Will the 4% rule lead to regret that you didn’t use your retirement wisely?

Recently, I received a message from someone who had read our complimentary book, “ENOUGH”, asking whether we supported the 4% rule.

I was so shocked, I nearly fell off my chair…

Thinking to myself, surely I can’t be coming across as a supporter of this retirement withdrawal method.

Regretting “someday” thinking…

Paul Armson, author of “Enough” recounts his father’s experience…

His mum passed away suddenly at the young age of 59, before Paul’s dad could make it home from work.

Even in his 90’s, Paul’s dad was still living with regret, always recounting “if only…”.

“If only I’d spent more time with your Mum, he’d say to Paul. If only I’d been there for her”, “she loved her flowers, if only I’d bought her more flowers…”

Reliving all the regrets he’d had…

Paul’s dad, like most, did what he knew best, he worked hard and that was the only way he knew. The only thing was his “someday” thinking led to regret as he lived the rest of retirement.

Have you ever said to yourself?, “One day I’ll do it”.

I think if we’re honest with ourselves we’re all guilty of this. The honest truth is life is so busy that sometimes we forget what’s important to us. It’s not until we experience a tragic event like Paul’s dad, that we realise we shouldn’t wait until one day comes.

One day may never come…

The man who hated his job…

In a recent conversation with Sam, he mentioned he hated his job…

Like many, he’d worked hard all his life. He was approaching age 60 but he hated his job. He hated the people he worked with. He hated the work he was doing.

Yet everyday, he’d go into work hating what he did, thinking I’ve only got a few more years to go.

For Sam he was using a very simple equation to work out how much money he needed to fund his retirement. He thought if he could get 5% interest on his investments, he would be right for life.

It was a very simple concept, but what he was missing is that he needed his money to last some 30-40 years. His idea was to cash in everything he’d saved hard for and whack it all in cash. That was his retirement plan.

It got me thinking about everything he was missing in terms of using not only that money to live a good life, but making sure it lasted for the next 30-40 years.

If Sam hated his job so much, why not retire now. Maybe he had enough money if prudently managed to see him through for the rest of his life. Rather than working a few more years in a job he hated.

What was stopping him, he just didn’t know…

Do you know how much money you need to live a good life without the risk of running out of money?

You need to know…

Where did the 4% withdrawal rate originate from?

Sam was working on a simple rule, the 4% rule, although he was using 5% as his benchmark.

The 4% rule was a concept developed by a financial adviser, Bill Bengen living in Southern California in the mid 1990’s.

Bill used historical data based on share and bond returns over a 50 year period. This period included severe downturns in the 1930’s and 1970’s.

What would happen if you relied on the 4% rule?

Time would only tell…

In current times, many believe 5% is a more realistic guide given future returns are likely to be lower than the last 10 years or so.

Using the 4% withdrawal rate may lead to retirement regret

While the 4% may be used as a guide, what if you used this and realised later on in life you had enough but didn’t know it?

Had more than enough to travel more, live more comfortably, have more experience or held the kids out when they really needed it.

But left too many experiences and memories behind…

Sadly, this is what many people do, why…FEAR OF RUNNING OUT OF MONEY.

All due to one thing, not knowing how much they need to live a comfortable lifestyle in retirement without fear of running out of money.

Do you know if you’re on track to retire comfortably and live out all your dreams?

You need to know or risk drifting into retirement and end up like Paul’s dad, regretting he didn’t do more.

[VIDEO] Which Retirement Path Are You ON, Retirement Regret or Living Your Best Life In Retirement?

Which retirement path are you on?

We find many people are on one of three retirement paths, not enough, just enough and more than enough.

Knowing which path you are on will enable you to make more informed decisions about your life and your money.

