How To Rip Off The Retirement Blindfold and Master Your Retirement Roadmap?

Are you one of the many struggling to plan for your retirement? Do you know if you are going to be okay financially in retirement?

Over 5,000 people have downloaded our free book download, “Enough” over the last few years. Combine that with hundreds of Retirement Clarity calls is proof enough many are struggling to plan their own retirements.

Millions of searches online to try and figure out this retirement puzzle. But yet are still no clearer on how to go about planning their own retirement.

It shows, it’s hard to do it yourself and figure it all out alone no matter how knowledgeable you are…

If you’re struggling to answer these all important questions:

How much is enough for a comfortable retirement?

When can we afford to retire?

Will we be okay financially in retirement?

You need to read on as we reveal our proven framework for planning a comfortable retirement. Helping soon to be retirees retire with more confidence, clarity and control of their retirement options.

But like most things in life, it involves a little hard work, it’s not meant to be easy.

While most people come to us to talk about retirement. It’s not really about that.

We believe you deserve to live your best life in retirement without fear of running out of money.

Are you sure you can confidently say you have enough money to live the life you want and never run out of money?

People lack a proven framework and the space to think through important decisions. So as another year begins I wanted to take you through a proven framework we use to help you make the next 20 – 30 years or more the best years of your life.

After all, retirement is all about doing all the things you never had time for. It’s all about creating experiences and memories while you’re fit and able too.

Don’t let one of the most important chapters in your life to chance. Plan with a goal to make it the best time ever.

Sure, you’ll see a lot by googling, but the challenge is figuring out what information is relevant and ignoring the stuff that’s not. It’s not easy and often leads to analysis by paralysis.

Here’s the framework we use to help soon-to-be retirees retire with more confidence, clarity and control than ever before.

You may also like to watch our video, “Four Financial Pillars for a Retirement Rebel Retirement Plan“.

Retirement Vision

What do I want my life to look like?

Any good retirement plan starts with a solid foundation. You can’t start putting on the roof on a house before you’ve designed the house. It doesn’t make sense.

What we’ve found is many have a general idea of what they want in retirement. But have not had the time and space to think it through at a deeper level.

It might sound a little fluffy. But after providing for your basic needs. Most want to live the best life we possibly can, no matter how much money we have.

Obviously, the more money you have the more comfort and luxuries you can afford. But money doesn’t necessarily make people happy.

It’s about finding that balance and aligning what’s important with the money you have.

For instance, we worked with a couple who were looking to retire in about 3 years time. They love sailing but never had a lot of time for it while working.

Their plan was to buy an interest in a Yacht which involved yearly fees and a large upfront cost. More cost effective than buying one outright.

While working through our framework and the impact of this expense, it became apparent they wouldn’t get the full benefits. In fact it would be cheaper to charter a Yacht when they wanted too.

In the end, they realised this was not as important as their other goals.

There are three components to build a solid foundation to work from.

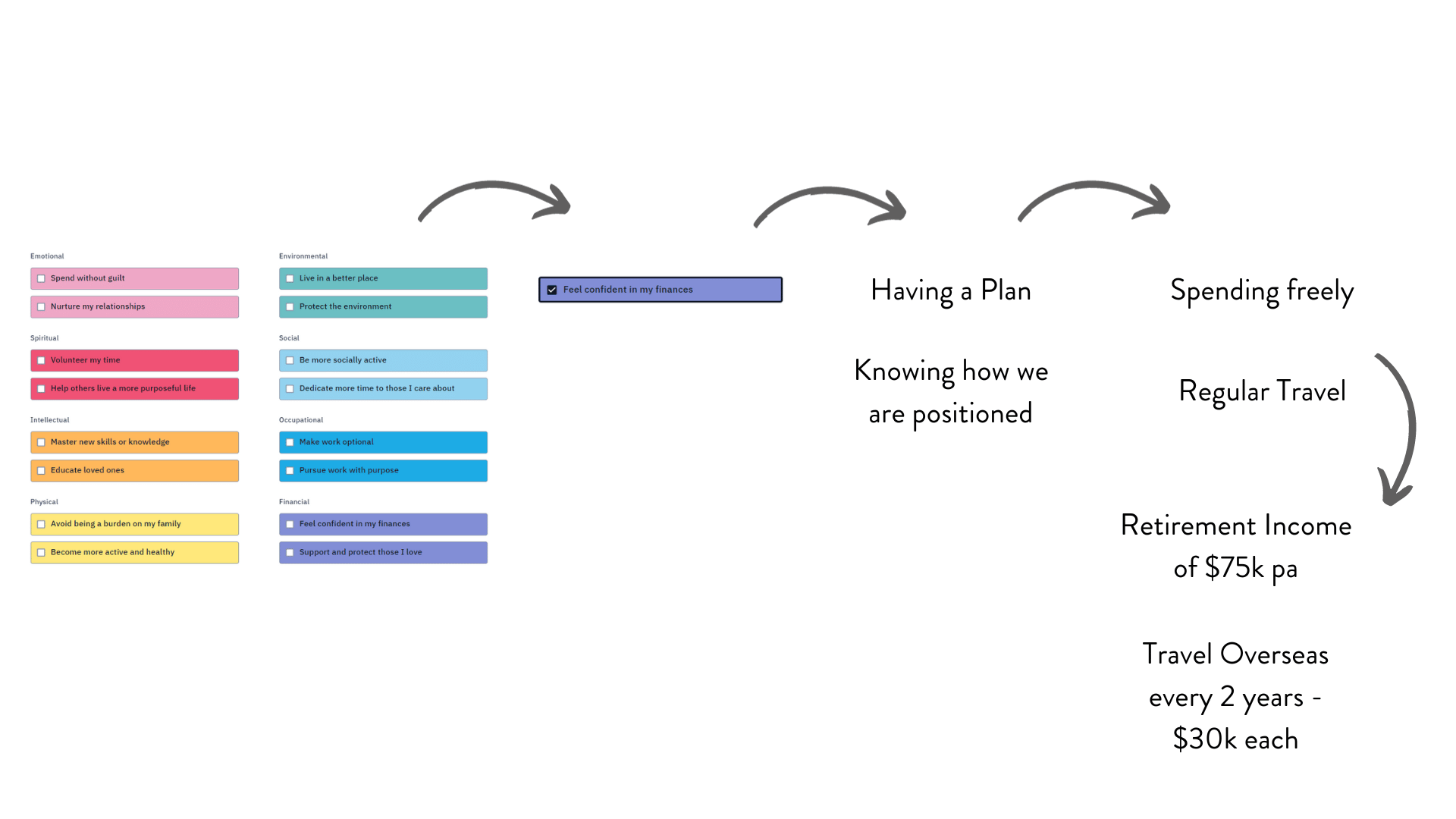

#1 What do you value?

#2 What do I want?

#3 What does my Best Life look like?

We have an exercise that we take every new client through to assist in building a solid foundation for their retirement.

Part of that involves having the couple (if it’s a couple) agreeing on the top five values.

The next step involves building out the financial and non-financial goals which will form the basis for the financial planning component of their retirement roadmap.

Please find below and example:

How feasible is your retirement plan?

Once you’ve dreamt up your retirement lifestyle, it will be very clear what financial aspects you need to plan for. Everyday living, travel, replacement of cars, house upgrades or helping out the children to name a few.

But it’s difficult to plan your retirement if you don’t know if it’s feasible.

Can you afford to live that lifestyle?

Most start with the bling of financial planning, investments, super and anything else that is front of mind. However, a well structured plan starts with understanding the feasibility of your plan. Blocking out the noise.

Usually this takes the form of long term cash forecasts. Taking into account the financial resources you have to fund your plan. Such as super, investments, investment properties, savings, work income and for some, Centrelink.

Undertaking this exercise will help identify any retirement risks you need to address immediately. Before it’s too late. Along with blind spots you need plan for.

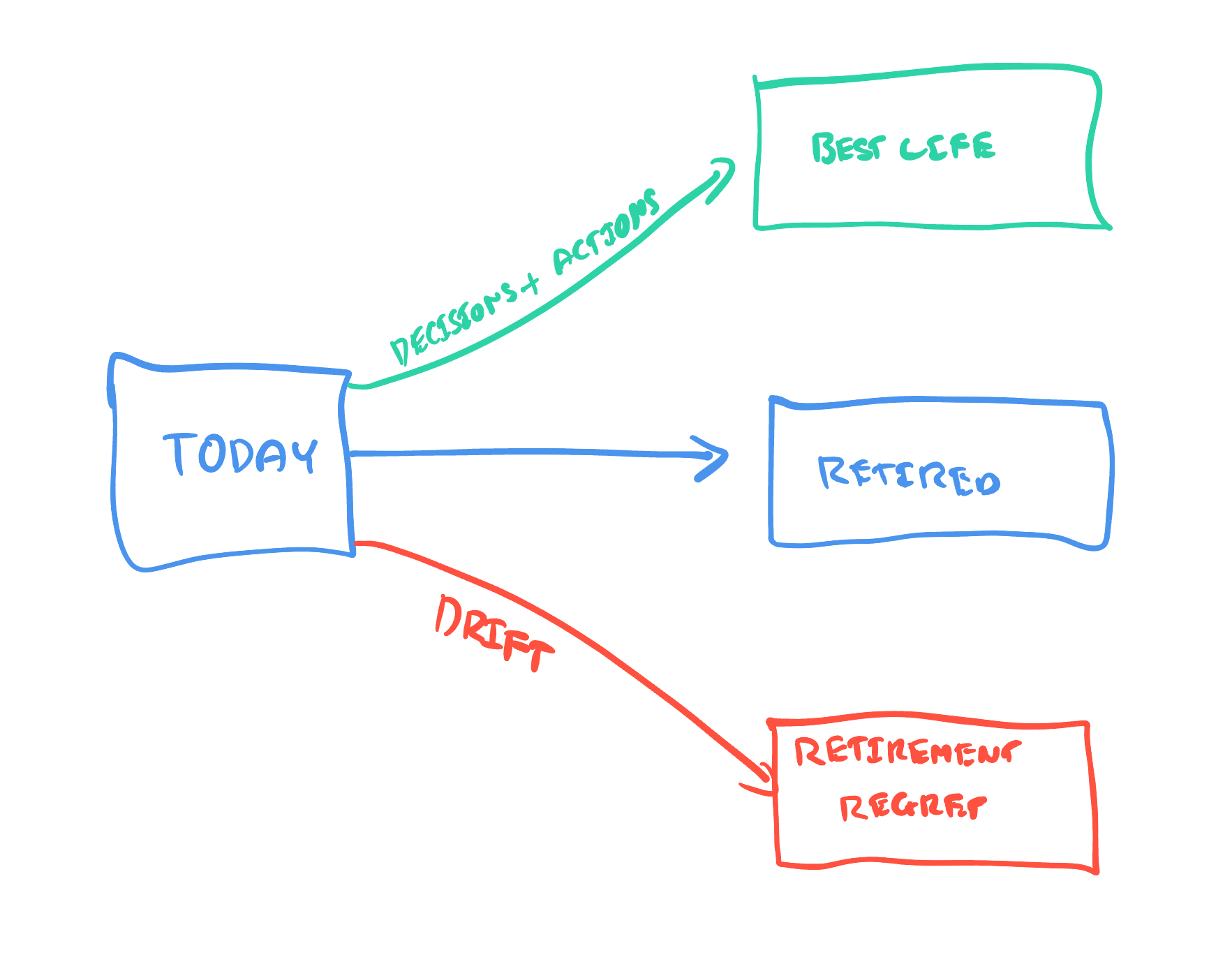

Many people we see are keen to get a plan in place, but have been drifting.

What needs to be taken into account when assessing the feasibility of your retirement plan?

#1 Longevity – I know, you may be sitting there thinking, I’m not going to live a long life. But what if you do and you haven’t planned for it?

The statistics show that there is a 90% chance at least one in a couple will make it well into their 90’s. It’s a longer retirement period you need to plan for than past generations. It needs to be planned for, otherwise you risk running out of money.

#2 Inflation – Inflation is hurting spending patterns as we speak, however, if you underestimate the rate of inflation, it will hurt you later on.

#3 Spending patterns – Your spending will differ throughout retirement. In your go-go years (generally the first 10-15 yrs), you’ll be most active and spending the most amount of money.

As you age, you will enter the slow-go years, where life becomes less busy. The thought of spending 18 hrs on a plane is not that attractive anymore.

Then you have your no-go years where it’s all about comfort and safety before you die.

#4 Investment risk – Many get this one wrong, they think they can keep on going the way they did when they were working. The reality is investing for retirement is different. It’s about preservation, safety and income.

They are the main four…

The outcome, this will give you a sense of whether you are on track for a comfortable retirement or drifting towards retirement regret.

It will give you the raw data to make better, more confident financial decisions.

The key here is once you know how you are positioned, you are able to start negotiating a feasible plan.

Whether that be working for a little longer, bringing retirement forward or partial retirement combined with work to fund your lifestyle.

Whatever the situation is for you, it will give you the ability to make more informed choices which will impact the rest of your life.

Want to know whether you’re retirement plan is feasible, book your Retirement Clarity Call by clicking here and we’ll provide some insights into how you can get your own retirement roadmap.

How do you make your retirement plan resilient?

Once you have negotiated your feasible retirement, it’s time to make your plan resilient.

#1 Address retirement risks and blind spots

As you haven’t been retired before, it’s hard to look forward and identify all the risks and blind spots.

After two decades of working with pre-retirees and retirees, we’ve seen them all and know what needs to be planned for.

There are many, but one main one we see people blind to is sequence of return risk. The order in which you generate your investment returns. If you don’t plan for this adequately, you’ll churn through your money at a rapid rate. Or even worse retire later because your never planned for it.

#2 Build a funding strategy

You need to fund your retirement income somehow. Many leave this to the last minute. We believe you need to start planning for this around five years out from retirement.

The reason is, most don’t tend to retire when they had planned to for a multitude of reasons.

Having an appropriate and well planned out funding strategy will prevent you falling prey to the many retirement risks and blind spots that lurk in the dark.

#3 Investment strategy

Another area many get wrong which has the potential to do major damage to your finances in retirement.

Many think they can continue with the same investment strategy they had while working. While those who love roller coasters are happy with retaining an aggressive approach, many are not.

It’s not uncommon to find people who have no idea how their money is invested. All they look at is the return and that is it.

Investing for retirement is different. Your money needs to last the distance. This means you need to consider a viable investment return. Enough to get the job done and not expose you to a financial tsunami mid retirement.

#4 Creating a retirement paycheque

Quite often I’ll have the male in the couple focus on the investments. While the female’s main concern is, “Can I access my money when I need it?”.

Ultimately, we believe everyone want’s to be able to live their best life and know they won’t run out of money.

Part of that is to ensure you have your investments structured in the most appropriate manner to fund your retirement paycheck. Ensuring you are not forced to sell investments when investment markets are down to fund your income and leave you short later on.

How do you Optimise your retirement plan?

Once you’ve worked through your feasible retirement plan and made it resilient, it’s time to optimise your retirement plan.

Unfortunately, this is where most start. It’s not their fault, it’s noisy out there. So much information is available. Half the problem is working out what relates to you and your personal retirement plan and what can be ignored.

It’s a little like building a house. How do you know where to start when you haven’t designed your house?

#1 Investment implementation

Here at Jigsaw, we like to keep this part pretty boring. It’s a little like watching grass grow. And that’s the way it should be. We use the evidence to guide investment decisions while avoiding the noise.

Many would argue that generating the best return is the most important. Once again, after working with pre-retirees and retirees for over two decades we know that’s not true.

The problem is many enter retirement with overconfidence bias. Thinking they are better than what they are. In most cases it’s come down to luck and many are one decision away from ruining their retirement. We’ve seen it time and time again when people push the envelope too far.

You need to find the right balance between growth, income and just the right amount of risk to see you through retirement safely.

#2 Tax Minimisation and Super

Once you know what you’ve got to work, you can now focus on tax minimisation. We have one of the best super systems in the world. But many go without using it to its full potential.

Many worry about goalposts moving. There’s an old saying, there are two certain things in this world, death and taxes. You can probably add super to that as well.

Nevertheless, if you can get past that and use it for all it’s worth, it might just reward you come retirement.

We find many don’t fully understand the super system. It’s not their fault, it’s so confusing and rules are forever changing.

But look past that, and it allows you the opportunity to minimise your taxes and put more money towards your retirement lifestyle.

- Concessional contributions – At present you are able to add $27,500 to super each year and pay a concessional tax rate of 15%. This includes your employer contributions, salary sacrifice and personal tax deductible contributions.

- Non-concessional contributions – Earnings on investment inside super are taxed at a maximum rate of 15% and 10% on capital gains while in accumulation phase. A great place to put excess funds. Depending on your account balance you are able to contribute up to $110k pa with a bring forward of two years of contributions. Meaning you can contribute up to $330k provided you don’t contribute anything further for the next two years.

- Catch up concessional contributions – If your super balance is under $500k and you have not used your concessional contribution limits from previous years. You have ability to make them up and save yourself some tax.

