Two ways to mess up your retirement…

The million dollar question: How much is enough? Or is it something more…

Day in and day out, we’re asked this question, where the focus is on a lump sum dollar amount, a financial target.

But planning for retirement goes far beyond mere numbers: it’s about understanding the nuances that can either set you up for a dream retirement or lead to regrets.

While this is a critical component of planning your retirement, it’s time to talk about what people get wrong when planning for their retirement.

After all, the best lessons are learnt from those that have gone about it all wrong. And we’ve seen a few in our time…

A successful retirement is much more than safeguarding against market risks and inflation. It’s about aligning your finances with your aspiration for this new chapter of life.

Modern retirement is vastly different from what our predecessors experienced. With longer life expectancies and evolving lifestyles, retirement planning demands a fresh perspective and proactive strategies.

While there is no mandatory retirement age, many use 65/67 as a benchmark. In the modern world, people have different timelines.

With medical advancements we are typically living longer. Meaning your retirement could last some 20-30 years. As long as your working life.

The retirement system is a complex beast to navigate, a good reason to seek professional advice as you approach this crucial transition.

Retirement can elicit mixed emotions along with questions around our identity and purpose. On the flip side it can be the best adventure ever. A time to let loose and experience everything life has to offer.

The good news…retirees are typically more financially satisfied compared to those that are working.

The bad news…there are no second chances and more often than not people get in the way of their own retirement satisfaction.

#1 Running out of money

The fear of outliving one’s savings looms large for many nearing retirement.

This was John’s biggest fear. He was petrified of running out of money. So much so he was going to dramatically change his investment strategy from risk taker to risk averse.

Don’t get me wrong, you’re probably going to want to adopt a lower level of risk to that in your working years. Retirement is a time you start drawing down on your capital to pay for your lifestyle. You need to adopt a different approach.

For John, he was doing a complete 360. His plan was to sell his investments, redeem his super and place it all in cash. John was assuming he would receive the same interest right through his retirement.

While he was worried about running out of money, he was unexpectedly putting himself at a greater risk of running out of money.

To make things work, John hated his job…he would leave tomorrow if he had the confidence. Sadly for John, he thought he knew everything…but this will eventually leave him short in retirement.

Sadly, for many people approaching retirement, they have no idea how long their money will last. Or they make outrageous assumptions which may put them at risk of running out of money in their retirement years.

Yes, no one knows what the future will hold. Thus the reason it’s such a complex equation to solve. Add in the emotional side and it’s no wonder so many people are anxious as they approach this major transition.

With the ride guidance and expertise, you can understand how financially your retirement may pan out. This will dictate what financial decisions you need to make.

Do you know whether you are at risk of running out of money in retirement?

If you want to confidently approach retirement, you need to know. Otherwise you risk making decisions that will either leave you short or you become too frugal and end up with too much.

Yes, being the richest person in the cemetery is a real problem too…

#2 Living with Regret

Often people put so much effort, energy and focus on the running out of money part. They end up drifting and squandering their time in retirement…

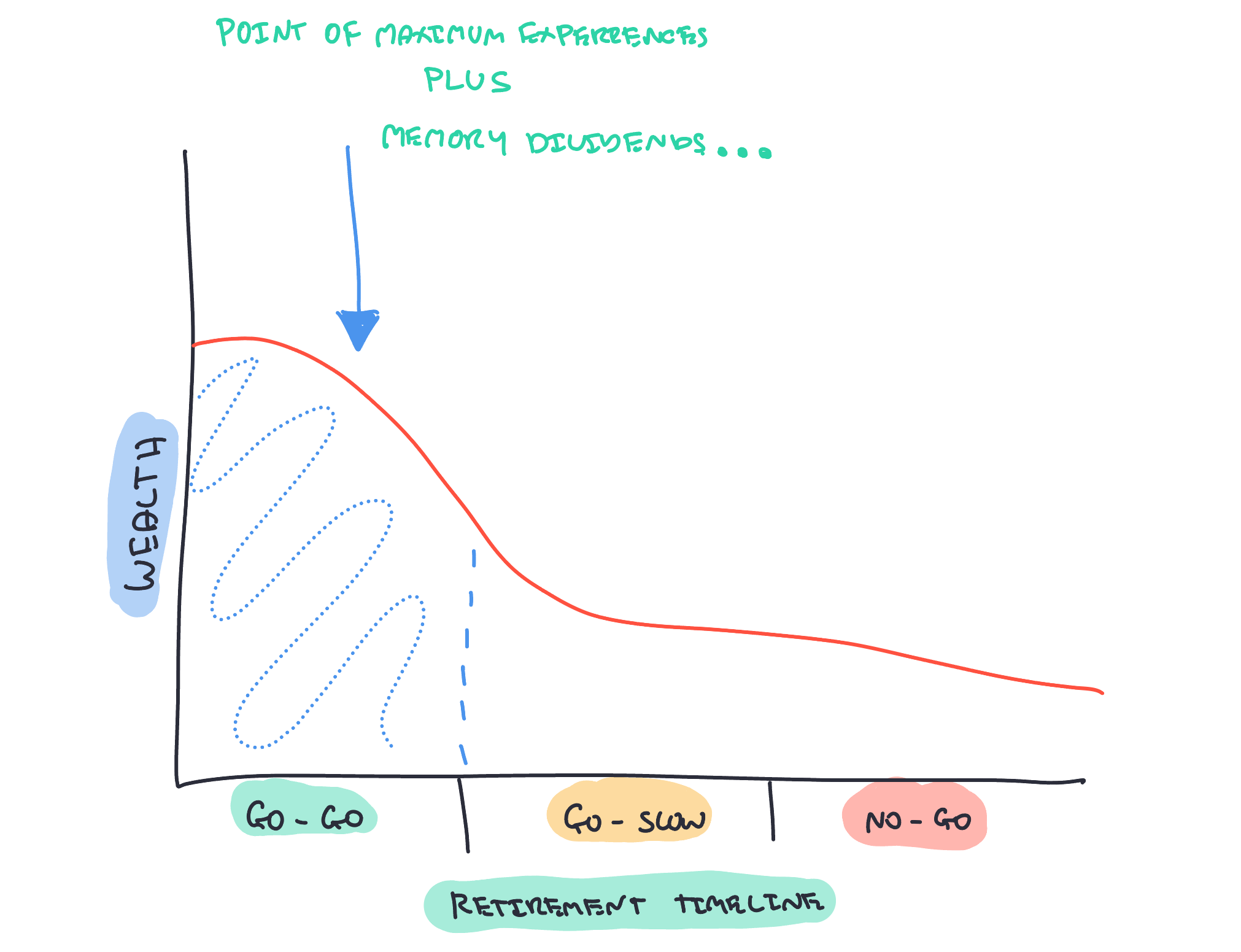

Retirement is a period in your life where the focus should be on aligning your money with your time. Doing what’s important to you with the little time you have left.

Bill Perkins authored a book called Die With Zero, you may have heard of it…

He wrote the following, “The business of life is acquisition of memories. In the end, that’s all there is.”

Recently I attended the funeral of my mother-in-law’s aunt. She passed away peacefully at the age of 93. As with all funerals, it’s a time we recount the memories and experiences family members had with their loved ones.

This was no different with many stories and memories talked about over a few drinks post the funeral.

Memories stay with us for life…

…memories should be the motivator to pursue experiences that provide more memories with our loved ones.

I call them memory dividends…the goal in retirement should be to use your money to bank as many dividend memories as you can.

It’s a little like compounding in investing, but applied to your life.

The most common regret…not doing things sooner.

Time and time again we see people mismanage this period of their life.

Meet Toby, he had accumulated enough money to retire, however, wanted to bank a little more before retiring. When he did finally retire, the unthinkable happened, COVID-19.

Not only did the pandemic prevent him from enjoying his early years in retirement, a health issue was added to the equation. His delayed retirement led to lost experiences. Experiences he may never get to enjoy…he’s now living with the regret he didn’t retire earlier.

Perhaps you’ve uttered these words to yourself…I should have done it sooner. Yet we often drift and delay experiences into the future.

Fear of squandering their money and/or “someday thinking”

People generally delay for two reasons…

They are so scared of spending their money, they forgo experiences.

Perkins, in his book DIE With Zero says, “We shouldn’t let opportunities pass us by fear of squandering our money. Squandering our lives should be a much greater worry.”

Here’s the thing, no-one knows what tomorrow is going to hold, there’s no promise of tomorrow.

We think about squandering our money, after all no one wants to run out of it, but rarely do we think about squandering our time and our lives.

The second reason people live with regret is “someday thinking”. We falsely think our time is infinite, telling ourselves we’ll do it one day.

Maybe it’s time to ask yourself a few questions:

What if ‘someday” never comes? Will you regret not taking action while you had the opportunity?

To be frank, there will be times where you delay for good reason. Maybe the timings not quite right or maybe the money’s not there. It’s a balancing act…

Zig Zigler captured this perfectly, “If you wait until all the lights are “green” before you leave home, you’ll never get started.”

I don’t want that for you…

There’s probably never going to be a perfect time nor is there a right way.

But as your retirement wheels start turning, your experiences don’t all have to be expensive.

Yes, you may want to fly business class to Europe. Buy a caravan and join the happy lappers around Australia. Eat at nice restaurants. Afford nice wine. Buy a luxury car.

There are also experiences that cost very little to no cost.

Here lies the purpose of financial planning. Whether you choose to go it alone or work with a professional like us, is to help you accumulate as many experiences as you can so you can live your best life with confidence.

Whatever that is for you…

Want clarity and insights on how to solve your retirement concerns and challenges. Take the first step by booking your Retirement Clarity Call by clicking here.…

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring happy lappers and avid travellers within 7 years of retirement