Break Free from Analysis by Paralysis and Step Towards the Retirement of Your Dreams

The Paralysis of Analysis

Are you constantly scouring the pages of google conducting your own research?

Trying to source relevant information and on the hunt for anything that will assist with planning your retirement?

If you are, I’d like to congratulate you for taking an active interest in retirement planning. It’s important to educate yourself and get familiar with all things retirement related.

But here’s the thing, there’s a massive amount of information floating around the internet that invariably leads to “Analysis by Paralysis”.

If you are anything like me, I love a great meal at a nice restaurant.

If I go to a restaurant and the menu is long and extensive, I find myself in a flux of confusion. Asking myself, “what do I choose?”.

More often than not the waiter will come around and ask me what I’d like to order and my first response is “start at the other end of the table”. Hoping by the time they get back to me I’ve made a decision.

Quite often, I’m left deciding between two meal offerings while the waiter is hovering over me. Probably thinking, “can’t this guy make a decision so I can get on with my job”.

The decision becomes easier with a smaller menu to choose from.

Time and time again, we are coming across more and more people who are struggling to make decisions. Struggling to make sense of all the information. Struggling to work out what to believe and working out what relates to them.

This was a gentleman we met recently, let’s call Jim.

Jim had got himself to the point in his life where he’d worked for 40 years. Accumulated a reasonable amount of money in super and left more confused than ever.

He’d read $1.5m would be enough to generate an income of $75k pa in retirement.

While on the other hand, while watching a tv show on finance, they mentioned they could generate the same level of income on half the capital amount.

This left Jim more confused than ever, leaving him on the endless trail of trying to find the right answer.

To be honest, I’m not sure Jim will find the answer that he’s looking for if he stays on the research treadmill. Here’s why:

- The first answer is based on a rule of thumb theory that if he were to withdraw a certain percentage each year, he’d be alright for the rest of his life. What if Jim relied on this information and later in life worked out he had enough money to do a lot more things in his active years. It’s likely he’d be regretting not knowing this earlier.

- The second answer is more than likely a combination of super and age pension. But what if he wanted to experience more in retirement? It involves a certain number of assumptions. When I’ve looked at these assumptions, it excludes a lot of other things.

If Jim continues down this road, he’s going to fall prey to Analysis by Paralysis. Years will pass by, no action will be taken and he’ll be still left wondering if he is going to be okay in retirement.

Lifetime Cashflow Forecasting: The Key to Clarity

Last week we shared a long post on the framework we use to help clients gain clarity, confidence and control with their retirement decisions. Click here to read…

Research can provide various answers, but the crucial one is based on your retirement lifestyle and how much it will cost. In other words, answering the question, “Will I be okay in retirement?”.

Your whole financial life collapses down to one binary question. Will your money outlast you or will you outlast your money?

Therein lies two challenges.

#1 Having enough money to retire comfortably.

#2 Having enough money to stay comfortable through retirement.

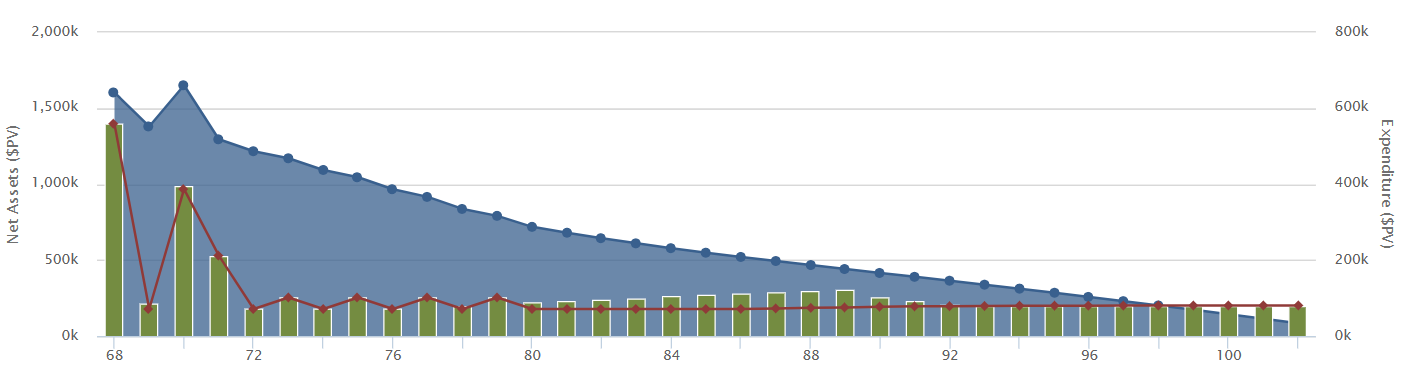

Answering this question with any level of accuracy needs to come from detailed lifetime cashflow forecasting.

Three critical components…

#1 How long are you going to live? The million dollar question that no one knows…

Longevity changes mean it’s likely one in a couple will live well into their 90’s. Provided health is on their side. Therefore, it’s critical to be planning on a 30 year retirement.

#2 How does inflation impact your ability to spend in retirement?

While no one will know what the inflation rate will be, you need to estimate it to assist with your number crunching.

#3 Investment returns and how are you going to achieve them.

Many are overconfident in this department which could spell disaster in retirement. This is one reason lifetime cashflow forecasting is so important.

It will allow you to best guess the investment return you need to make your money last through retirement. Maybe you don’t need to expose yourself to as much investment risk as you thought.

Once you know this, you can build appropriate safety margins into your retirement plan.

Important Questions Answered…

An accurate cashflow forecast will shine the light on many critical factors:

- Show whether your money will last through retirement?

- Highlight whether you can spend more or are destined to spend less.

- What level or risk can I take? More or less to get the job done.

- How does Centrelink pensions affect my cashflow?

- Highlight blind spots which could impact your retirement.

- Show whether you can retire earlier or have to work longer.

- How does inflation affect your spending?

- Can I spend more and build in more experiences and memories than I’d thought?

…and a whole lot more…

Online Calculators vs Professional Guidance…

Recently I was speaking to a couple who wanted real clarity about the path they were on for their retirement.

Like most they had accumulated assets over their working life. But now we’re more focused on planning out their retirement more than ever as that day etched closer.

They had a timeframe in mind. Had conducted a lot of their own research, using a multitude of online calculators.

However, they realised these calculators did not provide them with the assurance and confidence they needed. It was a simple calculation and nothing more.

But here’s the thing about online calculators, if you input incorrect information and rely on it, you may end up harming your retirement opportunities.

Don’t get me wrong, they have their place to give you some ideas, but don’t use it for the whole picture as they are quite restrictive.

For this couple, they felt it was very generalised and did not provide them with the clarity they were looking for.

After a Retirement Clarity Call, we are now working with them to work through their retirement options and opportunities. So they can retire with clarity, confidence and control over their financial decisions.

Understanding how your financial future will pan out will unlock your Analysis by Paralysis…

For Jim, I mentioned earlier, it all ends the same way. You research and research blindly not knowing what’s relevant and what’s not.

It’s an endless cycle…

But if Jim was to understand how his financial future could potentially look. It would save a lot of time wasting and highlight the decisions he needed to make along with the opportunities to explore.

Retirement is a mix of one part science and one part art. Trying to figure it out on your own is hard.

Understanding how your financial future will pan out will highlight a number of critical factors:

- Will I run out of money?

- How much money can I comfortably spend on a yearly basis?

- When can I retire?

- How much investment risk do I need to take?

- What blind spots do I need to manage through retirement?

- What tactics and strategies will optimise my position?

- What safety margins do I need to build into my retirement plan?

…and many more…

Do you know how your financial future will pan out?

If you want to approach retirement full of confidence and clarity you need to know. Otherwise, it’s difficult to make any meaningful decisions.

How long are you willing to wait to find the answers to the above questions?

The Impact of Professional Advice…

You may be someone who is hesitant to seek advice. Maybe you’re scared of being ripped off or fearful of advisers putting themselves before your interests.

A gentleman raised this very issue in an online forum recently. Stating that all financial planners were rip off merchants, a waste of money and not worth the cost.

I was curious as to why this guy thought this way, so I decided to ask a few questions. Through numerous interactions it was clear he sought advice, paid a fee and never received any recommendations in return. It turned out, this experience was 15 years ago and this one experience was holding him back.

Many are letting past experiences hold them back from seeking advice. On the one hand I don’t blame them. It’s hard to come back from a bad experience. On the other hand so much has changed in the last five years that the landscape is very different.

Since then there has been a lot of change in the financial planning industry. Moreso, since the Royal Commission.

As a result, due to the enforcement of increased legislation, financial adviser numbers have dropped significantly from some 27,000 to under 15,000 Australia wide.

In fact, there are not enough financial planners to service the needs of consumers…

While you may be weary, most financial planners do a great job in helping their clients achieve their financial goals.

Financial Planners have a legal obligation to act in your best interests. To put your interests before theirs.

As a retirement specialist, we see everyday the impact good advice has on clients’ lives. Helping them work out what they need to consider. Helping to cut though all the noise and providing guidance which helps them make confident decisions about their money.

Not only does financial advice provide tangible benefits, but provides for a better lifestyle. Research conducted in 2022 by Mymavins in conjunction with the Financial Advisers Association of Australia supports this view.

The research found 90% of people with a financial plan feel confident about their futures. Not only that, they feel more prepared to manage unexpected events.

More importantly, a sound financial plan gives you a framework to think through financial decisions as your life twists and turns through retirement.

The Urgency of Taking Action

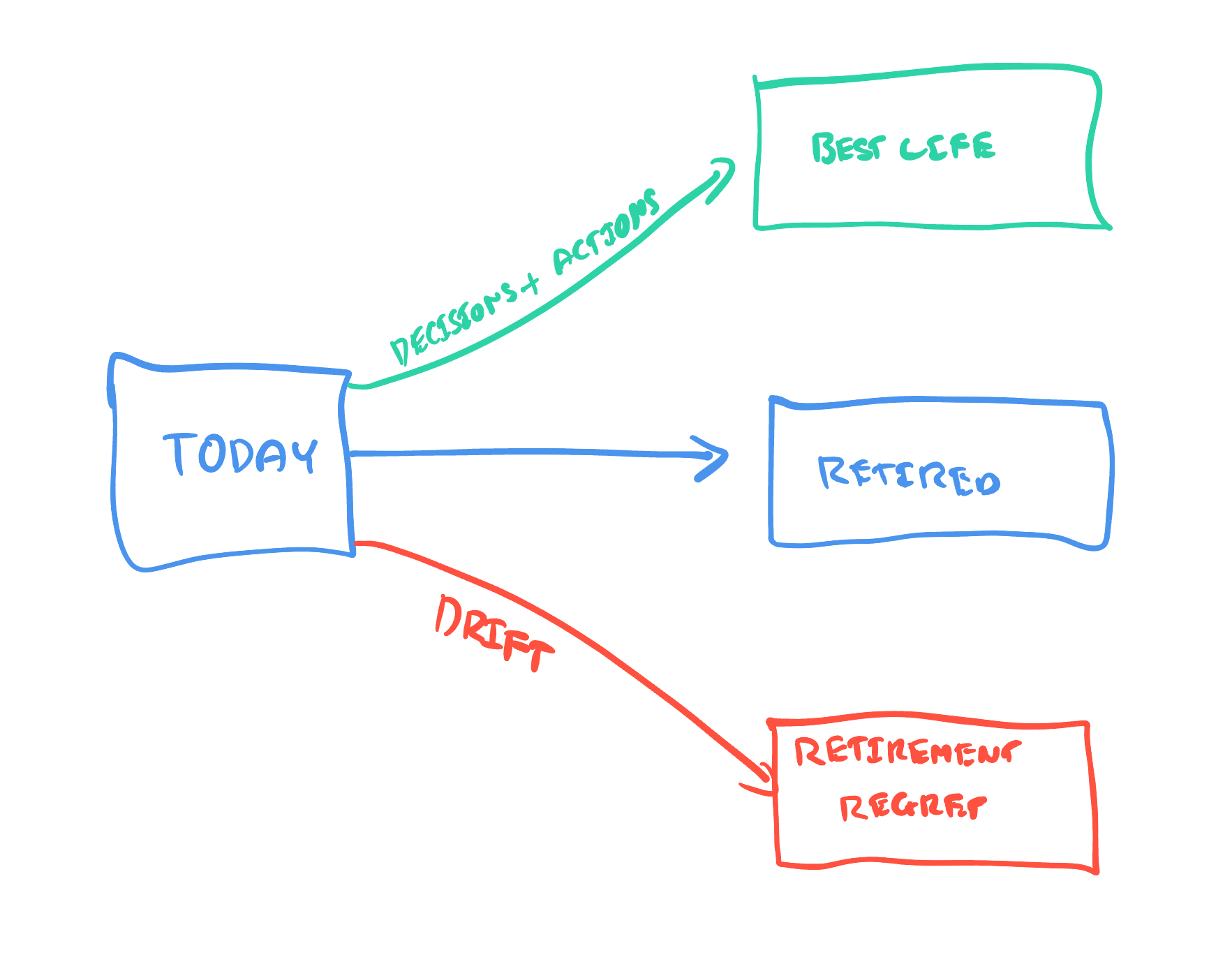

If retirement is on the horizon for you. You have two options. Continue to drift towards what we call retirement regret. Or, take decisive actions and craft a successful retirement designed to allow you to live your best life.

Achieving a successful retirement is all about applying a proven framework to your retirement planning over and over again. Giving you the confidence that you are on track for a comfortable retirement.

So the real question is, how long are you prepared to wait? Or alternatively how long can you afford to wait before you take positive decisive action to secure the retirement you know you can have?

Don’t wait a day longer to find answers to these crucial questions.

Here’s the thing, you only get one shot to get retirement right, there are no second chances. The longer you leave it, the longer you drift and this only leads to one outcome, retirement regret.

Don’t wait any longer. Seek advice from a Retirement Specialist like us today and take the first step towards a comfortable and rewarding retirement.

If you ready to stop drifting and flying blind, it’s time to book your Retirement Clarity Call by clicking here.

Glenn Doherty – CFP – Financial Planner | Retirement Planning Made Simple for aspiring grey nomads and avid travellers within 7 years of retirement