How many experience points will you accumulate in your next 30 years?

Would you rather have $0 and be 20, or have $100 billion and be 90? (aka, Warren Buffett, one of the best investors in the world).

Would you respond with “there’s no way I’d fast forward to age 90 with all that money and not fit or healthy enough to enjoy it.”

If so, it means money is not as important later on in life…

You see life is like a game of resource allocation like time, money, energy and our health.

While we all need to basics like food, water, and shelter to live day-to-day. Once you have those accounted for, you’re in a position to accumulate further resources.

Working for money to build your retirement fund. Sleeping for energy. Keeping fit to maintain your health.

The ability to open up endless opportunities for experiences and memories…

However, time is a limited resource that cannot be created or regained. TIME is a resource you have no control over.

No matter how hard we try, we can’t create more time…

So much of what you see in the media and online is about accumulating more, invest more or earn more on your investments. It’s all about one thing, MONEY and WEALTH.

We all have one life to live. To make the most of what we have left. Yet the focus is on the money and not on the time we have left to maximise.

One of my clients, a single lady who’s been a client for over 15 years. Divorced in her 40’s and sadly her son passed away of cancer at a young age.

Had plans to one day, when the time was right, travel and take up new hobbies. She had all the money.

She had the money and the time. Sadly life did not go according to plan. When she was ready, her health deteriorated to a point where none of that is possible.

No one knows what life will bring…

We know at some point our time on this great planet of ours is going to come to an end. We know there will be a time where our bodies just can’t to the things they used too.

It’s great to know…giving you more urgency to live your best life…

We spend so much time thinking about money…but little about how we spend our time.

It’s time to flip the script and think in terms of “experiences” and “dividend memories”…

Think of your life in terms of a game. The goal is to accumulate as many experiences as you can…call them “Experience Points”.

For every experience you have, that’s one point…

Each experience gives you a dividend in the form of memories.

But there’s ONE BIG problem…HURDLES to overcome…

Retirement Mindset

One hurdle you need to overcome is your mindset. It’s very different to the one you have while working.

Accumulate as much wealth as you can only to retire at age 65 or 67…

Who says you have to wait until age 65 or 67 to retire?

How much wealth do you really need?

Why defer enjoyment and experiences if you’re in a position to make that happen now? Just for the sake of some arbitrary number.

More and more we’re seeing people come to us, wanting to rack up experience after experience now. Instead of waiting until they meet some arbitrary number. Or too OLD to enjoy it…

Work

For some work is something we can’t wait to exit, it’s a grind.

For others it’s a sense of fulfilment. It’s a driver of happiness.

Even today, we’re finding there’s a cohort that have so much more to give. More to achieve. Work is part of their retirement plan. They just want more time to do the things they want.

For many, you can still accumulate experiences points while working.

Regrets

Bronnie Ware, a palliative carer and author of “The top five regrets of dying” shared the top regrets of people dying.

#1 “I wish I’d had the courage to live a life true to myself, not the life others expected of me.” – tread your own path…

#2 “I wish I hadn’t worked so hard.” – experience more, worked longer than they should have…

#3 “I wish I’d had the courage to express my feelings.” – something they should have done more off…

#4 “I wish I had stayed in touch with my friends.” – something they should have put more effort into and made a priority…

#5 “I wish that I had let myself be happier.” – don’t be so hard on themselves…

There’s a common theme running through all five regrets, most can be accomplished without money.

Solve for your best life not net wealth…

Don’t get me wrong, you need to accumulate enough money to live a good life for the next 30 years. Giving you the opportunity to accumulate as many experiences as you want.

To bank those dividends in the form of memories…

Creating experiences is one thing, being fit and able to do them is another.

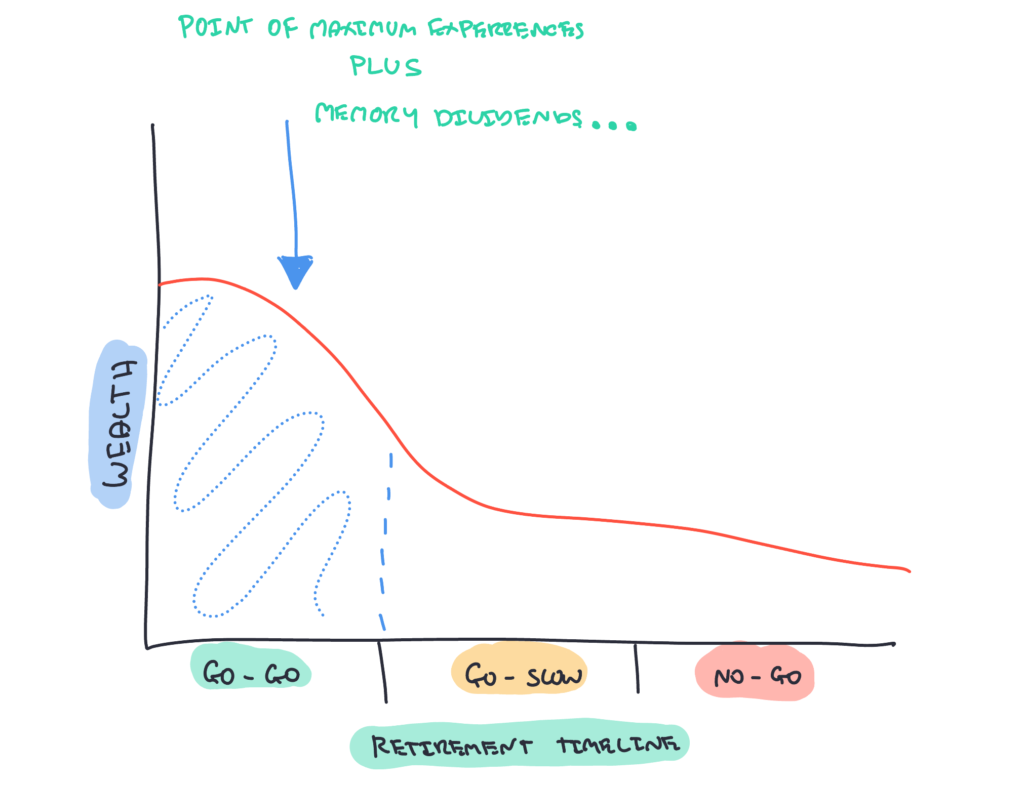

It’s important to consider the type of experiences you want and how they fit into the different phases of life.

For instance, between the ages of 60-75, you’ll be the most active. A period in which you will spend the most of your money in the next 30 years..

It’s when you will travel the most, be most active, be more social and the busiest.

It’s exactly what we are working on with a number of clients right now. Optimising their roadmap for the next 30 year. To accumulate as many experience points as they can while they are fit and able.

Having enough money is important, but living your best life and accumulating experience points will deliver memory dividends.

Are you going to be someone who slides into your grave thinking,

“WOW, that was one hell of a ride?”.

What’s your plan for accumulating as many experiences as you desire in the next 30 years?

Have you ever thought to yourself…

“Do I Have Enough Money To Retire?”

Then our Retirement Clarity Call may help bring the clarity you need to confidently build a roadmap for the next 30 years loaded with experiences…