Oh Shit, Retirement’s Here: How much did inaction cost me?

How long have you been thinking about putting a plan together so you can retire comfortably?

You may be one of the lucky few who has taken the bull by the horns and taken decisive action.

For the majority though, it’s like kicking the can down the road. Except retirement looms closer each and every year.

Imagine your future self. You’ve just retired, excited about all the plans you have. Looking forward to all the activities and experiences you’re going to enjoy.

But there’s one problem, you have no clue whether you have enough money let alone whether you’ll be able to afford the lifestyle you dreamt of for so long.

You’re worried about spending your money for fear of running out.

You talk to people who have meticulously planned their retirement with intent. So you sit there slouching back in your chair thinking to yourself, “why didn’t I do that?, why didn’t I plan earlier?, why did I wait so long?”.

Retirement could have been so much different…

Far too many people drift into retirement. It’s part procrastination and one part confusion or not knowing where to start.

It’s not your fault. Unless you are an expert, it’s hard if not impossible to figure it all out on your own.

But here’s the thing, the longer you kick the proverbial retirement can down the road, not only is it money you are missing out on, but more importantly experiences and memories in retirement.

Firstly let’s examine the main cause of inaction, procrastination…

Common Reasons for Procrastination

There are a number of reasons why many procrastinate when it comes to their retirement planning.

Have you considered what’s holding you back from planning one of life’s major transitions, retirement?

👉Overwhelm and complexity

Everywhere you look, someone has an opinion on how you should plan your retirement, how much you need to have or even how you should invest your money.

Your retirement is unique to you. What works for one will not necessarily work for you.

Planning out one’s retirement is highly emotional and can be an extremely anxious time for most.

There’s a mass of information to get your head around. You only have to take one look at google and it’s enough to get your head spinning.

Then there’s all the rules and regulations. You need to be an expert to figure out what’s relevant and what’s not. Then there’s how to implement it all so you don’t make any costly mistakes.

It’s no wonder people are so confused…

👉Waiting for the “perfect” time

I’m convinced people are waiting for a sign to start their retirement planning. Something that will push them to finally start.

I have a secret for you…

…come closer…

…just a little closer…

…a little more…

THERE’S NEVER GOING TO BE A PERFECT TIME

On a weekly basis we talk to people in this very position. They’ve been waiting for the perfect time. As time has passed they missed opportunity after opportunity to build a bigger retirement nest egg. What most don’t realise is these compound over time.

Leaving people little room and time to improve their financial position as retirement looms closer.

👉Don’t let research mode rob you of your retirement

If you’re reading this, it’s likely you are in research mode, sorry to be the bearer of bad news.

Sure, it’s great to gain some knowledge around planning your retirement and you should educate yourself as much as you can. However, far too many people stay in research mode.

Little action is taken due to confusion and quite frankly too much information.

What’s missing, a proven framework to work your way through your retirement planning in a methodical way.

How long will it be before you have enough information to take action?

👉Underestimation of Future Needs

It’s hard to work through what you need to plan for in retirement. Firstly, no one knows when you are going to die. But you don’t want to leave yourself in poverty not being able to afford the basic needs later on.

The modern day retirement for most will span 30 plus years. You need enough financial resources to make it last the distance in retirement.

Many use simplistic calculators not understanding what the calculations cover. Many will leave you short. On the other hand there are retirement benchmarks telling you what the average retiree needs. Or what capital they need to fund their retirement.

But it’s not your retirement. The modern day retirees want to do more stuff, particularly in their most active years of retirement. The first 10-15 years.

But these calculators and benchmarks don’t take that into account. They assume a straight line spending pattern. Retirement does not work like that.

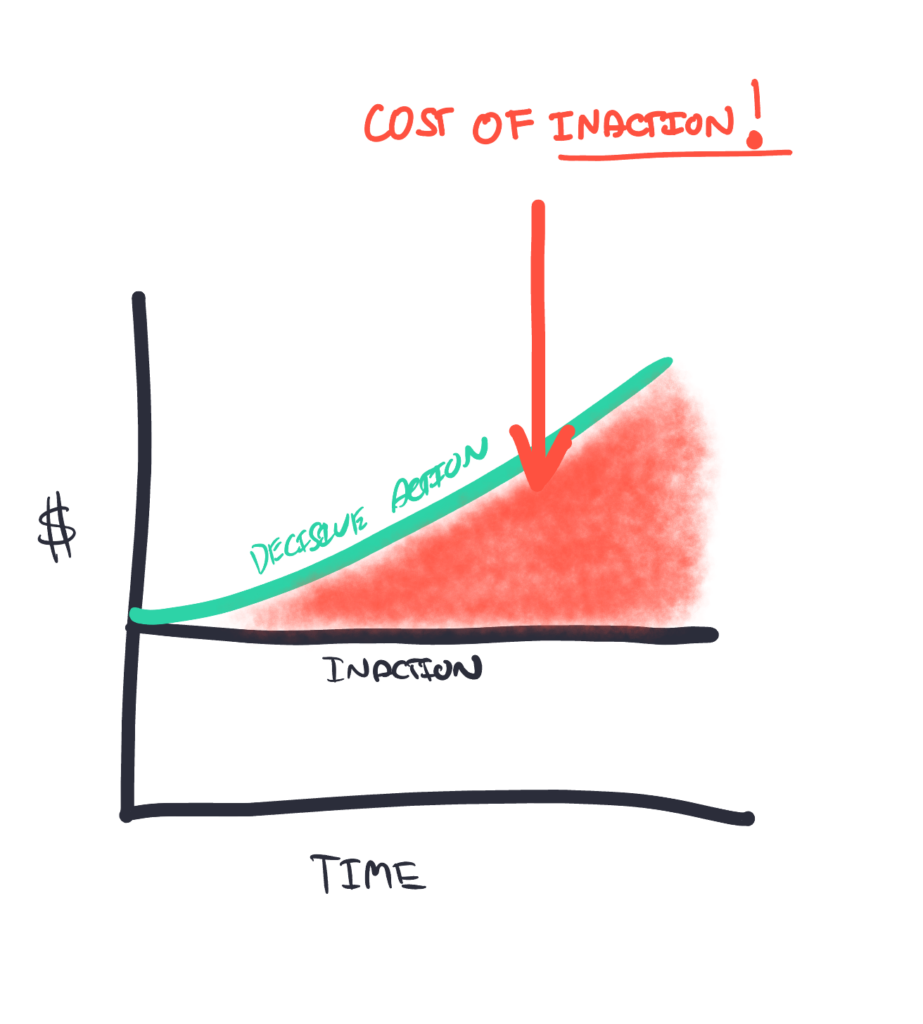

👉The Cost Of Inaction

Everyday you wait, you lose precious time that your money could be growing, thanks to the magic of compounding interest. It’s not just about the dollars and cents, it’s what those dollars and cents mean for your retirement lifestyle – the travel, hobbies, and the time with loved ones you might have to forgo.

👉Financial Implications

Inaction can be costly, however, many remain blind to the opportunities which may leave them in a financially worse off position.

Compounding your investment returns. For some, taking an overly cautious approach with a long lead in time to retirement can leave you thousands if not hundreds of thousands of dollars worse off.

Not taking advantage of the generous tax benefits. We have one of the best superannuation systems in the world. But many still sit there with their head in the sand worried about the potential changes the government might make to the system.

Here’s the thing, super is a tax system first and foremost. There are many ways to take advantage of them. If you snooze, you lose. Everyday people fly blind to ways they can legitimately save tax.

👉Psychological Impact

The cost of inaction is not limited to the financial implications. It’s the psychological impact which may be just as damaging in your retirement years.

The stress of being able to afford just a basic standard of living in retirement is huge if you have not done the work leading up to retirement. Being worried constantly about how much you can spend is no way to live out your retirement years.

Regret that you didn’t take action can be a big weight to bear in your retirement years. Regret you didn’t plan well enough, didn’t save enough and regret you didn’t get help sooner.

But regret isn’t just limited to what you didn’t do prior to retirement. Feeling regret you didn’t do enough when you were fit and able. You don’t want to be in your 90’s with all this money looking back thinking, “if I’d known that, I would have done more stuff”.

Have you considered what impact inaction is costing you?

Real-Life Consequences of Inaction

👉A friend’s investment advice…

Consider the case of a couple who, on the advice of a friend claiming to be an investment expert, convinced them to shift their super to a more conservative investment strategy in the middle of the Covid market crash.

This ill-timed advice, followed without professional guidance, resulted in them missing the subsequent market recovery, costing them around $300k in potential gains.

Just think about the extra experiences and memories this couple would have been able to create with this money.

👉A couple putting off retirement planning…

Consider Alan and Clare, who put off their retirement planning, thinking they had plenty of time. By the time they got serious, they realised they had to work for a further 5 years to maintain the lifestyle they wanted for their retirement.

👉Jane’s regret…

Jane was so tied up in her work, she became a workaholic, until she realised she wanted more from her life. Seeing people around her suffer health issues and some dying gave her a reality check.

All she wanted was to slow down, buy a house in a quiet place where she could spend her days in her garden.

Now Jane was filled with regret that she hadn’t taken action sooner, realising it might be too late to pursue her dream.

👉Jack’s missed world adventures…

Jack had gone through a fair amount of grief in his life, losing his wife to cancer many years ago. After a number of failed relationships, Jack had resigned to the fact he may be doing retirement on his own.

He had big dreams which included a lot of travel overseas. Being an avid motorbike rider, this included many riding holidays. Riding the highways in the US and through NZ.

But he felt he never had enough, so he kept putting off retirement.

Then when the day finally came, he suffered a serious health condition and spent the next few years recovering. Sadly Jack was in a comfortable position to retire, but kept postponing. He’s now regretting he hadn’t retired earlier.

👉Harry and Sally’s missed tax savings…

Procrastination can result in many missed opportunities for tax savings which can significantly affect your retirement savings. Leaving you with less to enjoy in retirement.

That was Harry and Sally who had been plodding along with no retirement plan. They thought they were doing everything. But they had missed substantial tax planning opportunities thinking that by after tax money to both their super funds, they were doing the right thing.

However, they also had an investment property they were selling. Sally had quite a lot of unused concessional contributions available to them. As the previous contributions had just tipped Sally over the $500k mark, they were unable to tax advantage of these opportunities.

With a little planning, they would have saved a further $30k in tax.

👉Age gap opportunity missed…

There was an age gap of 7 years between John and Julie. They’d saved diligently but would have to be careful to ensure their money lasted through their retirement.

But what John and Julie did not know is there were some opportunities, if they’d planned right they would have gained a fair chunk of the age pension for Harry. They were unaware of the opportunity.

Not being aware of this combined with not giving themselves enough time to implement a timely strategy, they missed out on approx $100k of age pension benefits. Compound that over their retirement and that’s a lot of missed experiences and memories they could have had.

The Power of Taking Action Now

After two decades of helping people plan and guide them through retirement, there’s one mistake many still make, they wait too long.

In fact, over this time, there’s one phrase that I’ve never heard from any client EVER: “I really wish I would have waited a little longer to do this”.

And, if you’re waiting for the “perfect time”, that’s never going to happen.

Many people are struggling with creating their own retirement roadmap for one simple reason, they don’t have a proven framework to guide them.

In a world filled with information, there’s a lot of noise out there which makes it difficult to plan.

Starting your retirement planning might seem daunting, but by breaking it down into smaller steps will make it easier to make confident financial decisions.

That is one of the many advantages of working with a specialist retirement planner like me. You get to leverage our framework, save you time and ultimately design your own retirement roadmap.

One that guides you towards living your best life in retirement. A roadmap to confidently let you experience more in your active years of retirement. While avoiding costly financial mistakes that will erode your retirement savings and ultimately your ability to live your life.

Don’t let indecision and drift rob you of your retirement dreams. Take the first simple step towards realising your retirement dreams by booking a Retirement Clarity Call by clicking here.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Specialist |Retirement Planning Made Simple for aspiring happy lappers and avid travellers within 7 years of retirement