Superannuation

Retirement Honey Pot: 6 Super Strategies to Boost Your Retirement Nest Egg For Over 55’s

Many struggle with what super strategies they should be using. Let alone knowing what’s available to build their nest egg. Others worry about the performance of their super fund. Let me be clear! Don’t confuse investing with your super tax structure. They should be treated separately on their own merits. If you’re anywhere up to…

Read MoreThe over 55’s guide to super contributions for building your retirement nest egg

Many of us are living longer than we ever expected. We need our retirement nest egg to last longer. This is why understanding your super is an important part of the retirement planning process. You need to be making contributions to your super fund. With so many different types available it can be overwhelming trying…

Read MoreThe Ins and Outs of Super: What is it? How does it work?

Everybody wants to retire comfortably, but few people know how to get there. One of the most important assets you can accumulate for your retirement is superannuation. But what are the ins and outs? What does it do? How does it work? In this blog post we’ll answer these questions and more! What is superannuation?…

Read MoreHow to stop investment biases ruining your retirement?

Would you like a short-cut? To reduce the number of errors your mind has control over. The biggest risk to your retirement is not market movements nor inflation. We explored cognitive biases which affect your financial decisions in our previous post. You can read the post by clicking here>> Repurposing emotion for more favourable outcomes!…

Read MoreThe uncomfortable truth about your biases which will haunt you in retirement!

Are you uncertain about your retirement plans? Like most, COVID-19 has infected many retirement plans. No matter the amount of money you have, it’s affected, everyone. Whether it be the way you invest. The timing of your retirement. Or a complete rethink about the retirement you had planned. Even the assumptions you based your plan…

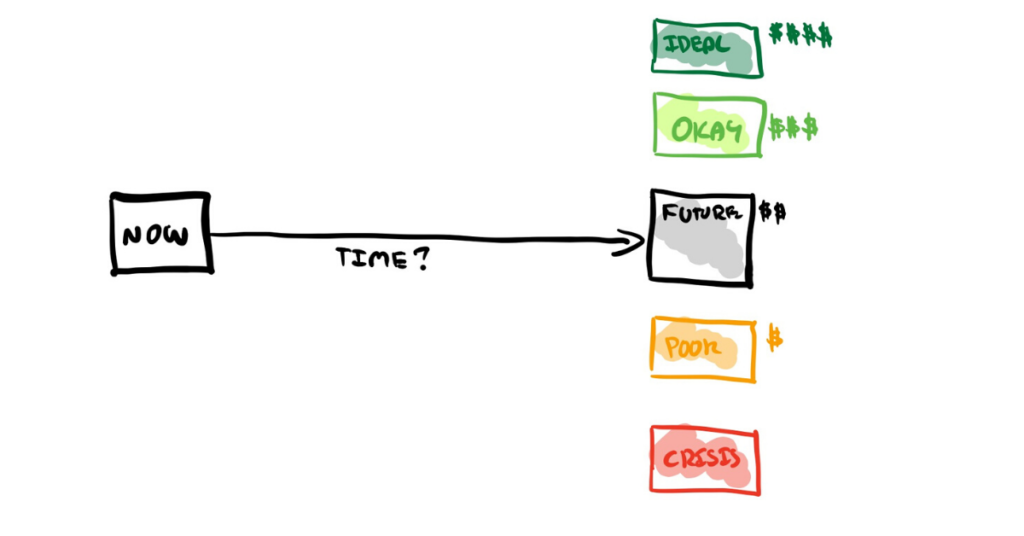

Read MoreDangers of Drifting vs Benefit of Decisions Towards Retirement

Hands down, the most asked questions are “how much money do I need for retirement?” and “will I be ok?”, normally code for will I run out of money in retirement. The simple answer, it depends… It depends on the retirement you have in mind. But, here’s the thing, many leave the planning till…

Read MoreTrends changing retirement planning forever!

COVID-19 disruption…a disruption that will change the way we live forever. It’s affected everything we do. From how we work, educate our kids and retirement planning to name a few. We were seeing these trends pick up pace before COVID-19 changed life the way we knew it. Forcing us into isolation. Forcing us to change…

Read MoreHow to nail your Retirement Plan in a Crisis?

The world is crazy right now! If retirement is on the horizon it can feel a little like landing a fighter jet on an aircraft carrier in the middle of a storm. One minute your thinking ahead, planning out your retirement. The next minute it all changes as you watch it turned on its head.…

Read More10 Commandments of Fearless Investing!

Investing can be a fearful thing to do. After all, the last thing you want is losing the money you’ve worked so hard for. Now more than ever is no time to be fearful. As Warren Buffet quotes in times like these: “be fearful when people are greedy and greedy when people are fearful” The…

Read MoreRetirement Action Plan

Retirement Action Plan Challenging times call for a calm and measured review. A time where everything you know about your investing journey has been challenged. Maybe you’re thinking the retirement you were planning is now of reach. Perhaps, your thinking about ramping up your efforts. Or maybe you’re looking to take advantage of the current…

Read More