Blast Through Retirement Roadblocks So You Can Navigate Retirement With Ease

Are you ready to take the reins of your retirement, or are you simply drifting into the unknown?

You have plans to retire at a certain point in time. You dream of the freedom, experiences and memories you want to create.

But you don’t have a clear path to make it happen. It’s like navigating through thick fog without a compass.

If so, you’re not alone…

Most people are unknowingly drifting towards retirement, facing the daunting task of securing their dream retirement while fearing the specter of running out of money.

As years pass, it becomes harder and riskier to navigate your ideal retirement path without understanding the roadblocks you need to clear.

After all, you’ve never been retired before so you could be forgiven for not knowing how to prepare adequately.

The pressure, anxiety and trepidation is at it’s highest. After all, you only get one shot to get it right.

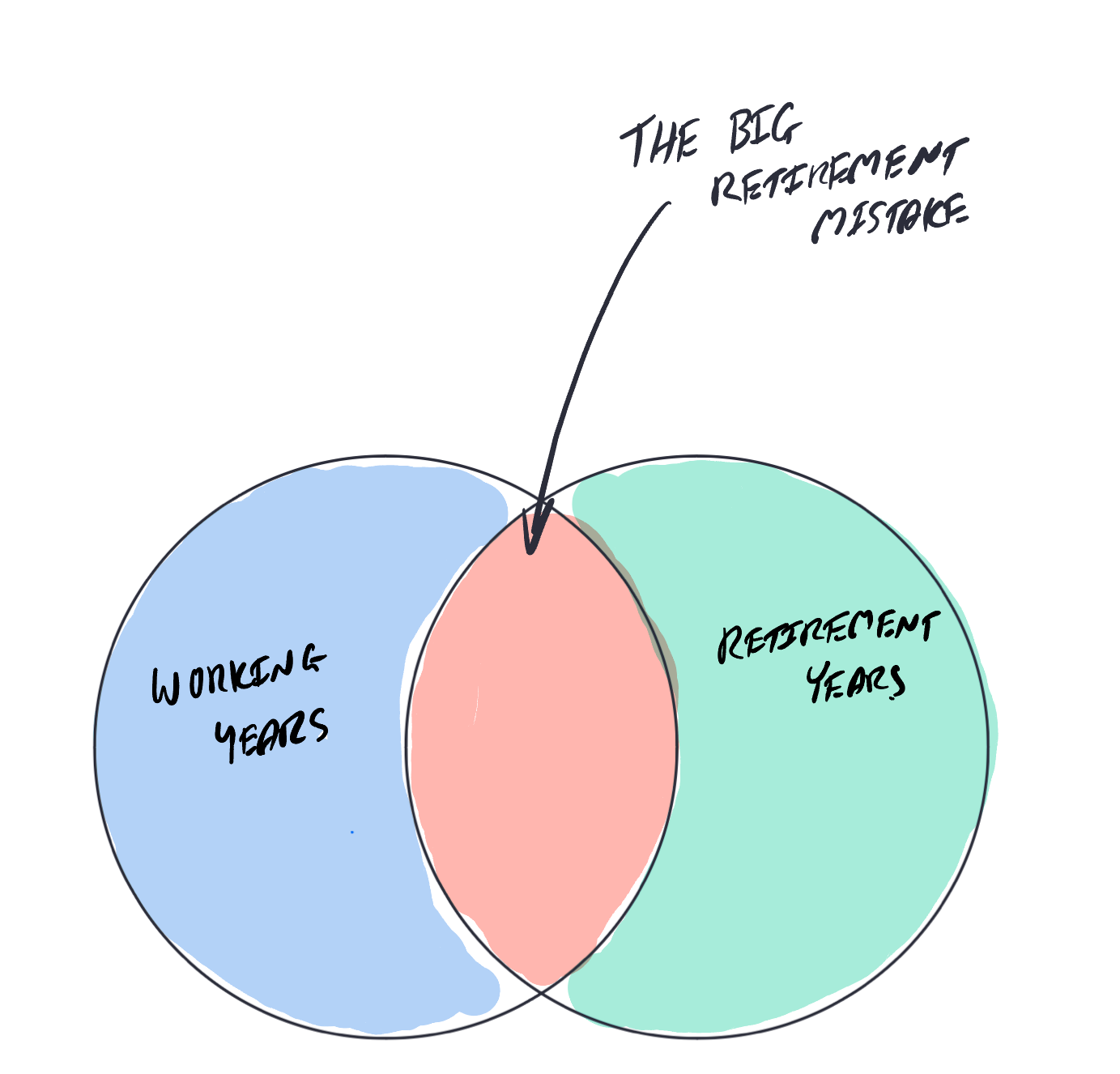

Here’s the thing, what you’ve done for the last 30 years or so will not see you through the next 30 years or so of retirement.

Ultimately, you yearn for the freedom to enjoy your retirement to the fullest, without constant worry of financial shortages.

Right?

Oh, and you probably don’t want to be the richest person in the cemetery either…knowing you’ve left experiences and memories behind.

For over two decades we’ve been helping people navigate their retirement journey. We’ve identified the roadblocks you need to overcome to clear a safe passage towards your comfortable retirement lifestyle.

Enough For A Comfortable Retirement

The BIG question everyone has is, “How Much Is Enough?”

In other words, Can I Afford to Live That Lifestyle?

It’s not a simple question to answer.

There’s many components which need to be taken into account when trying to work through your “Enough” number.

If you want to live a “BIG” lifestyle, you’ve going to need a “BIG” number. If you want to live a “SMALL” lifestyle, you’ve going to need a “SMALL” number.

Or you might be somewhere in between.

Everyone’s number is different and different factors will impact your “ENOUGH” number.

You need to know how much you need to live a comfortable lifestyle in retirement. Otherwise you’ll continue to drift towards “Retirement Regret”.

How much money do you need to live a comfortable lifestyle in retirement?

It’s only the start of your retirement planning journey…there’s much more you need to take into account.

Ideal Retirement Lifestyle

What does living your best life in retirement look like?

You’re going to have 168 hrs in the week. That’s 262,080 hours to fill up over a 30 year retirement.

What are you going to do with your time?

After all, there’s only so much golf you can play in a week.

Work plays a large part in our self-worth. For most people they need to find their purpose in retirement.

You need to think about what you value in life.

What do you want out of retirement?

What does your best life look like?

Sure you’ll have fun stuff like travel, dining out, hobbies and other activities. But what else are you going to do with your time, after you’ve done the fun stuff?

One of the exercises we take everyone through before we start talking about money, is a values exercise. To understand what’s really important to the people we work with.

For most, it’s the first chance many have been able to get on the same page and set’s a solid foundation to plan for a successful retirement.

Have you considered what your weeks will be filled with in retirement?

Perhaps grab a piece of paper, divide it up into 7 days and then each day into morning, afternoon and night. Start filling in your days and see how you go.

Assessing The Feasibility Of Your Retirement Plan

Before you start investigating the sexy side of financial planning, i.e. investments, super funds, tax strategies etc. You need to know if your retirement plan is feasible.

After knowing what it is you are planning for, you have the guidelines to know how to put numbers to those goals.

What are the financial resources you have available to fund your retirement plan?

Is it super, investment properties, other investments, employment of some sort and Centrelink pensions if applicable.

You need to know the financial resources you have available to fund your lifestyle in retirement.

This is where most struggle. Sure, you may create a spreadsheet. But what if you are wrong. What if the assumptions you are using are wrong?

It’s a critical component that must be taken seriously. After all, you only get one shot at this.

Do you know if your retirement plan is feasible?

You need to know, it will dictate every financial decision you need to make.

However, most drift towards retirement fearful they may not make it through with enough money. Best to know sooner rather than later so you can take pro-active steps to progress towards a feasible retirement plan.

A Change Of Mindset Is Required For Retirement

Many struggle with the transition from a life full of accumulating financial assets and maximising investment returns to one of income and capital preservation.

It’s hard to suddenly turn the switch from something you’ve known your whole life and implement a different strategy.

But here’s the thing, you need to realise there’s a change you need to make as you approach retirement. No longer can you sit there and focus on your assets growing, unless you have a bucket load.

Your thinking needs to change to one of preserving the financial assets you have to fund your retirement lifestyle and how you will generate your retirement income every month.

As humans, change is hard…

Have you considered the changes you need to make in preparation for retirement?

Longevity

I don’t know how many times I’ve heard from clients, “I’m not going to live that long”.

It’s one of those questions we’ll never have a definitive answer for. We don’t know what our future health is going to be and how long we’ll last.

It would be great if someone could hand us an envelope with our end date. This problem would be solved.

The reality is, and research backs this up, if you’re healthy at age 65, there’s a high probability one in a couple will live well into their 90’s.

Now you’re probably not going to be hopping on a plane for a 17 hr flight, but you’re going to want some comforts.

It’s common in the modern retirement to be planning a 30 year retirement and for some, even more.

How long have you planned on living in your retirement plan?

Health

Are you in good, average or poor health?

What’s the longevity in your family?

This will all have an impact on the ability to live a good lifestyle in retirement.

Health issues may cause you to retire early.

How are you going to take advantage of your health while you can?

How Much Income Do You Need To Fund A Comfortable Lifestyle In Retirement

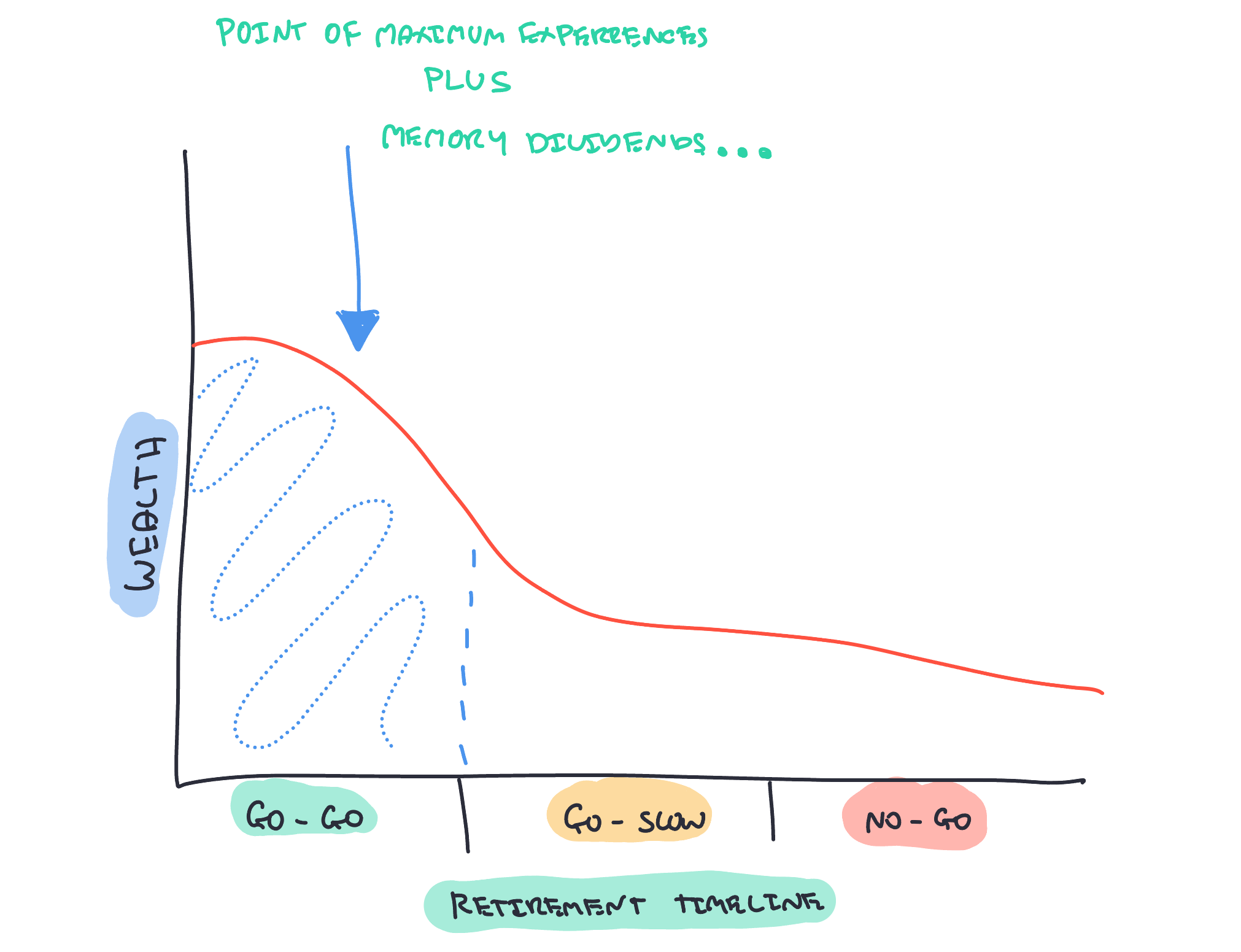

This will vary over your retirement. In your go-go years, generally the first 10-15 yrs of retirement you’ll be most active. You might complete the “BIG LAP”, travel overseas, socialise more, or take up new hobbies and interests to name a few.

In your go-slow years, things will start to slow down. You’ll do fewer overseas trips as the body starts to struggle with long haul flights for instance. Things won’t be as easy and you may stay closer to home.

Then you have your go-slow years, where the hips have gone, knees have gone and generally your body is not what it used to be. Things just get harder. This point in your life it’s all about comfort and security.

Understanding your income for these periods of your life is key to helping you figure out whether you are going to run out of money.

Have you considered what your spending might be like in the three stages of retirement?

Investment Risk

Ever considered the amount of risk you are taking or have taken in the past?

While you have considered it, do you really understand it?

It’s one area which may trip you up in retirement. We find after two decades of helping people retire confidently, many fail to understand the impact of investment risk in their retirement planning.

The risk you accepted while you were accumulating money over a 30 year working life may not be appropriate for your retirement years.

As mentioned above, it’s a major mindset shift that many have not considered.

Do you know the level of investment risk you need to accept to sail safely through retirement?

Investment portfolio

Another common roadblock many trip up on as they approach retirement is how to invest their hard earned money. So it doesn’t run out or expose them to financial risks in retirement.

Little consideration is given to the timing of their cashflow and the way the portfolio needs to be set up for the decumulation phase of retirement.

Sure, this is the sexy side of financial and retirement planning. When it comes to retirement, it’s no time for guessing and letting your ego get in the way.

This may be a problem lurking under the surface which may not show it’s ugly head until part way through retirement when you least expect it.

The portfolio you build must be in alignment with your spending strategy over retirement.

Funding Strategy

Ever considered how you are going to pay for your monthly income in retirement? Where is it going to come from?

Most people haven’t given it a minute’s thought. They think they will just transfer their super to pension and that’s it and Bob’s your uncle.

Thought needs to be given to the timing of your income. How is the income going to be paid? Where is the income going to come from?

Do you have to sell investments down when investment markets are down to fund your income?

If so, this may be a recipe for disaster. This will lead you to chew through your capital faster than you thought.

Therefore, consideration needs to be given to your investment risk, investment portfolio and funding strategy to reflect the retirement lifestyle you want.

Do you know how your income will be paid in retirement?

Retirement Risks

What risks and blindspots are you unaware of?

It doesn’t matter whether you have a few hundred thousand in the bank or multi of millions of dollars. Everyone has risks and blindspots they have not thought about.

After all, you’ve never been retired before so you’re not expected to know what’s ahead and what needs to be planned for.

A common one is “sequence of returns risk”. The order in which you receive your investment returns.

If you have a negative return experience in the lead up to retirement may mean less to enjoy in retirement. On the other hand, have a positive return experience and you have a comfortable retirement lifestyle.

Can this and many risks be managed? Yes, if you know how…

For most people, they won’t know until they experience them unless they work with a financial planner who specialises in retirement planning. Don’t let hidden risks knock you out financially in retirement.

The most risk you’ll experience is five years prior to retirement and five years post retirement. Get anything wrong in this period and it’s hard to come back from.

What risks and blind spots are you aware of that need to be managed for you to retire comfortably and full of confidence?

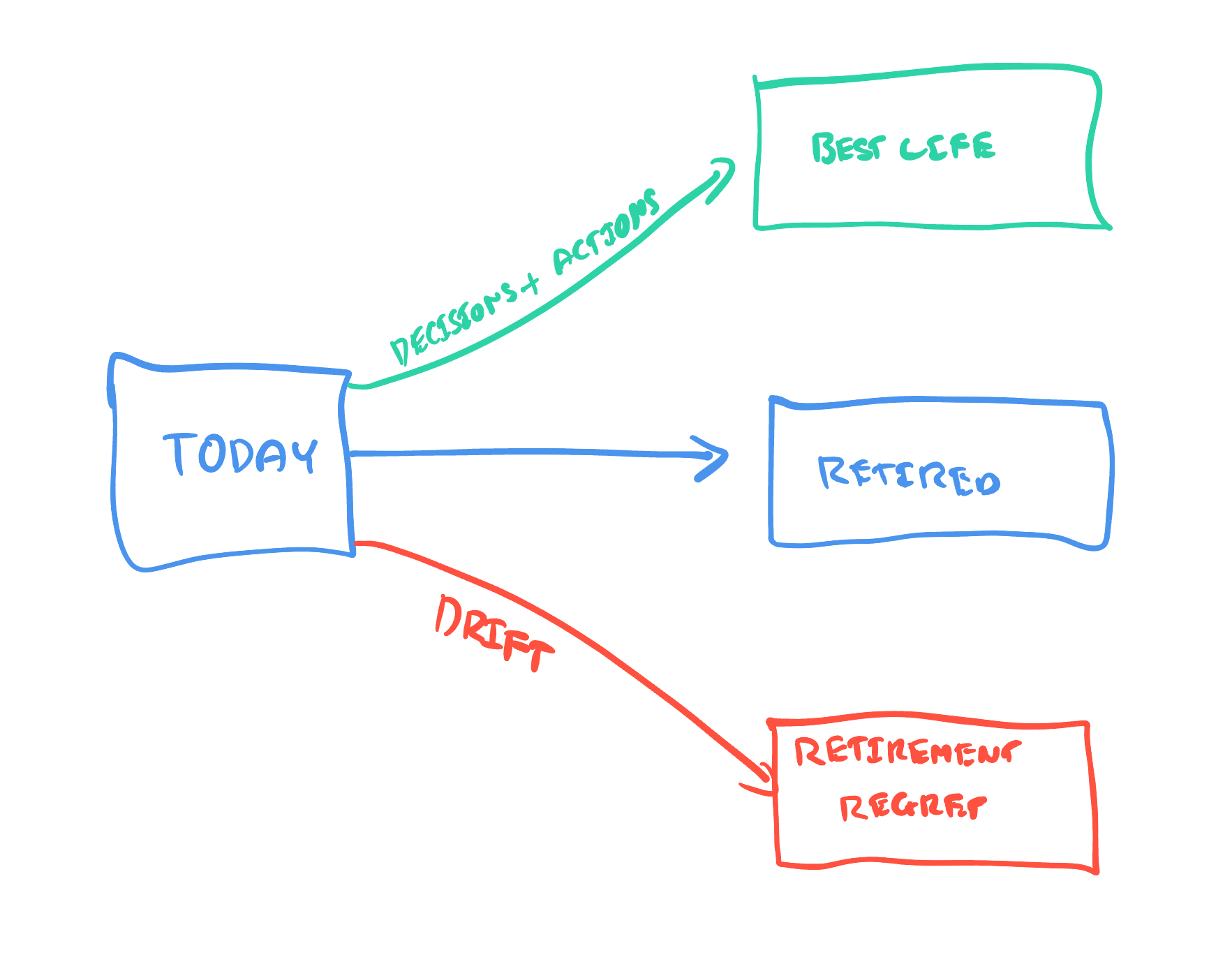

Which Retirement Path Are You On? Retirement Regret or Living Your Best Life

We see people generally on two retirement paths…

One where they are drifting. Decisions aren’t being made. Nor do they know how they are tracking when it comes to their retirement plan. In other words, they and whinging it…

This is not a good place to be. The more you drift and closer retirement approaches. You accelerate at a faster rate away from a comfortable retirement.

The second path is one where you are being decisive. You’re making informed decisions. Travelling on the right path that will lead you to retiring with clarity, confidence and control around your financial decisions.

Do you know which path you are on?

You need to know…

Implementation/Decision Making

So, you’ve got a plan. Now you need to implement. It’s pointless to have a plan and not implement it.

It can be an anxious time as it’s likely you have to make changes. Many people struggle with change. Particularly when you’ve being doing something one way for 30 odd years and then change as you approach retirement.

If you want to retire comfortably. Having full confidence you can fund all your experiences and memories in retirement. You need to have a roadmap you can follow and implement. A well thought out framework to make confident financial decisions.

What many people don’t realise, is having a plan is only the start. Life has many twists and turns and your plan changes.

You must review your plan on a regular basis. Always on the lookout for risks that you need to navigate or opportunities you can take advantage of.

That’s why many people work with a financial planner. To help keep them on track and to act as a sounding board so they can confidently make financial decisions. A good financial planner who specialises in retirement retirement planning will not only help you understand the financial side. But help you live your best life on your terms.

Ready to stop drifting and take decisive action?

If you want clarity and insights on how to solve your retirement concerns and challenges. Take the first step by booking your Retirement Clarity Call by clicking here.…

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement