financial planning adelaide

Your Retirement, Your Way: It’s Time to Choose Your Own Retirement Adventure

Retirement isn’t just one of life’s milestones; it’s a grand adventure waiting to be embraced. In a world where individuality is celebrated, why should retirement be any different? Retirement in the modern world means different things to different people. It’s as diverse as one’s travel preferences… For some, it’s about travelling the world or embarking…

Read MoreUncover a good egg with these 10 questions while avoiding a bad egg

As retirement fast approaches, or perhaps sooner than expected, the fear or running out of money in retirement looms large. While accumulating assets for retirement is a significant achievement, the transition to generating a lifelong income presents complex challenges. Without the certainty of employment income, it’s critical to assess if your assets can sustain your…

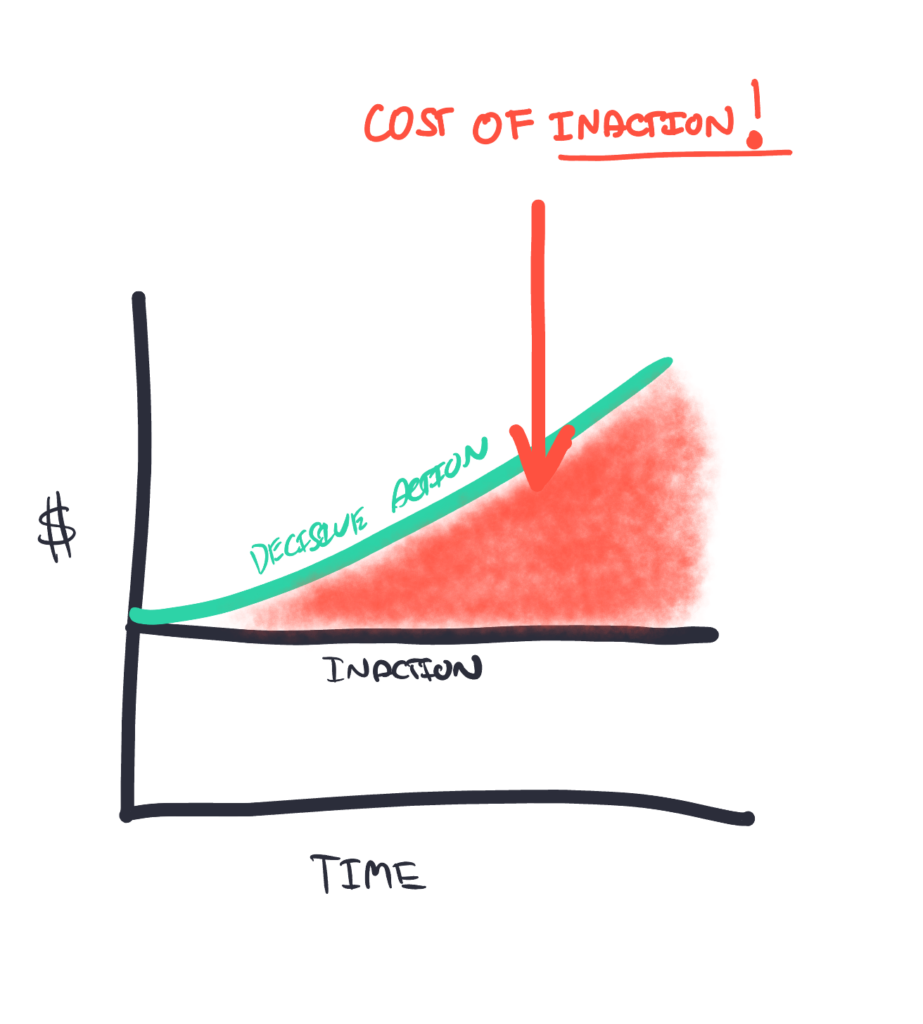

Read MoreOh Shit, Retirement’s Here: How much did inaction cost me?

How long have you been thinking about putting a plan together so you can retire comfortably? You may be one of the lucky few who has taken the bull by the horns and taken decisive action. For the majority though, it’s like kicking the can down the road. Except retirement looms closer each and every…

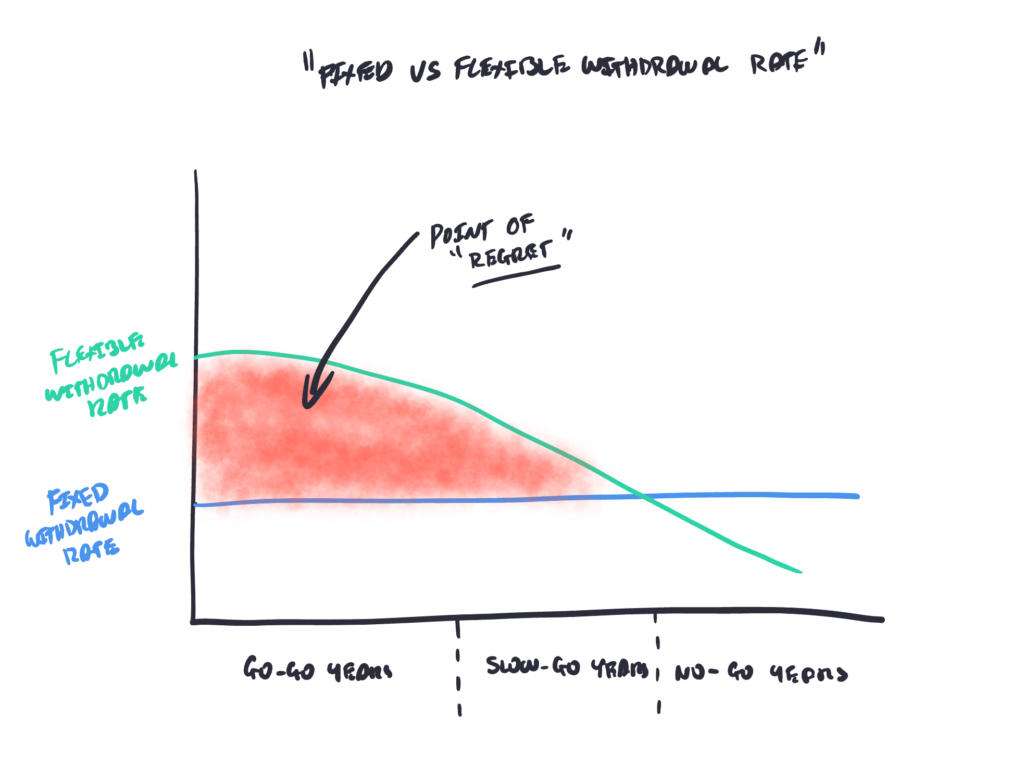

Read MoreWill the 4% rule lead to regret that you didn’t use your retirement wisely?

Recently, I received a message from someone who had read our complimentary book, “ENOUGH”, asking whether we supported the 4% rule. I was so shocked, I nearly fell off my chair… Thinking to myself, surely I can’t be coming across as a supporter of this retirement withdrawal method. Regretting “someday” thinking… Paul Armson, author of…

Read MoreTwo ways to mess up your retirement…

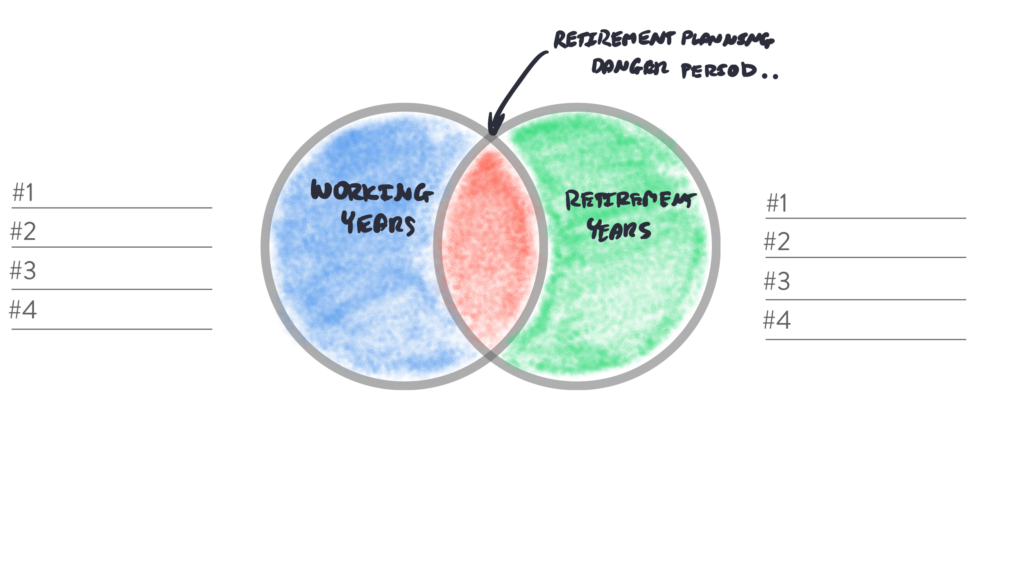

The million dollar question: How much is enough? Or is it something more… Day in and day out, we’re asked this question, where the focus is on a lump sum dollar amount, a financial target. But planning for retirement goes far beyond mere numbers: it’s about understanding the nuances that can either set you up…

Read MoreThe ONE thing you must get right to secure your comfortable retirement

Don’t risk retirement regret…There’s one critical factor most soon-to-be retirees overlook in securing their dream retirement.After 20 years of helping couples and individuals there’s one thing most get wrong as they approach retirement.It’s not spoken about a lot but this could be the difference between retirement regret or living your retirement dreams.Don’t miss out on…

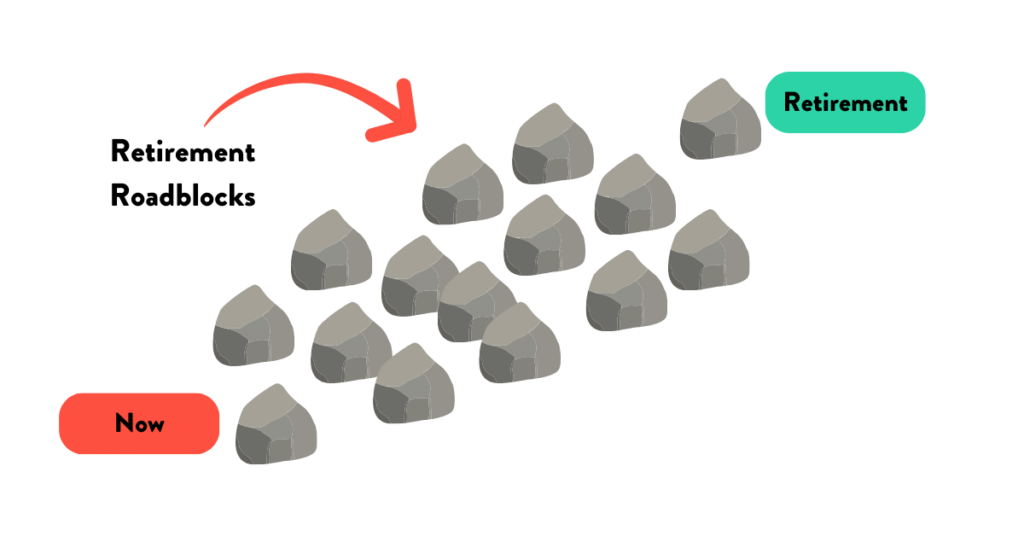

Read MoreBlast Through Retirement Roadblocks So You Can Navigate Retirement With Ease

Are you ready to take the reins of your retirement, or are you simply drifting into the unknown? You have plans to retire at a certain point in time. You dream of the freedom, experiences and memories you want to create. But you don’t have a clear path to make it happen. It’s like navigating…

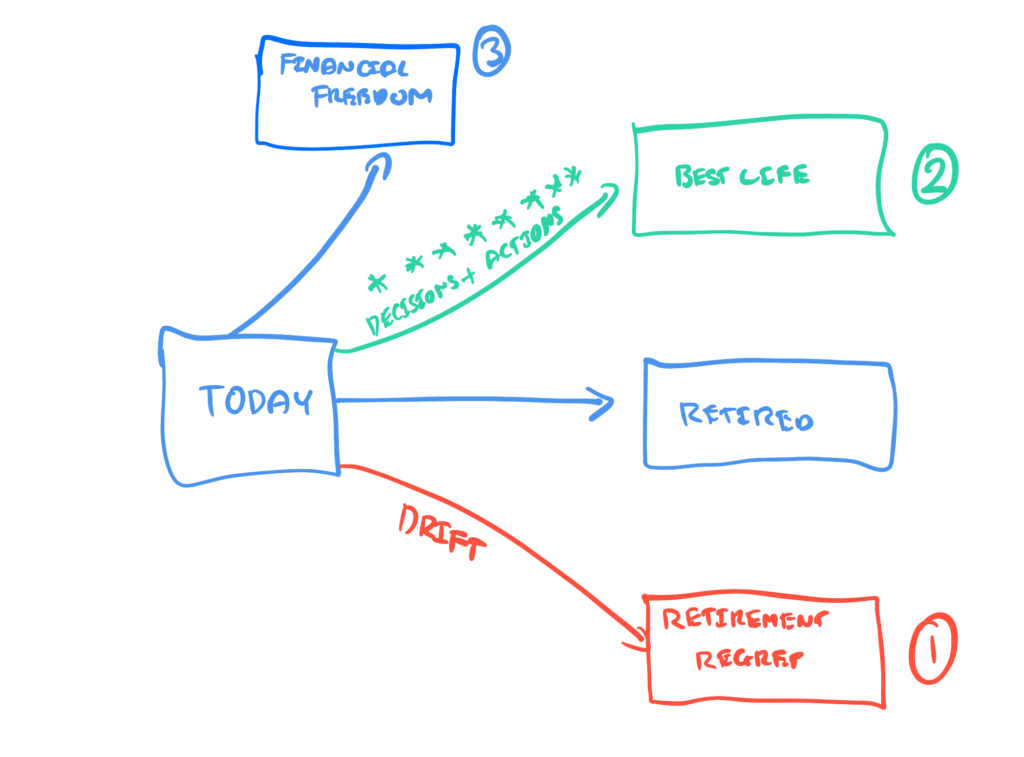

Read MoreWhich retirement path are you on, retirement regret or living your best life in retirement?

As you reflect on 2023 and enter 2024, have you considered whether you are on track for a comfortable retirement? If you are within 7 years of retirement, you need to know… One thing we know for sure is time passes, it’s unstoppable, it’s undeniable. At some future point you will end up retired, whether…

Read MoreMistakes Over 55’s Are Making In 2023 That May Cost Them A Comfortable Retirement

After over 200 conversations with over 55’s in 2023 I’ve collated the biggest retirement mistakes we see people making as they approach one of the most exciting periods in their life. In this post, we highlight the top 7 mistakes we’ve seen from 200 conversations in 2023. Retirement is a major transition, a major life…

Read MoreUnlocking a Secure Retirement: Your Guide to Choosing a Real Financial Planner

Imagine this: You’ve worked diligently your entire life, saving and planning for your golden years. You’ve heard the promises of financial freedom, comfortable retirements, and sunsets on the beach. But as you stand on the brink of retirement, you realise that not all financial advisers are what they seem. They may wear the title of…

Read More