Live life with no regrets! How to plan financially for a 100 year life with more freedom?

As you sit back in your chair, with a look of disbelief on your face. Thinking I’m not going to live that long.

Unless you have a significant health issue, there’s a good chance you’ll live well into your 90’s.

With advances in technology and healthcare, many people are entering retirement today with the opportunity to live longer than previous generations. Partly due to jobs requiring more mental labor rather than physical hard labor.

In recent research by Challenger, they found that there is a high probability of one in a couple living well into their 90’s. Knowing this, don’t you think it would be wise to make plans now on how much you will need to fund that lifestyle?

It may seem like you’re planning too far ahead but with more people than ever before reaching an age of 100+, it’s time you start thinking about this now rather than later.

The problem with traditional financial planning

From the early days of financial planning it’s been driven by product providers. Maybe you’ve been on the receiving end of being sold a product rather than receiving real financial advice.

It doesn’t feel very nice, does it?

Driven by product providers convincing you hand over a share of your wallet.

You only have to take one look at all the advertising. It’s a multi-billion if not trillion dollar industry.

Take another look at the Royal Commission into financial services. The big banks played a large part in flogging their products to unsuspecting clients. Neglecting the interests of the client.

Since then, many have lost faith in the financial services industry.

But here’s the thing, this has come about by the focus of selling a product.

That’s not real financial planning.

Introduction to real lifestyle financial planning

The number one focus is helping you to identify, achieve and maintain your desired lifestyle without fear of ever running out of money. No matter what happens.

The first part is understanding the life you want.

What is it you want to achieve between now and the time you end up in a box?

ALSO READ: How To Live An Epic Lifestyle With These Simple Steps

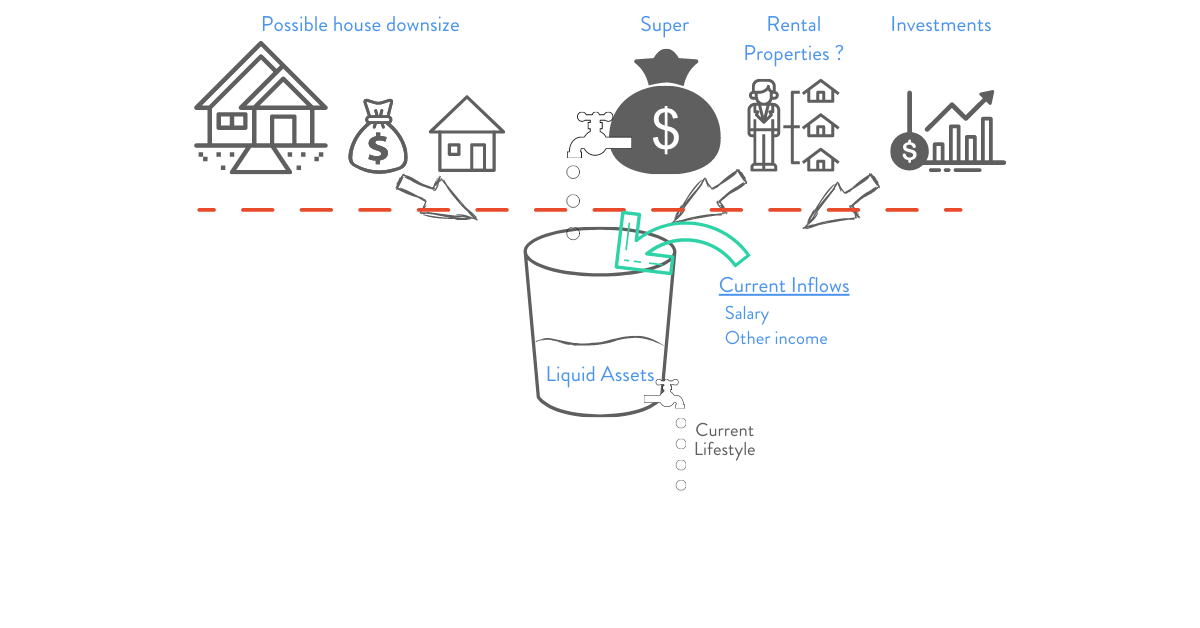

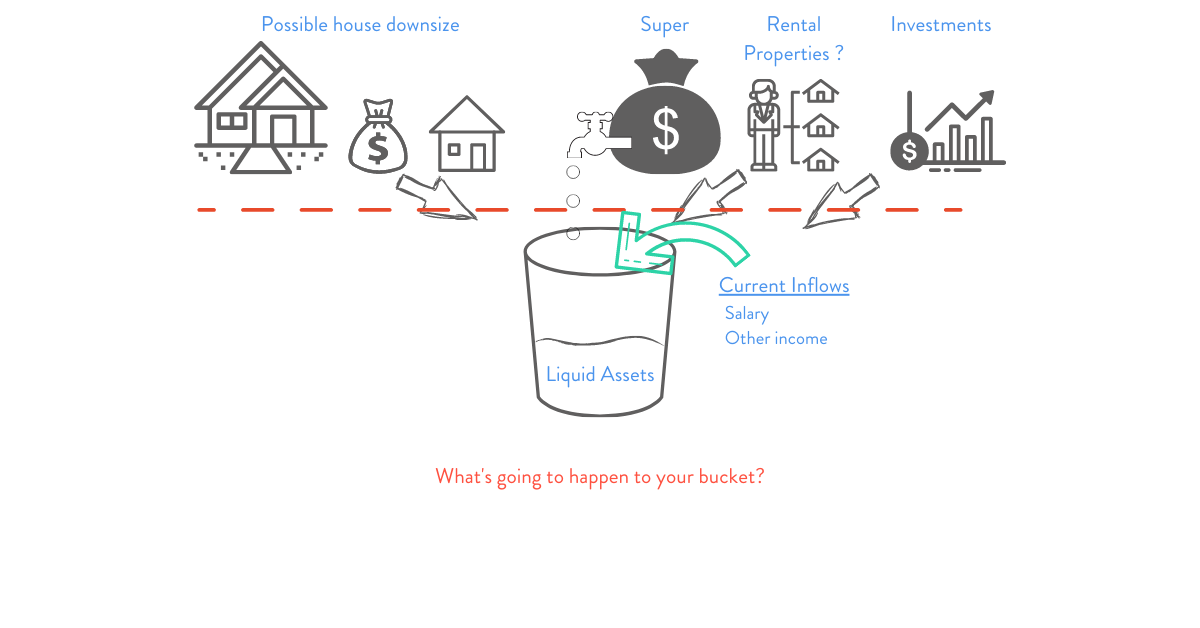

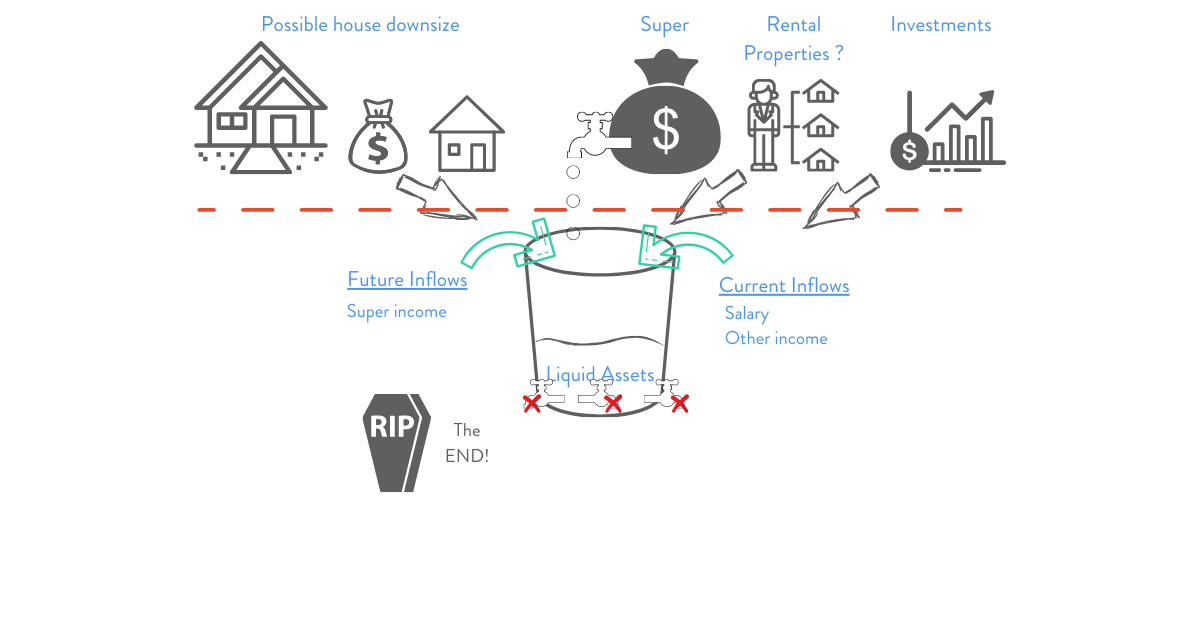

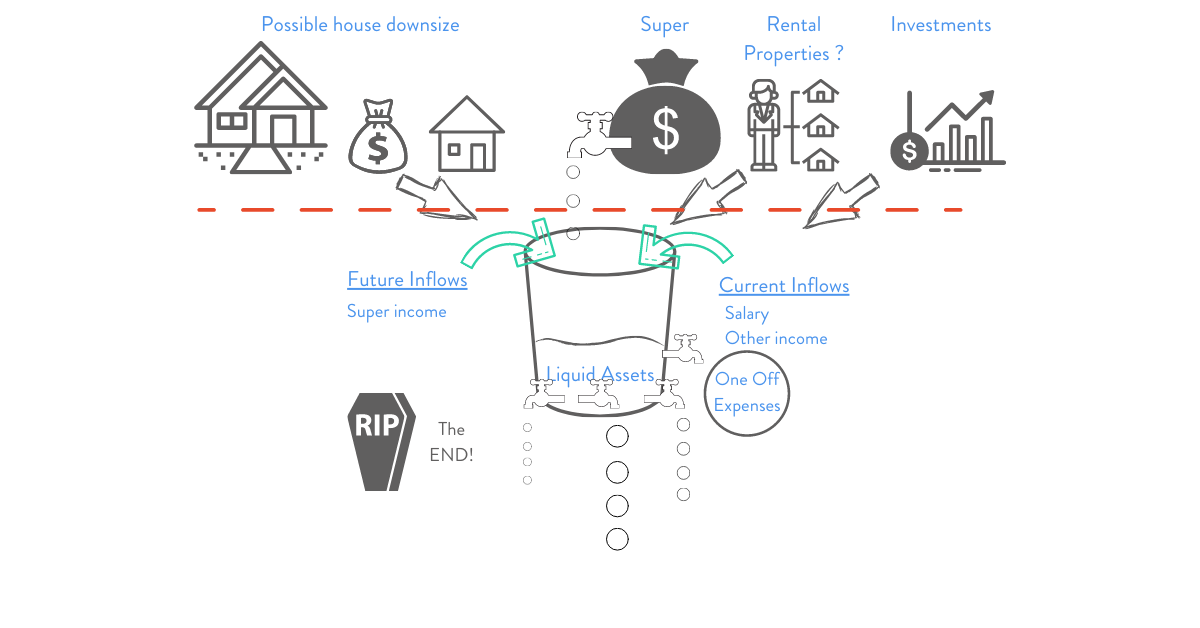

The second part is understanding what is going to happen to your financial bucket.

This has nothing to do with the investments you use or for that matter the product you use, that all comes later. They are tools in the tool bag.

If you don’t understand what’s going to happen to your financial bucket, you can’t make any sound financial decisions about the tactics, investments or the best financial product, if in fact you need one.

Once you understand what is going to happen to your financial bucket, you can take control of your financial future.

It’s understanding what will happen to your bucket using prudent assumptions.

Isn’t this what you’re really looking for? To make sense of the money you have to live the lifestyle you want free from worrying about running out of money.

Or for that matter dying with too much!

What is your bucket?

Your bucket is the money you have available right now to live your current lifestyle.

It will include any cash you have. It’s money you can get your hands on immediately. Your bucket will be filled up with income you generate from employment, rental property income, investment income or any other income you generate.

You’ll have your residential home. Which does not form part of your bucket. However, at some stage you may downsize. Only at that time may some of the proceeds go to fill up your bucket.

You’ll have super. Once again this does not form part of your bucket until you retire. At that stage you may take a lump sum or a regular income and that will top up your bucket.

Tap #1 – Current Lifestyle

At the bottom of your bucket you have taps.

The first tap is your current lifestyle. It funds your nice car. Visiting nice restaurants. Sneaky trips away and overseas travels…you get the picture.

This is what it costs to live your current lifestyle. It’s different for everyone.

But it’s ok, you need to live a good life now.

But at some stage this tap will be turned off.

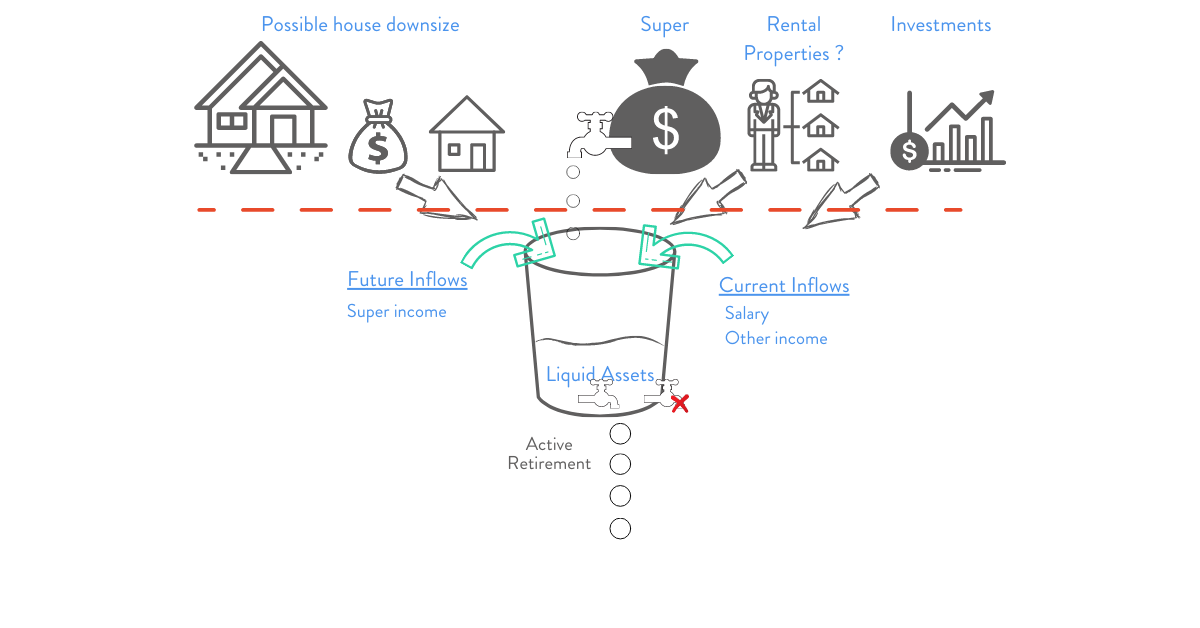

Tap #2 – Active Retirement

At some point you will need to turn on tap #2.

This is the time you’ve given up work and now you have more time to do all the things you couldn’t while working.

Spend months on the road with your caravan travelling through the centre of Australia.

Short trips interstate.

Take up a new hobby.

Spend more time on your interests.

Catchup with friends for a coffee or a sneaky red or two.

More time with your grandchildren.

50th wedding anniversary trip to Canada/Alaska.

Improving your golf game.

This will include everything you wanted to do when you retire – while you are still young and fit enough to do them.

Wherever you are doing, there’s going to be a cost to it.

Because you have more time on your hands you could be spending more money than when you were working.

Why?

Now you have all this spare time on your hands. It’s time to let your hair down and have a bloody good time. After all, isn’t that what’s it all about?

Don’t forget, life’s not a rehearsal!

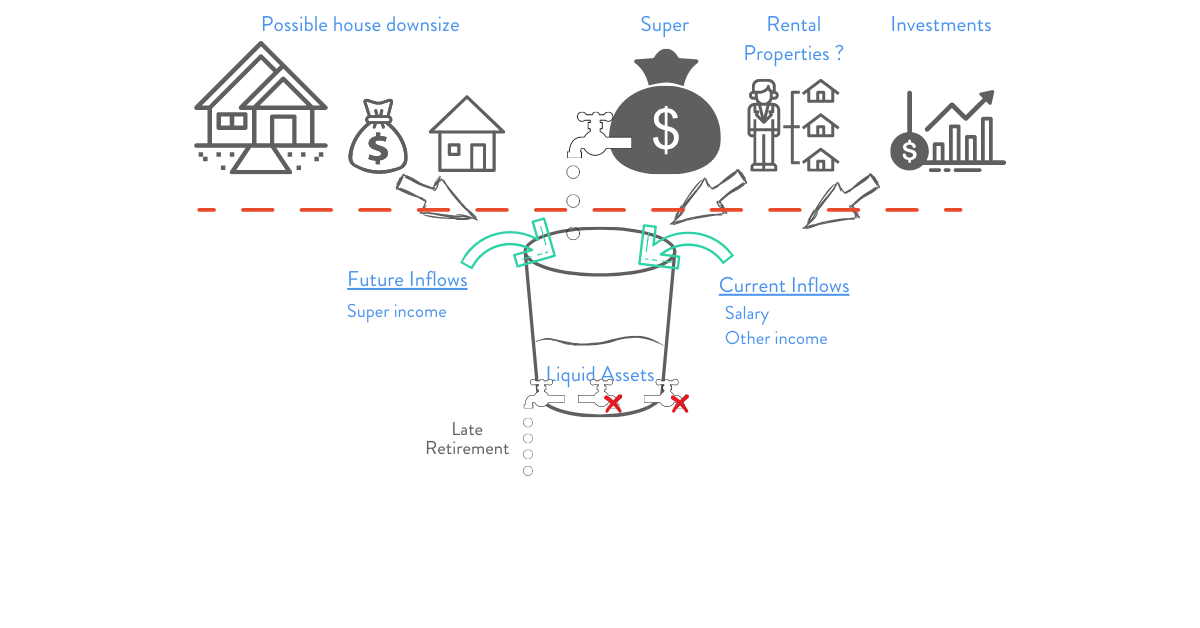

Tap #3 – Late Retirement Tap

Wow, what a great time you’ve had up until now!

For all us sadly, there comes a time where life slows down and your active retirement tap gets turned off.

That’s when you “late retirement tap” get turned on. And “your active retirement tap” gets turned off.

This is where you start to feel “knackered”. Your hips have gone, knees gone, you have more aches and pains. Even getting up the stairs is hard.

You’re worn out.

It’s a time where you struggle to “do stuff”.

You can’t do what you did 10 years ago.

Now it’s all about comfort, security and peace of mind…

It’s a time where your health care costs have gone up. Your weeks are dictated by medical appointments. And then you may end up in a nursing home.

It’s definitely not a time where you want to worry about money. And if you’ve done your planning properly, you won’t need too.

And then sadly you’re dead!

You end up in a box and that’s the end of you…

If you die with a full bucket, there is little use to you now, don’t you agree?

Tap #4 – Additional One Off Expenses Tap

On top of your lifestyle taps, you’re going to have one for those one off expenses.

It could be the big european holiday?

Purchase of a new caravan and vehicle to tow with?

Paying for grandchildren’s education?

A child’s wedding?

Lump sum expenses which will occur at various stages of your life. These expenses will have a significant impact on your bucket.

Summarising your buckets

The money inside your bucket, you can spend at any time.

Money outside your bucket does not form part of your bucket until they become available. i.e. super, investments or downsizing of your home.

Money comes into your bucket now in the form of income, dividends or rental income.

At some point into the future you will have other income come into your bucket. For most this is in the form of income from your super account.

Three main expenditure taps:

#1 Current Lifestyle Tap – the cost of your current lifestyle (if you are still working), before retirement.

#2 Active Retirement Tap – it’s party time, when you have more time to have more fun – while you’re young enough and fit enough to do so.

#3 Later Retirement Tap – when you’re less active, it’s harder to get around and too old to enjoy yourself.

Plus one more time:

#4 Once Off Expenditure Tap – for the once off big expenses which will occur throughout your life.

So, here’s the question…

Do you know what’s going to happen to your bucket?

Knowing what’s going to happen to your bucket will help plan your EPIC retirement lifestyle. One where you get to do everything you dreamed off without fear of running out of money.

Once you know the answer to this question, then will you be able to make confidence decisions about what you do with your money.

Are you managing your money in a way that will allow you to live your best life?

60 minutes to plan your next 30 years!

If you’ve finished reading this post, your trying to find the answer to “Will I have ENOUGH?” or “Am I on TRACK?”.

It’s hard to work out if you’ll have enough money for retirement!

You may have super, investments and/or a good income, but most people have no idea what it all means or what sort of financial future awaits them.

If you don’t get this right you don’t get to experience your best life in retirement.

At Jigsaw, we feel your frustrations and know you’re striving to live your best life. And we know you don’t want to worry about whether you’ll be okay in retirement. Because of this we’ve developed a framework for you to use so you too can experience your best life.

Knowing how much money you need to give you the freedom to live your life, minus the complexity, confusion and misinformation.

That’s exactly what our “Retirement Breakthrough Sessions” are designed to do. Help you work out your “ENOUGH” number and the exact steps you should be taking with your money so you can live the best life possible.

Schedule your complimentary “Retirement Breakthrough Session” here.

Live your best life in retirement!

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals