Investing: What you need to know to safely achieve your retirement lifestyle?

You spend your whole working life accumulating assets with the ultimate goal of reaching the summit (retirement and living a fulfilling life).

Focused on achieving the best return you can along the way.

After all, you can take on a reasonable amount of risk knowing you have your employment income to fall back on.

Besides, in most cases you can’t access your super anyway.

Through ongoing super contributions and if you hold any other investment assets. You are able to take advantage of the eighth wonder of the world, compounding.

Compound interest is your bestie through your working years.

This is all well and good while you are working…

But what works for you in your working years, works against you in your retirement years. You break up with your bestie…

Instead you withdraw from your investments to fund your income.

Apply the same accumulation mindset up to and through retirement can lead to devastation and quite possibly more stress and sleepless nights in your retirement.

ALSO WATCH: Paradigm Shift To Safeguard Your Retirement

Three risks you need to manage as you transition into retirement!

Market risk: All pre-retirees and retirees will face market risk. You can’t live off cash alone.

Market risk is the risk of losing money when investment markets decline or fall.

Done right, risk can be your friend.

As you approach retirement, your capacity to withstand market falls reduces.

Think back to the Global Financial Crisis. Probably a distant memory now for most.

When retirement plans were disrupted as investment markets around the world collapsed.

For some, unfortunately, they have not recovered.

Others, spooked, sold up, packed their bags and never returned.

Covid was another shock event. Many reacted in similar ways.

Those which were ill-prepared or panicked, suffered the most.

With the right set up, understanding and discipline. You can partake in the market. Sail through turbulent waters and still be okay.

Sequence of returns risk:

A risk many underestimate and the enemy of the overconfident ones.

The five years prior and five years post retirement is the highest risk period for any pre-retiree and retiree.

The order in which your investment returns are achieved can impact your retirement and your confidence.

Sequence of returns risk is when an investor is forced to withdraw from their investment portfolio when the value is down.

Longevity risk:

Another less thought off risk facing the soon to be retiree.

The reality for the most part, we are living longer due to medical advancements. The chance of one person living well into their 90’s is high.

Meaning, many will outlive their savings.

The challenge is saving enough money to last through retirement. Previous generations haven’t had to worry nor needed to fund such a long retirement.

While three risks sit between you and a worry-free retirement, they can be tamed if you know how.

“Risk comes from not knowing what you are doing, Warren Buffet”

Three Bucket Retirement Portfolio

Investing for retirement is different.

Your investment strategy needs to be set up to deliver reliable income. No matter what’s going on in the world or investment markets.

Unless you have bucket loads of cash, you’ll need to take on some risk.

And it’s okay to take on risk. Provided you do it the right way.

Know what you’re solving for.

As you approach retirement, you are already in the transition phase. You want to ensure no matter what happens with your job or investment markets. That you are well prepared to transition into retirement with ease.

Here’s where the three Bucket strategy works extremely well:

#1 Emergency Bucket – Enough money to cover any emergency.

#2 Income Bucket – Enough money to cover your next 3-5 years of estimated income. This needs to be in conservative investments. One which don’t move around a lot but still deliver a return better than cash.

#3 Growth Bucket – This where the remainder of your retirement funds will go. These are your investments which will be subject to market movements. They will go and go down.

????Tip: The amount of risk you accept in your growth bucket will be dictated by the return you need to generate to get the job done. This is why cash-flow planning is critical. To understand your potential outcomes. Maybe you don’t need to take as much risk as you think. To know what’s going to happen to your retirement bucket!

Retirement Building Blocks So You Can Sleep At Night

The biggest worry pre-retiree and retirees have is running out money in retirement. But they also want to make sure their money goes the distance.

Yes, you want to be able to sleep easy knowing you are going to be okay.

Knowing that your retirement will likely last 25 years or more. It’s a lengthy time horizon.

You need to take measured risk. So investing in some combination of growth investments depends on your unique circumstances.

Investment returns over time:

Your biggest risk leading into and through retirement will be investment risk.

However, understanding how investment risk works. Will provide you with the knowledge and comfort to worry less in retirement.

Your retirement investment portfolios will require:

#1 Exposure to growth assets to ensure your money lasts the journey.

#2 Mitigating or reducing the financial impact when investment markets go down. So you don’t experience the full decline.

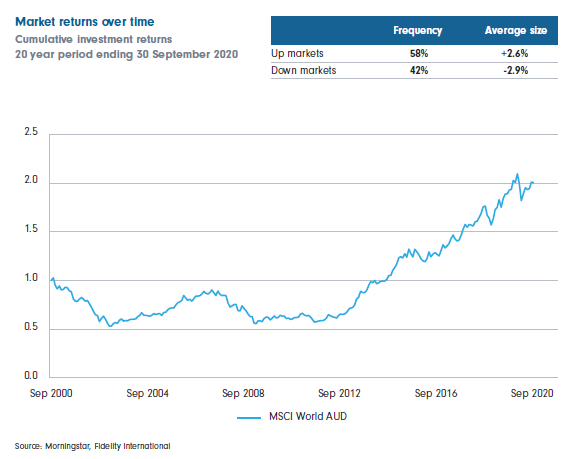

To understand this better, let’s look at the below chart.

You’ll see in the above chart the movement of the MSCI World Index. A good measure for evaluating the movement in investment markets.

Over this period in time investments are roughly up 58% of the time and down 42% of the time.

You’ll notice the falls in investments markets are more severe than the market gains.

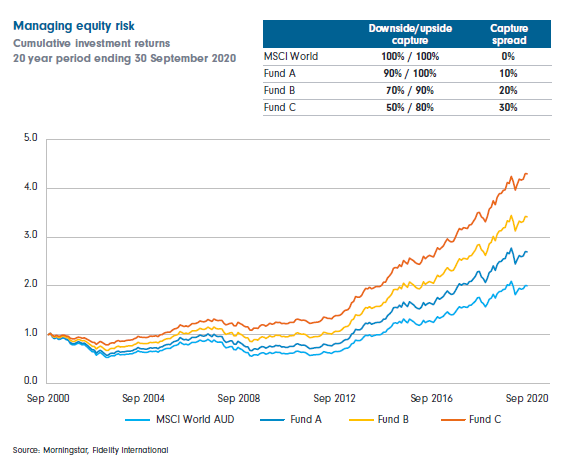

Managing Share Market Risk

An important aspect of investing. As you approach and transition into retirement. Is managing your growth investments in market downturns. Because they will happen whether you like it or not!

In the chart below you’ll see different portfolios.

MSCI World index (light blue) being the most aggressive on the left to the most conservative portfolio (orange) on the right.

The MSCI World Index participates in 100% of the ups and downs in investment markets.

While the most conservative on the right, only participates in 50% of the downturn. This is due to less being invested in growth assets.

ALSO READ: Retirement Planning: It’s all about CONTEXT!

While the more conservative investment portfolio lags in a rising market. You can see how well it performs over time.

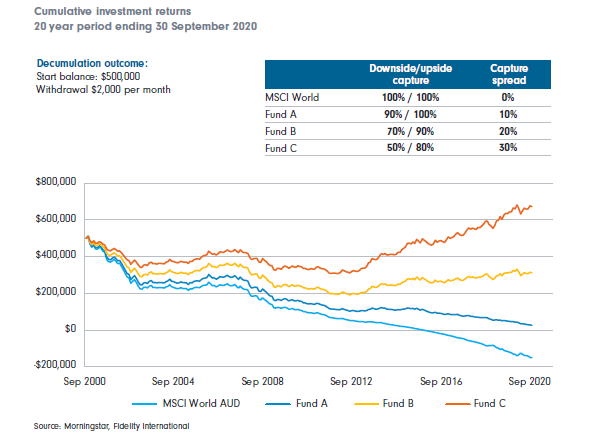

Managing retiree risk in decumulation phase

When the opposite of what you’ve done your whole life, happens. Accumulate wealth and add to it on a regular basis occurs.

In your working years, while you may not be aware, your superannuation is a perfect example.

Your employer and you (if you contribute extra) partake in regular contributions.

Meaning you are investing at times when investment markets are rising. Likewise when investment markets are declining.

Allowing you to benefit from long term compounding.

As we’ve discussed previously, what works for you in your working years does not work for you in your retirement years.

The complete opposite happens as you sell your investments to fund your income.

You’ll see how much of a difference the makeup of your portfolio matters in your retirement years.

A portfolio invested in 100% growth investments does substantially worse than a more conservative portfolio.

Why?

It all comes down to how much you participate in the ups and downs of investment markets.

But, you’ve got to have a plan!

You’ve heard the saying, “fail to plan, plan to fail”.

Also read: Is this the missing piece to your retirement puzzle?

So, what does that look like:

#1 Create a retirement which outlines the retirement lifestyle you want to achieve.

#2 Work out the return you need to achieve to deliver your income in retirement. This will drive how much you invest in different assets.

#3 Adopt a global approach. Home bias will harm your investment returns.

#4 Spread your money around to avoid company and investment risk.

#5 Hold enough in conservative investments to cover you when investment markets fall.

#6 Determine the most tax-effective way to hold your investments.

#7 Re-allocate your investments on a regular basis.

#8 Review your plan on at least an annual basis. Life changes, the world changes and investing changes. You’ll need to continually readjust your plan.

Having the right knowledge is key to ensure you retire and live your best life in retirement.

If this is something that resonates with you and you want to know how to set yourself up for retirement.

Here’s your opportunity to book your complimentary Retirement Breakthrough Session here.

Glenn Doherty – CFP – Retirement Planning Specialist | Retirement Planning made simple for over 55 white collar professionals