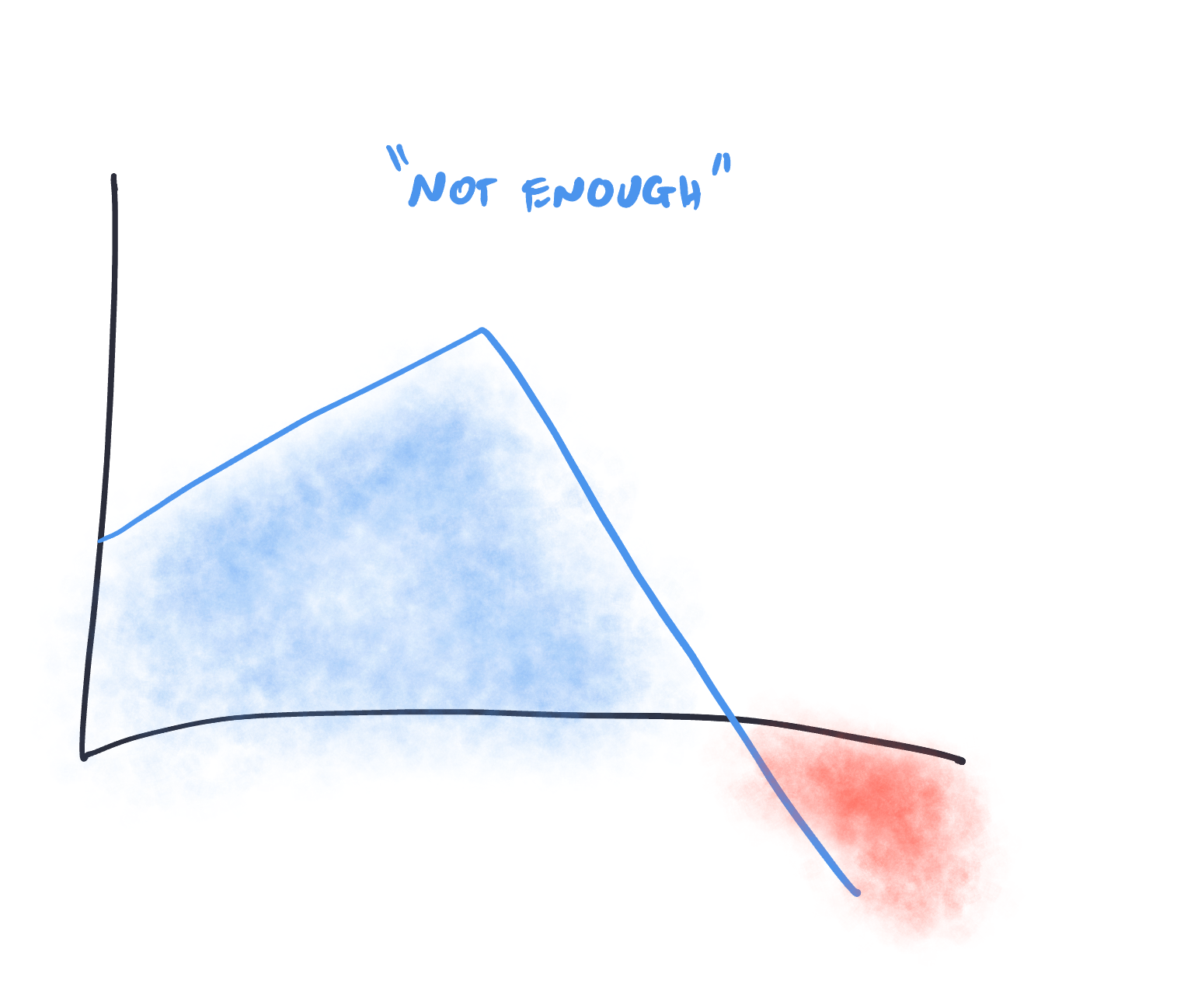

Not Enough…

Self explanatory, quite simply these people don’t have enough. Their financial bucket will most definitely run out. There just won’t be enough money to last them through retirement.

Quite often, the “Not Enough’s” are people who will never have enough if they continue to drift into retirement and take no action.

Solving this problem may not be as difficult as it seems, provided they are willing to take the right action.

It’s not a crime to be “Not Enough”. There are millions of them Australia wide.

Meet John and Sue. They had dedicated their lives to running a business. Like many, they focused on the business and their life at the time.

However, now as they approach retirement, which came around quicker than they liked, they just don’t have enough in their financial bucket to fund their comfortable retirement.

They had two options, retire and resign themselves to cutting back on the experiences they had dreamt off for many years.

Take proactive action and work for longer to fund their current lifestyle while building their financial bucket to a point they could comfortably retire.

Like many, they are ruing not taking action or seeking professional advice much earlier. Had they done so, things could have been much different for them.

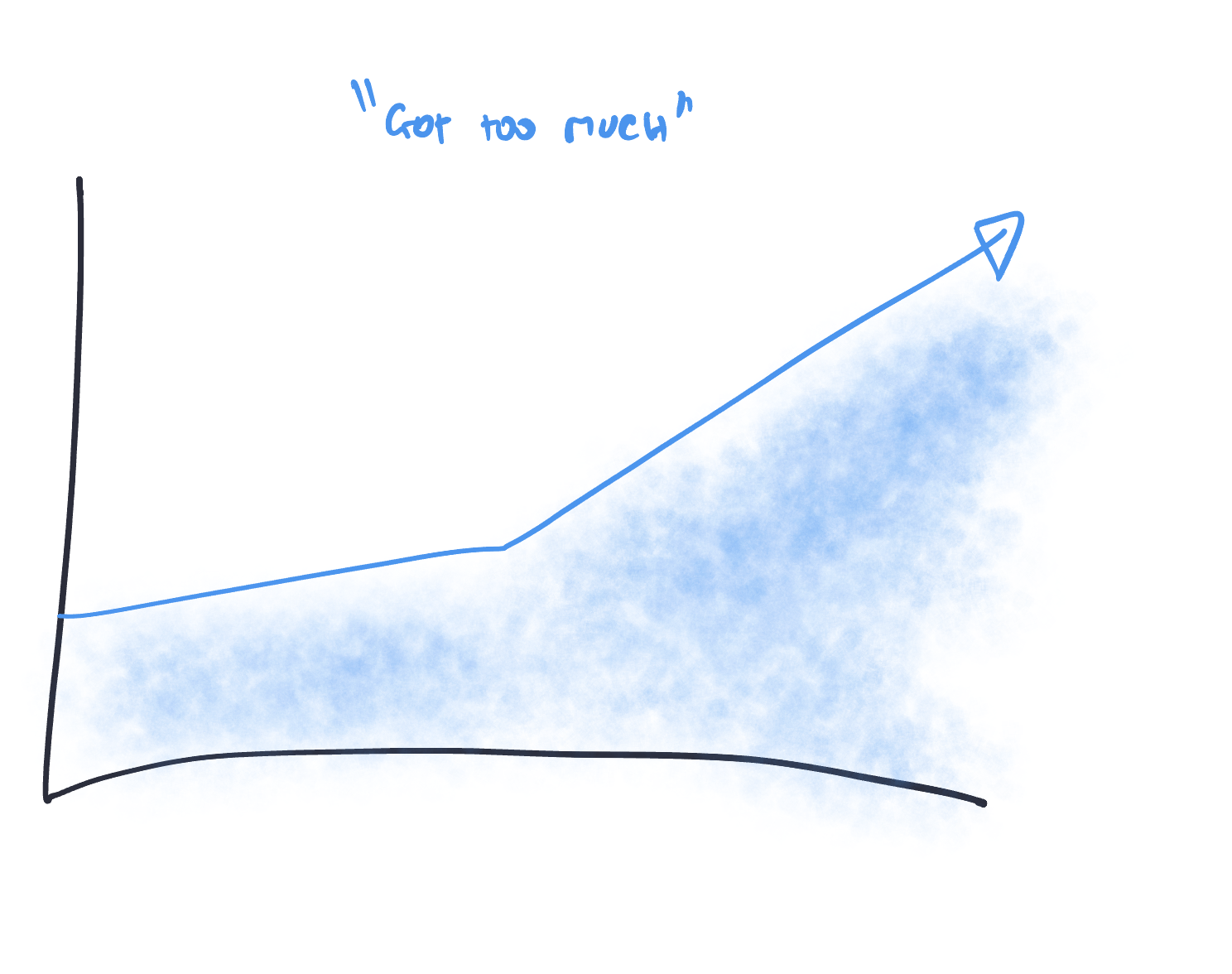

Got Too Much…

These people quite frankly have more than enough. They will not run out of money. Their financial bucket will overflow. They will go to their grave at risk of being the richest person in the graveyard.

It’s a great problem to have, but believe it or not, it’s a problem…

This is why it is so important to know how much is ENOUGH to see you through retirement which might last 30-40 years.

It opens up a whole array of opportunities…

Meet Dan and Sally. Like many others, they had spent their life diligently accumulating their wealth. Largely going it alone.

In their late 50’s, they now wanted to pursue life’s pleasures. Travelling regularly overseas in business class. Travelling locally. More time with loved ones. Helping their children get into the property market.

They had BIG plans. These guys had “Too Much”. They were at risk of being the richest people in the graveyard.

Once they knew this, we worked with them to make some changes to their future plans.

They included:

- More money for overseas holidays

- More annual spending

- More money allocated to helping their children get into the property market (after all passing on money with a warm hand is better than a cold one)

- Reduce economic shocks – their portfolio was at risk of halving when another financial shock comes (Dan’s comment when we raised this, “we’d just spend less”). You can’t just put living life on pause when this happens. So we put a number of safety margins in place to ensure this never happened.

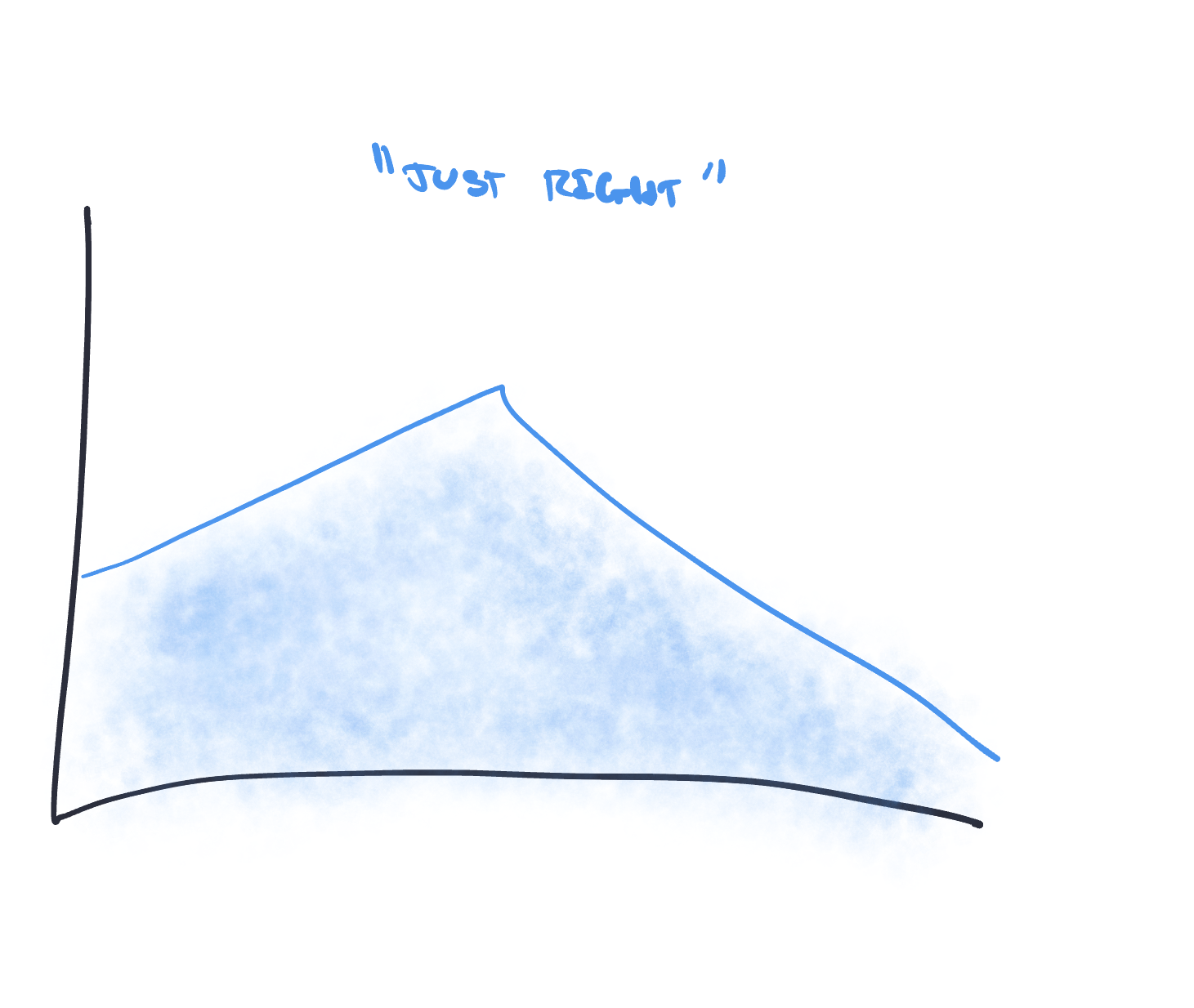

Just Right’s…

These people have just the right amount of money, enough in their financial bucket. The problem is they just don’t know it.

Nobody’s sat down and explained it to them.

There’s plenty of these people blindly drifting, not knowing they have enough to live a comfortable retirement. But, they go on accumulating more money because no one’s shown them they have enough…

Meet Harry and Sally, a couple in their early 60’s. Due to Harry’s body succumbing to the strains of his job was forced to retire before he did more damage.

Sally thought she’d have to work for a while longer. They had been diligent in their savings over their working life.

But they were stressed and worried about this next stage. Would they be able to survive? How long did Sally need to work before she could retire?

They had plans of spending more time travelling, visiting family and friends overseas for months at a time. On their list was exploring parts of Australia. All while their bodies were able to cope with the stresses of travel.

They had the money, but didn’t have the peace of mind that they would be okay. In fact, they had no idea how they were positioned financially. Whether their financial bucket was ever going to be full enough for both to retire.

After working with Harry and Sally, we were able to show them their financial bucket was in fact full.

They were going to have enough.

In fact, they had enough that now, Sally could contemplate early retirement if she so desired.

Together we devised a realistic retirement plan which accounted for their varying cashflow, building in safety margins to protect their spending in market downturns and they were able to reduce the amount of investment risk they were taking.

We were able to show them they could in fact spend more through their retirement years without the fear of running out of money.

What if you knew you were going to be okay, do you think you could relax more?

You could enjoy your money without feeling guilty about spending it…

Planning for your income in retirement goes well beyond investment planning

Pre-retirement main game: Accumulating wealth and maximising investments returns are crucial pre-retirement tasks. In other words, making sure your financial bucket is as full as you can possibly make it.

However, planning for a sustainable income in retirement requires a full understanding of the retirement picture. Something many are oblivious too…

After all, you haven’t experienced retirement before…

It involves exploring what’s important to you. What you want out of life.

Negotiating a feasible retirement plan that takes into account cashflow, investment risk, market risk, longevity risk, pension eligibility, home equity, legacy, super and tax optimisation along with making your plan resilient.

If that wasn’t enough to get your head around, you’ve also got behavioural factors to manage along your retirement journey. This is an area many don’t understand but may flip your retirement on it’s head if you get it wrong.

[VIDEO] Four Financial Pillars for a Retirement Rebel Retirement Plan

Your retirement plan will never go according to plan

Yes, you need a plan or a proven roadmap to help you make the right financial decisions. You need something to guide you as you embark on this journey.

Answering questions such as:

- When can you retire?

- How much money can you safely draw down?

- How much investment risk do you need to take vs what you’re taking?

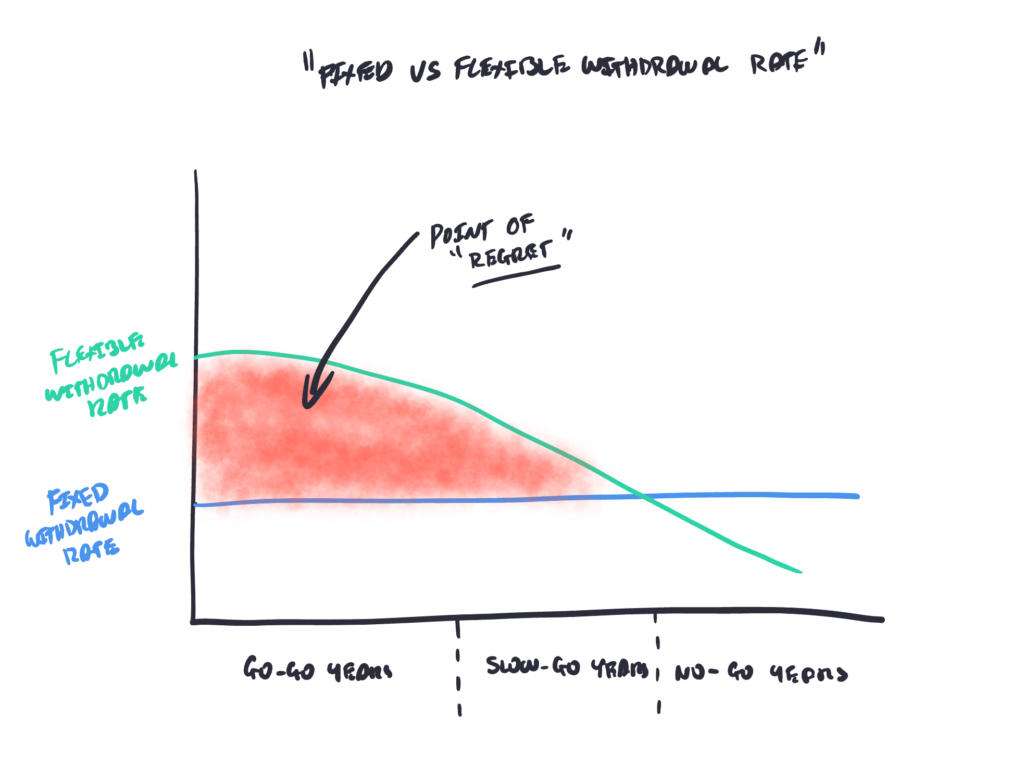

- Managing your income flows over your retirement through your go-go years, go-slow and no-go years.

Life has many twists and turns. Nobody knows what’s around the corner. Successfully navigating retirement requires an iterative approach.

One where you regularly review your spending, retirement goals and preferences, how you’re tracking and what blind spots or risks you need to be prepared for.

This approach, one we use with our clients, allows a more flexible withdrawal rate.

Typically leading to higher withdrawal rates in the go-go years. Generally higher than the 4% rule to allow for the most active years of retirement. Where you’ll experience more and create long lasting memories.

Adopting a more flexible spending approach in retirement will allow you to design your lifestyle on purpose. To confidently do all the things you had dreamed of. Knowing you will have enough money to see you through.

Leaving you to reflect on the experiences and memories you created rather than regretting you should have done more.

Life’s not a rehearsal…

Don’t let your busy life get in the way of you planning for a 30-49 year retirement.

We can save you the time, provide the answers and ultimately give you more clarity, confidence and control over your retirement journey.

Book your Retirement Clarity Call by clicking here.…

Glenn Doherty – CFP – Financial Planner | Retirement Planning Specialist |Retirement Planning Made Simple for aspiring happy lappers and avid travellers within 7 years of retirement