Quite often we see people with investments outside super or looking to sell investment properties with capital gains. If their super is under $500k and they have unused contributions, this is a great vehicle for reducing significant amounts of tax.

It is also great for people heading towards retirement to plan the sale of investment properties and utilise this great strategy.

- Younger spouse – For some couples, there is an age gap. This means with some great planning, they may be able to maximise the amount of Centrelink entitlements they can access.

It needs to be planned in advance, but there are some great strategies around this to make your savings go further in retirement.

- Downsizing – Many are looking to downsize at some point in retirement. Upon a sale of your residential property, provided you’ve held it for 10 years or more. You are able to contribute up to $300k each.

While these are not all the tactics and strategies, they are the main ones. Careful planning in advance will ensure you can use them to your benefit to make your dollars go further in retirement.

We find many have missed out on utilising some or all of these benefits which could have saved them thousands of dollars in tax along the way. It’s best to seek the advice of a professional as it is easy to mess it up if you don’t know what you’re doing.

#4 Legacy

Did you want to leave a tip to the tax office on the way out the door?

…I didn’t think so.

Many are not aware that if your super gets paid to your estate, any taxable components within your super is taxed at 15%. This means less for your beneficiaries and more for the tax man.

There are strategies that you can use to minimise, if not avoid this. But once again it requires time and planning to achieve.

Rinse and repeat

One of the biggest mistakes you can make is to think the job is done and leave it all to chance.

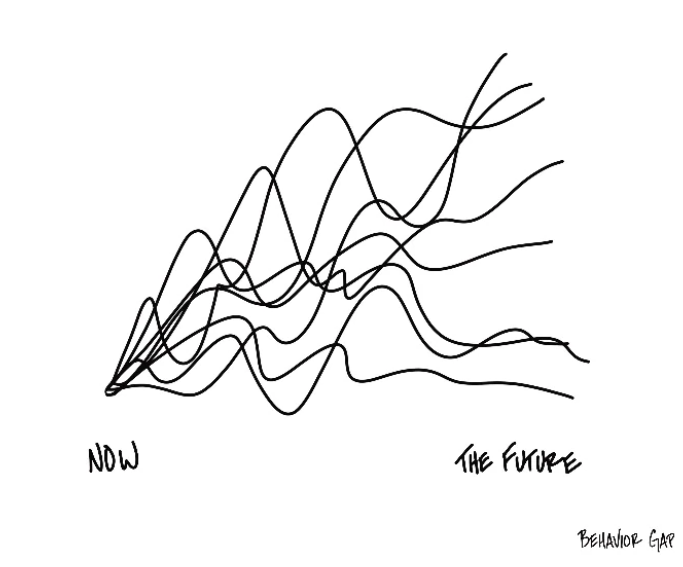

Life is uncertain and has many twists and turns. Your retirement path could and probably will take many different paths.

You may not retire at the time you thought. You may and probably will change some of your plans for retirement. You may suffer a health shock or even worse you or your partner may pass away unexpectedly.

Then you have share market shocks, world events (i.e. Covid 19 pandemic) and there will be many other events you won’t see coming.

This is why regular reviews of your retirement plan are crucial if you are going to live a comfortable lifestyle in retirement.

At times, you may need to pull the reins in and other times you may be able to experience a little more.

Either way, having a plan or a roadmap is just the beginning of your retirement journey. It sets a strong foundation for which to iterate as life unfolds. A methodical framework for which to make confident financial decisions about your future.

As you take one step forward, more information will become available which will help you make smarter decisions about your money.

How long are you going to drift and fly blind?

Retirement planning is not to be taken lightly. You only get one chance to get it right.

You have one life to make the most of what time you have available.

Do you know how you’re really positioned for retirement?

Here’s the thing, the sooner you know, the more confident you’ll be. You’ll have more clarity and control over your destiny.

I’m not going to lie to you, it’s going to take a little effort and time to get your retirement plan sorted. For instance, it takes us around 60 days to craft a retirement roadmap our clients are happy with.

Sure, you have every right to go it alone and fumble your way through. Or you can take a safer and faster path by working with a retirement specialist. One that has a proven framework to not only help you make smarter decisions about your money but ultimately guide you towards living your best life.

If you ready to stop drifting and flying blind, it’s time to book your Retirement Clarity Call by clicking here.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement

We work with people in Adelaide and around Australia via virtual via zoom!