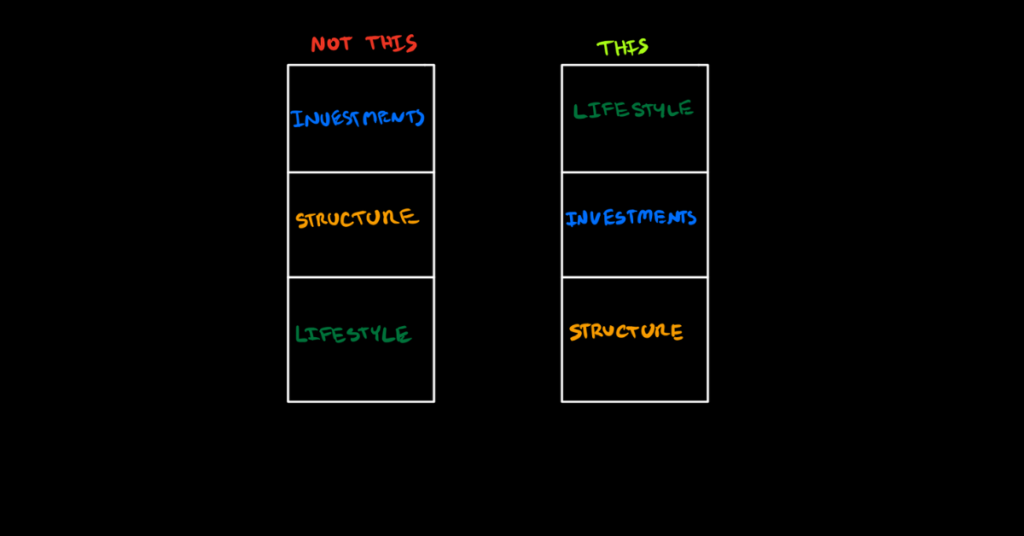

Read MoreDo you need to flip your investment script to secure your retirement lifestyle?

Investing for retirement is the most talked about topic with financial planners. Outside how much money do you need for retirement. Sure, the way you invest is important. After all, the way you invest will determine your investment return and how well you do. It’s the sexy part of retirement planning. The one thing you…

Read MoreHow to worry less in retirement by playing the investment game right!

Many factors contribute to your investment return. One of the most important ones…staying the course. Ignore this at your own peril… Two years ago, I’d had to swallow my own advice. Not investing but fitness. I took on a challenge to get in better shape. It involved reducing my calorie intake combined with the right…

Read MoreWhat an expensive watch can teach you about the dangers of emotional decision making?

Last week, the story which dominated the headlines and news channels was Christine Holgate, CEO of Australia Post. She rewarded seniors managers with watches. Not just any watches, but $5,000 Cartier watches. Not being a watch person I wouldn’t be able to tell the difference between a Seiko and a Cartier watch. It caused a…

Read MoreEvidence Based Investing

The financial landscape is full of investment options. Around every corner, you’ll find a different approach. While many are full of marketing hype and that one person knows the future. There’s is undeniable evidence which has stood the test of time. Evidence-based investing. In it’s simplest form, it’s your asset allocation which drives your investment…

Read More