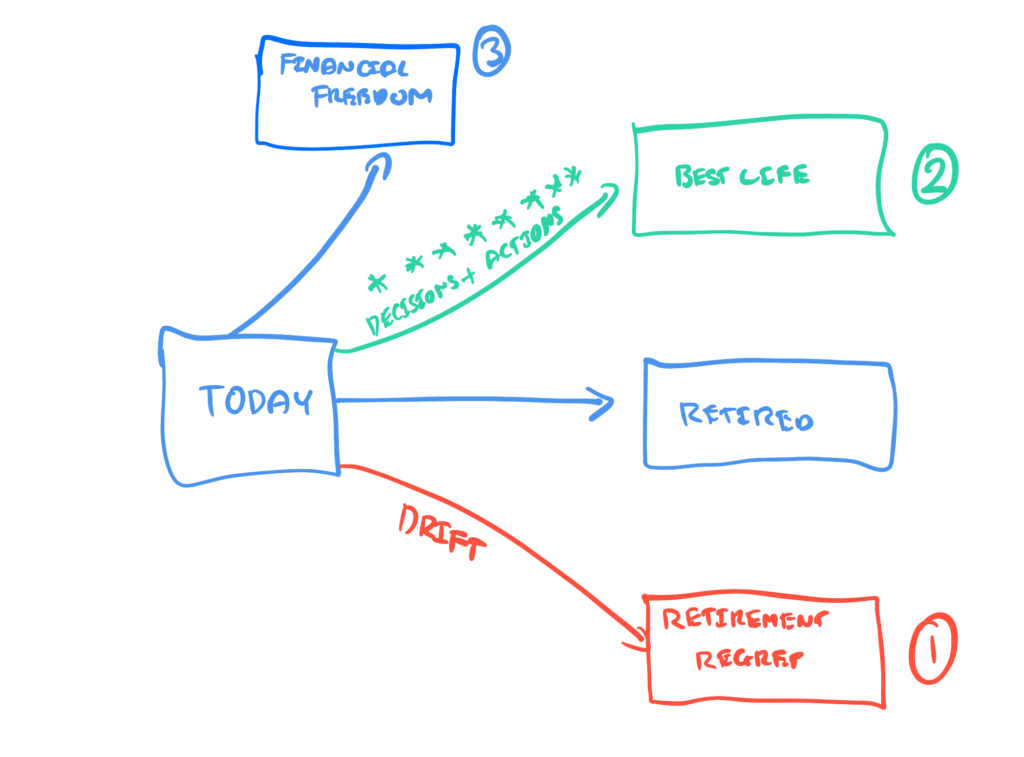

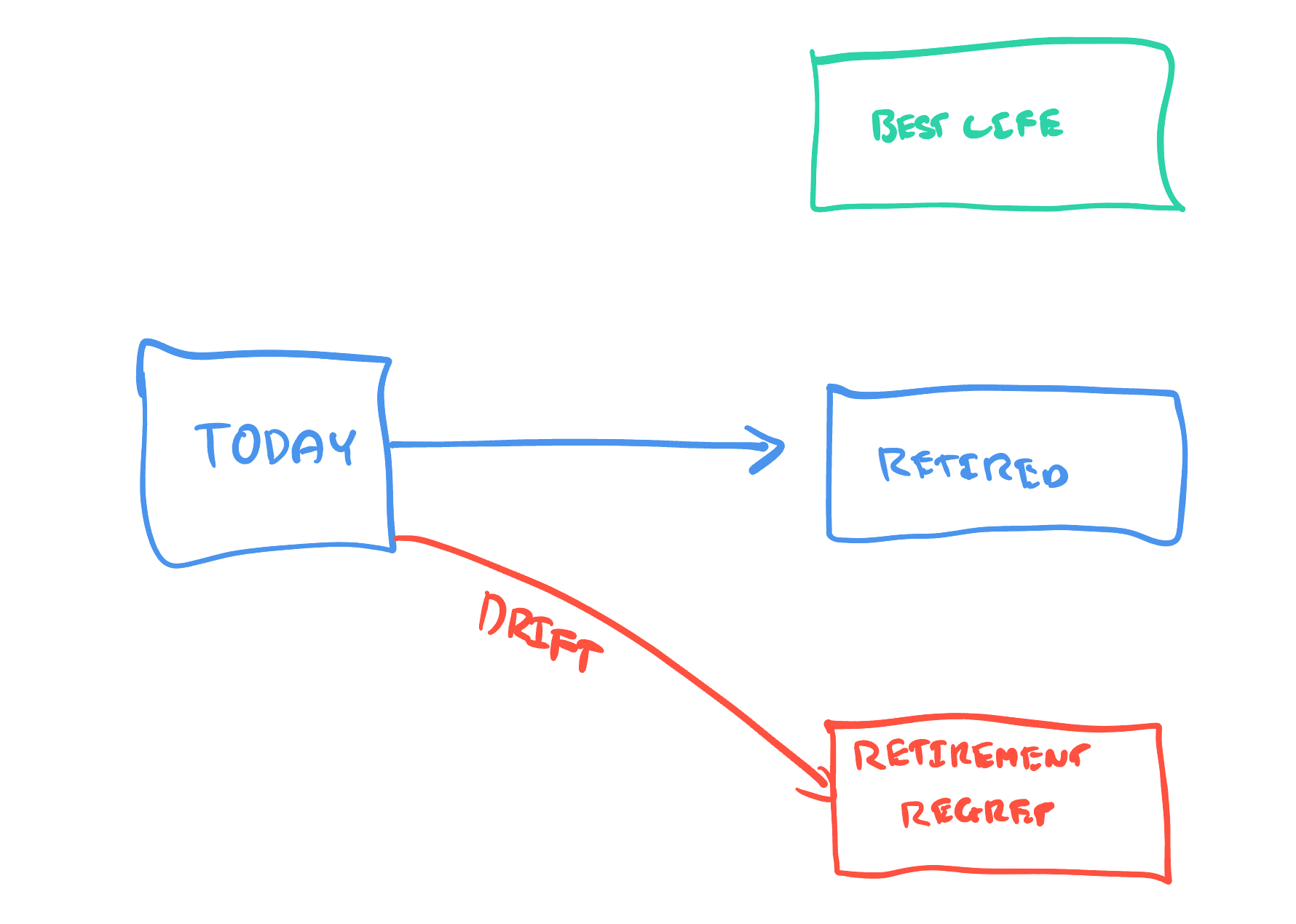

Which retirement path are you on, retirement regret or living your best life in retirement?

As you reflect on 2023 and enter 2024, have you considered whether you are on track for a comfortable retirement?

If you are within 7 years of retirement, you need to know…

One thing we know for sure is time passes, it’s unstoppable, it’s undeniable.

At some future point you will end up retired, whether that be 12 months, 2 years, 5 years, 7 years time or longer.

After working with countless couples and individuals approaching retirement for over 20 years we know the simple passing of time will see everyone heading towards one of two paths.

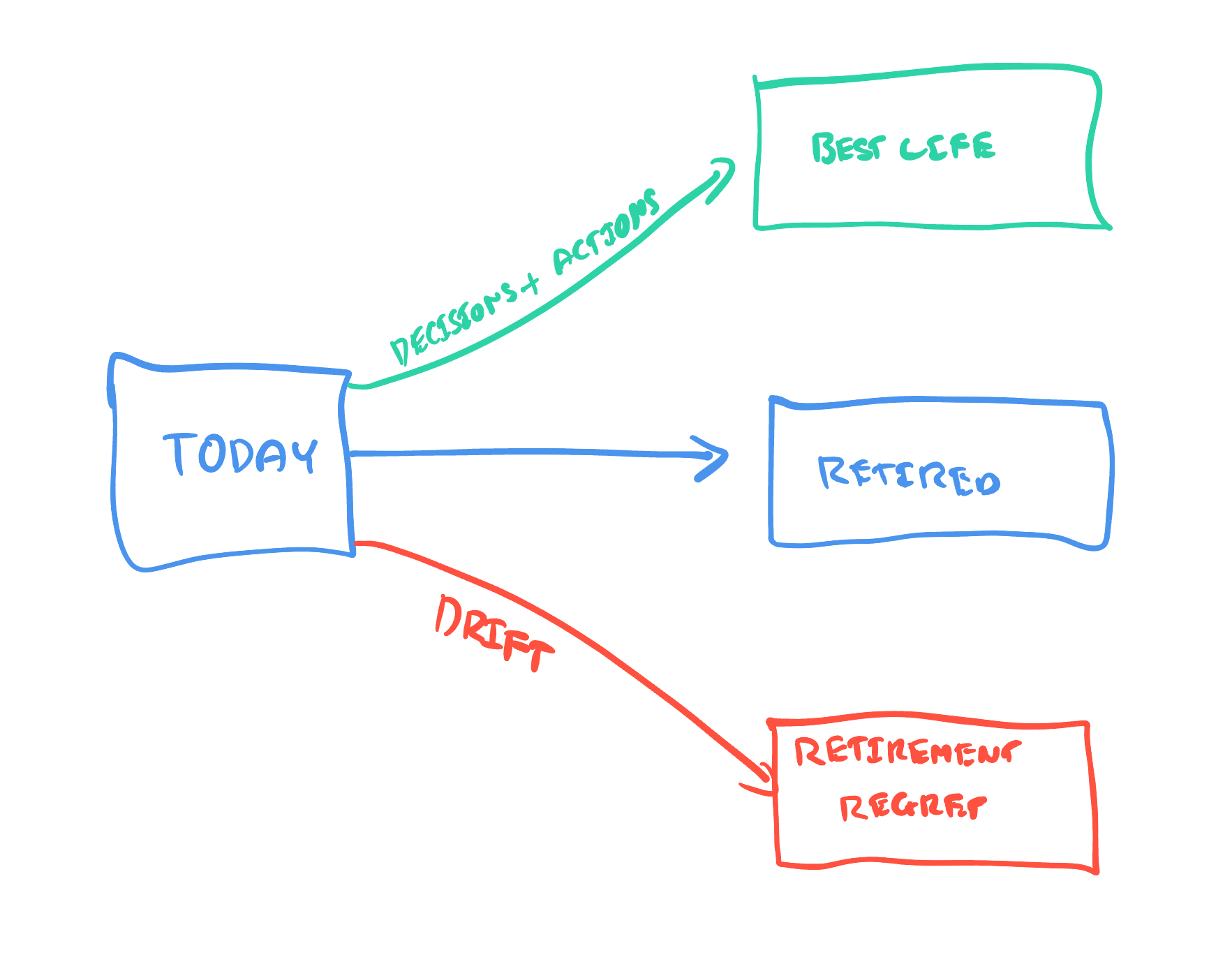

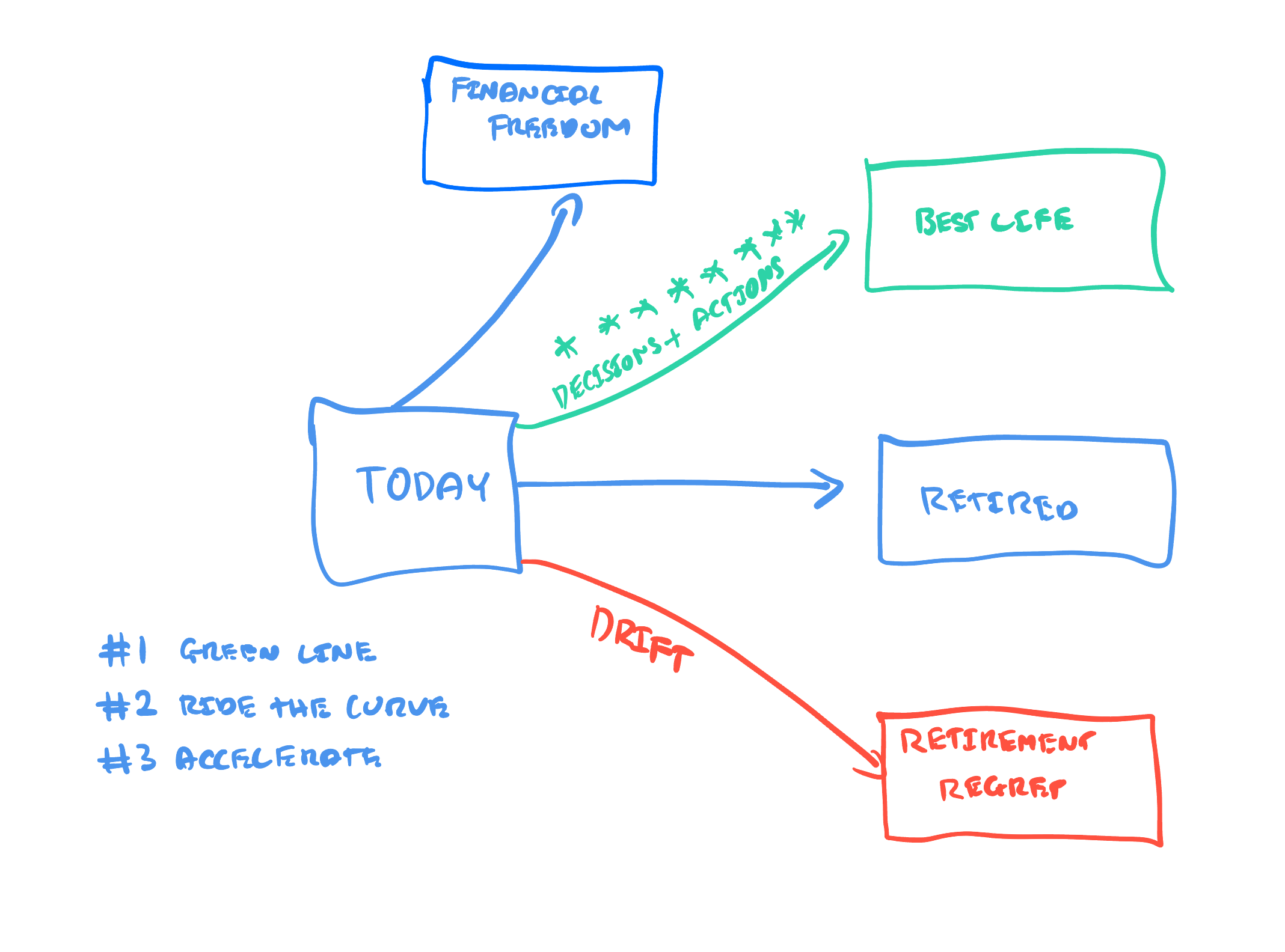

You could end up at the most rewarding point, the ability to fund your best life in retirement without fear of running out of money. This is your best life pathway.

For people we work with, this is making sure they make the most of the wealth they’ve accumulated. That they prioritise and experience more in their go-go years (first 10-15 years) of retirement while they are fit and able. While providing for financial security and comfort later in life.

It’s about maximising experiences and memories while you are able too…

On the other hand there are people who end up in a place they really don’t want to be, drifting towards a regretful retirement.

Many people think the line between where they are today and where they want to be is a straight line. It’s not, it’s a curve.

The line towards a regretful retirement accelerates more rapidly as time passes. This is caused due to drift.

Inaction, procrastination, confusion, information overload and analysis paralysis are often causes of drift.

However, the path towards living your best life in retirement curves up and away more rapidly as time passes.

The key to being on this path is making decisions and taking action.

The difference between drifting towards retirement regret and living their best life in retirement is people accelerating towards retirement are decisive and make decisions.

Not only that, they continually review and adapt their plan as life unfolds to avoid big financial mistakes in retirement.

Three Questions To Ask Yourself…

#1 Are you on course to live your best life in retirement? Are you confident you are on track for a successful retirement?

#2 Once you know you are on the right path, how confident you are riding the curve? Are you using a proven process to apply to your retirement planning over and over and over again?

It’s about having a repeatable process to keep you invested, taking the right level of risk and ignoring the noise so you stay on track. So you don’t get knocked off course…

#3 Can you accelerate your results? This is for people who want to get to retirement faster. Retire sooner rather than later so you can experience everything you’ve dreamed of before you’re too old to do so.

If you can’t answer these questions, it’s time to book your Retirement Clarity Call by clicking here.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement