Living Rich or Dying Rich: Your One Shot at a Remarkable Retirement

Imagine this: You work hard all your life, saving and investing for the period in your life where you can start enjoying the fruits of your hard work.

Free time to travel more, take on hobbies and interests you’ve never had time for, spend time with loved ones and live life at a more relaxed pace without worrying about the 9-5 grind.

You carefully plan out your retirement spending, cautious not to spend it all so it will last. You apply traditional retirement planning principles. For most this is taking the minimum amount from their account based pensions.

You live a good life, but as you sit there in your 90’s reflecting on the life you’ve lived. You have a similar amount of money to the amount you had when you retired. Sitting there with a sense of regret thinking, “I could have done more if I’d had known I’d be okay?”.

It’s a familiar feeling many have after applying the concepts of the traditional retirement of past generations.

In 2020 the government conducted a Retirement Income Review. They found that most people die with the bulk of their wealth they had at retirement intact.

Where do your priorities lie?

Living your best life or dying rich?

The Fear of Running Out of Money

The number one fear of soon to be retirees is “Running Out of Money”. After all, who wants to live on the smell of an oily rag?

Early in my financial planning career (2020) I worked for a Trustee company. One of their clients had passed away. The company I worked for was responsible for administering the estate.

This client lived in a nice suburb close to the city. But he lived frugally, almost in squalor living on the smell of an oily rag.

We were surprised that he died a multi-millionaire. He had enough to live a comfortable life, but chose not to for the fear of running out.

I wonder to this day, if someone was able to show him he’d be okay, whether he’d lived differently.

What would change if someone could show you you need not fear running out of money or you could in fact spend more on experiences and memories?

The Traditional Retirement System May Be Working Against You

Doesn’t it seem strange that you’re required to take less money when you’re most active in your retirement?

As we sit here today, the Australian retirement system is structured in a way to encourage you to save for your retirement. You spend decades saving and investing through your working life.

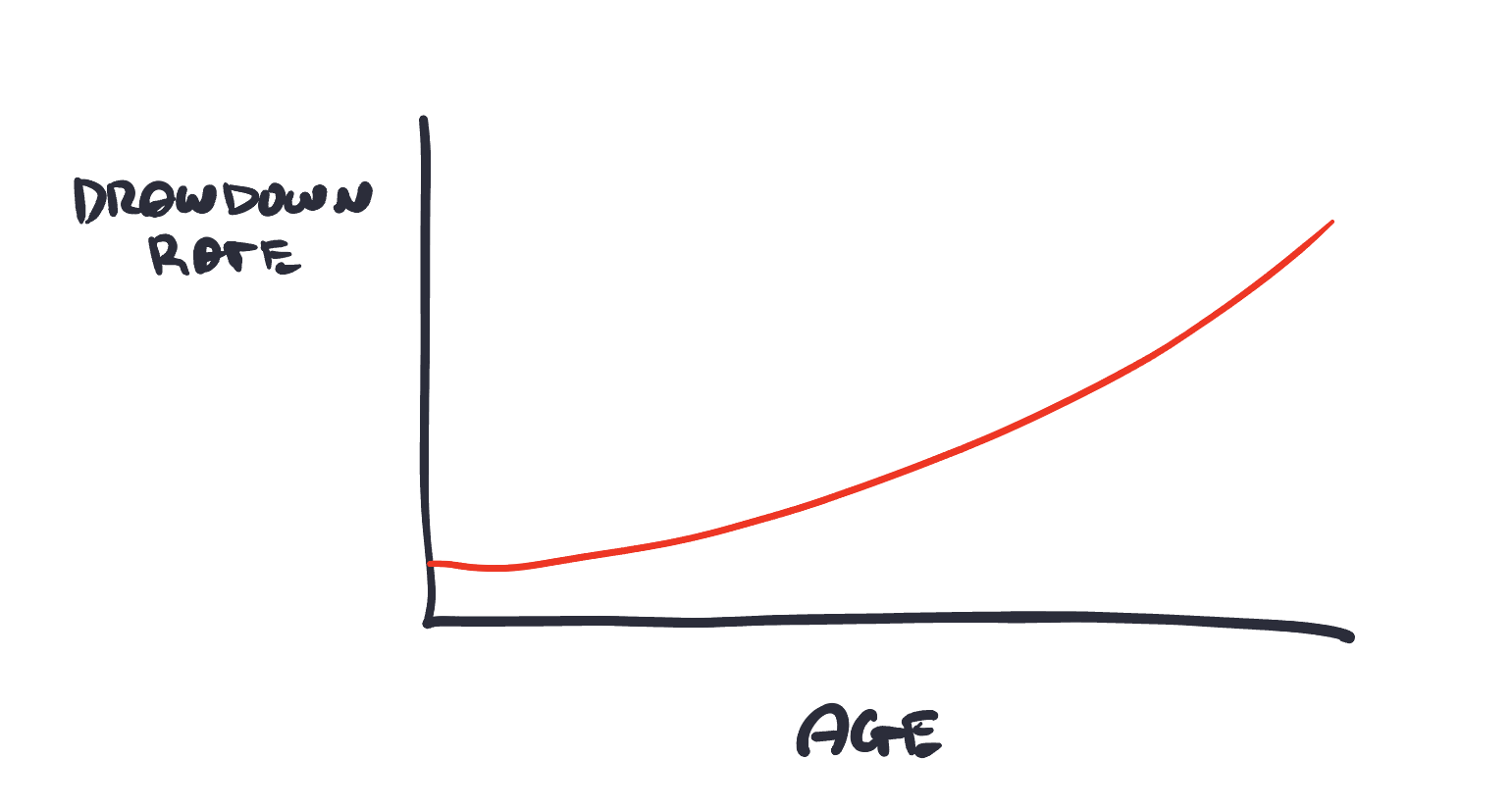

Then as you hit retirement, everyone has been educated about the minimum drawdowns from super. Just by chance, many people take these minimum payments in fear that their money won’t last.

These minimum payments start out at 4% of your balance and increase as you get older. By the time you get into your 80’s and 90’s they ramp up to 9% and 14% respectively.

Isn’t it a little odd that when you are most active in your early years of retirement, the retirement system requires you to take the least?

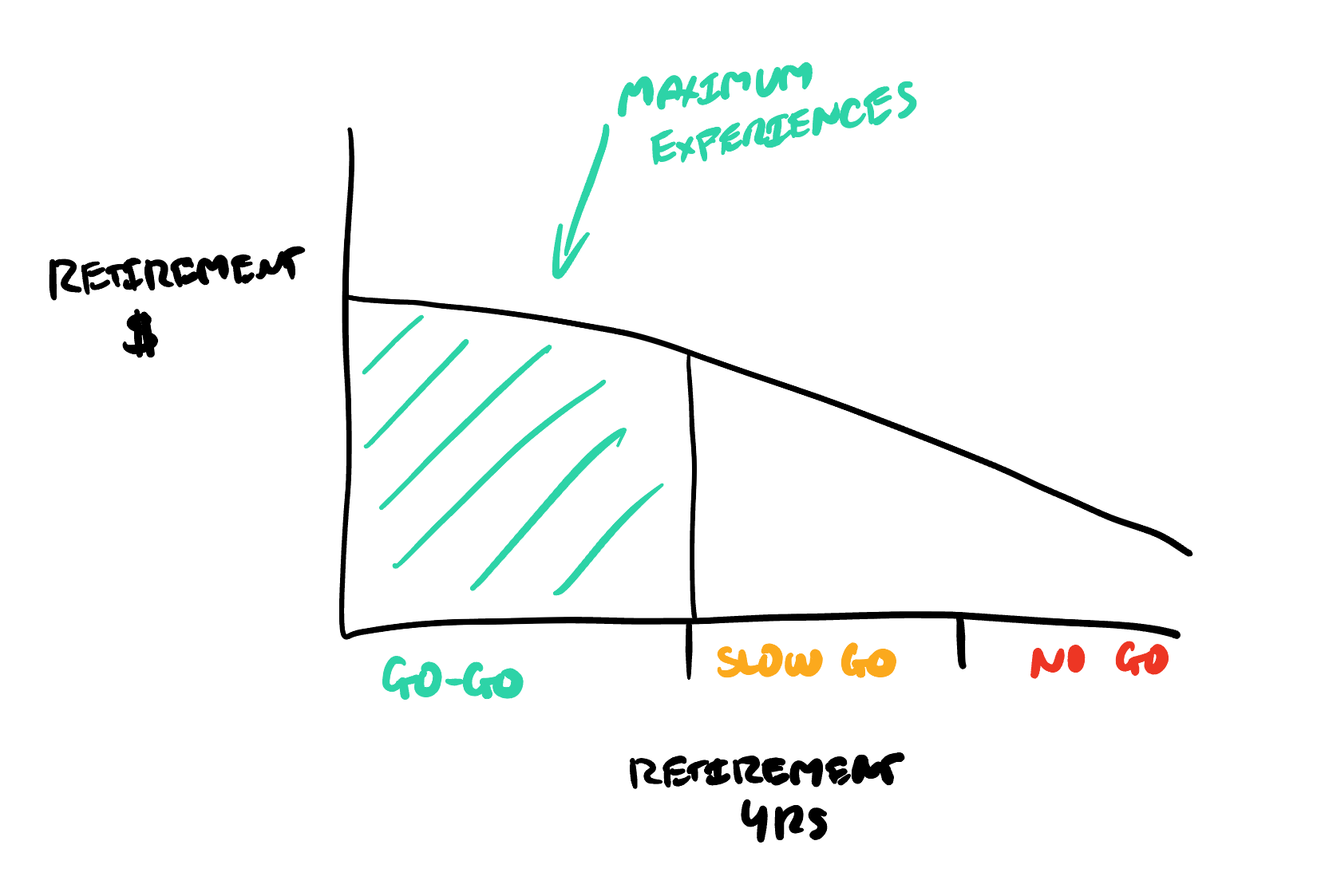

The Three Phases Of Retirement

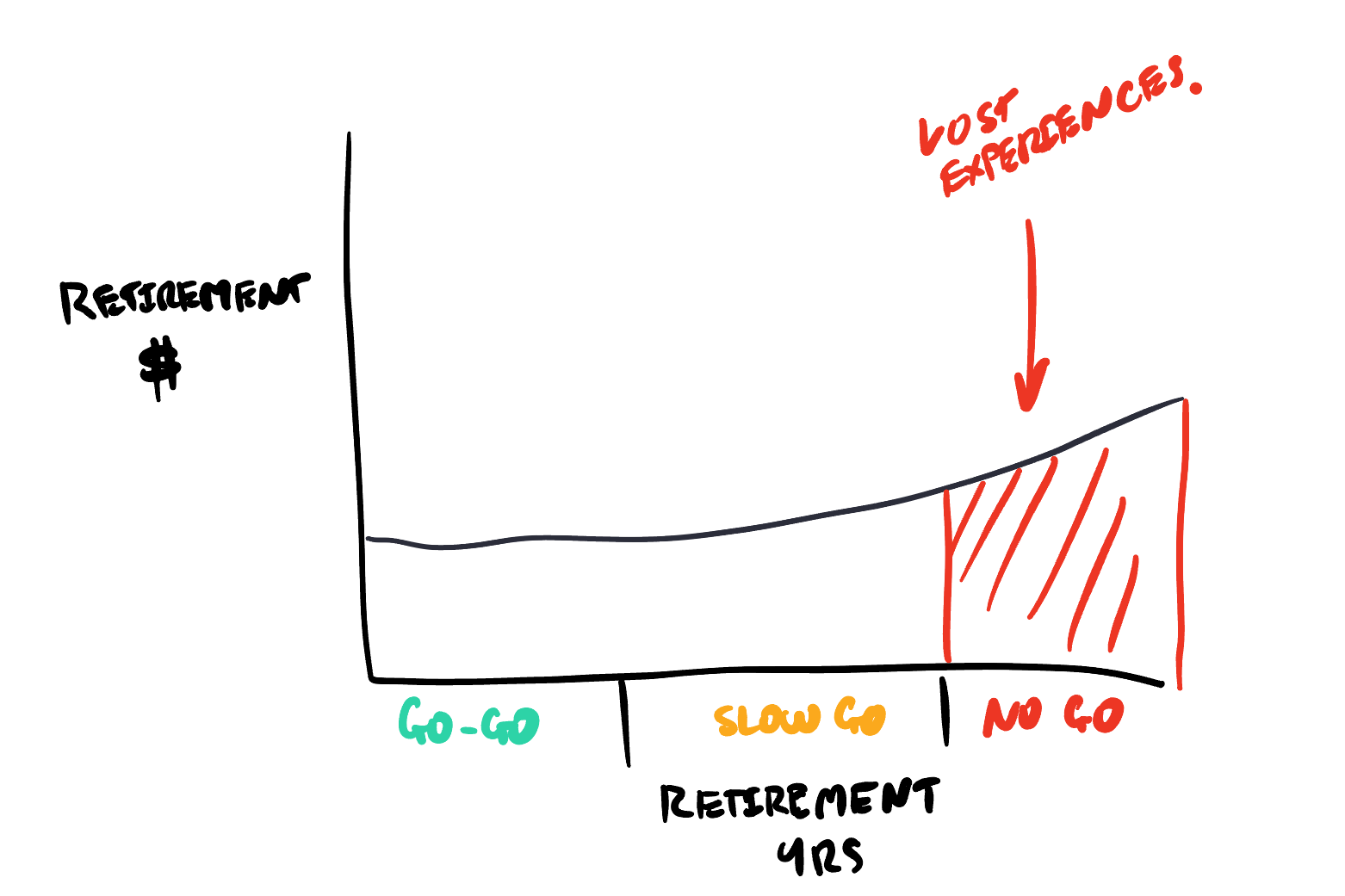

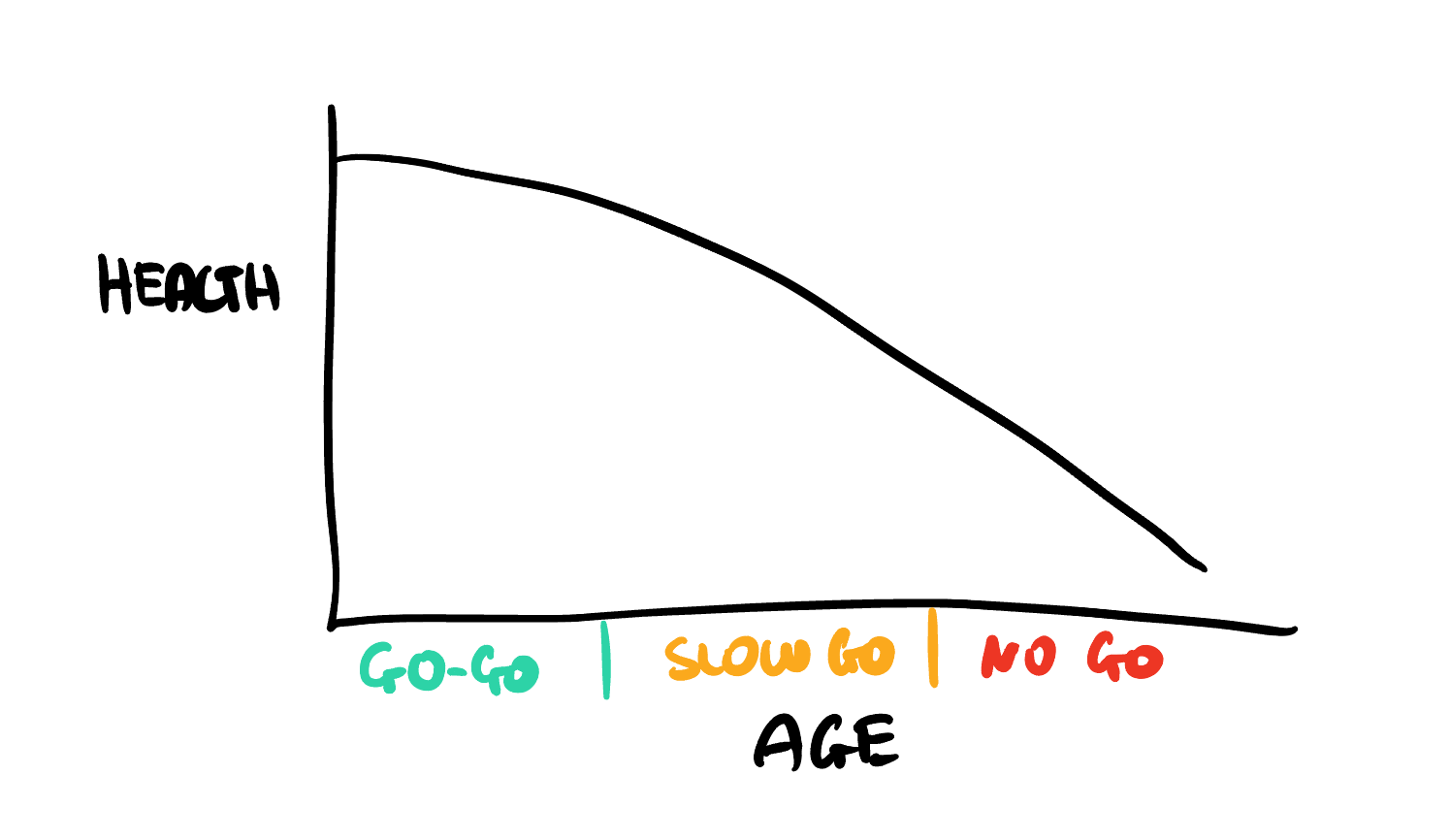

While everyone’s timeframe may be different, most will experience three phases of retirement:

#1 Go-go years – these are the years you are the most active. The years you do the most travel and engage in lifestyle activities. Generally this will be the first 10-15 years of retirement, up to approx 72-75.

#2 Go-slow years – this is a period in life when our bodies start to ache. The hips go, the knees go and we’re not as fit and able as we were in our earlier years of retirement. Hopping on a plane for 14 hrs at a time becomes less attractive. Hooking up the caravan and spending months on the road becomes harder. Entering this period from 72-75 up to 82-85.

#3 No-go years – a point in time when our health deteriorates to a point where it’s all about comfort and safety. From 82-85 onwards. Then sadly we’re gone, that’s it for you.

Your spending will differ in all phases of retirement. The first 10-15 years being your most expensive and tapering off after that. However, the current retirement system does not help soon to be retirees cater for this.

Accumulation vs Decumulation Mindset Shift

By the time we make it to retirement, we’re hardwired to save. With decades of saving and accumulating your wealth, many struggle to flick the switch and action decumulation mode.

We have a built in fear of spending too much and one day I’ll run out of money.

A mindset shift is required switching from accumulation, high return, dollar cost averaging to decumulation, return on income and safety.

Many are approaching retirement set up as though they will still save and accumulate in retirement. It’s the transition period between working and retirement that needs to be managed right. If this is neglected it will harm you in retirement…

This is where good financial planning can save you from a BIG mistake.

The Emergence of the Retirement Rebel…

Driven to live the best life they can while they are fit and able. Packing in as many experiences and memories as they can. Before they’re too old to enjoy them. Sure they want to leave a little behind for the kids, but they use their money to live life.

Work is no longer a priority and if there is a need to work it’s at a less stressful pace…

Take Henry and Jane for example, a client we recently started working with. They wanted to travel the world. Made a priority as they questioned how much time they will have after watching friends suffer health issues preventing them from living out their dream. While others passed away too young.

One thing was holding them back. Knowing they’d be leaving their secure jobs and needing to rely on their retirement savings. It was the confidence and the unknown that was holding them back.

We were able to show them how their retirement finances would potentially pan out. Giving them not only the confidence to make the jump, but to dream bigger. They could in fact amp up their retirement spending and still be financially okay for the rest of their life.

Another couple, a client of ours, had dreams of packing it all in and spending, hooking up the caravan and driving into the sunset for an undetermined period of time. Maybe a year or maybe longer as they tackle the BIG lap.

They had plans of retiring in five years time. However, not long after we started working with this couple, they came back to us after a caravanning trip and wanted to explore retiring earlier. Realising once again time was precious…

Working with this couple through a number of scenarios and financial decisions. They were in fact able to make this dream possible knowing they’d be financially okay.

It’s the emergence of the retirement rebel…those who want to pack in as many experiences and memories while they are fit and able to.

Overcoming the fear of running out of money

Retirement isn’t just about the money. It’s about making the most of the precious time you have left. While you are fit and able to do it…

Do you know how things could pan out for you?

Sure, there are uncertainties in life. However, if you apply a proven retirement framework to build out your retirement roadmap. One that is nimble enough to allow you to pivot with life’s twists and turns. You’ll be okay.

Understanding your cashflow in retirement is paramount. This will help you plan better and ultimately give you the confidence to live life without fear of running out of money.

It’s one of the first tasks we complete for every client prior to exploring the sexy side of financial planning (investments, strategies, tactics and financial products).

Using a retirement planner can help you find the right balance between living life and having enough money to last. Maybe that’s retiring earlier that you thought. Perhaps building in more experiences in retirement. Or maybe it’s taking life at a more relaxed and less stressful pace by freeing up time to do things you want while still undertaking some form of employment.

Your One Shot at Retirement…

Eminem captured it well in his song “Lose Yourself”…

“If you had one shot…one shot…or one opportunity…

To seize everything you ever wanted…one moment…

Would you capture it? Or just let it slip?”

You have “One Shot” at making your retirement great. There are no second chances…

When helping clients plan out their retirement, doing it right involves helping clients to live their lives between two financial guardrails. Just like the guard rails you have on the highway…

You don’t want to drift too far one way, you don’t want to drift too fat the other.

One guardrail is there to let clients live life free of the fear of running out of money, because that’s no way to live.

However, you don’t want to be living so far beneath your means due to the fear of running out of money that you end up dying on a mattress full of money, you could have and probably should have spent.

Life has many twists and turns. Your plan must be dynamic so it can be adapted to protect against life’s surprises.

Retirement offers you a unique opportunity to live your best life. To do all the things you never had time for while you were working.

But living a “Rich Life” can mean different things to different people…

For some it’s about travel, experiencing new cultures, seeing the world.

For others, it’s about that dream of hitching up the caravan and exploring the far reaches of Australia.

Then there’s people who want a simple life. Time to spend with family and friends. Time to spend on their hobbies and interests. They want to leave the stress of working for the man…

To live your rich life, to embrace the opportunities and experiences retirement provides, you must have a plan. One that can help you navigate the unknown path of retirement. One that can help you maximise your lifestyle with the money you have.

It’s time to stop procrastinating and take action towards your best life in retirement.

After all, “Life’s not a Rehearsal”.

Measuring Retirement Success…

So how do you measure success?

There are many ways of measuring success. The investment return you achieve, the amount of money you have or the number of experiences you’re able to pack into your life.

They are important, however, here’s how we measure success so clients can go live their best life.

#1 Clarity – What do I want my best life to look like?

#2 Confidence – Can I afford to live that life?

#3 Control – How can I protect myself from Life’s surprises?

Unlock your Rich Retirement, book your Retirement Clarity Call by clicking here now…

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement