How to be Unshakable in times of Uncertainty!

The world has changed forever.

Coronavirus has taken the world by the scruff of the neck.

Fear is spreading.

Panic is real.

Experiencing unprecedented actions by governments around the world.

Major events canceled.

Travel restrictions.

Schools being shut down.

Self-isolation.

And then financial markets collapse right in front of your eyes…

The shock you experience watching your investments go up in smoke.

Seeing your retirement dreams slip away right in front of your eyes.

Feeling like there’s nothing you can do.

Panic sets in.

For some, they sell their investment portfolios in fear of losing it all.

The big question, when will they get back into the market?

Reminiscent of scenes from the Global Financial Crisis.

Yet, some of those lessons have been forgotten about.

It’s a terrible state to be in.

It’s stressful times.

This post is written to help you be intentional with your retirement planning?

So you can still experience your Incredible Retirement!

We’ll help walk you through some pro-active things you can do.

What we can learn from the natural cycle of forests?

Investment markets crashing around the world.

Wow.

Only a month ago markets were at all-time highs.

Just like a vertical drop on a rollercoaster, it’s scary!

The current events have similarities to that of a forest fire.

Let’s think about how the forest lifestyle works.

And if I don’t quite get it right, forgive me.

A forest has a healthy stock of trees and ground cover.

It goes through really good seasons.

The forest experiences a lot of new growth.

New trees, new shrubs, new undergrowth.

Over time everything starts to compete for resources.

Water, sunlight and nutrients.

Undergrowth starts sapping resources from established trees.

The longer that goes on, the weaker those established plants and trees become.

A forest fire is nature’s way of bringing balance back to the forest.

A forest fire burns those trees and undergrowth.

Clearing out the weaker trees and undergrowth.

Healthy trees and stock may suffer a little.

Nutrients go back into the ground and returned to the healthy trees.

It’s a very healthy thing for the forest.

But what happens when you have a build-up, many good seasons back to back?

There’s a misalignment of resources.

The more fierce those fires can be.

If we think of that in terms of the economy and investments.

The nutrients are share investments, debt, and workers.

The more economic growth you have.

The more new companies are started.

In these times more unhealthy companies are able to continue and sustain themselves.

Just like the forest.

They are sapping economic resources.

Equity, debt, and workers.

The more established business compete with less-established businesses for economic resources.

All a recession or a market downturn is, much like a forest fire, is clearing the decks.

Bringing back the balance, removing the bad players and excesses from investment markets.

Returning the nutrients to healthier players.

Not to say they don’t get hurt.

More capital is freed up, debt is available and more workers available to help them grow.

Given we’ve had 10 years of expansion without little clearing the decks going on.

The impact can be more severe.

They are a necessary event.

I have personally for a time been concerned that we have not had them more regularly.

Which makes times like these harder to bear.

And therein lies the challenge in planning for your retirement.

You just don’t know when they are going to occur.

Who thought the coronavirus would be the spark to light the fire?

Nobody…

And then it hits home seeing these major events cancelled around the world.

No doubt about it, there’s major implications for the world economy.

It’s not just the events.

It’s the flights, accommodation, restaurants, and entertainment that money’s not being spent on.

It’s all great to say this is going to pass, and it will.

From an economic perspective, it’s the slowdown and impact to supply chains that are impacted.

Only just the other day I was in an electronics store.

Talking to the salesperson about the amount of products they are unable to source.

And then there’s the parts to make other products.

So what is one to do?

Ideally, you’d be preparing for a fire sale way in advance of one occurring.

We’ve been preparing as we do with our process with clients for these very events well in advance.

Just like having containment lines around your home in a bush fire zone.

If you’re approaching or in retirement, you have an income floor and cash reserves that act as your containment line.

Sure, you might experience a little pain, but the fire won’t get to you.

While we don’t know what will happen next.

Refuse the urge to act emotionally.

We know investment markets will come back.

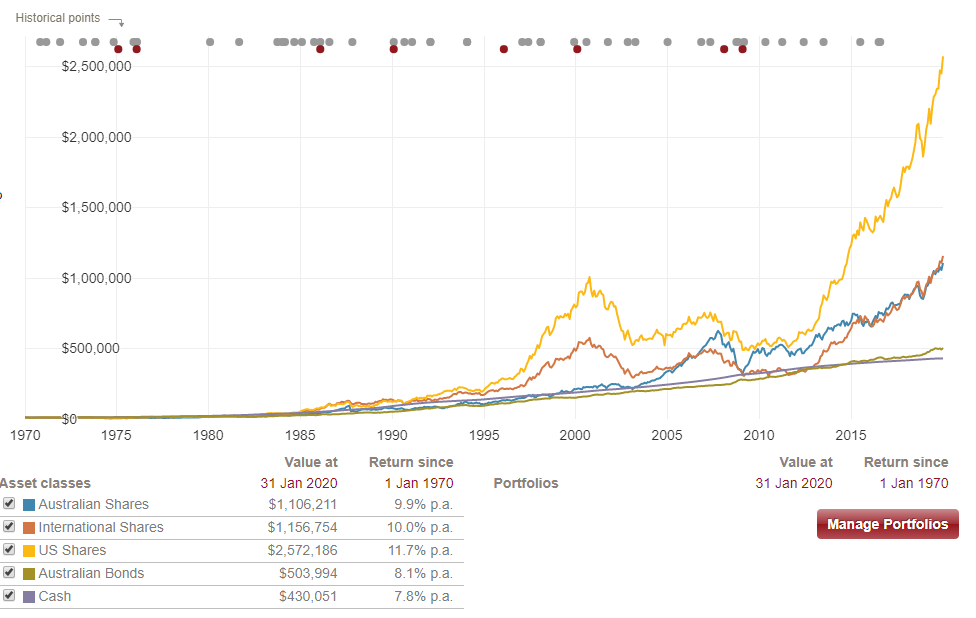

They always do after a major market event as shown by this chart:

You might be feeling like you need to do something.

We like to think in terms of…

What does this make possible?

It’s times like these that can help you re-assess your priorities.

You can take advantage of the current situation by asking yourself:

#1 Do you have your containment lines in place?

If you are closing in on retirement, have you built up enough cash to fund income for a number of years?

Now’s a perfect time for implementing a plan to build those containment lines, financially of course.

#2 Are there any little spot fires you need to take care of financially?

Maybe you’ve felt uneasy about the drop in your investment portfolio.

Now’s a great time to take note of that.

When we’re out of the woods you might want to adjust that.

Are there any faults in your strategy? Now is the time to address them and fix them.

#3 If you do not have any spot fires, what does this make possible?

Have surplus cash on the sidelines?

With cash now returning negative after inflation, the markets have provided you with an opportunity.

That cash you don’t need to access for 10 years or so, maybe look at dollar-cost averaging into the market.

In times like these, we revert to fight, flight or freeze.

As hard as it is, don’t make knee jerk decisions based on your emotions.

It’s time to take a big deep breath of fresh air…

As we do in with our clients, we rerun all the numbers and stress test all scenarios.

Something we do every year to ensure there are no faults in client’s containment lines.

And you can do this for yourself.

If you feel some stress it’s time you do something.

But what could that something be?

#1 Review your current spending.

What are you spending money on that you don’t use?

Perhaps cancel a subscription or two you don’t use.

#2 Defer that overseas holiday for another year.

Maybe go local where it will be a little cheaper.

#3 Hold off on purchasing a new car.

#4 Save more.

#5 Take some time to work out how you are going to fund your retirement.

#6 Take note of how you are feeling about the risk you are taking with your investments.

If you find yourself stressed about it, don’t do anything about it now.

Wait until we are out of it and then do something.

Whatever it is if you do something, make sure it’s intentional.

It’s times like these you can learn a lot about yourself.

Whether it’s something you need to address immediately or closer to retirement.

Take note of it, and make those necessary changes.

It’s not going to be the last market shock you experience.

This will help you prepare better for those in the future.

I hope that’s been useful in this current world of uncertainty.

Worried whether you’ll have enough to experience your Incredible Retirement?

Want to avoid the costly mistakes baby boomers make that ruins their retirement lifestyles?

It’s time to book your Worry-Free Retirement Strategy Call here>>

Here’s to your incredible retirement!

P.S. Do you want to avoid the retirement planning mistakes many are making?

Want to know you’ll never run out of money and never have to stress about it in your retirement?

Then, it’s time to protect the only retirement you get, book your Worry-Free Retirement Strategy call here and we’ll help you navigate your retirement stress-free.

While we can’t help everyone, if we can, we’ll let you know and if not at the bare minimum, you’ll know where your focus needs to be.

That’s a win for you.

Knowing is easy, doing in hard…

If you liked this, you might be interested in:

Investment markets ROCKED. Now what?

Glenn Doherty – CFP – Founder & Financial Organiser at Jigsaw Private Wealth