3 DIY Retirement Gaps You Must Overcome To Retire With Confidence

Retirement is one of the major life transitions we all go through at some stage in our life. A moment in time many have been working towards for the last 30 years or so…

A time to unwind from the nine to five grind. Unlocking the freedom of time to do all the things you’ve put off or ramp up your planned experiences.

But there’s something holding you back…

While you may be excited, it’s a daunting, scary, stressful and an anxious time for most.

The fear of the unknown is running rampant…

I can’t spell this out enough, YOU ONLY GET ONE SHOT AT THIS.

Retirement is not just a milestone; it’s a delicate balance between excitement and apprehension, freedom and uncertainty.

Imagine standing at the edge of a vast ocean, exhilarated by the possibilities yet paralyzed by the fear of what lies beneath.

It’s a moment where every decision counts, where one wrong step could send ripples of regret through the rest of your life.

Think of it like sailing into uncharted waters; a navigation error here could strand you on financial reefs for the rest of your days,

There is no coming back from costly financial mistakes in retirement. They are permanent.

If you get this wrong from the beginning there is no coming back from it.

Knowing where to start is hard…

Working out whether you’ll have enough to last you through retirement is confusing…

Making sense of the retirement landscape is complex…

Identifying your blindspots and retirement gaps are hard…

Making sense of what information to use and what to ignore is hard…

And let’s not forget, you haven’t been retired before so knowing what to expect is nigh on impossible.

No wonder so many people are confused and struggling with navigating this major life transition.

Just point me in the direction of some resources…

This was a message I’d received recently. This person had been reading my weekly blogs for some time.

He thought retirement planning fees were expensive, but also thought they may be worth it. Didn’t want to invest in his retirement and just wanted to be pointed in the direction of some resources he could use to plan his retirement.

Curious, I asked him to come back with some information so I could get a feel for his situation. Maybe that would help me, I thought…

Boy Oh Boy…

When I looked over the information, my first thought was, he’ll never be able to figure this out. I’ve spent over 20 years in this space. I know how much knowledge he’d need to know to go it alone. I know the mistakes people make…some have cost people their enjoyment in retirement.

There was a high risk he’d get something wrong and this would harm them financially, if not hinder their ability to live the retirement they’d dreamt of.

It would be malpractice if I pointed him to some resources…

So I listed all the key areas he’d need to address at a minimum.

While I appreciate there are some who are capable of going it alone, many lack the knowledge, expertise and more importantly a framework to plan their retirement with confidence.

Many think financial planning fees are expensive. Personally I’d be worried if they were cheap…

There’s a reason you pay good money for a medical specialist…you want someone who knows what they are doing. Retirement advice is no different and comes in a close second to your health.

The cost of getting it wrong can be multiple of thousands if not hundreds of thousands of dollars. That is not taking into account lost time and missed experiences. I’ve seen plenty of situations where DIY has come unstuck. It’s not a great place to be…

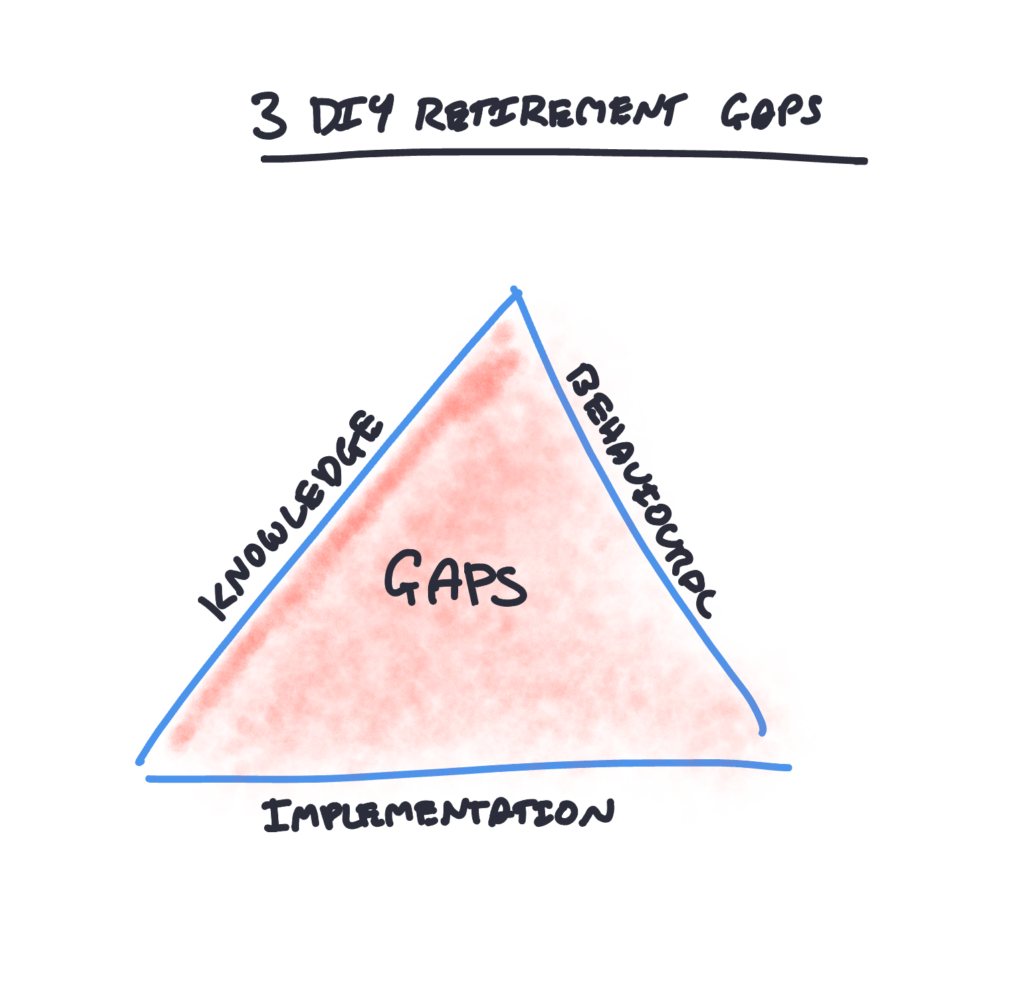

What are the major DIY Retirement Planning Gaps

Knowledge Gaps

While there is a bucket load of information through Dr Google, it’s hard to filter and decipher what’s relevant for your situation.

The problem is filtering the stuff you need to know vs ignoring what you don’t need to know.

To be honest, a lot of it is just noise if not a distraction.

Many people we have conversations with have tried to gain the knowledge they need to plan their retirement. But many still don’t know where to start or how to go about setting their retirement plan up.

If anything, they are more confused than ever…

One critical step we find most are missing is having a framework to be able to make smart and confident financial decisions.

You may want to watch “Four Financial Pillars For A Retirement Rebel Retirement Plan”

They start with what I call the sexy side of financial planning. Investments and products. They are only tools to drive your retirement plan. You need to know what tools you need first.

Not only is it knowledge many struggle with but also the blindspots and hidden gaps. You’re not expected to know these because you’ve never been retired before.

Here are a few of the knowledge gaps we’ve seen that people get wrong:

- You’ve invested the last 30 years to accumulate as much as you possible can. It’s all about return on investment. As you approach retirement the focus turns to return of income. If you continue with the same strategy you are at risk of churning through your money, leaving your financially short in retirement.

- Many use retirement simple retirement calculators online but remain confused. Retirement is not just a math’s equation, it’s also a life equation. Too many people rely on these calculators while missing other critical information that needs to taken into account.

- Not understanding the full extent of the super rules. Some strategies need to be planned years ahead if you are going to obtain the right outcome. Many miss out on benefits they would been entitled too but haven’t planned well enough ahead.

- Drawdown in retirement is different to accumulating money in your working years.

- Misunderstanding what their enough number needs to be – this is a complex equation. If you have a bucket load of money it’s not much of an issue. However, many neglect the impact of inflation, investment returns, draw down rates, centrelink and longevity issues. All will lead to you overspending or underspending in retirement. Neither are good…

- Missing out on government pensions where an age gap exists – where an age gap exists many ignore the time required to plan so they can maximise their centrelink pensions. It’s a complex area with missing out on benefits which would have normally been available to them.

- Leaving a BIG tip to the tax office – for this can be in the hundreds of thousands if not planned for.

- Misinterpreting super rules – many misunderstand many of the super rules, meaning they are leaving too much money behind.

Behavioural Gaps

You may not think of this as a gap, but it is alive and well for the unadvised.

Let’s look at one common one…

Investment markets are dropping like a lead balloon. Think back to March 2020. Oh that’s right, it’s a distant memory…

You tell your friends your worried about the dropping value of your super. They tell you it’s going to continue to drop because they have a crystal ball (p.s. mine broke a long time ago).

They advise you, because they are an expert, to sell down to a more conservative investment.

Fast forward 3 years and you’re still sitting in that more conservative option. Comparing the numbers, you’re down $200k. Fast forward another year, you’re now $300k worse off.

This is a real case and I’m afraid it’s not isolated. And if you think you are immune, wait until you’re retired and you experience this.

Here’s the thing, this so-called expert, aka so-called friend, just cost you $300k. They didn’t know when you were retiring. They didn’t know your retirement plan intimately. They weren’t even an expert in retirement planning.

Here are a few common behavioral pitfalls we see all too often:

- Start their retirement planning too late – the cost of inaction can be huge and the different between retirement success and retirement regret.

- Confidence – let little wins boost their ego – now they think they are better than investment markets only to get crushed when things go the opposite way.

- Ignoring the benefits of the super system because they are afraid of too many changes. Many forget super is a tax vehicle first and foremost. Use it for all it’s worth. While government may tinker with it, exploit for your own benefit. You can’t just ignore it due to a personal grudge.

- Poor investment decisions – investing is simple if you follow a few core principles but many overthink it chasing the next best thing. Don’t risk your retirement by punting of the next best thing.

- Listening to the wrong people – unless they are an expert in retirement planning, ignore them.

- Thinking they can leave their planning till they retire – we see far too many people let time slip by only to be forced into retirement far worse that what they should have been.

Implementation Gaps

A plan is useless unless implemented…

As humans we can be terrible implementers. We get distracted so easily, whether that’s watching a show on TV, scrolling Facebook or life.

We let things get in the way, “I’ll just wait a little longer” is a BIG culprit.

And if we do implement something, sometimes we get it wrong.

Here are few examples we’ve experienced over the years:

- I’ll invest when the market goes down – missing out on tens of thousands due to waiting for the perfect time

- Incorrectly filling in forms – leading to lost tax deductions

- Not converting to tax-free pensions at the right time – missing out on 0% tax rate

- Only partially taking action

- Waiting for the perfect time to plan while watching the years and opportunities pass them by

- Not taking action earlier enough – some take detailed planning and time to implement. Taking any action is better than none…

Don’t leave your retirement to chance…

I get it, it can be difficult to understand the benefits of a financial planner. But the financial impact of getting it wrong can be far more costly.

Consider a retirement planner as your trusted guide in an ever changing landscape. They possess the knowledge, experience, and tools to chart a course that aligns with what’s most important to you and your circumstances.

Think of them as your guide who’s travelled the journey many times over. Helping guide you through the darkness, helping you avoid hidden danger and safely reaching your destination.

You’re heading towards the unknown…why would you risk your retirement just because you had a grudge about how much retirement planning might cost.

Ultimately there needs to be a financial benefit for seeking advice. I can happily say we will not take on a client if we don’t believe we can’t achieve a multiple return above the fee we charge.

Yes, we have turned potential clients away, many times.

Here’s a real client example of the results we typically achieve…

- Using unused tax deductible contributions to reduce taxes by circa $30k

- Circa $90k saved by the estate

- Reduced costs on their super fund

- Reduced level of investment risk

This is a client who had assets between $1-$1.5m outside the family home.

That’s prior to identifying this couple could retire 2 years earlier than they thought while increasing their spending in retirement. Two years of extra experiences they may not have had if they continued on the same path and waited to get professional advice or got none.

Add to that the clarity they now have, the confidence to retire while living out their dreams and control over the decisions they make.

I’m biased but that’s a pretty good return on investment…

While it’s understandable to have concerns about costs, it’s essential to weigh them against the potential consequences of DIY mistakes. Consider it an investment in your future, a safeguard against the tidal waves of financial uncertainty that could otherwise sink your retirement dreams. Remember, it’s not just about the upfront expense; it’s about the long-term value and peace of mind that professional guidance can provide.

Don’t let time deprive you of experiences in your retirement

There’s one statement I’ve never had any client say to me, never “I should have waited longer to do this”.

If anything the majority say I should have done this sooner.

Time is your greatest enemy. Time does not slow down, if anything it accelerates. Everyday you wait means you’re running out of precious time and opportunities.

It’s the very reason why we offer a Retirement Clarity Call. To help you gain insights and ideas. Giving you clarity on how to resolve your issues as they relate to your retirement planning..

If that’s you, book your Retirement Clarity Call by clicking here.…

Glenn Doherty – CFP – Financial Planner | Retirement Planning Specialist |Retirement Planning Made Simple for aspiring happy lappers and avid travellers within 7 years of retirement