How Much Money Do We Need In Super for a Good Retirement for 2 People?

Retirement is a time most of us eagerly anticipate. It’s a period of life where you can put your feet up, relax, and enjoy the fruits of your labour. However, the road to a successful retirement can be riddled with uncertainty, especially when it comes to one fundamental question: How much money do we need in super for a good retirement for 2 people?

The Weight of This Question

This question can keep you awake at night, and it’s no wonder. Your retirement savings need to last for a long time. You want to ensure you can maintain the comfortable lifestyle you desire.

This question was raised in a retirement forum recently. The vast array of answers was intriguing. With little information about this person’s circumstances, people were sprouting all sorts of numbers ranging from $600k to over $1m. If this couple relied on this, they could be in a world of pain…

It’s a question we work with many clients to answer as they approach retirement, their next phase of life. However, the number can vary substantially based on a number of factors.

Here are some of the core components to answering this question…

The Core Components of “Enough”

Let’s dissect this daunting question and break it down into more manageable pieces:

#1 The Experiences and Memories You Want

Most people have a list of overseas destinations they want to visit or dream of the freedom of caravanning around the country for months at a time.

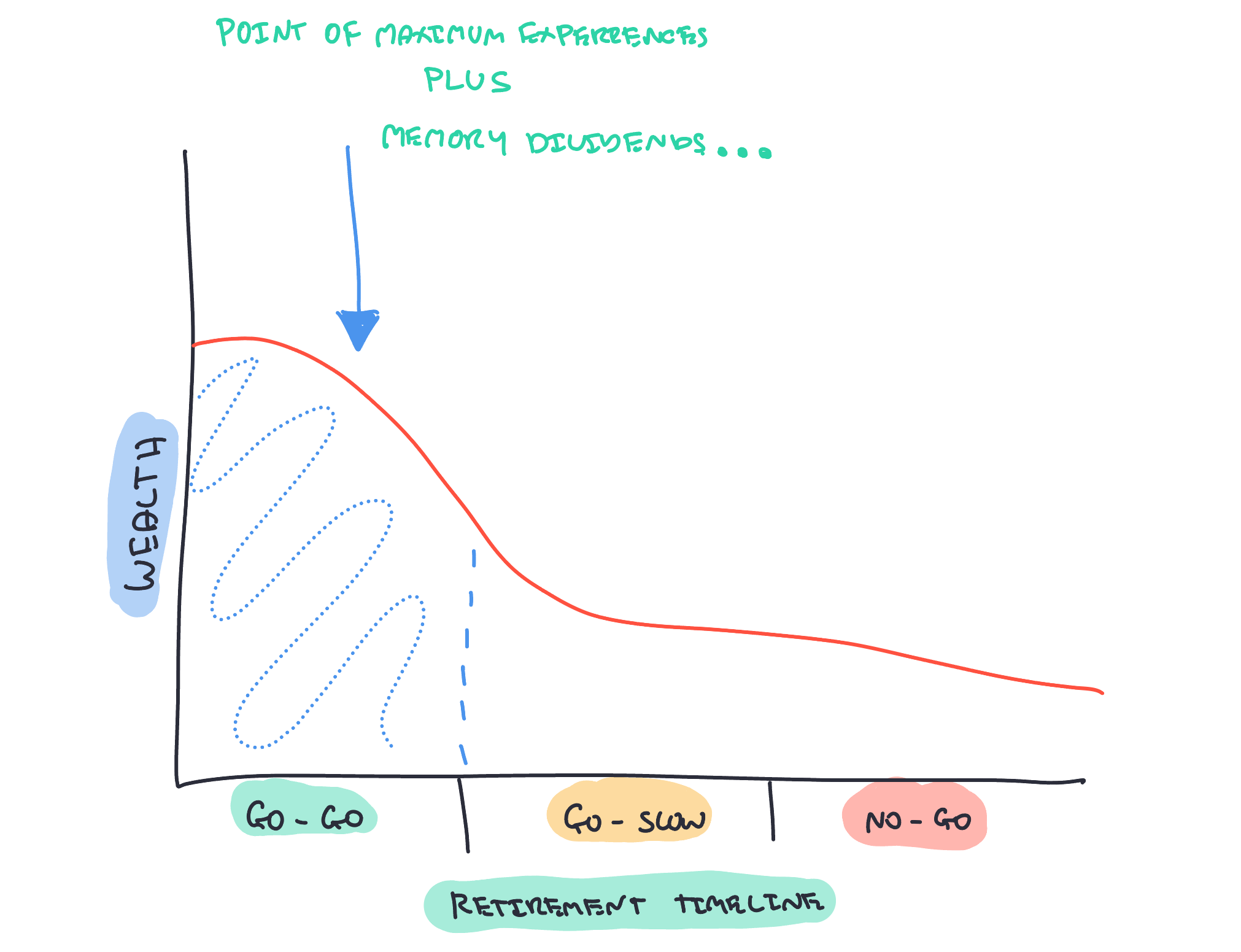

The early years of retirement, often referred to as the “go-go” years, are filled with plans and dreams. There’s a limited time when your health allows you to be at your most active. This could span 10-15 years depending on when you retire.

These are the times when you’ll likely spend more on adventures, hobbies, and ticking items off your bucket list.

People are fearful of spending too much in this phase of retirement for fear of running out of money. There are various studies that have shown that a large proportion of retirees die with a large chunk of their retirement savings in tack.

This shows that retirees are cautious about spending their money. They don’t have the confidence to spend in their go-go years. Meaning they are not maximising this period of their life.

It’s critical to understand your cashflow requirements in retirement and the impact on your finances so you leave no experience or memory behind.

The first step to determine your “enough number” is to think about what you want to do in these active years.

#2 Stop Cold Turkey or Take on Part-Time Work

One size does not fit all when it comes to retirement.

The choice between working, part-time work or stopping cold turkey is a personal one, and there’s no right or wrong answer.

While some might aim to retire fully, others may wish to continue in a part-time capacity either in the same line of work, or something different and less stressful. Deciding which path suits you will affect the financial equation.

We’re working with a number of clients currently, that have had enough of work and want time back to other things. While we have some where work will be a component of their retirement plan, but at a less stressful pace.

#3 Longevity

The duration of your retirement is a critical factor in calculating your “enough number”. It’s impossible to know how long this will be. But you can take some educated guesses.

With good health and medical advances, the modern retirement can potentially stretch for 30, 40, or more years. There’s now a high chance at least one in the couple will make it well into their 90’s compared to previous decades.

Good planning will help you enjoy your “go-go” years while ensuring you will have enough to keep you comfortable as you age.

#4 Cashflow

Cashflow is the bedbrock to achieving financial security in retirement. Understanding where your cashflow will originate is vital. Will it come primarily from your superannuation, your property investments, or a combination of both?

#5 Downsizing or Reverse Mortgage

The equity in your home can be a valuable asset in retirement. Are you an empty nester who wants a low maintenance home? Is your house ideal for your retirement years? Or do you have equity in your home you’d like to use to fund your income at some point in retirement.

With a huge amount of people’s wealth tied up in their property, what you do with your home, may impact your final “enough number”.

#6 Access to Age Pension

Government pensions can be a game-changer for many retirees. Most online calculators are designed to give you a lump-sum. However, may not take into account any age pension you might be entitled to.

This could be equivalent to hundreds of thousands if converted to a lump sum. This inclusion could change your “enough number” significantly.

#7 How Much Investment Risk Are You Taking

The level of investment risk you take, or are comfortable with, plays a significant role in your calculation.

While some are happy with taking on high levels of risk, we find many struggle with BIG falls in retirement when investment markets fall significantly.

In fact, the majority of people we work with, don’t need to take on the same risk they did while working and accumulating their wealth.

It’s critical to understand the impact of investment risk on your final “enough number”.

#8 How Are Your Assets Structured?

The way your assets are structured can make all the difference in retirement. For many, if they continue with similar arrangements while they are working, they may see them churn through their money faster than they thought.

Retirement is no time for getting this wrong. Planning needs to start a long time before you get to that finish line…

These factors form the cornerstone of determining how much you and your partner need for a comfortable retirement. It’s not an easy equation nor is it an easy one to answer.

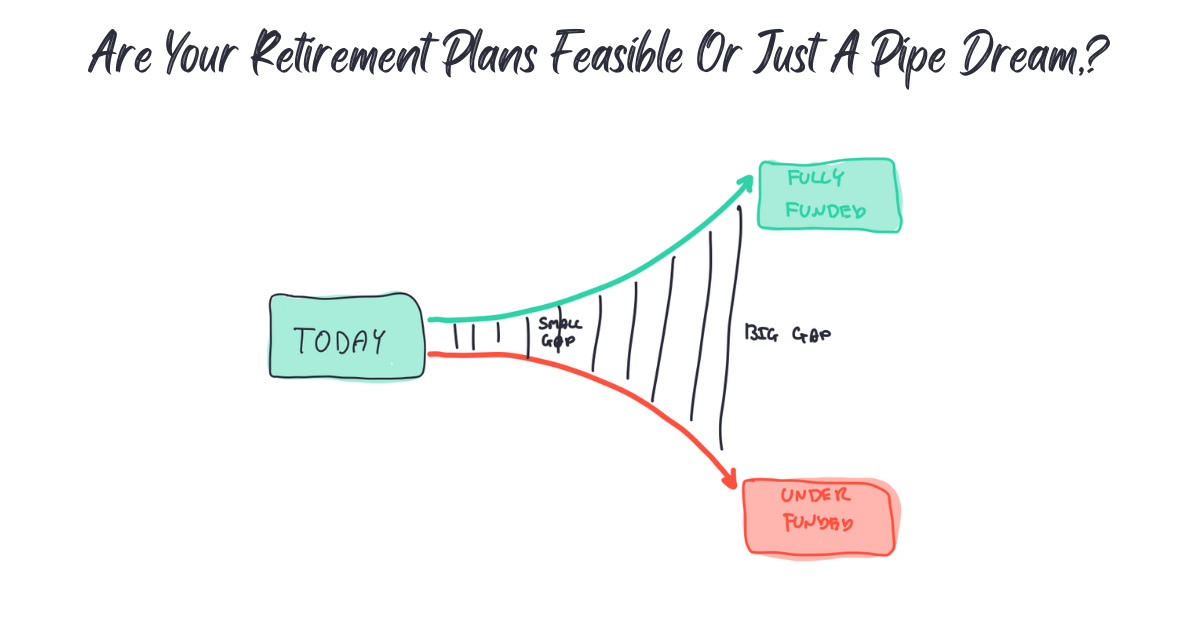

One miscalculation could see you short by many hundreds of thousands of dollars.

It’s why many approaching retirement find it so difficult to find answers to this very question. What’s right for one couple, may not be the right number for another couple.

It’s Not Just About the Money…

Remember, when it comes to retirement planning, it’s not just about the money. It’s about crafting the retirement lifestyle you desire. With the right guidance and well-thought-out plan, you can embark on your retirement journey with confidence.

You’ve got one shot…

You only get one go to get it right. The decisions you make today about your retirement will either harm you or help you towards an enjoyable retirement lifestyle.

So, are you ready to take the next step? To know if you are on the right path to a comfortable retirement. To have real clarity about the decisions you need to make. Have the confidence and financial security that you will have a comfortable retirement.

Book your Retirement Clarity Call by clicking here…

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement